The digital payments industry is shifting fast, and staying stuck with outdated methods is costing you real cash. We at Web3 Enabler have watched businesses transform their payment operations by adopting smarter solutions-and we’re here to show you how.

Where the Digital Payments Market Stands Right Now

The Numbers Tell a Clear Story

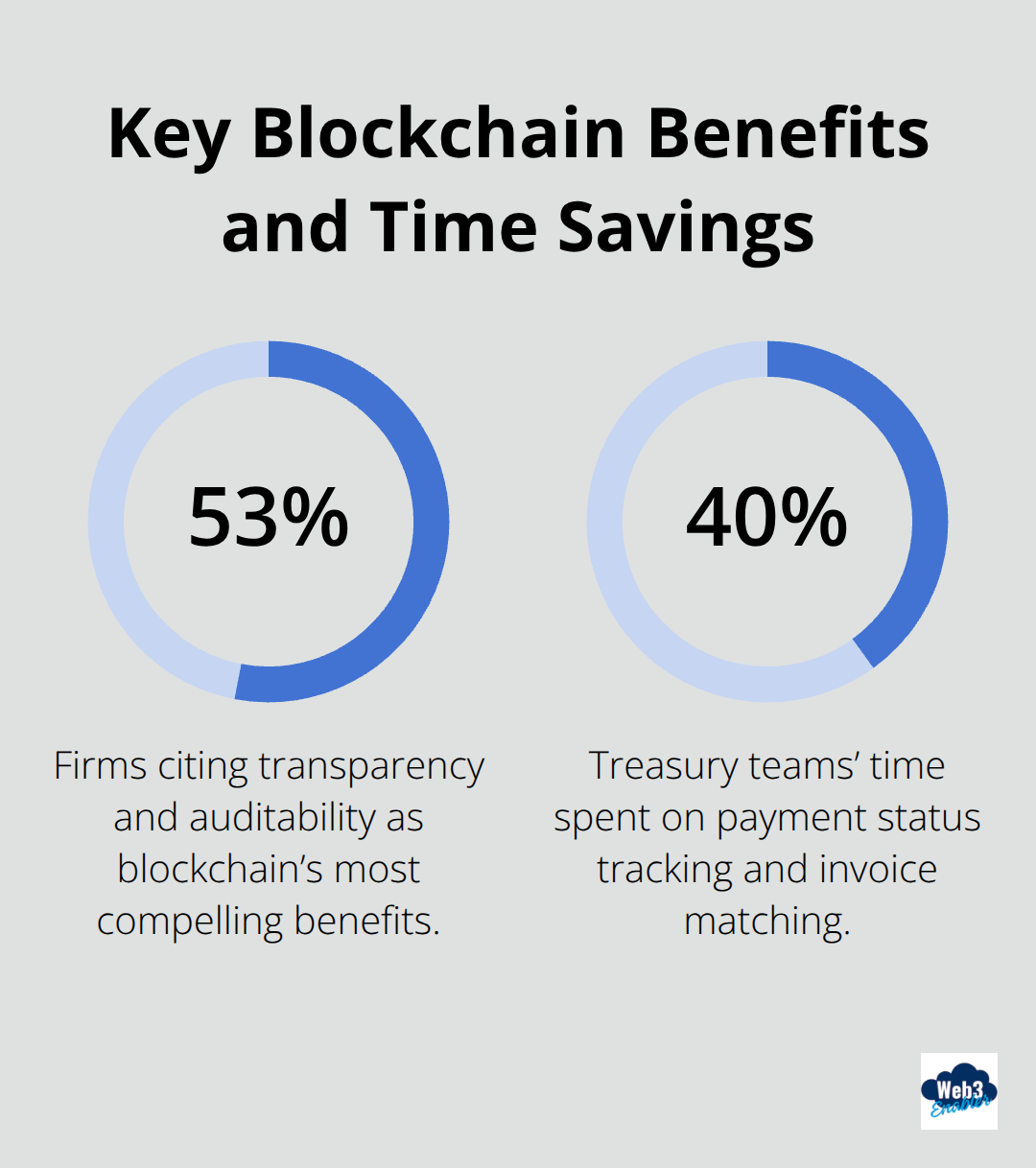

The global market for QR Code Payment was valued at US$14.7 Billion in 2024 and is projected to reach US$38.2 Billion by 2030, growing at a CAGR of 17.2%. Financial services firms plan to invest $6.98 billion or more in blockchain-based payment solutions over the next year, per The Business Research Company. That’s real cash moving toward solutions that solve actual problems. Fifty-three percent of firms cite transparency and auditability as blockchain’s most compelling benefits-they want immutable records they can trust.

Real-Time Settlement Changes Everything

Real-time payments adoption accelerates globally. The Federal Reserve’s FedNow, SEPA Instant in Europe, and RTP in the US enable near-instant settlement for both consumer and B2B transactions. The old three-to-five-day settlement window becomes obsolete, and companies that haven’t integrated these rails leave money on the table. Cross-border payments move faster and more transparently through SWIFT gpi, which improves tracking and reduces delays. The World Bank reports this matters enormously for remittance corridors where every day of delay costs money.

Payment Methods Shift Toward Mobile and Alternatives

Mobile wallets and contactless payments dominate checkout, especially on mobile devices where they now represent a substantial share of transactions, according to the Nilson Report and Visa data. QR code payments expand rapidly in emerging markets, particularly Asia-Pacific, where they’ve become the default payment method. Open Banking and payment initiation services under PSD2 and OBIE frameworks let banks function as payment rails, giving businesses more options and potentially lower costs than traditional card networks.

Consolidation Around Smarter Platforms

The competitive landscape consolidates around platforms that solve multiple problems at once. Payment orchestration platforms help merchants consolidate multiple payment service providers, optimize acceptance rates, and improve resilience-McKinsey notes these platforms route payments to best-performing providers by region and device type. Embedded payments within platforms and marketplaces reduce checkout friction and create new monetization opportunities. Meanwhile, fraud remains a persistent threat; financial institutions lost over $44 billion globally to fraud in 2023, per The Business Research Company, making data integrity non-negotiable.

Infrastructure and Cost Control Matter Most

Strong Customer Authentication and 3D Secure 2 adoption reduce fraud, but they can impact conversion rates, so risk-based authentication and frictionless 3DS2 implementations become standard. Interchange fee regulation constrains merchant costs in many regions, pushing businesses toward alternative payment rails like ACH and instant payments to control expenses. Cloud-native, API-first infrastructure replaces legacy systems because it improves scalability and resilience-Gartner emphasizes that containerization and automated deployments are now table stakes. Settlement timing matters more than ever; choosing payment service providers that offer real-time or same-day settlements directly improves cash flow and reduces funding costs tied to delayed payments.

The market fragments into specialized solutions, and businesses that adopt regional payment preferences and real-time settlement options outpace competitors still waiting for international transfers to clear. But knowing what’s available isn’t enough-you need to understand which modern solutions actually fit your operation.

Why Your Current Payment Setup Drains Cash Faster Than You Think

Transaction Fees That Add Up Quietly

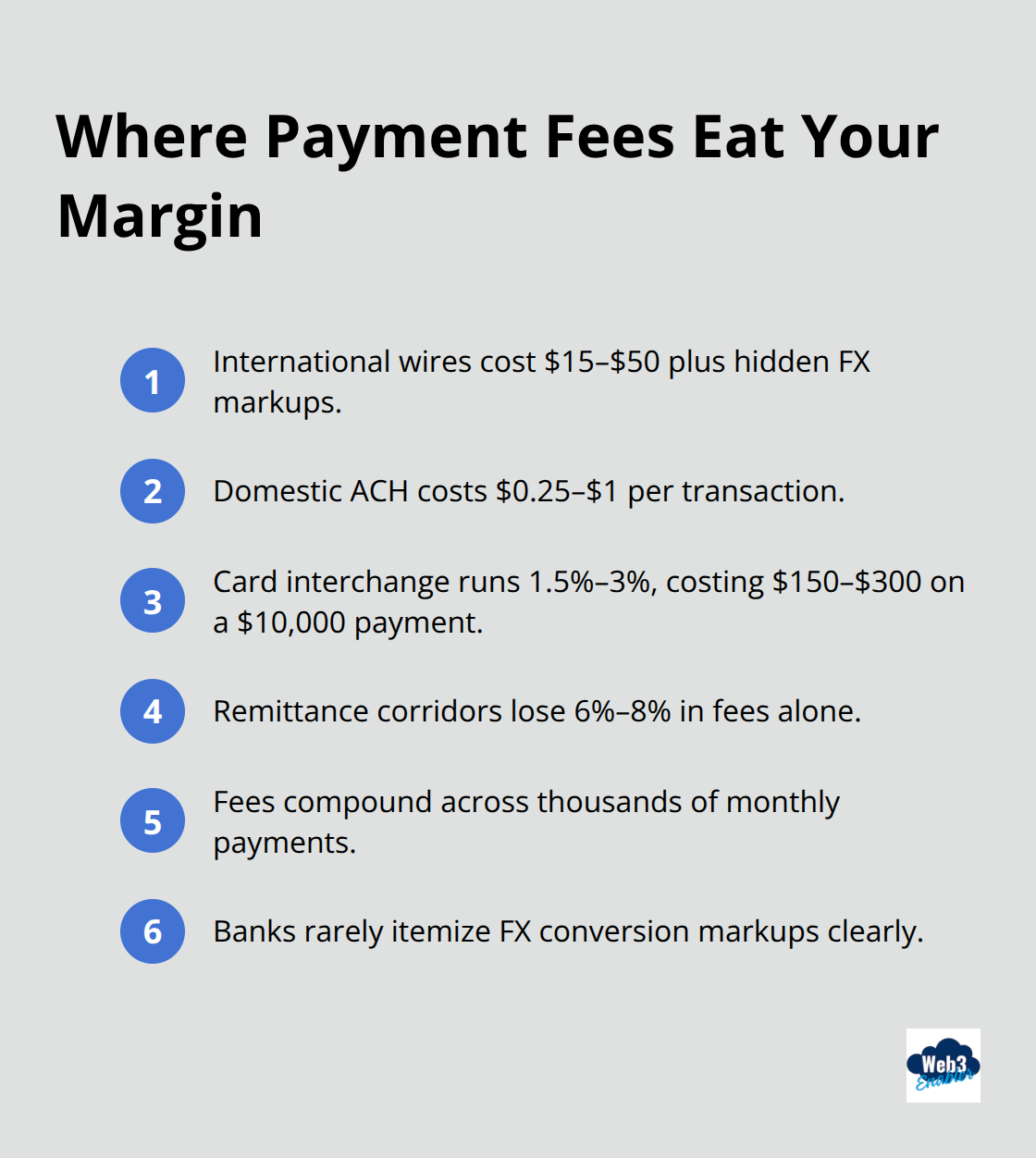

Traditional payment methods hit your bottom line in ways that compound silently. Every international wire transfer costs $15 to $50, plus hidden markup on currency conversion that banks never itemize clearly. Domestic ACH transfers charge $0.25 to $1 per transaction, but scale that across thousands of monthly payments and you hemorrhage thousands annually. Interchange fees on card transactions run 1.5% to 3% depending on card type and merchant category, meaning a $10,000 B2B payment costs you $150 to $300 just to move money.

The World Bank estimates that remittance corridors lose 6% to 8% in fees alone, and your business probably bleeds similarly without realizing it.

Settlement Delays Kill Your Cash Flow

Settlement delays compound the problem relentlessly. Traditional banking clears funds in three to five days, tying up working capital and forcing you to carry float costs that accumulate fast. When you need cash flow velocity, waiting half a week for a payment to land feels prehistoric. Real-time settlement options exist today, yet most businesses still operate on legacy timelines that waste money and operational efficiency.

Fraud Detection Remains Reactive, Not Preventive

Compliance and fraud management in legacy systems demand constant vigilance and expensive manual work. E-commerce payment fraud losses were estimated at $41 billion in 2022, and most fraud detection still relies on reactive monitoring rather than preventive architecture. Your team spends hours reconciling transactions across multiple bank statements, payment processors, and accounting systems because data sits in silos with no real-time visibility. Strong Customer Authentication and 3D Secure 2 reduce fraud, but they also tank conversion rates if implemented poorly, forcing you to choose between security and user experience.

International Transfers Create Compliance Nightmares

International transfers multiply compliance headaches exponentially. SWIFT transfers require manual KYC verification at multiple checkpoints, each adding days to settlement and creating audit trail gaps. You can’t easily prove transaction provenance or trace funds through correspondent banks, making regulatory reporting a nightmare. Businesses stuck here accept fraud as operational cost rather than a solvable problem, and they accept delayed settlements as inevitable.

Modern Solutions Eliminate These Pain Points

The infrastructure exists today to solve every problem mentioned above. Blockchain-based payment solutions, real-time settlement rails, and automated compliance systems replace the manual chaos of traditional banking. Businesses that adopt these modern approaches gain immediate advantages in cash flow, fraud prevention, and regulatory compliance. The question isn’t whether solutions exist-it’s which ones fit your operation and how to implement them without disrupting existing workflows.

What Actually Works When You Replace Your Payment Stack

Stablecoins Move Money Faster and Cheaper Than Traditional Rails

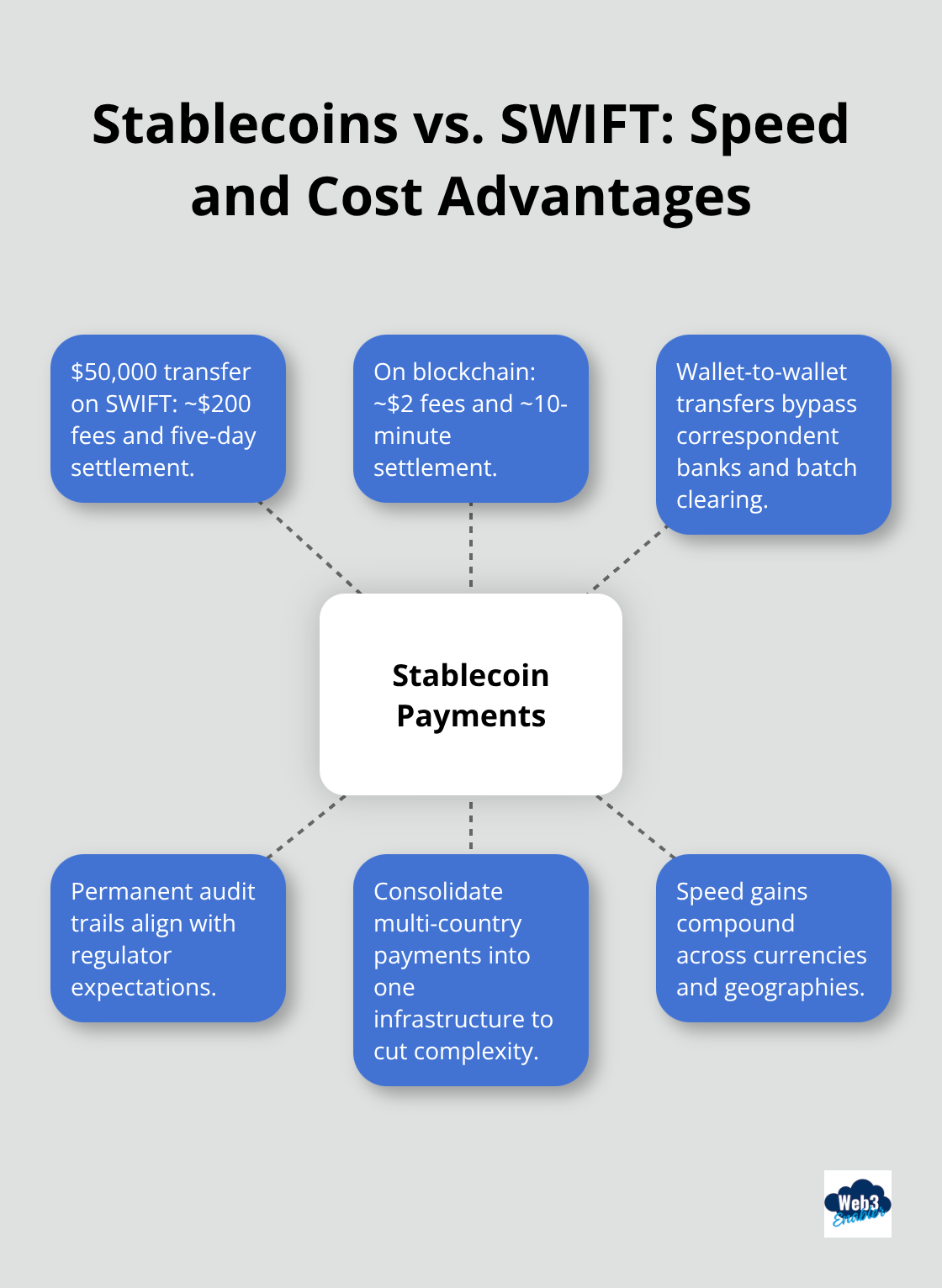

Stablecoins for moving money and blockchain integration sound exotic until you realize they function as faster, cheaper rails for moving money. USDC and USDT settle in minutes instead of days, cost a fraction of wire fees, and create permanent audit trails that regulators actually want to see. A $50,000 international transfer that costs $200 and takes five days on SWIFT costs $2 and settles in ten minutes on blockchain. That’s not theoretical-it’s the actual economics businesses operate with today.

Real-time settlement options like FedNow and SEPA Instant exist, but they still route through traditional banking rails and require correspondent bank networks for international transfers. Stablecoin payments bypass those intermediaries entirely. You send money directly from wallet to wallet without waiting for clearing houses or correspondent banks to process batches. That speed advantage compounds when you operate across multiple countries or currencies. A business paying suppliers in five different countries consolidates those transfers into a single stablecoin payment infrastructure instead of maintaining separate relationships with banks in each region. The operational simplification alone cuts costs and reduces settlement risk.

Integration With Your Existing Systems Matters Most

Isolated payment infrastructure creates data silos that kill compliance efficiency. When your payment ledger connects to your CRM and ERP, you gain real-time visibility into transaction status, customer payment history, and settlement timing all in one place. Gartner emphasizes that cloud-native, API-first infrastructure is now table stakes, and stablecoin payments on blockchain represent the most efficient version of that architecture available today.

The integration challenge remains real, though. Legacy ERPs and CRMs need API connections to blockchain infrastructure, and that requires planning. Web3 Enabler builds blockchain solutions as native Salesforce integrations, so your payment automation connects to your existing customer and financial data without expensive middleware. This approach lets you validate the technology, train your team, and measure ROI on a contained scope before scaling.

Automation Transforms Payment Operations Into Predictable Processes

Smart contracts on blockchain execute payment conditions automatically-invoice triggers payment, shipment confirmation releases funds, compliance checks happen before settlement. You eliminate manual reconciliation because blockchain creates immutable records that don’t require human verification. Treasury teams stop spending forty percent of their time on payment status tracking and invoice matching. Instead, they focus on strategy and cash optimization.

A logistics company using blockchain-based trade finance connects with suppliers, insurers, and banks through a single platform where documentation, payments, and compliance checks happen simultaneously. IBM and Maersk’s TradeLens platform reduced shipping document processing from weeks to hours by automating documentation on a shared ledger. That’s not a future state-it’s operating reality for businesses that moved off legacy systems.

Asset Tokenization Unlocks Faster Settlement and Fractional Ownership

Tokenization of assets on blockchain enables fractional ownership and faster settlement for everything from real estate to commodity trades. The immediate payoff for most businesses comes from automating routine payments rather than complex asset structures. Start with one specific payment problem-international supplier payments, customer refunds, or inter-company transfers-and automate that workflow before expanding to other payment types.

Final Thoughts

The digital payments industry has fundamentally shifted, and stablecoin infrastructure, real-time settlement, and blockchain-based automation now represent operational reality rather than future concepts. Businesses that moved off legacy systems already capture efficiency gains and cost savings that competitors still chasing outdated methods will never achieve. The question isn’t whether to modernize your payment stack, but which solution actually solves your specific problem without creating new friction.

Start with one concrete pain point rather than attempting to overhaul everything at once. If international transfers drain your cash flow, stablecoin payments settle in minutes instead of days. If fraud detection consumes your team’s time, blockchain’s immutable audit trails and automated compliance checks eliminate manual reconciliation. If your suppliers span multiple countries, consolidating those transfers into a single infrastructure cuts operational complexity and reduces settlement risk.

We at Web3 Enabler build blockchain solutions designed specifically for this reality, with Salesforce-native tools that connect stablecoin payments, global transfers, and compliance automation directly into your existing CRM and financial systems. You integrate blockchain capabilities where they solve actual problems, measure the impact, and scale from there. Your competitors in the digital payments industry are already moving-the real question is whether you’ll lead the shift or spend the next year watching others capture the advantages that modern payment infrastructure delivers.