Digital payments have fundamentally changed how consumers handle money. From contactless cards to mobile wallets, the shift away from cash is accelerating globally.

At Web3 Enabler, we’ve observed how the impact of digital payments on consumers extends far beyond convenience. Security, cost savings, and financial inclusion are reshaping transactions worldwide.

How Digital Payments Went Mainstream

The shift toward digital payments isn’t a future trend anymore-it’s the present reality. Global digital wallet users reached 5.2 billion in 2025, and about 50% of all e-commerce transactions now happen through digital wallets. These numbers tell a clear story: consumers have abandoned the hesitation they once felt about digital money. Contactless payments and mobile wallets aren’t novelties anymore. They’re the default choice for most transactions.

Regional Dominance and Scale

In some Asian markets, digital wallet penetration exceeds 80%, with China’s Alipay and WeChat Pay accounting for over 90% of mobile payments in that region. India’s Unified Payments Interface achieved over 20 billion monthly transactions by late 2025, demonstrating that open, interoperable payment networks drive massive scale. The reason is simple: speed and convenience matter more than ever. Consumers expect to pay instantly without fumbling for cards or cash.

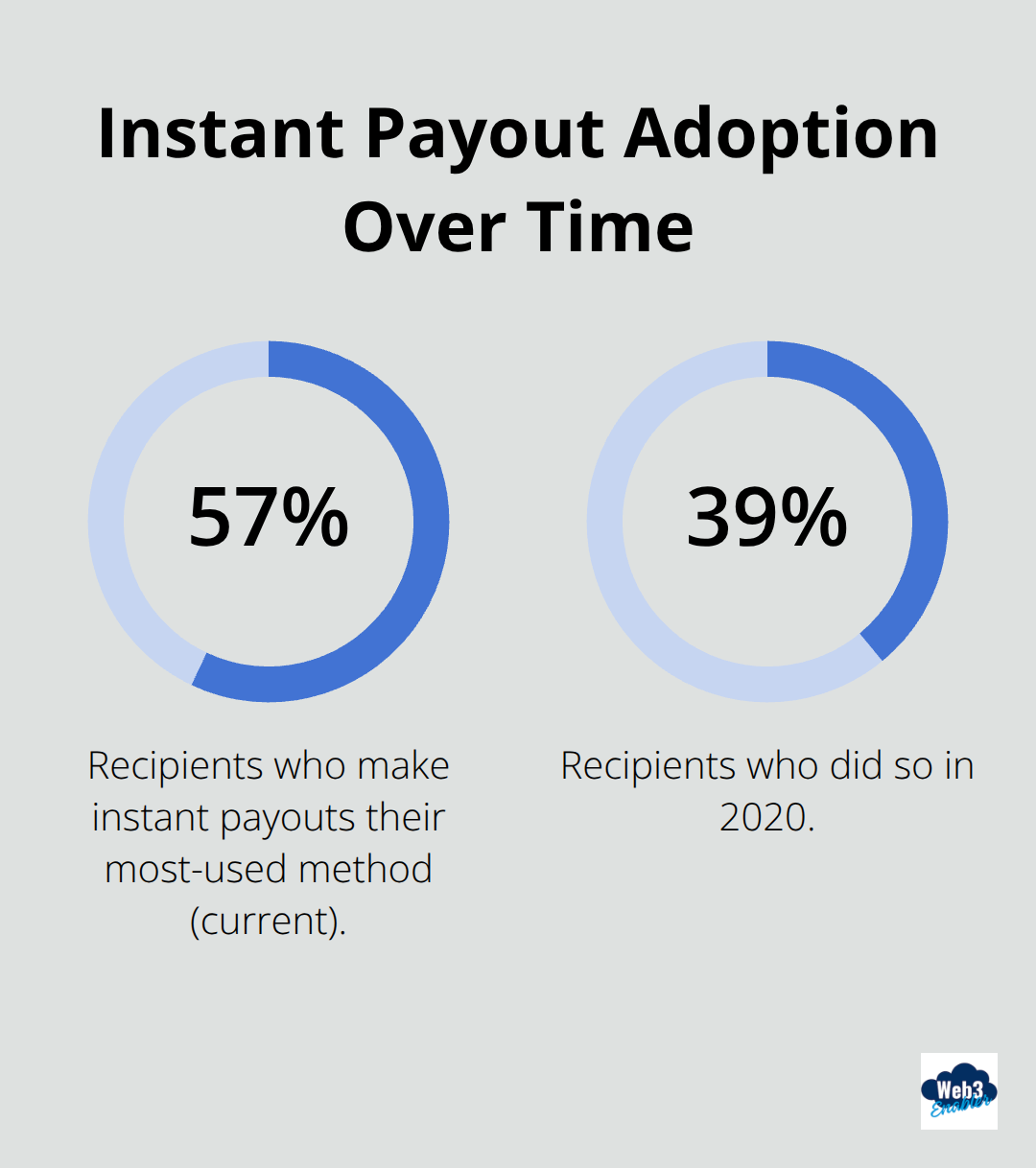

When businesses make instant payouts their default method, users log in more often and cash out more frequently. This behavioral shift is irreversible. According to PYMNTS Intelligence research in collaboration with Ingo Payments, 57% of recipients who receive an instant payout make it their most-used method, up from 39% in 2020. That’s not incremental growth-that’s a fundamental restructuring of payment behavior.

Why Wallets Beat Traditional Cards

Digital wallets are 58% more effective than bank deposits at turning occasional instant payout users into regulars. This matters because wallets do more than move money around. They create ecosystems. A wallet lets you receive money, spend it, transfer it, and store it all in one place. Traditional bank deposits feel static by comparison.

Apple Pay alone processes an estimated 10 trillion dollars annually in Western markets, while PhonePe commands roughly 47.8% market share in India’s payments landscape, processing over 6 billion transactions monthly. The infrastructure varies by region-Western wallets rely on NFC-based payments, while many Asian wallets leverage QR codes that require minimal merchant hardware upgrades. This difference matters for businesses deciding which payment rails to support.

The real advantage of wallets is stickiness. Among recipients for whom payouts are core cash flow, nearly 70% of one-time instant users become regulars. That’s not a small group either. For gig workers and freelancers, instant payouts provide the liquidity to cover rent, groceries, gas, and childcare without waiting days for settlement.

The Data Advantage Reshaping Business Strategy

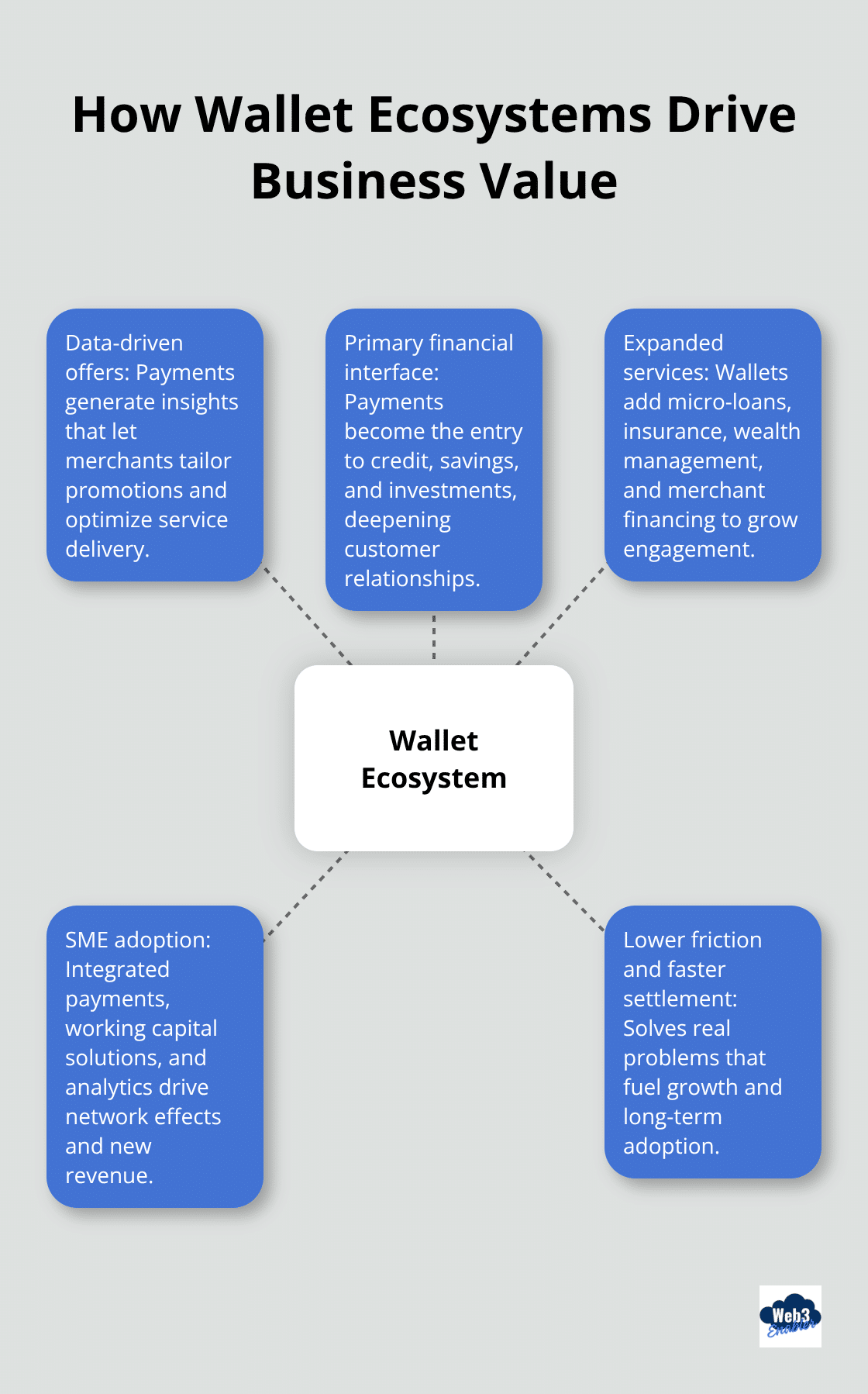

Digital payments generate rich data insights that merchants and providers use to tailor offers and optimize service delivery. Wallets become primary financial interfaces, with payments as the entry point to broader relationships in credit, savings, and investments. This is where the real value emerges.

Beyond transactions, wallets expand into micro-loans, insurance, wealth management, and merchant financing. SMEs increasingly adopt wallet ecosystems for integrated payments, working capital solutions, and business analytics, driving network effects and new revenue streams. Global digital wallet transaction values will exceed 16 trillion dollars by 2028. That growth isn’t random. It reflects the fact that wallets solve real problems: faster settlement, lower friction, and deeper customer relationships.

A connected payments ecosystem, rather than isolated solutions, is critical to deliver seamless consumer journeys and scalable growth. The companies winning right now are those investing in the right technology and partnerships to create that connectivity. Yet this expansion of wallet capabilities introduces new challenges around security and consumer trust-issues that shape how businesses and regulators approach digital payments today.

Security and Trust Shape Digital Payment Adoption

Wallets and payment networks process massive transaction volumes, but consumers won’t adopt them at scale without confidence in security and data handling. The infrastructure protecting digital payments has evolved dramatically, yet consumer concerns about privacy persist alongside genuine fraud risks that demand attention. Trust isn’t built through marketing claims-it’s built through transparent security practices, compliance with regulations, and demonstrable fraud prevention results. Encryption and tokenization have become standard requirements. Visa’s encryption processes and similar protections across major networks reduce fraud compared to cash handling, but the real barrier isn’t technology sophistication anymore. It’s consumer awareness and regulatory clarity.

Authentication Methods Create New Security Layers

Biometric authentication has become standard across payment platforms, with fingerprint and facial recognition reducing friction while improving security simultaneously. J.P. Morgan’s strategic insights emphasize that biometric payments will grow as daily-life usage expands on phones and devices, delivering more secure and seamless experiences. This expansion of authentication methods creates a parallel challenge: data collection. The richer the payment data becomes-transaction history, location, spending patterns, merchant details-the more valuable it is to businesses and the more vulnerable it is to misuse or breach.

Data Privacy Tensions Drive Regulatory Action

Consumer concerns about data privacy aren’t theoretical. GDPR in Europe forces businesses to disclose how they use payment data, creating tension between data monetization and consumer control. The shift to ISO 20022 increases data richness across payment rails but also elevates privacy and security challenges, requiring stronger data controls and transparent disclosures at checkout. Regulators understand this friction point. Crypto legislation creates a federal regulatory framework for digital assets, signaling clearer rules for stablecoins and enabling faster cross-border payments with defined consumer protections.

In 2026, regulators are expected to tighten oversight further through federal rules for stablecoins plus increased state scrutiny of earned wage access and buy-now-pay-later services. This patchwork of federal and state regulation creates compliance complexity for payment providers, but it also signals that consumer protection is becoming non-negotiable.

Fraud Risks Demand Proactive Defense

Fraud remains a major risk as real-time payments and digital assets expand. Crypto and non-traditional fraud targeting older adults persists, underscoring the need for targeted consumer protections and robust identity checks. Real-time payment rails deliver faster transactions and refunds, but they require stronger authentication, dispute resolution, and consumer education to mitigate risk.

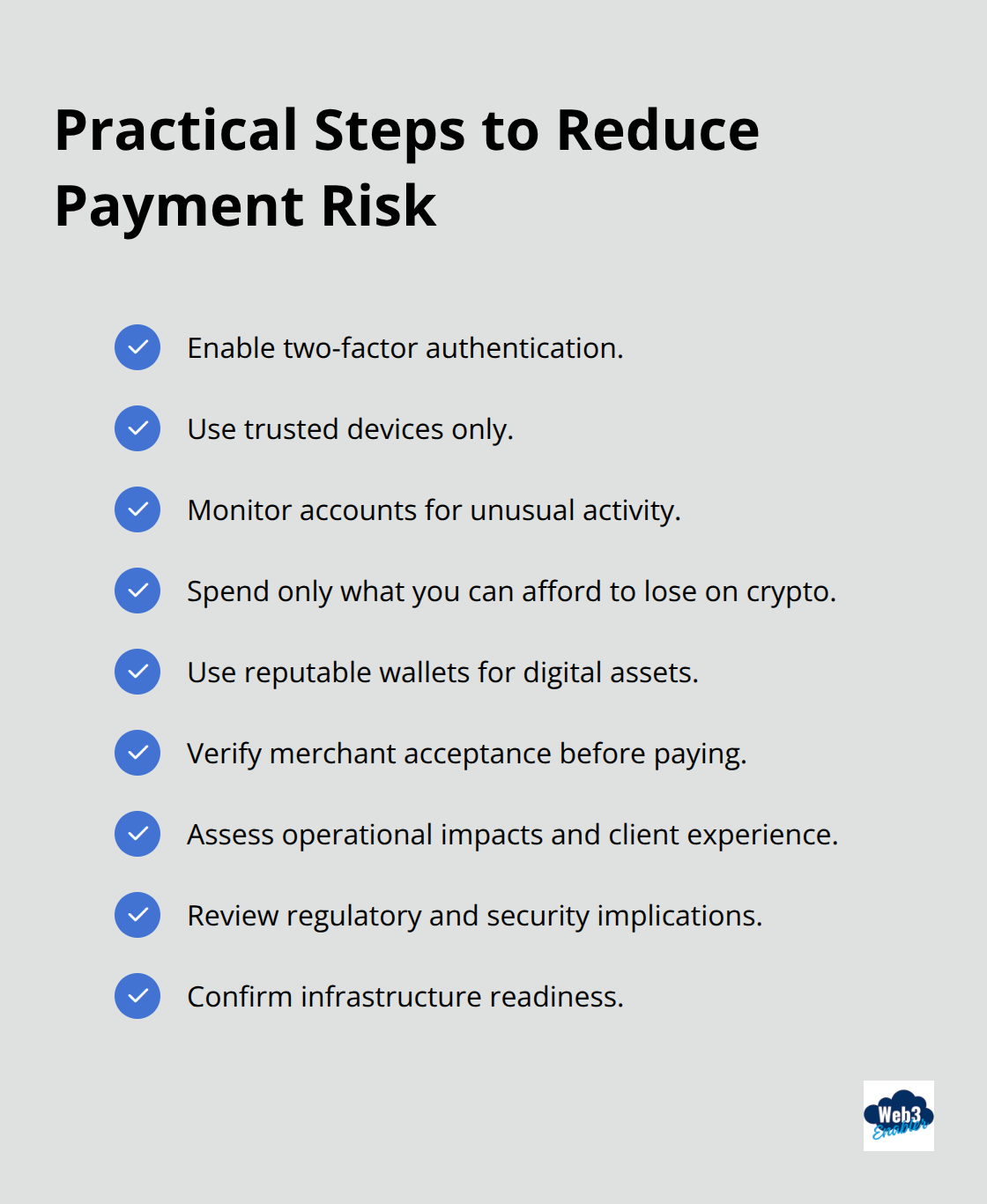

Enable two-factor authentication, use trusted devices, and monitor accounts for unusual activity. For crypto purchases, only spend what you can afford to lose, use reputable wallets, and verify merchant acceptance before attempting payment. When evaluating new payment technologies, ask how options affect operational efficiency and client experience, plus the regulatory and security implications and infrastructure readiness. These practical steps reduce exposure while you navigate an increasingly complex payment landscape where speed and safety must coexist.

Cost Savings and Financial Inclusion Through Digital Payments

Digital payments reduce costs at every transaction stage, but the savings vary dramatically depending on transaction type and geography. Traditional banking charges consumers and merchants fees that accumulate quickly. A wire transfer through a bank costs between $15 and $50, while international transfers can exceed $100. Digital wallets and payment networks eliminate many intermediaries, cutting costs substantially. For merchants, card interchange fees average 1.5 to 3 percent of transaction value, but real-time payment rails and stablecoin transfers can reduce this to near zero. A pending interchange settlement could lower average card interchange by about 10 basis points for five years if approved, signaling that regulators recognize merchants absorb excessive fees.

Gig workers and freelancers benefit most directly. Instant payouts eliminate the need to wait days for settlement, meaning workers access earnings immediately without overdraft fees or payday loan interest. For populations earning irregular income from multiple sources, this matters enormously. Real-time payments enable just-in-time supplier payments and rapid customer refunds, enhancing consumer satisfaction while businesses improve cash flow instantly rather than waiting for batch settlement cycles that traditionally took 24 to 48 hours.

Settlement Speed Transforms Cash Flow

Real-time payment systems settle transactions in seconds instead of days, fundamentally changing how households and businesses manage liquidity. A consumer receives a refund from a merchant and funds become available immediately rather than waiting for the next business day or longer. Small businesses no longer carry cash reserves to cover settlement delays between transactions and fund availability. India’s Unified Payments Interface achieved over 20 billion monthly transactions by late 2025 precisely because instant settlement eliminates friction for millions of workers and vendors operating on thin margins.

When funds arrive immediately, spending patterns shift. Consumers with access to real-time payouts spend more frequently and increase platform engagement significantly. Among recipients for whom payouts represent core cash flow, nearly 70 percent of one-time instant users become regulars, according to PYMNTS Intelligence research in collaboration with Ingo Payments. This behavioral stickiness reveals that speed isn’t a convenience feature for this population-it’s a financial necessity that determines whether rent gets paid on time or whether groceries remain unpurchased.

Financial Access Beyond Traditional Banking

Digital payments reach populations that banks have historically ignored or underserved. Mobile wallets function on any smartphone with internet connectivity, eliminating the need for physical bank branches or minimum balance requirements that exclude lower-income consumers. Unbanked and underbanked populations gain access to payment systems, savings mechanisms, and credit opportunities through wallet ecosystems that traditional banks never provided.

This expansion drives measurable economic activity. Global digital wallet users reached 5.2 billion in 2025, and this growth concentrates in emerging markets where bank branch density remains low but mobile penetration runs high. Wallets expand beyond payments into micro-loans, insurance, and wealth management services, creating pathways to financial products previously inaccessible to workers without formal employment or credit history. SMEs increasingly adopt wallet ecosystems for integrated payments and working capital solutions, accessing capital and payment infrastructure simultaneously rather than separately through banks and payment processors.

Final Thoughts

Digital payments have reshaped consumer behavior fundamentally, with 5.2 billion wallet users and 50% of e-commerce transactions flowing through digital channels rather than traditional cards. The impact of digital payments on consumers extends across adoption at mainstream scale, security infrastructure that now protects transactions more effectively than cash, and financial inclusion that creates pathways for unbanked populations and gig workers. Real-time settlement eliminates days of waiting, wallet ecosystems expand into credit and insurance, and instant payouts drive behavioral stickiness with 57% of recipients making them their primary method.

Stablecoins and blockchain technology will enable faster, cheaper cross-border payments as regulatory frameworks emerge in 2026, while biometric authentication expands beyond phones into daily payment experiences. Interoperability across payment networks will become non-negotiable as consumers expect seamless experiences across channels and regions. These structural changes in how money moves demand infrastructure built for real-world business needs rather than speculation.

We at Web3 Enabler recognize that this evolution requires solutions connecting blockchain technology with corporate infrastructure. Our Salesforce-native blockchain solutions enable businesses to accept stablecoin payments, send global payments faster, and integrate crypto holdings visibility directly into existing systems to deliver faster, more secure transactions that benefit consumers and businesses alike.

Frequently Asked Questions

Impact of Digital Payments on Consumers Today

How have digital payments changed consumer behavior?

Digital payments have shifted consumer behavior toward faster, always-available transactions. Mobile wallets, contactless payments, and instant payouts reduce friction at checkout and make it easier to receive, store, and spend money in real time.

Why have digital wallets become so popular?

Digital wallets combine multiple functions in one place. Consumers can receive money, spend it, transfer it, and store it without switching between tools. Wallet ecosystems also create convenience through features like QR payments, tap-to-pay, and integrated offers.

How do digital payments affect consumer trust and security?

Adoption depends heavily on trust. Consumers are more likely to use digital payments when providers show strong security practices, clear compliance standards, and reliable fraud protection. Encryption, tokenization, and secure authentication methods have become standard expectations.

What is tokenization and why does it matter?

Tokenization replaces sensitive payment information with a substitute value that is useless if intercepted. This reduces the risk of exposing real payment data and is one of the most important security measures used across modern payment systems.

How does biometric authentication impact digital payments?

Biometric authentication, such as fingerprint and facial recognition, helps make payments more secure while reducing friction. It adds a strong security layer without requiring consumers to remember passwords or PINs for every transaction.

Why are consumers concerned about data privacy in digital payments?

Digital payments generate rich data such as transaction history, location, and spending patterns. While this data helps businesses personalize experiences, it also raises privacy concerns. Regulations like GDPR push providers to disclose how data is used and protected.

How do digital payments reduce costs for consumers and merchants?

Digital payments can reduce or eliminate certain fees and intermediaries compared to traditional options like wires and some cross-border transfers. Real-time rails and stablecoin transfers can lower costs in specific scenarios, especially when international settlement is involved.

How does settlement speed impact consumers and gig workers?

Faster settlement improves access to money. For gig workers and freelancers, instant payouts can reduce reliance on overdrafts, payday loans, and waiting days for funds to clear, which can directly improve financial stability.

How do digital payments support financial inclusion?

Mobile wallets can reach unbanked and underbanked populations who may not have access to traditional bank branches or minimum balance accounts. Wallet ecosystems can also expand access to services like micro-loans, insurance, and savings tools.

What role will stablecoins play in consumer payments?

Stablecoins can enable faster and cheaper cross-border transfers while reducing volatility risk compared to traditional cryptocurrencies. As regulatory frameworks become clearer, stablecoins are expected to support broader mainstream payment use cases.

How does Web3 Enabler support this shift in digital payments?

Web3 Enabler builds Salesforce-native blockchain solutions that help businesses accept stablecoin payments, move money globally faster, and connect blockchain capabilities with existing business infrastructure in a secure and scalable way.