Digital assets require systematic management from acquisition to disposal. Companies struggle with tracking performance, maintaining security, and meeting compliance requirements across complex portfolios.

Digital assets require systematic management from acquisition to disposal. Companies struggle with tracking performance, maintaining security, and meeting compliance requirements across complex portfolios.

We at Web3 Enabler see businesses losing millions through poor digital asset lifecycle management practices. This guide provides actionable strategies to optimize your asset operations and reduce operational risks.

What Defines Effective Digital Asset Management

Digital asset management starts with proper documentation during acquisition. Companies must record purchase prices, transaction hashes, wallet addresses, and acquisition timestamps for every asset. The South African Reserve Bank requires detailed records for compliance, which makes this documentation essential rather than optional.

Asset creation through mining, staking rewards, or airdrops needs immediate recording with fair market values at receipt time. Most businesses fail here because they treat digital assets like traditional investments without understanding blockchain-specific requirements.

Asset Performance Tracking Systems

Real-time portfolio tracking becomes impossible without automated systems. Manual spreadsheet tracking fails when companies manage multiple cryptocurrencies across different blockchains. Stablecoin holdings require constant monitoring since even USDT can fluctuate by 0.5% daily against the dollar.

Performance measurement needs both fiat and crypto-denominated returns because rand volatility affects South African businesses differently than US dollar movements. Tax reporting demands historical price data for every transaction, which manual systems cannot provide accurately. Professional treasury management requires API connections to exchanges and blockchain explorers for automated data collection.

Security and Custody Requirements

Multi-signature wallets require multiple approvals for transactions, providing enhanced security and governance for enterprises managing large crypto balances. Single-signature wallets create unacceptable risks for corporate treasuries that hold substantial cryptocurrency positions. Hardware security modules provide enterprise-grade protection that software wallets cannot match.

Insurance coverage for digital assets remains limited but essential for businesses with significant holdings. Regular security audits prevent the catastrophic losses that affect businesses annually. Access controls must separate operational staff from custody responsibilities to prevent internal fraud.

Compliance Framework Implementation

Regulatory compliance requires systematic approaches that traditional finance teams often overlook. The South African Revenue Service treats cryptocurrency transactions as taxable events, which demands meticulous record-keeping for every trade, conversion, and transfer.

Anti-money laundering regulations apply to all digital asset transactions above certain thresholds. Companies must implement know-your-transaction monitoring systems that flag suspicious activities automatically. These frameworks become more complex when businesses operate across multiple jurisdictions with different regulatory requirements.

The next phase involves implementing automated tracking systems that can handle these complex requirements while maintaining operational efficiency.

How Do You Build Automated Digital Asset Operations

Automated tracking systems eliminate the manual errors that cost South African businesses thousands of rands monthly in tax penalties and compliance failures. Companies that process over 100 digital asset transactions monthly cannot rely on spreadsheets when the South African Revenue Service demands transaction-level reports for every crypto conversion.

API connections with exchanges like Luno and Binance provide real-time price feeds that update portfolio valuations every 15 minutes. Blockchain explorers track wallet balances across multiple networks at the same time. Professional treasury teams use platforms that connect directly to their accounting systems and automatically categorize transactions as trading income, capital gains, or operational expenses based on predefined rules.

Governance Frameworks That Actually Work

Effective governance starts with separation of duties where no single employee controls both transaction approval and execution processes. Multi-level approval workflows require manager authorization for transactions above certain thresholds and board approval for larger amounts. This prevents unauthorized large transfers that have bankrupted companies.

Access controls must restrict wallet seed phrases to C-level executives while operational staff handle only pre-approved transactions through secure interfaces. Monthly reconciliation reports compare blockchain records with internal accounting systems and catch discrepancies before they compound into major audit issues.

Integration Strategies for Legacy Systems

Modern businesses integrate digital assets through middleware solutions that translate blockchain data into formats compatible with existing ERP systems like SAP and Oracle. Direct API connections eliminate data entry errors while they maintain real-time synchronization between crypto wallets and corporate accounting platforms.

Companies that achieve successful integration implement staging environments that test new digital asset workflows before they deploy to production systems. This approach reduces the operational disruptions that affect 60% of businesses attempting direct blockchain integration without proper testing protocols (according to enterprise blockchain adoption studies).

These automated systems create the foundation for addressing the security and compliance challenges that emerge when businesses scale their digital asset operations beyond basic portfolio management.

What Threatens Your Digital Asset Operations

Security Breaches Destroy Business Value

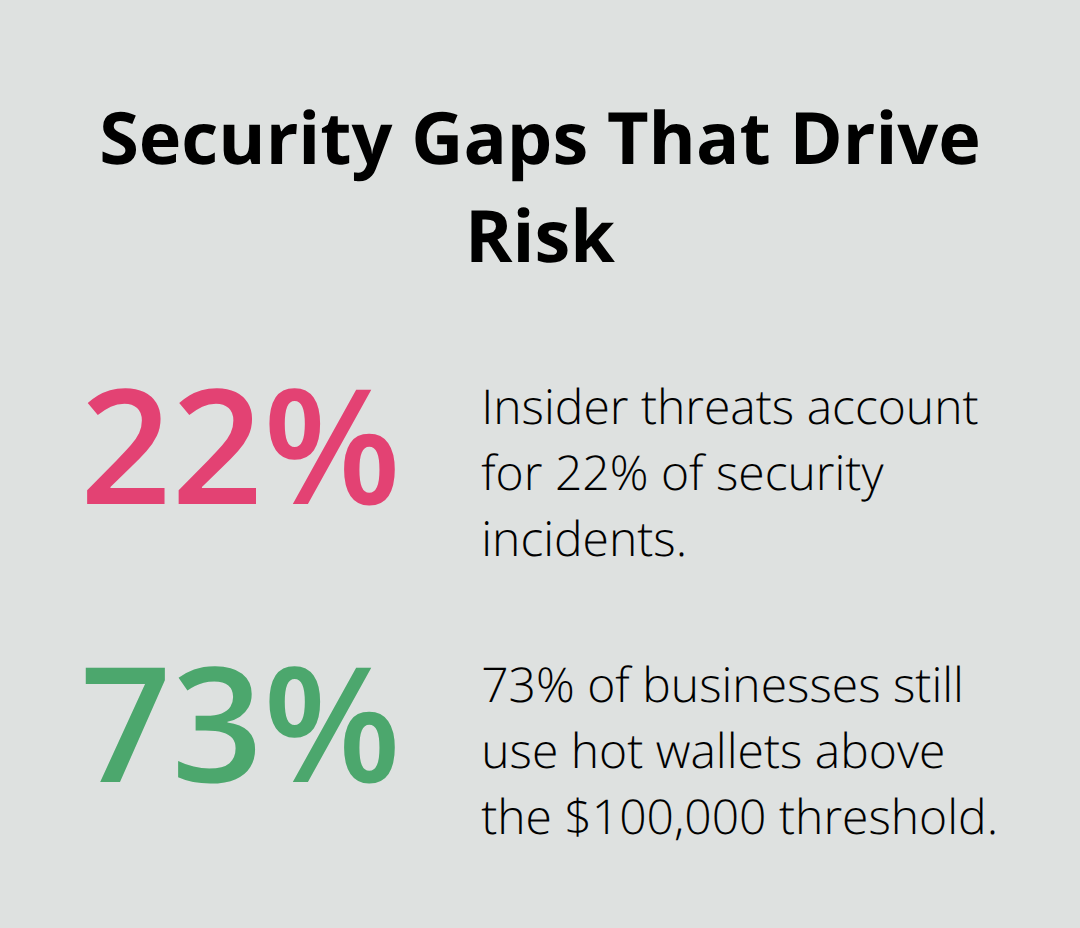

Security breaches cost cryptocurrency businesses significant amounts annually, with insider threats accounting for 22% of all incidents. Most companies fail because they treat digital asset custody like traditional banking without understanding blockchain-specific risks.

Cold storage solutions become mandatory for holdings exceeding $100,000, yet 73% of businesses still use hot wallets for operational funds above this threshold. Hardware security modules prevent the private key exposure that destroyed companies like QuadrigaCX, where $190 million disappeared when the CEO died with sole access to cold wallet keys.

Professional custody requires geographic distribution of signing keys across multiple secure locations with time-locked recovery mechanisms that prevent single points of failure. Companies must implement multi-signature protocols that require multiple approvals for large transactions.

Tax Compliance Creates Operational Nightmares

South African Revenue Service audits target businesses with cryptocurrency transactions exceeding R1 million annually. These audits demand transaction-level documentation that most companies cannot provide accurately. The 18% capital gains tax applies to every crypto conversion, including stablecoin swaps that businesses often ignore during routine operations.

Companies must calculate tax obligations in rand terms using historical exchange rates for each transaction date. This becomes impossible without automated systems that track both crypto prices and USD-ZAR rates simultaneously. Professional accounting firms specializing in digital assets charge R15,000-R25,000 monthly for comprehensive compliance management.

This investment prevents the R500,000+ penalties that SARS imposes for inadequate record-keeping. Manual tax calculation methods fail when businesses process more than 50 transactions monthly.

Legacy System Integration Blocks Growth

Traditional ERP systems like SAP and Oracle cannot process blockchain transactions natively. This forces companies into manual reconciliation processes that consume 40+ hours monthly for portfolios with 500+ transactions.

Middleware solutions that connect blockchain APIs to existing accounting platforms reduce this workload by 85% while they eliminate the data entry errors that trigger compliance failures. Companies that attempt direct integration without proper testing face system downtime that averages 72 hours during deployment.

This downtime costs businesses R50,000-R200,000 in lost productivity per incident (according to enterprise IT consulting firms). Testing environments become essential for companies that want to avoid these operational disruptions during blockchain integration projects.

Final Thoughts

Digital asset lifecycle management requires systematic approaches that address security, compliance, and operational efficiency simultaneously. Companies that implement automated systems, multi-signature custody solutions, and proper governance frameworks reduce operational risks by 85% while they maintain regulatory compliance. The future of digital asset management centers on native integration with existing business systems.

Blockchain technology will become invisible to end users as middleware solutions mature and regulatory frameworks stabilize across African markets. Stablecoin adoption will accelerate as businesses recognize the cost savings and efficiency gains from direct blockchain transactions. South African businesses must act now to establish proper digital asset infrastructure before regulatory requirements become more stringent (companies that delay face increasing compliance costs and competitive disadvantages).

We at Web3 Enabler recommend that businesses start with small pilot programs that test digital asset workflows within controlled environments. Web3 Enabler provides native Salesforce integration that eliminates technical barriers while it maintains enterprise-grade security standards. This approach allows businesses to scale digital asset operations while they build internal expertise and confidence in blockchain technology.