At Web3 Enabler, we’ve watched this shift unfold, and honestly, the momentum is real. More businesses are accepting crypto for everyday payments, which means your digital assets can actually do something useful beyond sitting in a wallet.

This guide walks you through exactly how to make it happen.

How Crypto Payments Actually Reach Your Biller

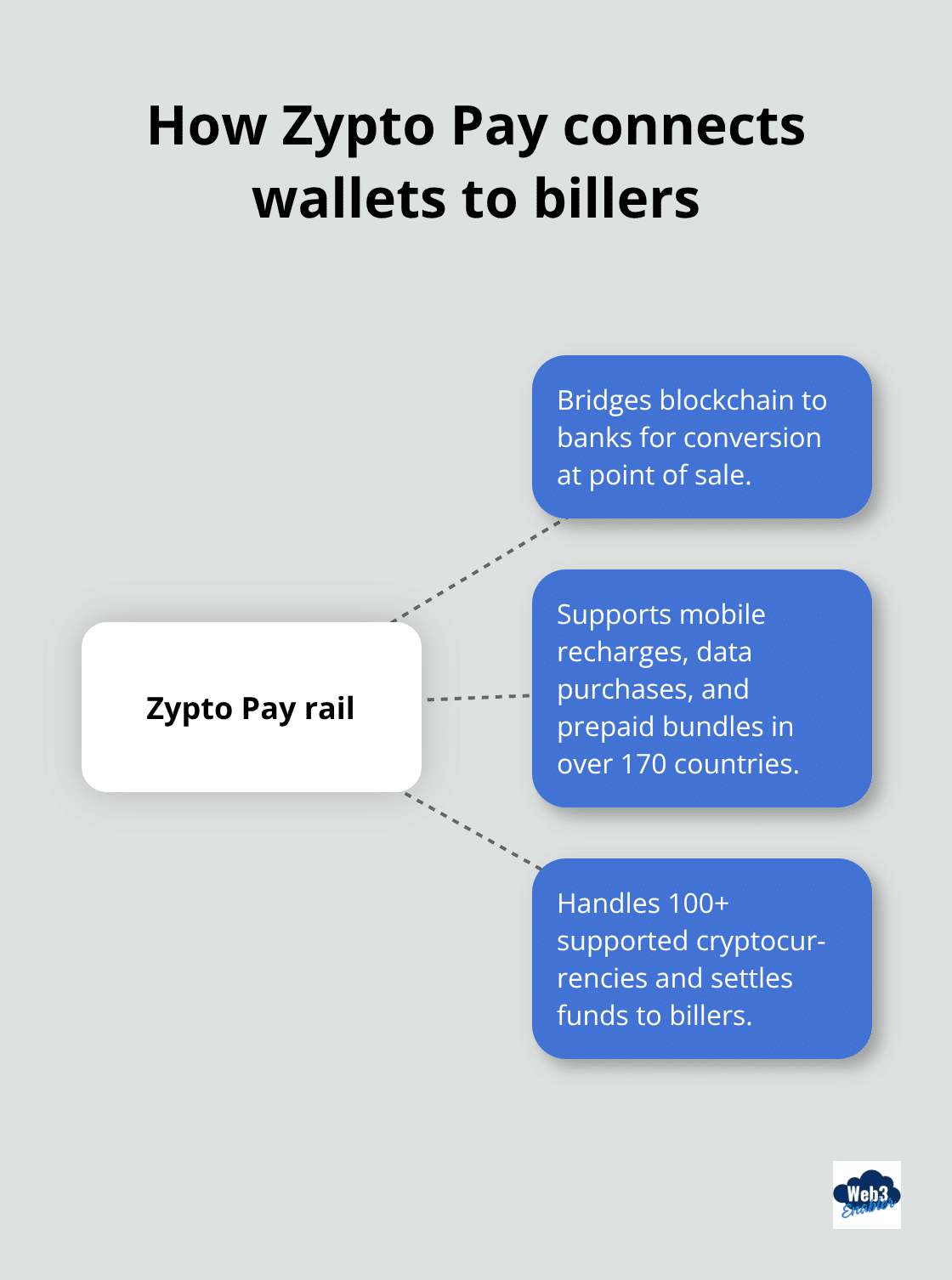

The Bridge Between Blockchain and Banks

When you initiate a crypto payment, your digital assets travel through what’s called a crypto-to-fiat rail-essentially a bridge that connects blockchain networks with traditional banking systems. The process starts when you select your biller and cryptocurrency, then your payment gets converted to local fiat currency at the point of sale. Services like Zypto Pay handle this conversion and settlement, supporting mobile recharges, data purchases, and prepaid bundles in over 170 countries with more than 100 supported cryptocurrencies.

Your electric company or mortgage lender receives their payment in traditional currency while you pay from your crypto wallet. Settlement typically happens within 48 hours, though blockchain network congestion and the specific payment rail affect the speed. Processing fees run around 3% plus $5 per transaction, plus whatever blockchain gas fees the network charges-costs that are genuinely lower than international wire transfers but higher than domestic ACH payments.

Why Businesses Accept Crypto Payments

Businesses jump on crypto payments for straightforward reasons: they get faster international settlements, lower friction for cross-border transactions, and access to customers who prefer holding crypto. Major brands like Costco, Ikea, Nordstrom, and Hilton now accept crypto payments through platforms like Zypto Pay, proving this isn’t some niche experiment. The adoption signals real business value, not speculation.

Stablecoins: The Practical Choice for Bills

Stablecoins like USDT and USDC are the real workhorses here, not volatile tokens like Bitcoin or Ethereum. Stablecoins maintain a 1:1 peg to fiat currencies, which means your bill amount stays predictable-you’re not gambling on whether the value of your payment drops 10% while waiting for settlement. For recurring bills especially, stablecoins eliminate the volatility headache entirely. The crypto-to-fiat conversion happens instantly at a locked rate, giving you certainty about exactly how much you’re spending in local currency terms.

What Happens Next

Now that you understand how payments actually flow from your wallet to your biller, the next step is getting yourself set up to make these payments happen.

Getting Started with Crypto Bill Payments

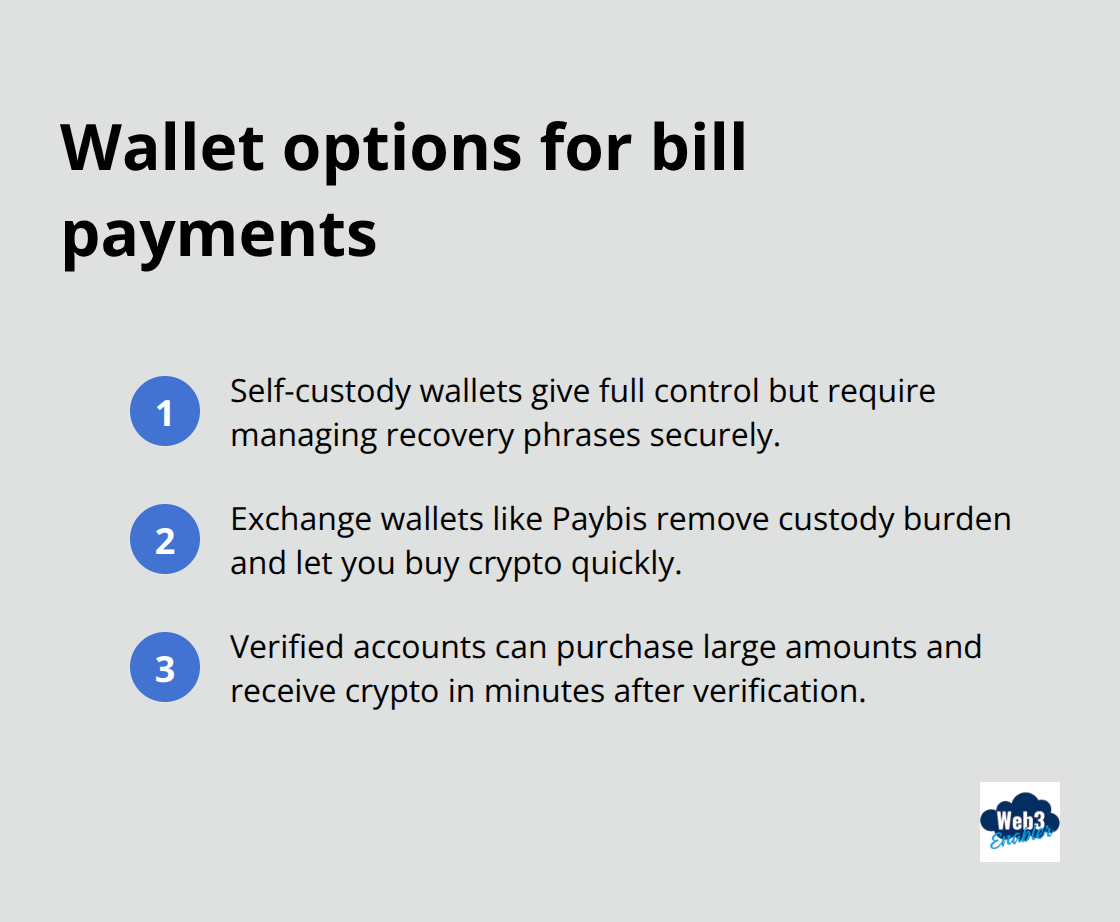

Pick Your Wallet Type

Getting crypto into a wallet that actually works for bill payments requires picking the right tool for the job, and not all wallets are created equal. Self-custody wallets like MetaMask or Trust Wallet give you full control but demand you manage your own security and recovery phrases-one mistake wipes out your funds permanently. Exchange wallets from platforms like Paybis skip that headache entirely.

You can buy crypto with a debit or credit card in under two minutes once verified, and Apple Pay support makes the process frictionless for Apple users. Paybis lets you purchase fractional Bitcoin starting at just $5, which matters because you don’t need a whole coin to pay a $50 electricity bill.

Verified accounts can buy up to $20,000 daily and $50,000 monthly, though most people paying regular bills never approach those limits. Your Bitcoin lands in your wallet within minutes after verification completes, letting you move from decision to payment without the multi-day delays traditional banking demands.

Convert Crypto to Fiat When Needed

Once crypto sits in your wallet, converting it to fiat becomes the next consideration. Stablecoins bypass conversion entirely since they already track fiat value, but if you’re holding volatile assets like Bitcoin, you’ll want to convert before paying. Paybis supports conversion to 65+ currencies and offers direct bank transfers, which means your local utility company receives their payment in the currency they actually want.

For businesses needing to pay vendors across borders, Paybis corporate on-ramps and private swaps provide liquidity access without moving through consumer channels. The fees matter too-Zypto Pay charges 3% plus $5 per transaction plus blockchain gas fees, which lands around 5–7% total for most payments, genuinely cheaper than wire transfers for international bills but pricier than domestic ACH. You’ll want stablecoins specifically for recurring bills because volatility kills predictability; locking in a rate for 30–60 seconds during conversion protects you from the kind of price swings that turn a $100 payment into $110 mid-transaction.

Find Providers That Accept Your Bills

Finding actual providers who accept crypto for bill payments means knowing where your specific bills can be paid. Zypto Pay covers billers worldwide including utilities and companies, with expanding coverage in India, Mexico, the Philippines, Egypt, Malaysia, Pakistan, El Salvador, and beyond. In the US specifically, you can pay major retailers like Costco, Ikea, Nordstrom, and Hilton through Zypto’s network, plus utilities, credit cards, loans, mortgages, and insurance across multiple countries.

The platform’s simple flow lets you select your country, pick your biller, enter billing information, choose your cryptocurrency, and complete payment-Zypto handles the conversion and settlement automatically. Settlement happens within 48 hours typically, though blockchain congestion occasionally extends that window. For checking whether your specific biller participates, Zypto’s website lists supported billers by country, so you can verify before committing to crypto payment.

Explore Emerging Payment Options

The landscape keeps expanding; services launched their gift card marketplace in December 2025 offering thousands of brands where you can convert crypto into spending power. Premium card offerings like Zypto Premium Visa cards provide concierge services and purchase protections alongside crypto-to-fiat spending capabilities. What matters most is that the infrastructure connecting your crypto wallet to actual bill payment networks exists now and works reliably-this isn’t theoretical anymore, it’s operational across major brands and utilities worldwide. With your wallet funded and your provider selected, the real question becomes how to actually execute these payments without leaving money on the table through unnecessary fees or security mistakes.

Where Your Crypto Payments Actually Go

Understanding the Real Infrastructure Behind Crypto Bills

Costco, Ikea, Nordstrom, and Hilton accepting crypto payments sounds impressive until you realize these transactions don’t magically work through crypto wallets alone. Real-world crypto bill payments require specific infrastructure, and understanding where your money actually flows matters far more than knowing which brands technically accept digital assets. When you pay your electricity bill or mortgage with Bitcoin through Zypto Pay, the platform handles conversion and routing through traditional banking infrastructure. The catch is fees. Zypto charges 3% plus $5 per transaction plus blockchain gas fees, totaling roughly 5–7% for most payments. That’s genuinely cheaper than international wire transfers costing 8–12%, but it’s substantially pricier than domestic ACH transfers running 0.5–1%.

Choosing Which Bills Make Financial Sense

Your strategy should depend entirely on bill type. Recurring domestic bills lose money to crypto conversion fees, making them poor candidates. International payments to vendors or cross-border mortgage payments benefit immediately from the 5–7% crypto route beating wire transfer costs significantly. For the US market specifically, Zypto covers 21,000+ companies and utilities, so your specific biller likely participates, but checking their supported biller list first prevents wasted time.

Minimizing Fees Through Smart Choices

Fee minimization starts with stablecoin selection and timing. USDT and USDC eliminate volatility during conversion, but their blockchain networks matter. Paying through Ethereum costs substantially more in gas fees than Polygon or Solana alternatives. If your provider supports multiple stablecoins, Solana-based USDT costs roughly 70% less in network fees than Ethereum equivalents. Lock exchange rates for 30–60 seconds before confirming payment, protecting yourself from price swings that inflate bills mid-transaction.

Protecting Your Funds from Theft and Mistakes

Security requires treating crypto payments like any high-value financial transaction. Your wallet’s private key or seed phrase is literally your money, so hardware wallets like Ledger or Trezor protect against malware stealing credentials from computers. Never screenshot recovery phrases, never text them, never store them in cloud services. For regular bill payments, segregate funds into a dedicated payment wallet holding only amounts you plan to spend within 30 days rather than storing your entire crypto portfolio in an active payment account. Two-factor authentication on exchange accounts and wallet applications adds another layer, though it won’t stop you from sending funds to the wrong address through phishing attacks. Verify biller addresses independently rather than clicking links in emails. Most critically, test small amounts first before committing to large bill payments through new providers, confirming settlement actually reaches your biller before sending monthly mortgage payments.

Final Thoughts

Crypto bill payments have moved from theoretical to operational, and the infrastructure supporting them keeps expanding across 126+ countries. Major retailers, utilities, and financial services now accept cryptocurrency, proving this isn’t a fringe experiment anymore-the real shift happened when platforms built reliable bridges between blockchain networks and traditional banking systems. Stablecoins eliminate volatility, crypto-to-fiat conversion happens within 48 hours typically, and fees run 5–7% for most transactions, which works brilliantly for international payments where wire transfers cost 8–12% but doesn’t make sense for domestic recurring bills where ACH transfers cost under 1%.

Getting started requires three concrete steps: fund a wallet through a provider like Paybis that lets you buy crypto with debit cards in under two minutes, verify your biller participates in networks like Zypto Pay’s 21,000+ supported US companies and utilities, and use stablecoins for predictability while testing small amounts before committing to large payments. Security matters most here-hardware wallets protect against malware, segregating payment funds prevents catastrophic losses, and verifying biller addresses independently stops phishing attacks cold. The momentum behind crypto payments for everyday bills keeps accelerating, with Zypto’s gift card marketplace launching in December 2025 and premium card offerings now providing concierge services alongside crypto spending.

At Web3 Enabler, we help businesses connect blockchain technology with existing corporate infrastructure through Salesforce-native solutions that make it simple to accept stablecoin payments, send global payments faster, or gain visibility into crypto holdings. The infrastructure supporting how to pay bills with crypto exists now-Web3 Enabler provides tools built for business operations rather than speculation. The question is whether you’re ready to use it.