Your business is sitting on stablecoin reserves for payments, but they’re just… sitting there. Missing out on potential returns while inflation quietly nibbles away at their value.

Smart companies are waking up to stablecoin yield opportunities that can turn idle payment reserves into profit centers. We at Web3 Enabler see businesses earning 3-8% annually on funds they’d otherwise park in zero-yield accounts.

The question isn’t whether you should generate yield-it’s how to do it safely while maintaining the liquidity your business needs.

Why Businesses Hold Stablecoin Payment Reserves

Corporate treasurers shift payment strategies faster than finance departments can update their policies. Stablecoin payment reserves have exploded from experimental pilot programs to mainstream treasury operations, with companies holding millions in USDC and USDT for operational needs. The Federal Reserve estimates that the total market could be worth $3 trillion in five years, driven primarily by business adoption rather than retail speculation.

Instant Settlement Beats Wire Transfer Delays

Traditional cross-border payments take 3-5 business days and cost 2-5% in fees, while stablecoin transfers settle within minutes for pennies. Companies that process international supplier payments or employee salaries in emerging markets need immediate liquidity access. Payment processors require businesses to maintain minimum reserve balances (typically 10-15% of monthly transaction volume) to handle payment reversals and compliance requirements.

These reserves previously sat in low-yield corporate accounts that earned 0.5% annually, but now companies demand better returns on working capital.

Compliance Forces Higher Reserve Requirements

Financial regulators across jurisdictions mandate specific reserve ratios for payment service providers, often requiring 110-125% backing for processed transactions. The European Union’s Markets in Crypto-Assets regulation and similar frameworks in Singapore and Hong Kong require licensed entities to segregate customer funds in qualified custodial accounts.

Companies that operate in multiple markets must maintain separate reserve pools to meet local compliance standards. This creates substantial idle balances that traditional banking cannot efficiently monetize.

Cash Flow Optimization Drives Strategic Reserves

Modern businesses maintain stablecoin reserves to smooth seasonal cash flow variations and capitalize on supplier payment discounts. Companies can instantly access funds for unexpected opportunities or urgent payments without waiting for bank transfers or credit line approvals.

Treasury teams now view stablecoin reserves as working capital that should generate returns while maintaining full liquidity. The challenge becomes finding yield opportunities that match corporate risk tolerance and regulatory requirements.

Yield Generation Strategies for Stablecoin Reserves

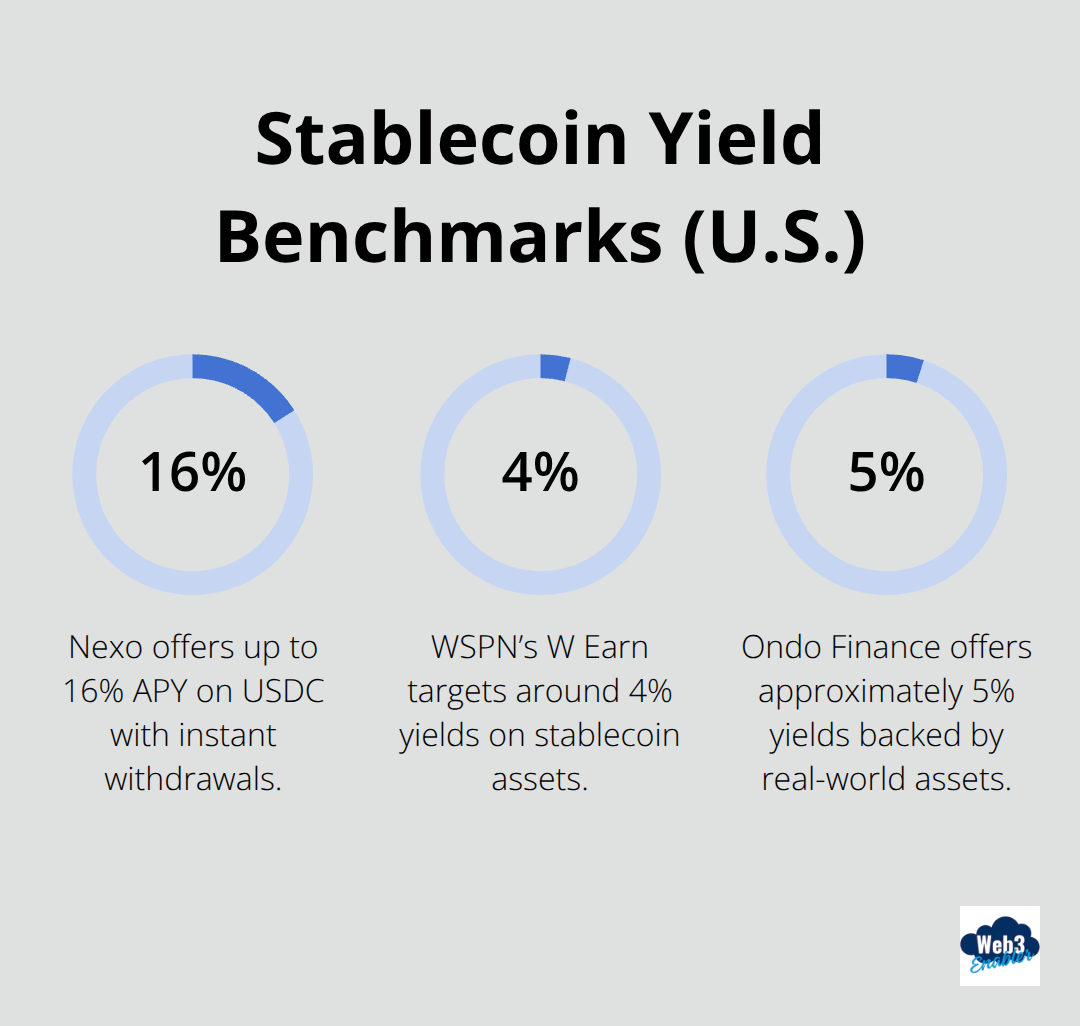

Centralized crypto yield platforms dominate corporate treasury adoption because they offer predictable returns without DeFi complexity. Nexo and similar platforms provide up to 16% APY on USDC deposits with instant withdrawals, backed by insurance coverage that appeals to risk-averse CFOs. Aave reports over $10 billion in total value locked across its pools, with corporate clients who earn 3-10% annually on stablecoin deposits. These platforms handle compliance documentation and provide the institutional-grade reports that auditors demand, which makes them the practical choice for companies that need yield without blockchain expertise.

Traditional Finance Meets Crypto Returns

Major financial institutions now offer crypto yield products that bridge traditional finance and digital assets. WSPN’s W Earn product targets institutional clients with around 4% yields on stablecoin assets, and deploys funds into U.S. Treasury bills and money market funds rather than experimental DeFi protocols. These products settle within two business days and maintain full liquidity, which addresses corporate concerns about lock-up periods. Real-World Asset protocols like Ondo Finance have attracted over $10 billion in total value locked during 2025, and offer yields of approximately 5% backed by tangible assets rather than speculative crypto positions.

DeFi Protocols for Advanced Treasury Teams

Companies with sophisticated treasury operations can access higher yields through established DeFi protocols, though this requires technical expertise and comprehensive risk assessment. Curve Finance and Morpho offer yields that range from 5-15% on stablecoin liquidity provision, but corporate participation demands dedicated blockchain personnel and robust smart contract audits. Origin Dollar automatically compounds yields for holders without active management, and provides 3-5% annual returns while it maintains dollar parity.

Automated Yield Solutions

Self-custodial wallets now integrate yield features that eliminate complex DeFi interactions. Tangem’s Yield Mode allows users to generate returns directly from their wallet through Aave’s protocol (with APY fluctuations between 3-10% based on market conditions). These solutions maintain complete liquidity and transparency while they simplify the technical barriers that traditionally prevented corporate adoption.

The real challenge lies not in choosing a yield strategy, but in balancing returns against the security requirements that protect your business from the unique risks these opportunities create. However, regulatory developments like the CLARITY Act may impact future yield opportunities, as the legislation specifically prohibits paying interest on certain stablecoins.

Risk Management and Security Considerations

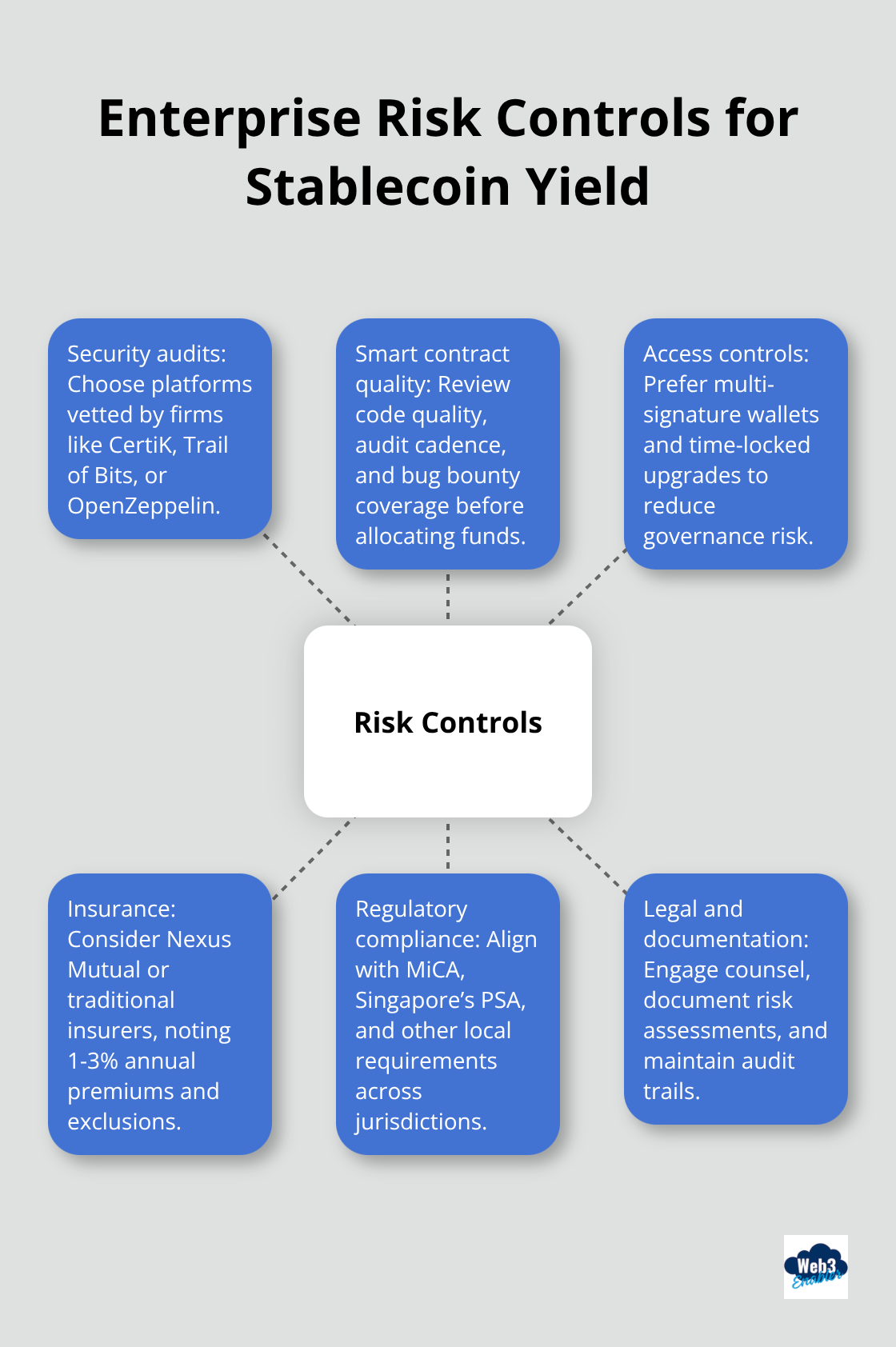

Smart contract vulnerabilities and regulatory uncertainty create the biggest threats to corporate stablecoin yield strategies, but specific assessment frameworks can minimize these exposures. Companies should prioritize platforms with comprehensive security audits from CertiK, Trail of Bits, or OpenZeppelin rather than chase maximum yields from unaudited protocols. The collapse of Terra Luna and FTX taught treasury teams that due diligence beats promotional materials every time.

Platform Security Assessment

Established platforms like Aave and Curve Finance publish transparent on-chain proof of reserves and performance metrics, while newer protocols often lack the operational history that corporate risk committees demand. Treasury teams must evaluate smart contract code quality, audit frequency, and bug bounty programs before committing funds. Platforms with multi-signature wallet controls and time-locked upgrades provide additional security layers that protect against sudden protocol changes.

Insurance coverage through providers like Nexus Mutual or traditional insurers like Lloyd’s of London can protect against smart contract failures, though coverage typically costs 1-3% annually and may not cover all scenarios.

Regulatory Compliance Across Jurisdictions

European Union regulations under MiCA require licensed entities to segregate customer funds and maintain specific reserve ratios, while Singapore’s Payment Services Act demands different compliance standards for the same activities. Companies that operate across multiple jurisdictions must structure their yield strategies to meet the most restrictive requirements, which often means they accept lower returns for regulatory certainty.

The United States lacks comprehensive federal stablecoin regulation, which creates uncertainty around yield-bearing products that may be classified as securities. Japan requires crypto businesses to segregate customer assets completely, which makes certain DeFi yield strategies legally impossible for registered entities.

Legal Framework Navigation

Treasury teams need legal counsel familiar with crypto regulations in each operational jurisdiction before they commit funds to yield strategies. Platform selection should prioritize those with established compliance frameworks and regulatory relationships rather than experimental protocols that promise higher returns without legal clarity. Companies must document their risk assessment processes and maintain audit trails that satisfy both internal controls and external regulatory requirements.

Tax implications vary significantly between jurisdictions, with some treating stablecoin yields as ordinary income while others apply capital gains treatment.

Final Thoughts

Corporate stablecoin yield strategies have evolved from experimental treasury tactics into mainstream financial operations. Companies now earn 3-16% annually on payment reserves through established platforms like Nexo and Aave, while traditional institutions offer 4-5% yields through products backed by U.S. Treasuries. The key lies in matching yield opportunities with your company’s risk tolerance and regulatory requirements.

Smart treasury management starts with platform diversification across audited protocols and insured centralized services. Companies should prioritize compliance documentation, maintain detailed audit trails, and work with legal counsel familiar with crypto regulations in their operational jurisdictions. The regulatory landscape continues to evolve, but businesses that establish proper risk frameworks can safely generate stablecoin yield while they maintain operational liquidity.

The future belongs to companies that integrate blockchain payments with existing corporate infrastructure (rather than treating them as separate systems). Web3 Enabler provides solutions that connect stablecoin payments with enterprise systems, which enables businesses to accept payments and manage crypto assets within familiar platforms. As stablecoin adoption accelerates toward the Federal Reserve’s projected $3 trillion market, treasury teams that master yield generation today will maintain competitive advantages tomorrow.