B2B payments are stuck in the slow lane. Wire transfers take days, fees eat into margins, and reconciliation feels like a never-ending paperwork nightmare.

At Web3 Enabler, we’ve watched companies waste thousands on outdated payment infrastructure. Digital B2B payments don’t have to be this painful-and we’re going to show you why stablecoins are changing the game.

Why Your Current Payment System Is Costing You More Than You Think

The Hidden Drain of Slow Transfers and Invisible Fees

Wire transfers sit in limbo for three to five days while your cash flow tightens. International payments take even longer-cross-border B2B transactions settle about slower rates than domestic ones. Meanwhile, 31% of companies still rely on checks, which cost between $2.01 and $10 per transaction to issue. That adds up fast when you process hundreds of payments monthly. The real kicker? Most businesses have zero visibility into when money actually arrives or what fees they pay until the statement hits. Hidden FX markups, correspondent banking charges, and processing delays create a fog around your true payment costs.

Where SMBs Feel the Squeeze

SMBs report that high credit costs plague 43% of them, while lengthy approval processes drag out another 35%. Your suppliers aren’t thrilled either-47% complain about no transparency on settlement times, and 44% say invoice approvals take forever. The result is a fractured ecosystem where everyone loses: you bleed money on fees and delays, your suppliers wait longer for cash, and your finance team drowns in manual reconciliation work that should have been automated years ago.

The Daisy Chain of Intermediaries

Correspondent banking creates a chain of intermediaries-typically three to five banks touching each cross-border payment. Each one takes a cut and adds time. A 2022 AFP survey found that 86% of companies still accept checks as payment, yet 62% of firms cite increased efficiency as the main reason they shift to electronic payments. That tension reveals the truth: legacy methods are expensive and slow, but many businesses haven’t fully switched. Automation cuts per-invoice processing costs from $16–$22 down to roughly $5.89–$6.89, according to the AP/AR Automation Tracker 2022. That’s a 65% reduction in operational overhead. Yet most B2B workflows still involve manual reviews (45% of SMBs report this as a pain point), system integration gaps (39%), and slow payment receipt confirmation (38%).

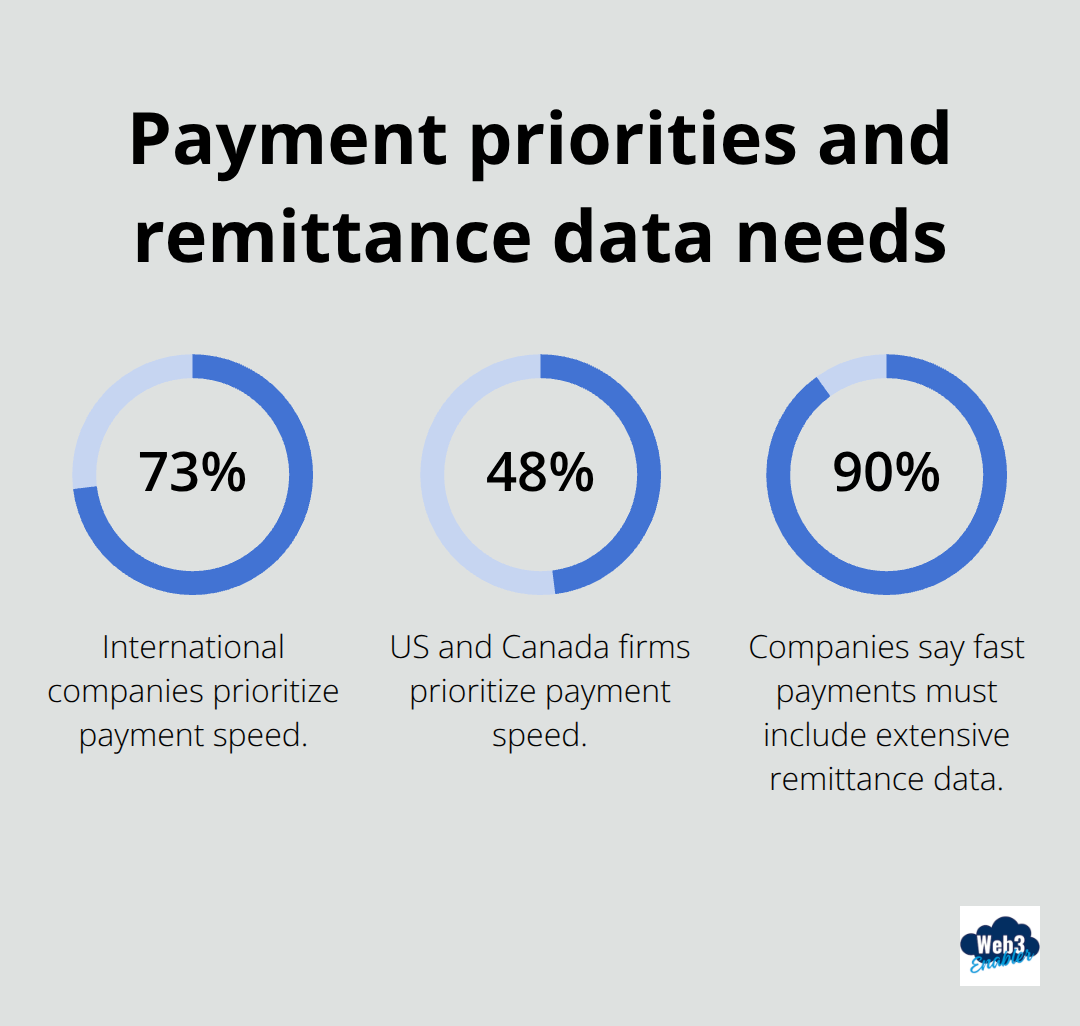

Speed and Visibility as Competitive Advantages

Speed isn’t just convenience-it’s cash flow strategy. Companies that adopt digital payments and real-time visibility gain faster liquidity, tighter cash management across currencies, and stronger supplier relationships. The AFP survey shows 73% of international companies rank payment speed as their top priority, compared to 48% of US and Canada firms. That gap tells you something: global businesses have already felt the pain and want solutions.

Rich remittance information matters too-90% of companies say fast payments must carry extensive remittance data to improve processing and reconciliation. Most accounting platforms like Xero or MYOB now integrate with digital payment solutions, enabling real-time dashboards and spend visibility that paper-based systems simply can’t match. This visibility transforms how you manage cash and supplier relationships, setting the stage for what modern payment infrastructure can actually deliver.

Why Stablecoins Cut Through B2B Payment Friction

Stablecoins Eliminate the Correspondent Banking Maze

Stablecoins solve the core problem wire transfers created: they move value across borders in minutes, not days, without the correspondent banking gauntlet. Unlike Bitcoin’s wild price swings, stablecoins like USDC and USDT maintain a fixed value pegged to the US dollar or other fiat currencies. This stability means you know exactly what you’re sending and receiving, with no FX surprises eating into margins. For B2B transactions, this matters enormously. A payment that would take three to five days via wire transfer settles on-chain in under an hour, and you get immediate confirmation of receipt. No more guessing when cash lands in your supplier’s account.

How Stablecoins Simplify Your Accounting

The accounting becomes cleaner too-stablecoins eliminate the hidden FX markups and correspondent bank fees that plague traditional transfers. Fragmented infrastructure with multiple intermediary banks creates delays and opaque pricing; stablecoins bypass that entire layer. Your supplier gets paid faster, your cash flow improves, and reconciliation becomes straightforward because every transaction is immutable and timestamped on the blockchain. Integration with platforms like Xero or MYOB means real-time visibility into outgoing payments without manual data entry or reconciliation delays.

The Cost Advantage Compounds at Scale

Automation already cuts per-invoice processing costs from $16–$22 down to $5.89–$6.89 according to the AP/AR Automation Tracker. Stablecoins go further by eliminating settlement delays entirely, so you’re not financing idle balances waiting for international transfers to clear. Companies sending payments to contractors, remote teams, or global suppliers see immediate impact-no more three-to-five-day limbo. The security is enterprise-grade because transactions are cryptographically verified and transparent, reducing fraud risk and compliance burden. You’re not speculating on crypto volatility; you’re using stablecoins as a payment rail that works faster than legacy methods while maintaining predictable pricing and regulatory clarity.

Making Stablecoins Work Within Your Existing Stack

Web3 Enabler lets you accept stablecoin payments and send global payments faster and more securely, all within your existing Salesforce infrastructure. This means your finance team keeps working in systems they already know, not juggling new platforms or wrestling with wallet management. Your team stays productive in familiar tools while gaining access to faster, more transparent payment rails. The next step involves understanding how to actually implement these solutions without disrupting your current workflows.

Making Stablecoins Work With Your Current Tools

Stay Inside Your Existing Systems

Moving stablecoin payments into your actual workflow doesn’t require ripping out your existing infrastructure. The key is selecting a solution that sits on top of what you already use, not replacing it entirely. Web3 Enabler builds 100% Salesforce native blockchain solutions available on the Salesforce AppExchange, which means your team stays in Salesforce while accessing faster, more transparent payment rails. This matters because switching platforms costs time, retraining, and operational friction that most finance teams can’t afford. Your Xero or MYOB integration continues working seamlessly. Your approval workflows stay intact. What changes is the speed and visibility you get.

Watch Settlement Times Collapse

When you send a stablecoin payment to a supplier, crypto payments settle in minutes rather than the traditional three to five business days. Your accounting team sees real-time confirmation instead of waiting for bank statements. Reconciliation becomes automatic because every transaction is timestamped and immutable on the blockchain, eliminating the manual matching that currently consumes 45% of SMB finance teams’ time. The integration itself is straightforward: your Salesforce instance connects to stablecoin rails, so payments flow directly from your existing approval process to settlement without additional logins or wallet management headaches. Your finance team works in familiar systems while the backend handles the blockchain complexity.

Test Before You Scale

Start with a pilot before rolling out stablecoin payments company-wide. Test the workflow with a handful of international suppliers or remote contractors who already accept digital payments, measure the time savings and cost reduction, then expand. This approach lets you validate that your vendors actually want faster payments (spoiler: they do), catch any integration quirks in your specific Salesforce setup, and build internal confidence before touching your entire payment flow.

Measure What Matters

Track three metrics during the pilot: settlement time from approval to confirmation, cost per transaction including any platform fees, and reconciliation time. Compare those numbers to your current wire transfer process and you’ll have concrete evidence to justify the broader rollout. Most companies see settlement time drop from five days to under one hour and per-transaction costs fall by 30–50% because you eliminate correspondent banking fees entirely.

Expand Gradually

Once the pilot proves the value, expand to more suppliers and increase payment volumes gradually. This measured approach prevents chaos from moving too fast while capturing real savings that justify the initial setup work.

Final Thoughts

B2B payments don’t have to be slow, expensive, or opaque. The shift from wire transfers and checks to digital B2B payments is already here, and companies that move first gain real competitive advantages in settlement speed, cost reduction, and cash flow visibility. Stablecoins eliminate the correspondent banking maze that plagued international payments for decades, settling transactions in minutes instead of days while keeping your accounting clean and your FX exposure predictable.

Your finance team stays productive in Salesforce, Xero, or MYOB while accessing faster, more transparent payment methods-not learning new platforms or managing wallets manually. Pick a pilot group of suppliers or contractors, test the workflow, measure the impact, then expand to see settlement times collapse from five days to under an hour and per-transaction costs drop by 30–50% as correspondent banking fees vanish. Reconciliation stops consuming manual effort because blockchain transactions are immutable and timestamped automatically.

Web3 Enabler builds Salesforce native blockchain solutions that let you accept stablecoin payments and send global payments faster and more securely within the systems your team already uses. Visit Web3 Enabler to see how your business can streamline digital B2B payments without the complexity.

Digital B2B Payments FAQs

What are digital B2B payments?

Digital B2B payments are electronic business-to-business transactions that replace checks and manual bank transfers with faster, trackable methods like ACH, card rails, real-time payments, and stablecoin rails.

Why are wire transfers so slow for B2B payments?

Wires often move through multiple banks and settlement steps, especially for cross-border transactions. That creates delays, unpredictable fees, and limited visibility until funds arrive.

How do stablecoins improve B2B payments?

Stablecoins can settle in minutes with near-instant confirmation, reducing time-in-transit and improving payment visibility. They also avoid many correspondent-bank fees that inflate traditional cross-border payments.

Are stablecoins risky for businesses to use in payments?

The main risks are operational and compliance-related, not “price volatility” in the same way as other crypto. Businesses typically reduce risk by using reputable stablecoins, converting promptly when needed, and working with compliant payment providers.

Do stablecoins replace my accounting and AP tools?

No. The goal is to integrate stablecoin payments into the tools you already use so approvals, reconciliation, and reporting stay inside your existing workflows.

How do stablecoin payments simplify reconciliation?

Each payment has a timestamped, immutable transaction record, which can reduce disputes and manual matching. When integrated properly, confirmations and remittance details can flow directly into your accounting records.

What’s the best way to start using stablecoins for B2B payments?

Start with a small pilot for a handful of international suppliers or contractors, then measure settlement time, cost per transaction, and reconciliation effort. Expand gradually once the workflow is proven internally.

What metrics should we track during a stablecoin B2B pilot?

Track settlement time from approval to confirmation, total cost per transaction including any platform fees, and the time your team spends reconciling and closing the loop on each payment.

Can stablecoins help with supplier relationships?

Yes. Faster settlement and clearer payment status can reduce supplier friction, improve trust, and help you negotiate better terms when vendors know funds arrive predictably.

How does Web3 Enabler fit into digital B2B payments?

Web3 Enabler helps businesses connect stablecoin payment rails to existing systems so teams can initiate, track, and reconcile payments with less manual effort and more real-time visibility.