Your payment system is probably slower than your competitors’. Most businesses are still stuck with infrastructure that processes transactions like it’s 1995, complete with settlement delays that tie up cash and cross-border headaches that make international expansion feel impossible.

At Web3 Enabler, we’ve watched companies lose deals because their payment tech couldn’t keep up. Innovation in digital payments isn’t some distant future-it’s happening now, and the businesses moving fastest are already winning.

Why Your Payment System Is Costing You Money

Settlement Delays Drain Your Cash Flow

Settlement delays eat into your margins right now. Traditional payment systems take one to five business days to move money between accounts, meaning your cash sits frozen while competitors with faster infrastructure already reinvest their revenue. Your working capital gets trapped in the system, and that costs you real money in lost opportunities and financing charges.

Cross-border payments hit even harder. They often take longer because your bank routes transactions through correspondent banks in multiple countries, each taking a cut and adding delays. A business sending $100,000 internationally loses money to FX spreads and intermediary fees alone-and that’s before waiting to see the money land.

Compliance Overhead Multiplies Your Costs

The compliance burden compounds this problem significantly. Your team manually reconciles transactions across spreadsheets, email trails, and banking portals because legacy systems don’t talk to each other. When you operate across multiple countries, you manage separate compliance frameworks for each region and hire more staff to handle Travel Rule requirements and sanctions screening.

This manual work creates friction at every step. Your finance team spends hours on reconciliation instead of analyzing data that could drive decisions. Each region demands different documentation, different timelines, and different verification processes-all handled separately, all costing money.

Security Vulnerabilities in Legacy Systems

Older infrastructure wasn’t designed for modern threats. Legacy systems get breached regularly because they rely on centralized databases that attackers target directly. Blockchain-based payments eliminate this vulnerability through cryptographic security that’s far harder to compromise than traditional databases.

The data backs this up: illicit activity represents only 0.14% of cryptocurrency transactions, yet legacy payment systems still suffer breaches because they weren’t built for today’s threat landscape. Your competitors aren’t waiting for your payment system to catch up-they’re already moving faster and safer.

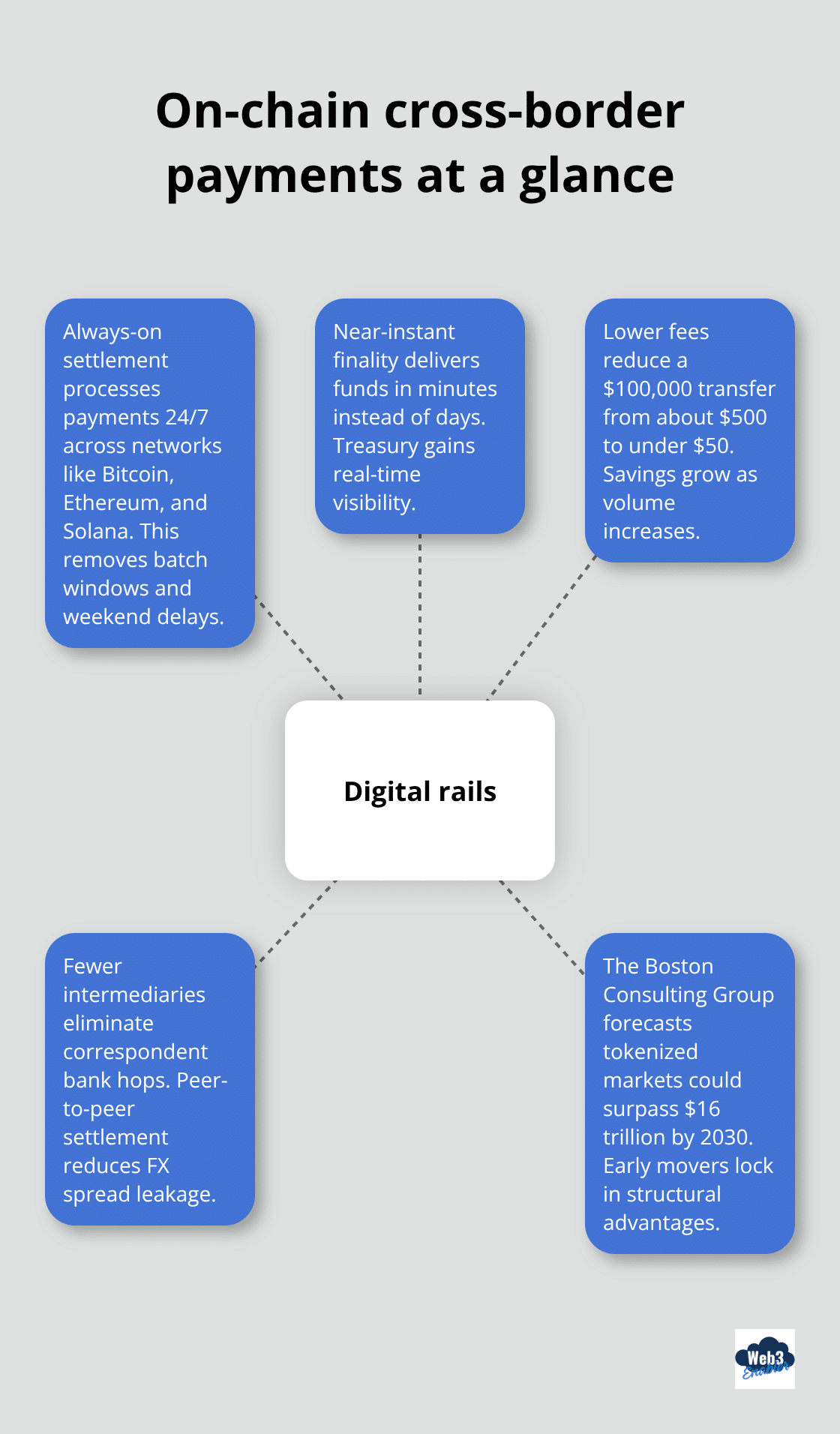

What Digital Rails Actually Change

Digital rails eliminate settlement delays entirely by processing transactions in minutes or seconds instead of days. Automated on-chain verification reduces your compliance burden dramatically, and cryptographic security provides protection that legacy systems simply can’t match. The cost difference is staggering: cross-border payments that cost thousands today could cost under $50 with digital rails.

These aren’t theoretical improvements-they’re operational changes that hit your bottom line immediately. Faster settlement means better cash flow. Lower fees mean higher margins. Reduced compliance overhead means your team focuses on growth instead of spreadsheets.

The question isn’t whether digital payments work. The question is how quickly you can implement them before your competitors lock in the advantage.

What Makes Digital Payments Actually Work

Stablecoins like USDC have become the backbone of real-world blockchain payments because they solve a problem legacy systems never could: they move value at blockchain speed without the volatility that kills business use cases. When Visa settled transactions with USDC on Solana, they weren’t experimenting-they were proving that stablecoins work for actual commerce at scale. Stripe now accepts USDC directly, and Shopify lets merchants price in fiat while settling on-chain in minutes. This isn’t theoretical adoption. Companies like GrabPay convert customer funds to USDC and USDT for instant settlement to local currencies like Singapore dollars, cutting what used to take days into seconds. Your competitors who move to stablecoin rails keep more cash, avoid FX losses, and redeploy capital faster than you can process a traditional wire transfer.

Blockchain eliminates the middlemen that slow you down

Every correspondent bank in a traditional payment chain takes time and money. Blockchain networks like Bitcoin, Ethereum, and Solana operate 24/7 without intermediaries, which means your cross-border payments settle in minutes instead of one to five business days. You stop losing money to FX spreads because transactions happen peer-to-peer. A $100,000 international payment that costs $500 in fees and takes three days with traditional banking costs under $50 and settles in under five minutes on-chain. The Boston Consulting Group forecasts that tokenized markets could surpass $16 trillion by 2030, which means the infrastructure you build today determines whether you lead that shift or scramble to catch up.

Real-time visibility transforms your cash management

Traditional banking gives you settlement visibility after the fact. Blockchain gives it to you in real time. Your treasury team sees exact confirmation status on every transaction as it happens, which means you stop guessing about cash positions and start making decisions based on facts. Corporate treasury operations benefit immediately: you get instant inter-division transfers, eliminate FX risk through stablecoin settlement, and increase transparency across every payment. Payroll teams can pay global contractors in stablecoins instantly instead of waiting for international wire processing. Gig economy platforms can pay workers the moment a task completes rather than holding funds for processing cycles.

Speed and security work together on-chain

Blockchain transactions settle faster because they don’t require the manual verification steps that legacy systems demand. Cryptographic security protects each transaction through mathematical proof rather than centralized database protection. Illicit activity represents only 0.14% of cryptocurrency transactions, yet legacy payment systems still suffer breaches because they weren’t built for modern threats. Your infrastructure choice determines whether you operate with the security posture of 2025 or continue relying on systems designed decades ago.

The infrastructure you need already exists and operates reliably at scale. What remains is deciding whether you’ll implement it before your competitors lock in the advantage.

Moving From Legacy Systems to Digital Rails

Map Your Current Payment Pain Points

The gap between knowing digital payments work and actually implementing them stops most businesses cold. You need a realistic roadmap that fits your operations, not a theoretical framework that sounds good in a board meeting. Start by mapping exactly where your payment infrastructure fails today. Which transactions take longest? Where do you lose the most money to fees and FX spreads? Which regions cause the biggest compliance headaches? Document these pain points with numbers, not assumptions. If your cross-border payments average three days and cost $500 per transaction, write that down. If your compliance team spends 200 hours monthly on reconciliation, measure it. These specifics become your success metrics later, and they determine which digital payment solution actually solves your problem instead of creating new ones.

Choose Solutions That Integrate With Your Existing Stack

Your existing systems won’t disappear overnight, so any digital payment solution must integrate cleanly with your current infrastructure. This is where most implementations fail. You need platforms that connect to your ERP, accounting software, and banking systems without requiring your team to rebuild workflows from scratch. When evaluating solutions, ask vendors specifically how their platform talks to your current stack. If they can’t show you a working integration with your accounting software or banking partner, move on. Integration complexity kills adoption faster than any technical limitation.

Solutions built natively within your existing environment work best. Salesforce Native blockchain solutions sit directly inside your Salesforce environment, which means your sales team, finance team, and operations team all work in one place rather than toggling between separate systems. This approach eliminates the friction that derails most digital payment rollouts.

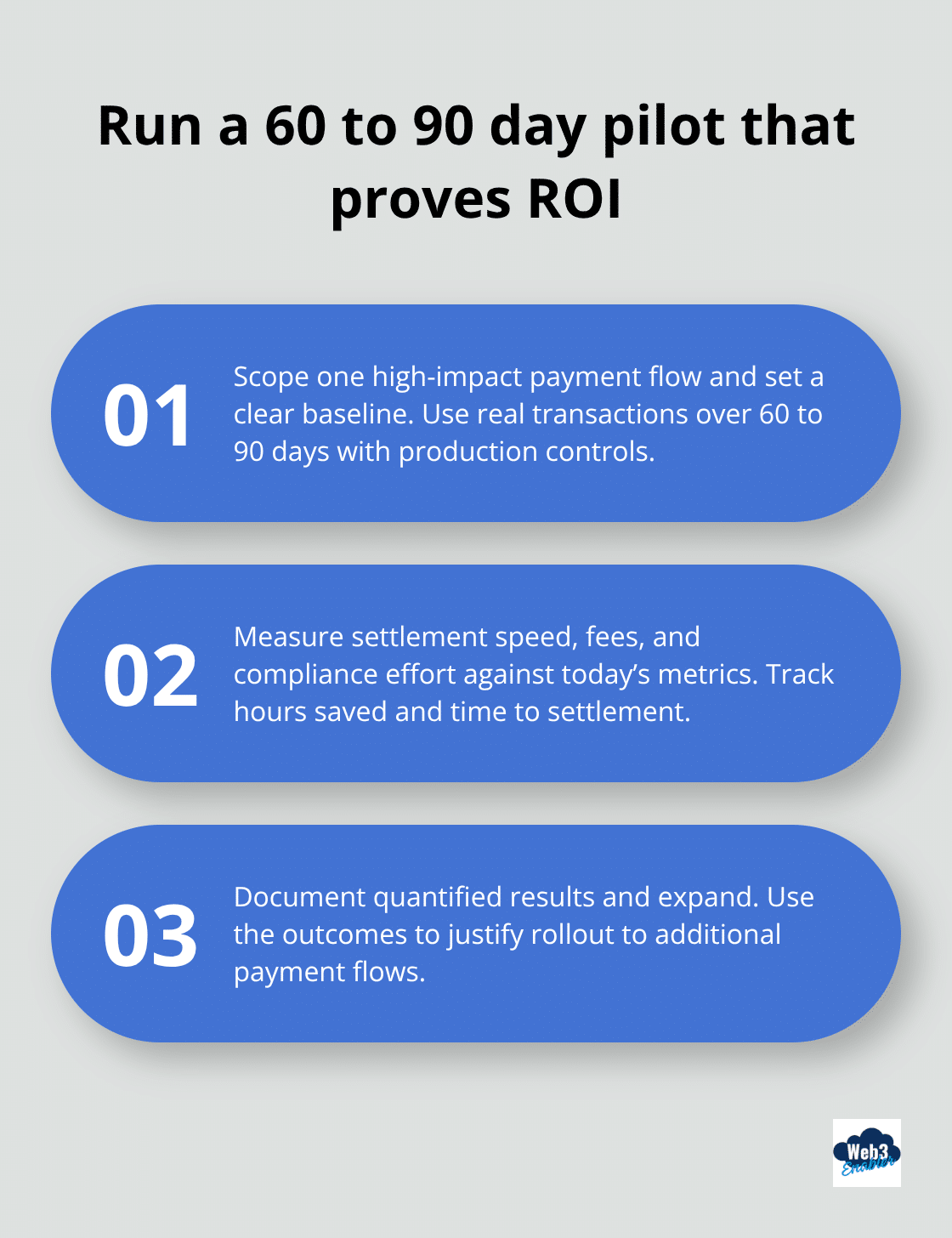

Run a Pilot Program With Real Transactions

Start small with a specific payment problem that causes the most friction right now. Maybe it’s payroll for your international contractors, or maybe it’s settlement delays on your largest customer payments. Run a pilot with real transactions over 60 to 90 days, not a theoretical test environment. Measure settlement speed, fee reduction, and compliance overhead against your baseline. If your pilot saves 30 hours monthly on reconciliation or cuts settlement time significantly, you’ve proven the business case. Document these results with actual numbers because they become your justification for expanding to other payment flows.

Your team learns the technical workflow without betting the entire payment operation on a new system, and you build internal confidence that digital rails actually work before scaling across your whole business.

Final Thoughts

The businesses winning right now move fast on innovation in digital payments instead of waiting for perfect conditions or industry consensus. They implement solutions that cut settlement times from days to minutes, reduce fees by 90%, and give their teams real-time visibility into cash positions. Your competitors are already moving, and the question is whether you’ll follow or lead.

Innovation in digital payments solves real operational problems that drain your margins every single day. Faster settlement improves your cash flow. Lower fees increase your profitability. Reduced compliance overhead frees your team to focus on growth instead of spreadsheets. These aren’t future benefits-they’re operational improvements you can measure and implement within months, and Visa, Stripe, and Shopify already process payments this way at scale.

Start with a pilot program on your biggest payment pain point, measure the results, and scale what works. The businesses that move first lock in competitive advantages that take years for others to match.

Frequently Asked Questions About Innovation in Digital Payments

What does “innovation in digital payments” mean for businesses?

Innovation in digital payments means upgrading how money moves so you can settle faster, reduce cross-border friction, and get real-time visibility into cash. For many companies, that includes modern payment rails, automation, and, in some cases, blockchain-based settlement using stablecoins.

Why are traditional cross-border payments still slow?

Many international transfers run through legacy networks and multiple intermediary banks, which adds manual checks, cut-off times, and extra hops. It is still common for cross-border payments to take one to five business days, depending on the route, currencies, and compliance review.

What are “digital rails” in payments?

Digital rails are the underlying infrastructure that moves value, like card networks, ACH, real-time payments, and blockchain networks. When people refer to blockchain rails, they typically mean using a public network plus tokenized money, often stablecoins, to settle value continuously, including outside banking hours.

What is a stablecoin like USDC, and why do businesses use it?

A stablecoin is a digital token designed to track the value of a fiat currency, most commonly the U.S. dollar. Businesses use stablecoins like USDC when they want blockchain-speed settlement without the price volatility of non-stable cryptocurrencies, especially for cross-border settlement, treasury movements, and payouts.

Do stablecoin payments work at real commercial scale?

Yes. Major payment and commerce platforms have launched stablecoin settlement and acceptance options, which signals practical adoption beyond experimentation. For example, Visa has expanded USDC settlement capabilities for participating institutions, and Shopify has announced USDC payments for merchants with partners like Coinbase and Stripe.

How fast can blockchain or stablecoin payments settle?

On-chain settlement can confirm in minutes, and sometimes faster, because transactions are validated continuously rather than waiting for banking windows. The exact time depends on the network used, risk controls, compliance checks, and how your provider handles finality and conversion.

How do stablecoin payments convert to USD and fit into accounting workflows?

Many businesses use a payments provider so customers can pay in stablecoins while the business receives settlement in USD to a familiar balance or bank account. For example, Stripe’s stablecoin payments can settle into a Stripe balance in USD, which helps simplify reconciliation and reporting for finance teams.

Are blockchain and stablecoin payments compliant with KYC, AML, and the Travel Rule?

They can be, but compliance depends on your implementation and partners. Many regulated providers apply KYC, AML, sanctions screening, and monitoring. The FATF Travel Rule also requires collecting and transmitting sender and recipient information for certain virtual asset transfers, which businesses should design for early.

Are blockchain payments secure, and what about fraud?

Blockchain transactions use cryptographic verification and create an auditable transaction trail, which can improve transparency and reduce certain operational risks. However, fraud still exists, like social engineering and compromised credentials, so strong controls, wallet security, vendor due diligence, and monitoring are essential.

How do you migrate from legacy payment systems to digital rails without breaking operations?

Start by mapping your biggest payment pain points, like settlement time, fees, FX loss, and reconciliation hours. Then choose a solution that integrates with your ERP and accounting workflows. Run a pilot using real transactions for a defined use case, measure results against your baseline, and scale what proves ROI.