Enterprise blockchain solutions are transforming how businesses handle payments, treasury management, and vendor relationships. Companies report 40% faster payment processing and 25% lower transaction costs after implementation.

Enterprise blockchain solutions are transforming how businesses handle payments, treasury management, and vendor relationships. Companies report 40% faster payment processing and 25% lower transaction costs after implementation.

We at Web3 Enabler see businesses struggling with outdated payment systems that drain resources and slow operations. The right blockchain platform can streamline your financial processes while maintaining security standards.

What Makes Enterprise Blockchain Different

Enterprise blockchain solutions serve a completely different purpose than the consumer applications most people know. Consumer blockchain focuses on individual transactions and cryptocurrency trading, while enterprise solutions handle complex business operations like vendor payments, treasury management, and compliance reporting. The difference is stark: consumer blockchain prioritizes decentralization and public access, while enterprise blockchain emphasizes control, privacy, and integration with existing business systems.

Built for Business Operations

Enterprise blockchain platforms process thousands of transactions daily within controlled environments. Companies that use these systems report payment processing in under 3 minutes compared to 3-5 business days with traditional wire transfers. The architecture supports permissioned networks where only authorized participants access data, which maintains the privacy requirements that businesses demand. Smart payment automation triggers transactions when specific conditions are met, and this eliminates manual processing delays that cost companies time and money.

Integration and Compliance Focus

The biggest advantage of enterprise blockchain lies in its ability to connect with existing ERP and CRM systems. Modern platforms support API integration that provides real-time access to transaction data, which improves cash flow visibility and risk management.

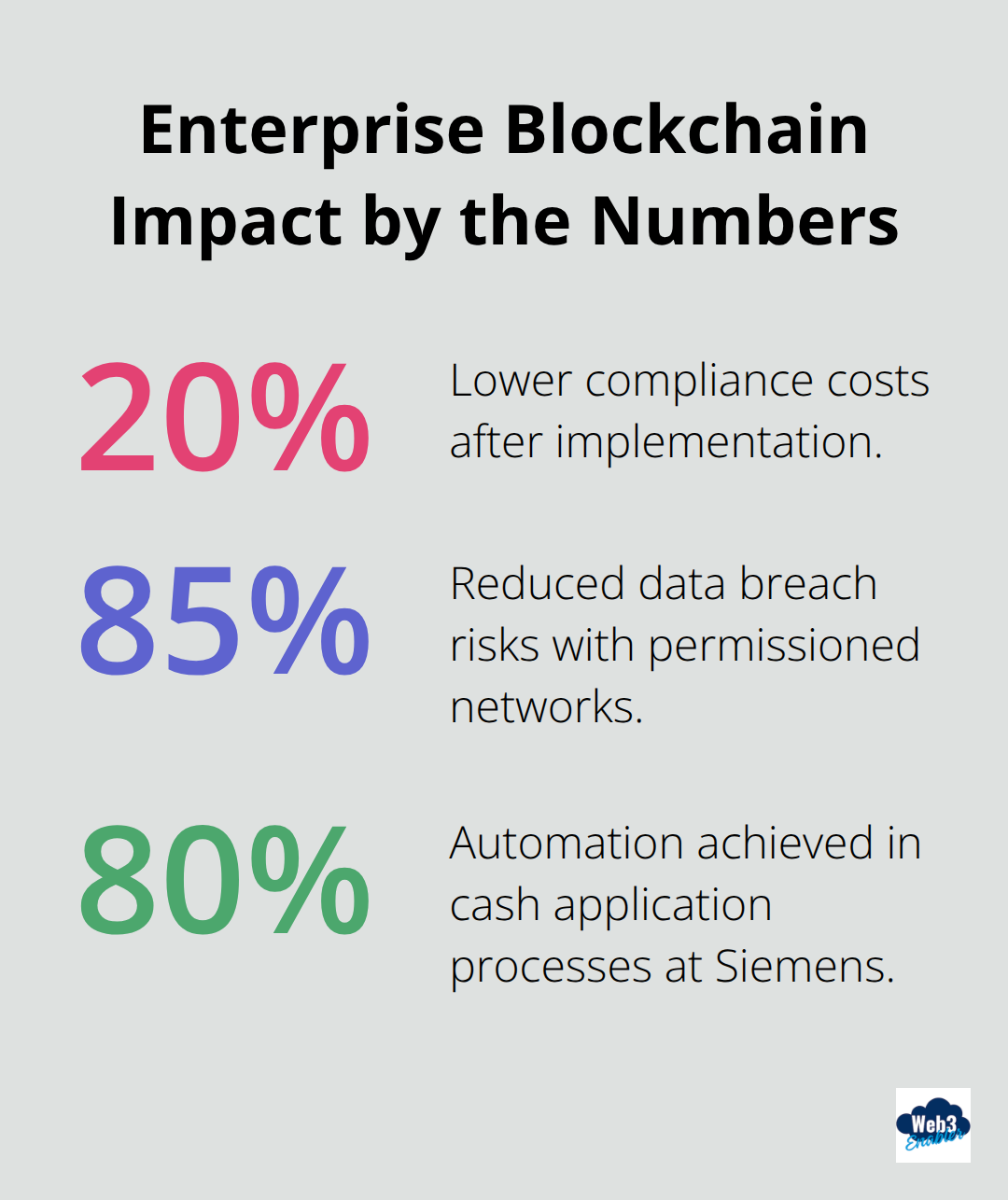

Compliance features built into enterprise blockchain automatically generate audit trails and regulatory reports, and this reduces the manual work that traditional payment systems require. Companies that implement these solutions typically see 20% lower compliance costs and significantly faster regulatory reporting (according to IBM research data).

Market Growth and Adoption

The numbers tell the story of rapid adoption. Stablecoin transaction volumes reached $32 trillion in 2024, with $5.7 trillion dedicated to payment use cases according to Visa. Cross-border payment costs drop from 2-7% with traditional methods to 0.5-1% when businesses use blockchain systems. The enterprise blockchain market is projected to grow from $9.6 billion in 2023 to $146 billion by 2030, driven by measurable cost savings and operational improvements that businesses can no longer ignore.

These compelling benefits raise an important question: what specific features should you evaluate when selecting an enterprise blockchain solution for your business?

Key Features to Evaluate in Enterprise Blockchain Solutions

Security architecture forms the non-negotiable foundation of any enterprise blockchain platform. Permissioned networks that restrict access to verified participants reduce data breach risks by 85% compared to traditional payment systems (according to IBM research). Look for platforms that offer role-based access controls, multi-signature authentication, and end-to-end encryption for all transactions.

Compliance automation features should generate audit trails automatically and support regulatory frameworks like SOX, GDPR, and anti-money laundering requirements. The best platforms integrate compliance checks directly into transaction processing, which eliminates manual oversight and creates a complex regulatory patchwork that varies significantly across jurisdictions.

System Integration Capabilities

Your blockchain platform must connect seamlessly with existing ERP, CRM, and accounting systems without expensive custom development. API-first architectures enable real-time data synchronization that gives treasury teams instant visibility into cash positions and payment status.

Siemens achieved 80% automation in cash application processes through virtual account structures that integrated with their existing systems. Their API integration provides real-time access to over 70% of bank account balances. Choose platforms that support standard data formats and offer pre-built connectors for major business software like SAP, Oracle, and Salesforce.

Performance and Scalability Standards

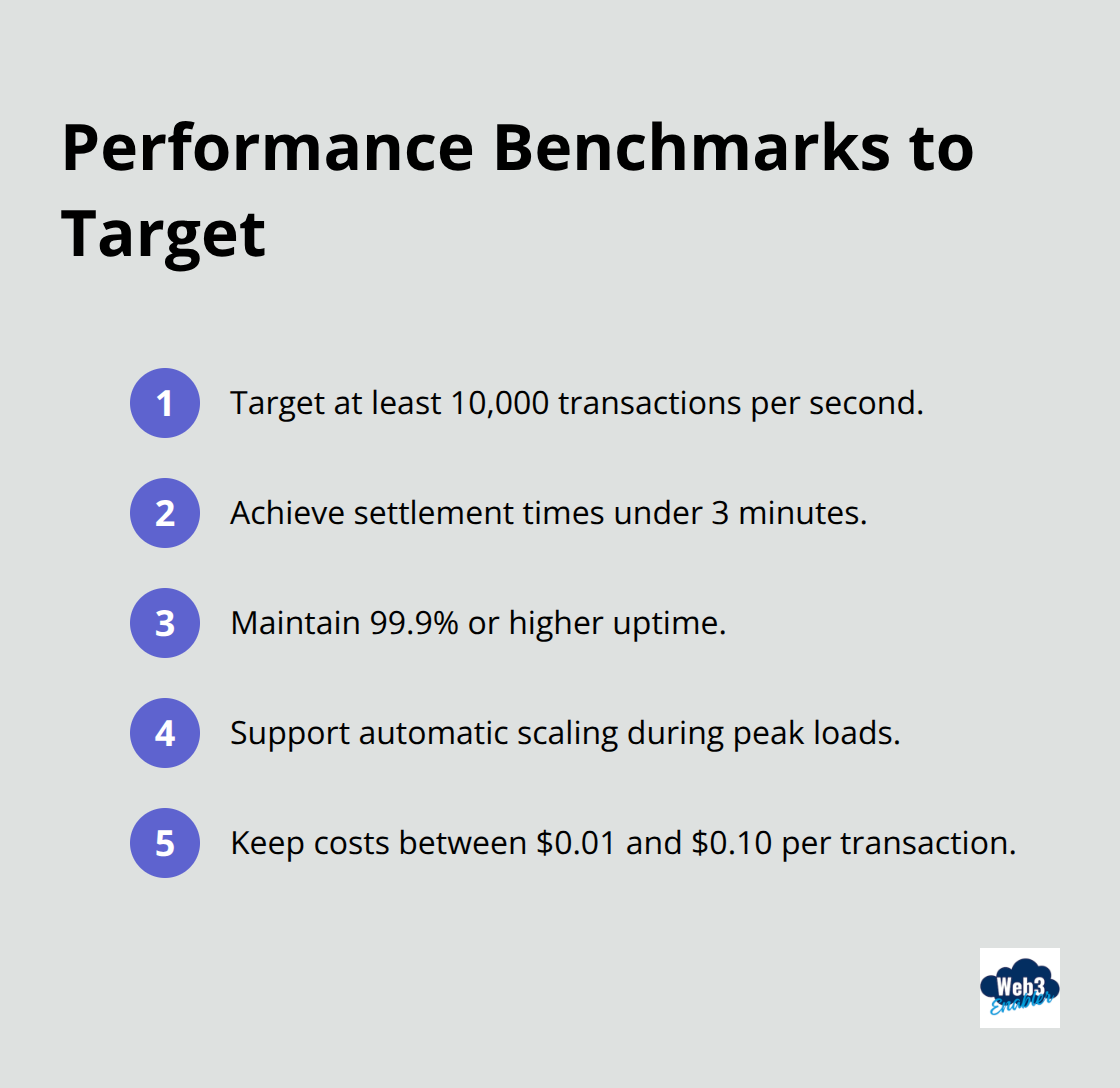

Transaction processing speed directly impacts your operational efficiency and customer satisfaction. Enterprise blockchain platforms should handle at least 10,000 transactions per second with settlement times under 3 minutes. Hedera Hashgraph delivers this performance while it maintains energy efficiency, and Polygon CDK offers customizable Layer 2 solutions that scale with your business growth.

Network uptime must exceed 99.9% availability, and the platform should support automatic scaling during peak transaction periods. Cost per transaction should remain predictable even as volume increases. Leading platforms charge between $0.01 to $0.10 per transaction regardless of payment size or destination.

Data Management and Transparency

Modern enterprise blockchain solutions provide complete transaction transparency while they maintain privacy controls. Each entry receives a timestamp and becomes immutable, which boosts accountability and traceability that supply chain management requires. The platform should offer customizable reporting dashboards that track key performance metrics and generate compliance reports automatically.

Smart contract automation reduces manual processing errors and speeds up transactions significantly. Companies that implement these automated workflows typically see 20% increases in operational efficiency. The system should support conditional payments that execute automatically when predefined criteria are met.

These technical capabilities matter, but successful implementation depends heavily on practical considerations like costs, team preparation, and vendor relationships that determine long-term success.

Implementation Considerations for Enterprise Blockchain

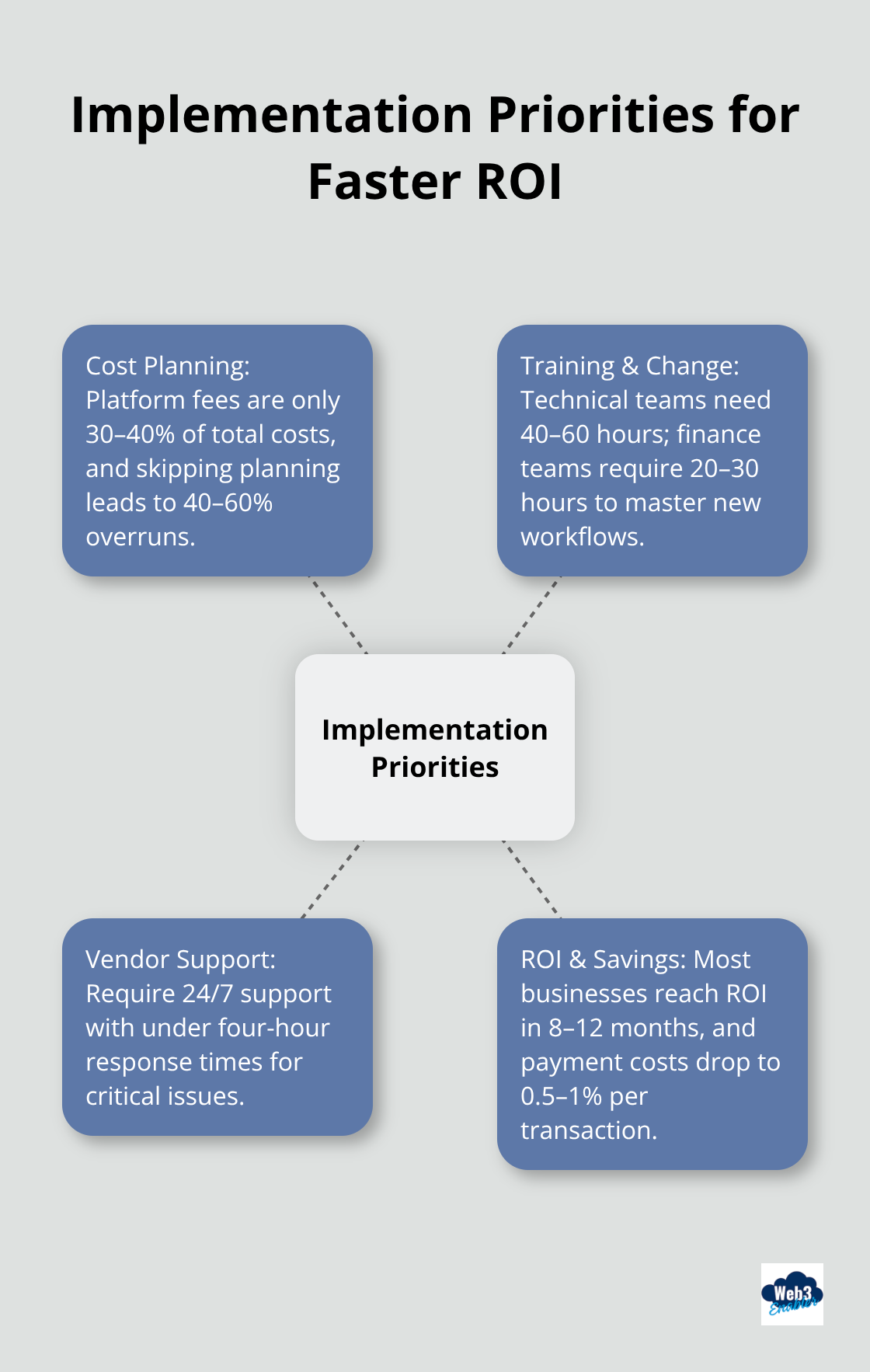

Enterprise blockchain implementation requires strategic financial planning beyond the initial platform fees. The blockchain technology market is expected to reach USD 24.46 billion in 2025 and grow at a CAGR of 65% to reach USD 299.54 billion by 2030, reflecting the growing adoption across enterprises. Platform fees represent only 30-40% of total costs, while system integration, data migration, and staff training consume the majority of your budget. Companies that skip comprehensive cost planning face budget overruns of 40-60% during implementation.

ROI Timeline and Performance Metrics

Most businesses achieve positive ROI within 8-12 months after full deployment. Siemens achieved 93-second processing times for commercial paper transactions and reduced account management workload by 80% through virtual account structures.

Payment processing costs drop from 2-7% to 0.5-1% per transaction, which creates immediate savings on high-volume operations and helps slash transaction costs.

Track specific metrics like transaction processing time, compliance hours, and manual error rates to measure success. Companies that process over $10 million annually in vendor payments typically recover implementation costs within six months through operational savings alone.

Staff Training and Change Management Strategy

Technical teams need 40-60 hours of platform-specific training, while finance and treasury staff require 20-30 hours to master new workflows. Resistance to change kills more blockchain projects than technical limitations do. Finance teams accustomed to traditional processes often struggle with automated payment systems and real-time transaction visibility.

Schedule training sessions before system launch and assign blockchain champions within each department to drive adoption. The most successful implementations involve finance leaders who actively promote the technology and demonstrate measurable benefits to skeptical team members.

Vendor Support and Partnership Quality

Your blockchain vendor must provide 24/7 technical support and maintain response times under four hours for critical issues. Look for vendors with proven track records in your industry and established partnerships with major financial institutions. The vendor should offer dedicated implementation managers who understand your business requirements and can customize the platform accordingly.

Evaluate the vendor’s roadmap for future features and their commitment to regulatory compliance updates. Strong vendors provide regular platform updates, security patches, and new feature releases without additional costs (most charge annual maintenance fees of 15-20% of the initial license cost).

Final Thoughts

Enterprise blockchain solutions transform business operations when companies select platforms with strong security architecture, seamless system integration, and proven scalability performance. Organizations that implement permissioned networks with API-first architectures and sub-3-minute settlement times achieve 40% faster payment processing and 25% lower transaction costs. The financial benefits extend beyond immediate cost savings to include 20% increases in operational efficiency and 80% reductions in manual processing tasks.

Success requires comprehensive planning that addresses staff training, change management, and vendor partnership quality. Technical teams need 40-60 hours of platform-specific training while finance staff require 20-30 hours to master new workflows. Companies that process over $10 million annually in vendor payments typically see ROI within 8-12 months (with some achieving positive returns even faster through operational savings alone).

We at Web3 Enabler provide native blockchain solutions that enable businesses to accept stablecoin payments and send global payments faster and cheaper through Salesforce integration. Our platform eliminates the technical barriers that prevent many companies from adopting blockchain technology. The enterprise blockchain market will reach $299.54 billion by 2030, and companies that implement these solutions now gain competitive advantages through reduced costs, faster payments, and improved operational efficiency.

![Flexible Payment Terms Using Stablecoin Technology [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-terms-hero-1764936594.jpeg)