Your Salesforce revenue operations are bleeding money through traditional payment systems. Every cross-border transaction, currency conversion, and processing fee chips away at your bottom line.

Your Salesforce revenue operations are bleeding money through traditional payment systems. Every cross-border transaction, currency conversion, and processing fee chips away at your bottom line.

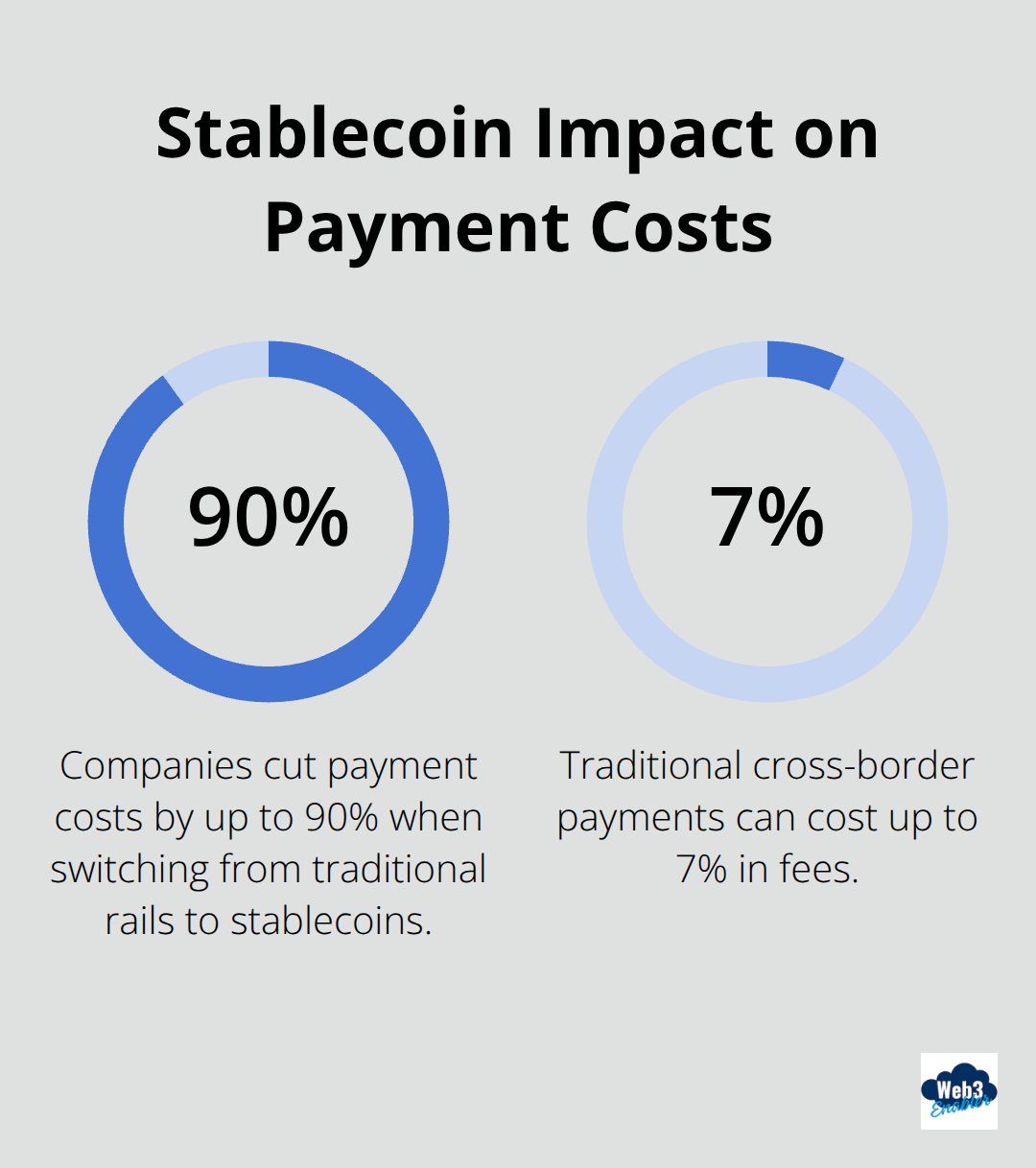

Stablecoins flip this script entirely. We at Web3 Enabler have seen companies slash payment costs by up to 90% while accelerating settlement times from days to minutes.

This isn’t just about saving pennies – it’s about complete revenue optimization that transforms how global businesses handle payments within their existing Salesforce workflows.

How Stablecoins Cut Payment Processing Costs by 90%

Traditional payment processors drain massive fees from every transaction you process through Salesforce. Credit card companies charge 2.9% plus 30 cents per transaction, while international wire transfers cost $25 to $50 each. Cross-border payments through traditional banks add currency conversion spreads of 3-4% on top of base fees. These costs compound quickly when you process thousands of transactions monthly through your revenue operations.

Stablecoins Demolish Fee Structures

Stablecoins destroy these fee structures completely. Ethereum transactions cost around $1-5, while Polygon-based stablecoin transfers cost under $0.01. Companies that process $100,000 monthly save $20,000 annually when they switch from traditional banks to optimized stablecoin rails.

MoonPay achieved 112% year-over-year revenue growth after they enabled businesses to bypass traditional payment rails entirely. The math becomes even more compelling for international transactions where stablecoins eliminate currency conversion fees altogether. BitPay processes over 600,000 annual transactions with stablecoins that comprise the majority of volume (proving businesses already make this transition at scale).

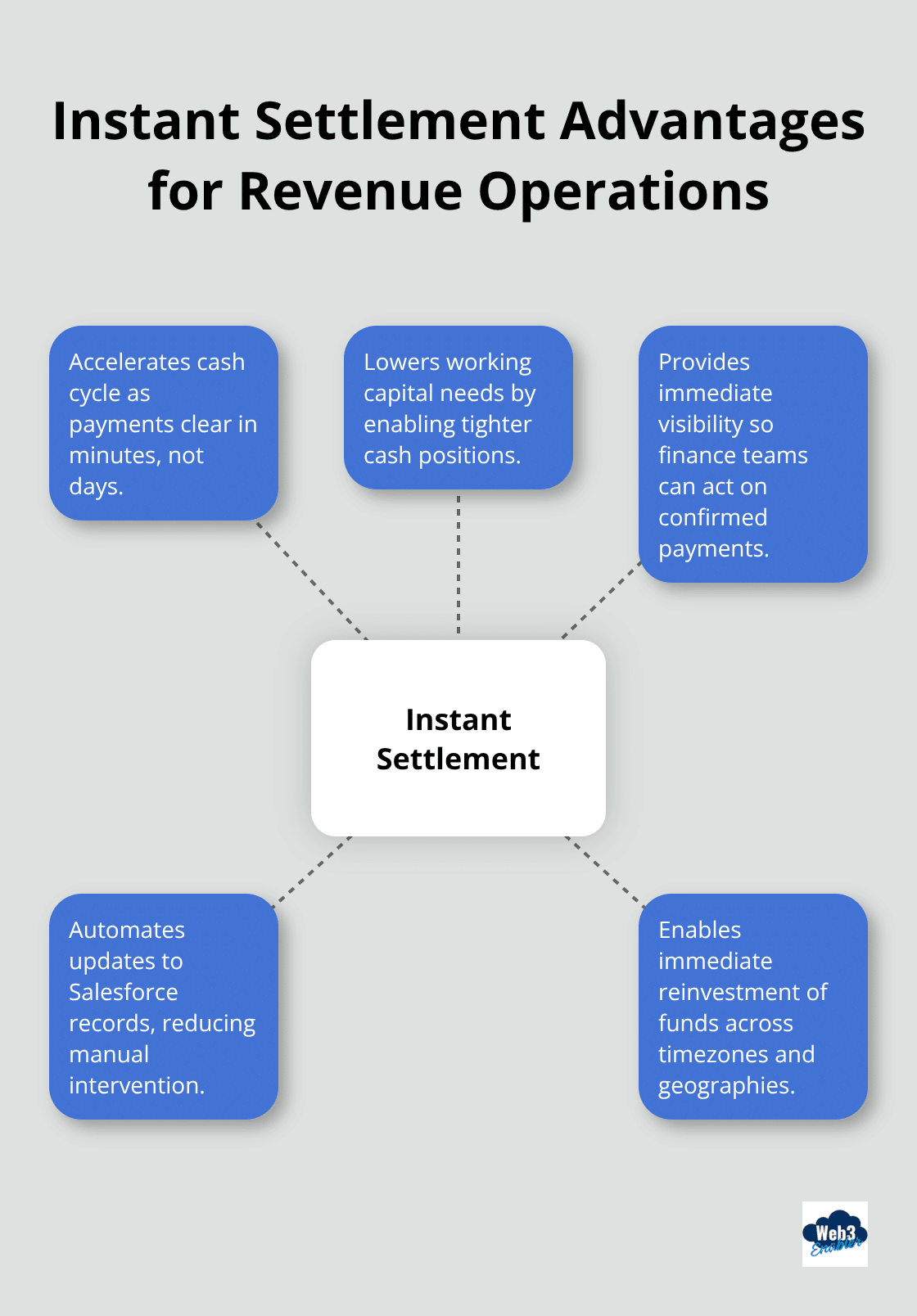

Instant Settlement Transforms Working Capital

Traditional payment settlement times destroy your cash flow management within Salesforce. Bank transfers take 3-5 business days to clear, while international payments can take up to 2 weeks through correspondent networks. This delay forces businesses to maintain larger cash reserves and creates nightmares for revenue operations teams.

Stablecoin payments settle in minutes, not days. Modern Treasury acquired Beam for $40 million specifically to target this settlement speed advantage for corporate clients. When payments clear instantly, your capital requirements drop dramatically. You can operate with tighter cash positions and reinvest funds immediately rather than wait for traditional systems to process transactions.

Fraud Protection Without Chargeback Chaos

Chargeback disputes cost businesses an average of $190 per incident according to payment industry data. Traditional payment methods expose you to months-long dispute processes that tie up revenue and require extensive documentation. Credit card fraud alone accounts for billions in annual losses across payment networks.

Stablecoins eliminate chargebacks entirely through blockchain’s immutable transaction records. Once a stablecoin payment confirms on-chain, it cannot be reversed without the recipient’s explicit approval. This shift removes the uncertainty that plagues traditional payment reconciliation within Salesforce revenue systems.

But cost reduction only tells half the story. The real magic happens when stablecoins accelerate your entire cash flow cycle.

How Stablecoin Integration Transforms Your Cash Flow

Stablecoin integration transforms your Salesforce cash flow operations from reactive to proactive management. When Ramp expanded its workforce to 2,516 employees, they focused heavily on sales and engineering teams specifically to capture the cash flow advantages that real-time settlement provides their 30,000 business clients. Traditional payment systems force you to forecast around settlement delays, but stablecoins give you immediate access to funds that clear in 2-3 minutes rather than 3-5 business days. This speed eliminates the cash float that traditional banking creates and lets you operate with 40-60% lower working capital requirements.

Real-Time Visibility Eliminates Payment Uncertainty

Stablecoin transactions provide complete transparency that traditional payment systems cannot match. Every payment shows up immediately in your Salesforce revenue tracking with blockchain confirmation timestamps and transaction hashes that eliminate reconciliation disputes. Alchemy Pay processes over 8 million transactions with this level of visibility across 173 countries, proving that real-time tracking scales globally. Your finance team can see exactly when customers pay, how much they paid, and track payment status without waiting for bank notifications or dealing with payment processor delays. This visibility transforms monthly reconciliation from days of detective work into automated processes that sync directly with your Salesforce revenue records.

Automated Processing Cuts Manual Intervention

Smart contract automation handles invoice processing and payment confirmation without human intervention. When customers pay with stablecoins, the transaction triggers automatic updates to your Salesforce opportunity records, invoice status changes, and customer account balances. Circle’s successful NYSE IPO validates that institutional-grade stablecoin infrastructure can handle enterprise-level automation requirements (making this technology ready for serious business use). Your accounts receivable team stops chasing payment confirmations because blockchain records provide instant, immutable proof of payment that updates your revenue systems automatically.

Instant Settlement Accelerates Business Operations

Traditional banking creates artificial delays that slow your entire business cycle. Wire transfers take 3-5 days to settle, international payments can take weeks, and ACH transfers create multi-day holds on your working capital. Stablecoins settle transactions in minutes across any timezone or geography. Modern Treasury acquired Beam for $40 million specifically to help banks and corporations capture these settlement advantages. When your payments clear instantly, you can fulfill orders faster, pay suppliers immediately, and reinvest revenue without waiting for traditional banking systems to process transactions.

This speed advantage becomes even more powerful when you expand operations globally and need to manage revenue across multiple currencies and markets.

Why Global Revenue Operations Need Stablecoin Infrastructure

Global revenue operations face exponential complexity when traditional banks control your payment flows. Cross-border payments from New York to Singapore take 3-5 days and cost up to 7% in fees. Alchemy Pay operates across 173 countries specifically because traditional banks create these geographic bottlenecks that stablecoins eliminate completely. When you process international payments through stablecoin rails, transactions settle in 2-3 minutes regardless of geography, timezone, or local bank holidays.

Stablecoins Eliminate Banking Intermediary Costs

Traditional international payments route through multiple correspondent banks that each extract fees and add delays. A payment from your US Salesforce system to a European customer typically touches 3-4 different banks before it reaches its destination. Each intermediary charges fees while currency conversion happens at spreads that favor banks rather than your business.

Stablecoins bypass this entire correspondent network and settle directly on blockchain infrastructure. Ramp serves over 30,000 business clients and generates more than $2 billion in savings specifically through the elimination of these intermediary costs. Your payment goes directly from sender to recipient without traditional banking rails that extract value at every step.

Multi-Currency Pricing Becomes Predictable

Currency fluctuation destroys revenue forecast accuracy when you price products across different markets. Traditional businesses lose 2-5% of international revenue to currency volatility between the time customers commit to purchases and payments actually settle. Exchange rates change hourly, but traditional payment settlement delays mean you cannot lock in favorable rates when customers pay. Stablecoins solve this through dollar-pegged stability that eliminates currency risk entirely. Circle completed its NYSE IPO specifically because institutional investors recognize that stablecoin infrastructure removes currency uncertainty from global business operations (making this technology ready for enterprise adoption). Your Salesforce revenue forecasts become accurate across all markets because stablecoin payments maintain consistent dollar values regardless of local currency fluctuations.

Cross-Border Compliance Simplifies Operations

International payment compliance creates massive operational overhead through traditional banking systems. Each country maintains different regulatory requirements, reporting standards, and documentation needs that slow payment processing and increase administrative costs. Banks require extensive paperwork for international transfers while compliance teams must track payments through multiple jurisdictions with different rules. Stablecoins operate on transparent blockchain networks that provide complete transaction visibility and immutable audit trails. This transparency simplifies compliance reporting because every payment creates permanent records that regulators can verify instantly (rather than requesting documentation from multiple banking intermediaries).

Final Thoughts

Stablecoins transform revenue optimization within Salesforce through measurable cost reductions and operational improvements. Companies cut transaction costs by 90% while they eliminate currency conversion fees and chargeback disputes entirely. Settlement times drop from days to minutes, which improves working capital management and creates predictable cash flow across global operations.

Implementation demands careful evaluation of compliance frameworks and technical connections to existing Salesforce workflows. Businesses must select providers who offer robust KYC processes, transparent reserve management, and seamless API connections to revenue systems. The regulatory clarity from legislation like the U.S. GENIUS Act establishes a stable foundation for enterprise adoption (making stablecoin integration viable for serious business operations).

Major acquisitions like Stripe’s $1.1 billion Bridge purchase and Modern Treasury’s Beam acquisition demonstrate institutional confidence in stablecoin infrastructure. Circle’s successful NYSE IPO proves this technology meets enterprise-grade requirements for global revenue operations. We at Web3 Enabler provide Salesforce Native blockchain solutions that connect stablecoin payments directly to your existing revenue operations while maintaining full compliance.