Your customers want payment options that actually work in 2025. Crypto payments aren’t some distant future thing anymore-they’re happening right now, and businesses that ignore them are leaving money on the table.

We at Web3 Enabler have helped dozens of companies figure out how to integrate crypto payments on their websites without the headache. This guide walks you through everything: picking the right stablecoin, setting up the tech, and staying on the right side of regulations.

Why Your Business Can’t Ignore Crypto Payments Anymore

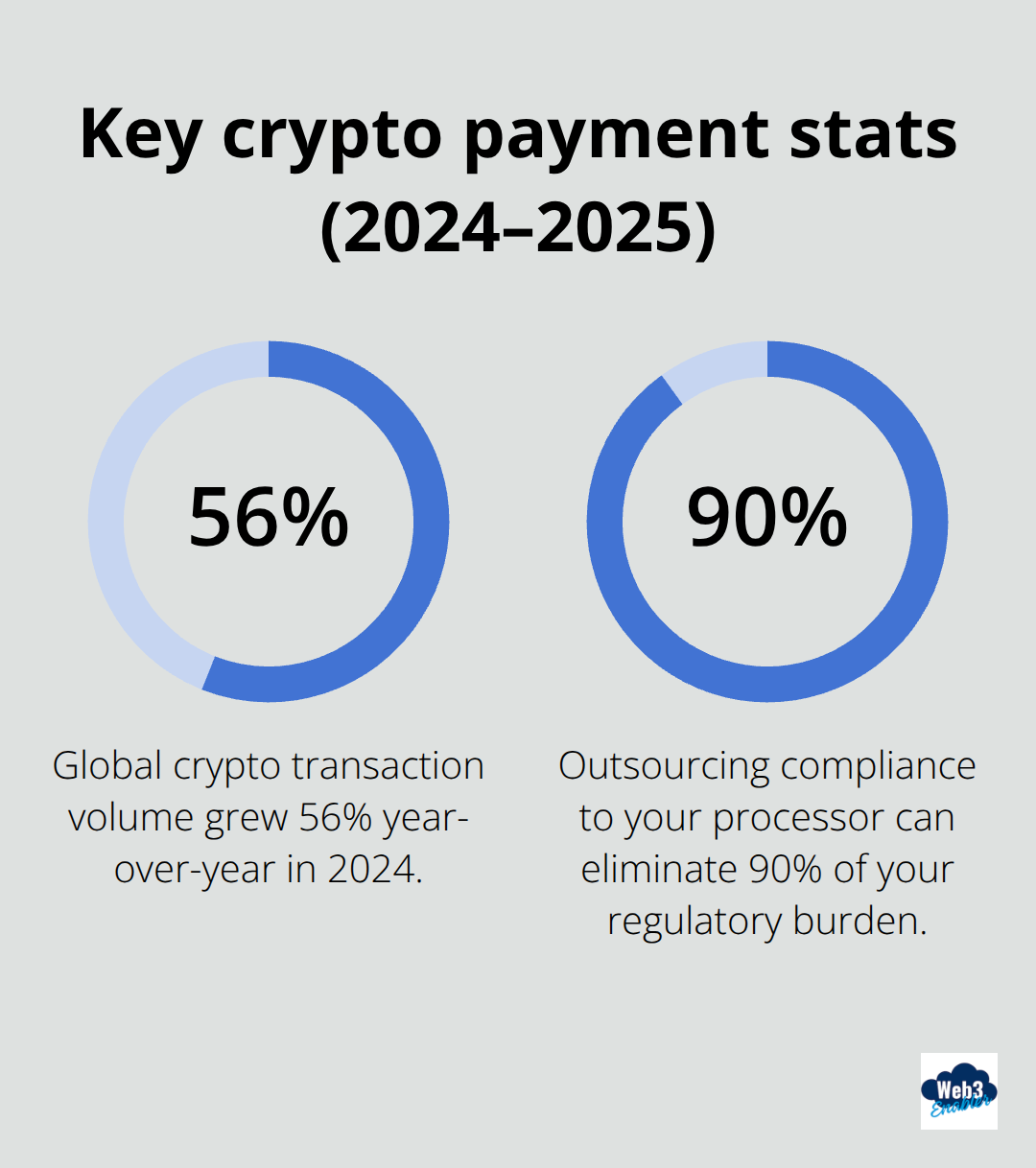

Global crypto transaction volume hit 10.6 trillion dollars in 2024, up 56 percent year-over-year, with over 15,000 businesses now accepting crypto according to Stripe. That’s not niche anymore. Stablecoin payments alone surpassed 5.8 trillion dollars in transaction volume last year, and stablecoin circulation climbed to 307 billion dollars by November 2025 with annual growth exceeding 50 percent. Your competitors are already moving. If you’re still pretending crypto payments don’t matter for your business, you’re gambling with revenue.

The question isn’t whether to accept crypto payments-it’s whether you can afford to wait.

The Math Actually Works in Your Favor

Here’s where crypto payments get interesting for your bottom line. Cross-border transactions cost only a few cents regardless of where your customer lives, compared to traditional payment rails that bleed 2-3 percent in fees plus multiple days of settlement. Crypto payments settle in minutes instead of days, which means faster cash flow and less capital tied up. Chargeback risk disappears because on-chain transactions are final once confirmed-no more fighting with customers over disputed payments. If you’re selling to international customers, travelers, or creators, stablecoins like USDC eliminate currency conversion headaches entirely. One USDC equals one dollar everywhere, so your pricing stays simple and your accounting doesn’t turn into a nightmare.

Access Markets That Traditional Banking Can’t Reach

Billions of people live in regions with unstable local currencies or minimal access to traditional banking infrastructure. Crypto payments open your checkout to these customers without requiring them to jump through hoops with international wire transfers or currency conversions that cost them money. Stablecoins have doubled in circulation over roughly 18 months between 2023 and 2025, making payments more reliable and faster. This isn’t theoretical-real transaction volume shows genuine adoption momentum. Your business gains access to a global customer base that actively prefers crypto because it solves real problems for them. That’s not a niche market anymore; that’s a revenue stream most of your competitors haven’t figured out how to capture yet.

Why Stablecoins Matter More Than You Think

Stablecoins eliminate the volatility headache that makes crypto payments feel risky. When a customer pays you in USDC, you know exactly what you’re getting-one dollar per coin, no surprises. This stability transforms crypto from a speculative asset into a legitimate payment method that your accounting team won’t fight you over. The infrastructure supporting stablecoins has matured dramatically, with major providers now offering seamless integration into existing payment systems. Your customers benefit from borderless, permissionless settlement, while you benefit from predictable pricing and straightforward crypto compliance and tax reporting. That combination doesn’t exist anywhere else in the payments world.

Setting Up Stablecoins Live on Your Website

USDC and USDT are your main players here, and honestly, USDC wins for most businesses. USDC has 307 billion dollars in circulation as of November 2025 according to Stripe, with annual growth exceeding 50 percent, and Circle backs it with transparent reserves. USDT has larger total volume but comes with slightly more regulatory uncertainty depending on your jurisdiction. Start with USDC unless your customer base specifically demands USDT, then expand later. Your accounting team will thank you because both maintain a 1:1 peg to the US dollar, eliminating the pricing chaos that comes with volatile cryptocurrencies. If you sell primarily to European customers, add EUR-based stablecoins, but USDC handles 95 percent of use cases for international businesses. The technical implementation doesn’t care which stablecoin you choose, so don’t overthink this decision.

Selecting Your Integration Partner

You have three paths: use a payment processor like Stripe that handles crypto natively, integrate a dedicated crypto gateway, or manage your own wallet infrastructure. Stripe offers 125+ payment methods across 195 countries with 135+ currencies supported, handles no-code fraud protection, and guarantees 99.999 percent uptime. That removes compliance headaches and technical risk from your shoulders. If Stripe feels too heavyweight, evaluate dedicated stablecoin and blockchain payments providers, but verify they handle KYC/AML automatically, support multiple stablecoins, and offer fiat conversion. Managing your own wallet requires serious security expertise, cold storage infrastructure, and compliance resources that most businesses shouldn’t attempt. The processor you choose determines your customer experience, compliance burden, and operational overhead.

Building Your Checkout Flow

Once you’ve picked your processor, the integration takes days not months. Stripe’s crypto API documentation is solid, and most developers get a test checkout working in under an hour. You’ll need to generate API keys, map your pricing to stablecoin amounts using real-time price feeds from providers like CoinGecko, and verify on-chain receipts to finalize orders. Your checkout flow shows customers a pay-with-crypto button, they connect their wallet via QR code or payment link, approve the transaction, and settlement happens on-chain in minutes. Tax reporting requires logging the fair market value of each payment at receipt time, which your processor should handle automatically.

Securing Your Implementation

Security basics matter here: enable multifactor authentication for your API keys, never expose them in client-side code, and implement robust error handling for rate limits or network issues. Test extensively in testnet environments before going live. The complexity people imagine doesn’t match reality once you’re actually building it. With these fundamentals in place, you’re ready to handle the regulatory side of crypto payments-which is where most businesses stumble without proper guidance.

Managing Compliance and Security

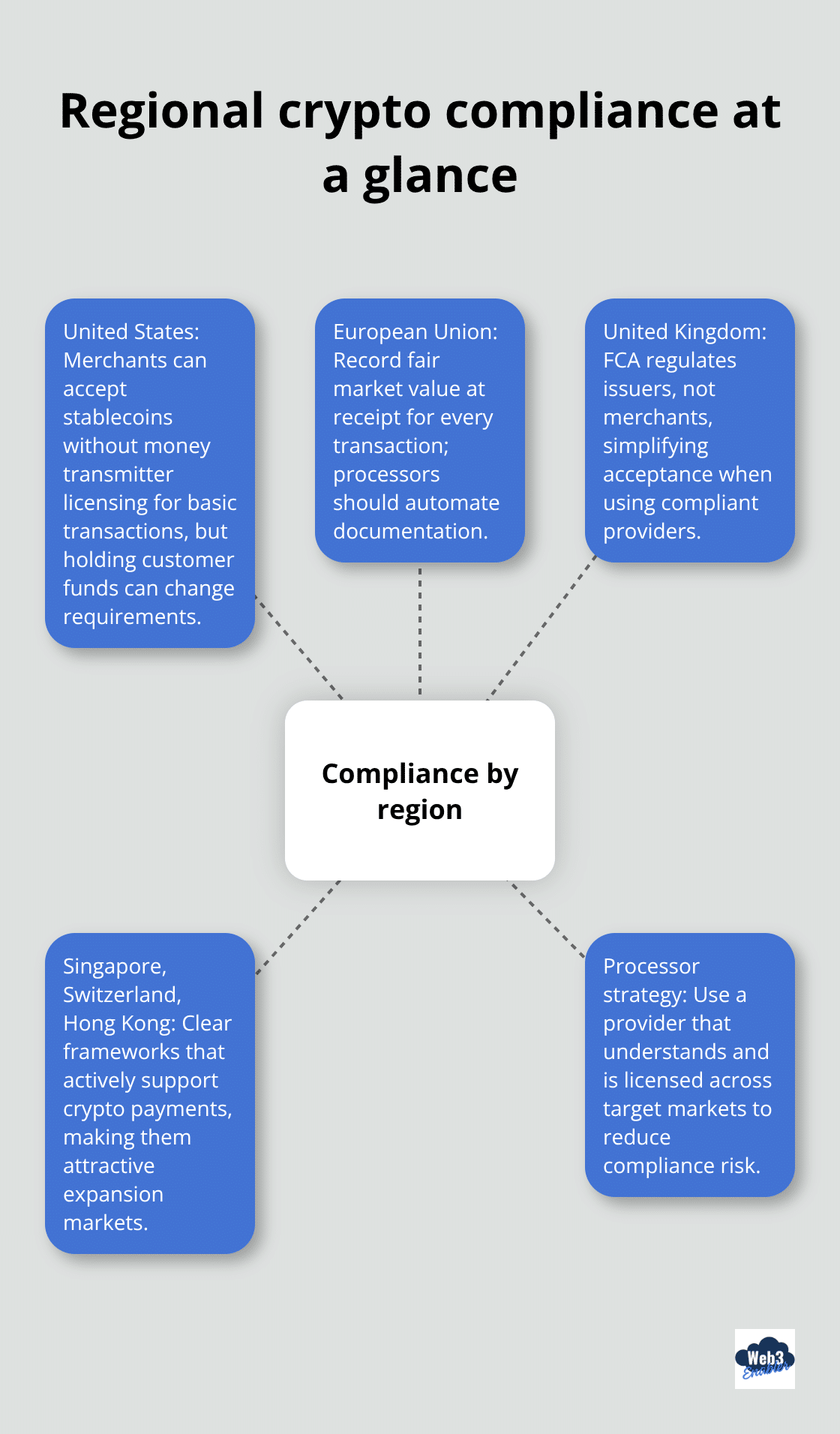

Crypto payments are legal in most countries, but the regulatory landscape varies wildly depending on where your customers and your business operate. In the United States, accepting stablecoins for goods and services is legal, and you’re generally not classified as a money transmitter for basic acceptance. However, if you hold customer funds, exchange crypto for fiat, or transfer crypto on behalf of customers, you may trigger money transmitter licensing requirements that vary by state. The European Union treats crypto payments as property transactions for tax purposes, requiring you to record the fair market value of each payment at the moment you receive it. This means documenting the USD equivalent of every USDC transaction for tax reporting. The UK Financial Conduct Authority regulates stablecoin issuers but not merchants accepting them, making acceptance straightforward provided you work with compliant providers. Singapore, Switzerland, and Hong Kong have clear regulatory frameworks favoring crypto payments, making them ideal markets for expansion. The practical takeaway: use a processor like Stripe that handles compliance automatically rather than managing regulatory obligations yourself. If your processor handles KYC/AML verification, maintains proper licensing, and reports transaction data to tax authorities, you’ve outsourced 90 percent of your regulatory burden.

Tax Reporting That Won’t Haunt You

Tax authorities treat crypto payments as property sales, not currency exchanges. When a customer pays you $100 in USDC, you report $100 in revenue at that moment based on the spot price when you received it. You don’t owe capital gains tax on receiving the payment itself, only if you later convert USDC to fiat at a different price or hold it and the value changes. Your processor should generate transaction records showing the date, amount in fiat equivalent, customer wallet address, and your receiving address for every payment. Export these records monthly into your accounting software and match them against your revenue records. For tax purposes, document the fair market value immediately upon receipt, not weeks later when you convert to fiat. This eliminates disputes with tax authorities about when you actually earned the revenue. If you accept multiple stablecoins, track each one separately because regulatory treatment may differ. Consult a tax professional familiar with crypto, as rules vary significantly by jurisdiction and your specific business structure.

Security That Protects Everyone

Crypto transactions are final once confirmed on-chain, meaning you cannot reverse a payment the way you can with credit cards. This cuts chargeback fraud to zero, but it also means you must protect customer wallets and your receiving addresses from theft or compromise. Enable multifactor authentication on every account that can access your crypto payment infrastructure (whether that’s your processor dashboard, your API keys, or your wallet management system). Never expose API keys in client-side code, environment variables, or version control repositories where attackers can find them. If you manage your own wallet, use hardware wallets or cold storage for balances exceeding $50,000 to eliminate hacking risk. Test all security measures in testnet before going live. Implement monitoring that alerts you immediately if transaction volumes spike unexpectedly or if payments arrive from suspicious patterns. Most breaches happen through weak passwords, phishing, or exposed API keys, not through blockchain exploits. Your processor’s security infrastructure matters more than your own in most cases, which is another reason using Stripe or similar providers beats managing your own infrastructure.

Understanding Regional Regulatory Differences

Different jurisdictions impose different requirements on crypto payment acceptance. The United States allows stablecoin acceptance without money transmitter licensing for basic merchant transactions, though holding customer funds changes this calculation. The European Union requires you to record fair market value at receipt time for every transaction, creating a documentation burden that your processor should handle automatically. The UK Financial Conduct Authority regulates stablecoin issuers rather than merchants, simplifying your compliance obligations significantly. Singapore, Switzerland, and Hong Kong offer clear regulatory frameworks that actively support crypto payments, making these regions attractive for business expansion.

Work with a processor that understands these regional differences and maintains proper licensing across your target markets.

Outsourcing Compliance to Your Processor

Managing regulatory obligations yourself creates unnecessary risk and complexity. A processor like Stripe handles KYC/AML verification automatically, maintains proper licensing across jurisdictions, and reports transaction data to tax authorities on your behalf. This outsourcing approach eliminates 90 percent of your regulatory burden and keeps your team focused on running your business rather than chasing compliance paperwork. Your processor becomes your regulatory shield, handling the technical and legal requirements that would otherwise consume your resources.

Final Thoughts

Integrating crypto payments on your website takes days, not months, and the payoff justifies the effort immediately. You pick USDC as your starting stablecoin, select a processor like Stripe that handles compliance automatically, and watch your payment options expand without consuming your team’s resources. The numbers speak for themselves: stablecoin transaction volume hit 5.8 trillion dollars in 2024, and that momentum accelerates because the math works-faster settlement, lower fees, access to customers traditional banking ignores, and zero chargebacks.

Your implementation stays straightforward once you commit to the process. Security requires multifactor authentication, API key protection, and cold storage for large balances (nothing exotic). Tax reporting demands that you document fair market value at receipt time, which your processor handles automatically. Regulatory compliance varies by region, but outsourcing this burden to your processor eliminates 90 percent of the headache and lets you focus on selling.

The real question stops being whether to accept crypto payments and starts being whether you can afford to wait while competitors capture customers you currently turn away. We at Web3 Enabler help businesses connect blockchain technology with existing infrastructure like Salesforce, making crypto payments work seamlessly within systems you already use. Explore what Web3 Enabler offers to learn how we guide you through integrating crypto payments on your website while maintaining full visibility into transactions and compliance.