Financial institutions face mounting pressure to modernize payment infrastructure while maintaining ironclad compliance standards. Stablecoins offer a direct path forward, delivering real-time settlement, transparent audit trails, and automated regulatory reporting that traditional systems simply cannot match.

At Web3 Enabler, we’ve built Financial Services Cloud stablecoin capabilities directly into Salesforce to make adoption seamless. Your compliance team gets the visibility they need, your operations team gets the efficiency gains, and your clients get faster, cheaper transactions.

Why Stablecoins Beat Traditional Cross-Border Payments

Speed That Eliminates Intermediaries

Global stablecoin volumes exceeded $25 trillion annually, a velocity that rivals major card networks and reflects institutional adoption at scale. Financial institutions using stablecoins eliminate the intermediary layers that slow traditional wire transfers-no correspondent banks, no SWIFT messaging delays, no end-of-day batch processing. Settlement happens in minutes, not days. A multinational financial services firm with hundreds of entities achieves faster internal settlement and reduces manual reconciliation when adopting stablecoin rails instead of managing multiple bank relationships across jurisdictions. More than 80% of stablecoin transactions occur outside the United States, driven by remittance corridors and currency stability needs in Latin America and Asia-Pacific, where traditional banking infrastructure remains fragmented and expensive.

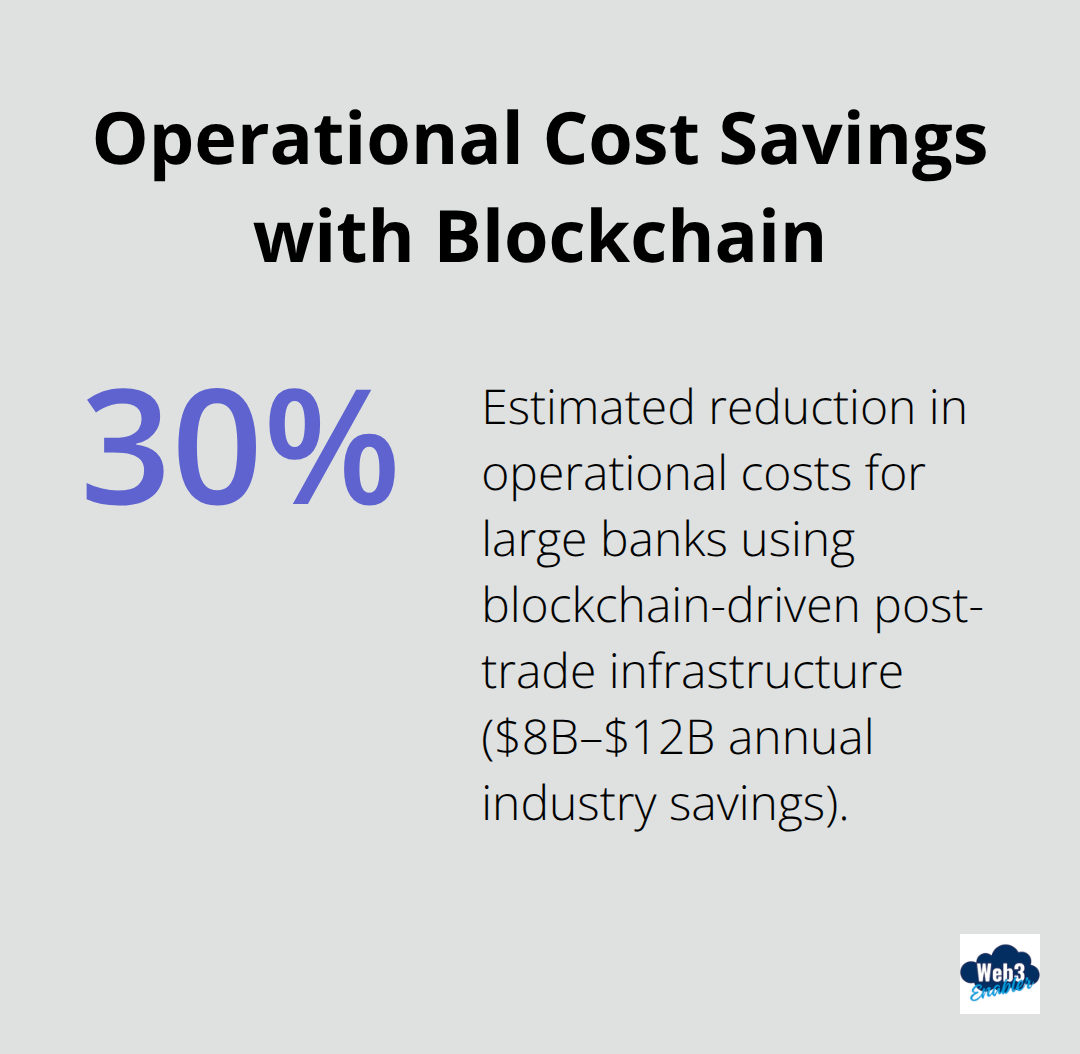

Operational Cost Reduction at Scale

The cost advantage extends beyond transaction fees. Blockchain-driven post-trade infrastructure cuts operational costs for large banks by approximately 30 percent, equating to $8 billion to $12 billion in annual savings industry-wide.

Stablecoins eliminate FX conversion friction in cross-border corridors (holding value on-chain without intermediary markups). For treasury operations, your institution manages liquidity positions across multiple geographies without maintaining correspondent banking relationships or absorbing conversion spreads. Real-time settlement frees capital faster-funds available for redeployment within hours rather than locked in multi-day clearing cycles.

Programmable Efficiency and Real-Time Visibility

The programmable nature of stablecoins unlocks additional efficiencies. Auto-executing transactions trigger subscription renewals, rebalance reserves, or settle intercompany payments without manual intervention, reducing operational headcount and error rates in high-volume environments. Web3 Enabler integrates with Financial Services Cloud to give your advisors real-time visibility into client wallet balances and digital asset positions, enabling more informed liquidity decisions and faster response to market conditions. This transparency transforms how your teams manage client relationships and capital deployment.

These operational gains set the foundation for what compliance and transparency truly demand in modern financial services.

Compliance and Transparency Built Into Every Transaction

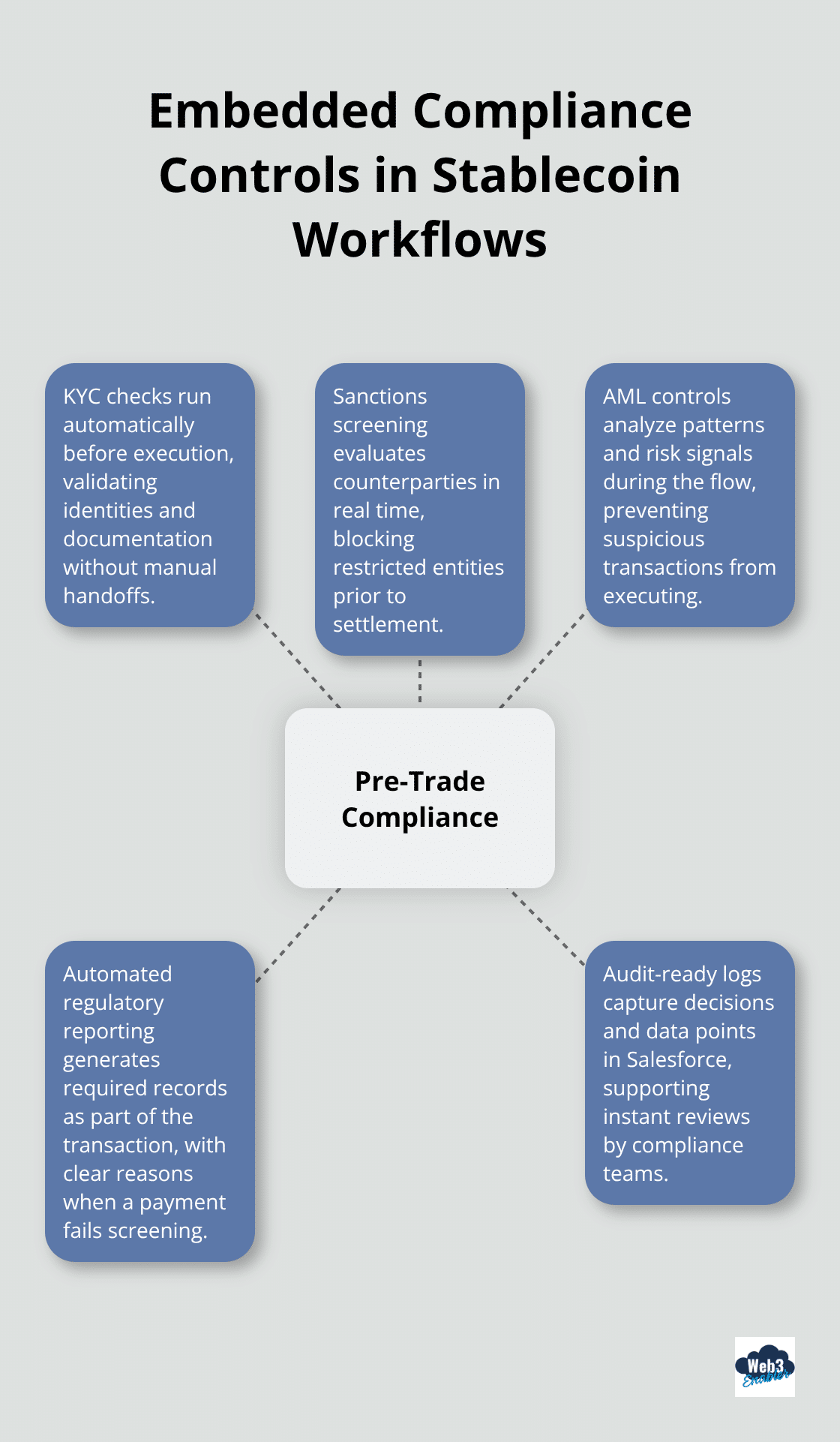

Regulators Demand Compliance at the Transaction Layer

Financial regulators now expect stablecoin platforms to embed compliance into the transaction layer itself, not bolt it on afterward. The EU’s Markets in Crypto-Assets Regulation moves toward full enforcement by mid-2026, requiring issuers to maintain audited reserves, conduct real-time transaction monitoring, and produce transparent settlement records. Your compliance team needs visibility that traditional banking infrastructure simply does not provide.

Immutable Audit Trails Replace Delayed Reconciliation

On-chain settlement creates an immutable audit trail where every transaction records with timestamp, counterparty, amount, and reserve backing-data that auditors can verify instantly rather than requesting from intermediaries weeks after the fact. When you settle client transactions through stablecoins in Financial Services Cloud, each movement timestamps and traces on the blockchain, eliminating the reconciliation delays that plague wire transfers and SWIFT corridors. This means your audit trail completes before settlement finishes, not reconstructed from bank statements months later.

Automated Controls Stop Non-Compliant Transactions Before Execution

Automated regulatory reporting transforms how your institution stays compliant. Self-executing transaction workflows embed Know Your Customer checks, sanctions screening, and Anti-Money Laundering controls directly into payment flows, preventing non-compliant transactions from executing rather than flagging them after the fact. Financial institutions using stablecoin infrastructure report that compliance automation reduces manual review overhead because transactions either pass all screens before settlement or fail with clear documentation of why.

Unified Visibility Across Finance, Compliance, and Operations

Web3 Enabler integrates compliance capabilities directly into Salesforce, so your compliance team sees real-time alerts within the CRM itself, your operations team tracks settlement status without switching systems, and your advisors in Financial Services Cloud maintain complete visibility into client digital asset positions and transaction history. This unified view eliminates the data silos where compliance gaps hide. Your institution gains the on-chain transparency that regulators demand while your teams operate from a single source of truth, reducing the operational friction that typically slows stablecoin adoption in conservative financial environments.

The foundation of compliance and transparency now sits in place. What remains is translating these capabilities into your actual Salesforce workflows-a process that demands thoughtful integration architecture and clear operational procedures.

Implementing Stablecoins Within Salesforce Financial Services Cloud

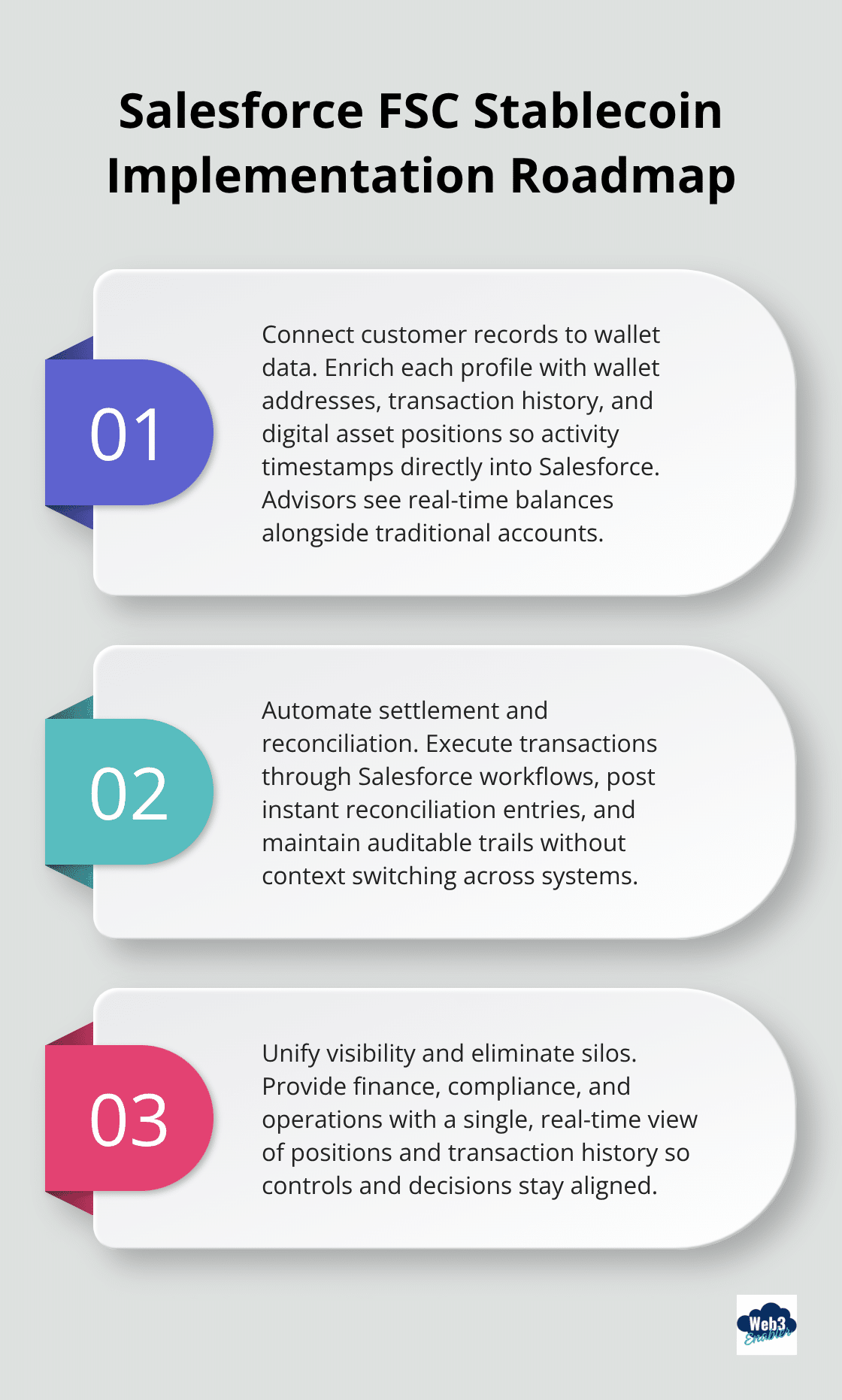

Connect Customer Records to Wallet Data

Your FSC customer records form the foundation for stablecoin operations. Each client profile now includes native stablecoin wallet addresses, transaction history, and digital asset positions without manual data entry or external systems. When a client initiates a stablecoin transfer or receives funds on-chain, that transaction timestamps directly into their Salesforce record, creating a complete financial narrative within the CRM itself. Your advisors see wallet balances in real time alongside traditional account data, enabling faster responses to liquidity requests and more informed conversations about digital asset exposure.

Automate Settlement and Reconciliation

Settlement automation completes the operational picture. Transactions execute through workflows embedded in your Salesforce environment, triggering immediate reconciliation entries and updating client records without manual intervention. A financial institution managing hundreds of client relationships processes stablecoin settlements in minutes rather than days, with every movement auditable through Salesforce’s native audit logs. This native integration eliminates the need to toggle between blockchain explorers, banking systems, and CRM platforms, reducing operational friction and compliance risk simultaneously.

Gain Real-Time Visibility Across Teams

Your compliance team gains immediate real-time visibility into transaction details directly within Salesforce alerts, while your operations team tracks settlement status without context switching. Your advisors maintain complete control over client digital asset positions from the single interface they already use daily. Web3 Enabler integrates these capabilities directly into Salesforce, so finance, compliance, and operations teams collaborate from a unified environment rather than managing parallel workflows that drain resources and create audit gaps.

Eliminate Data Fragmentation

Stablecoin capabilities built into Financial Services Cloud require connecting three critical layers: your customer records, your digital asset tracking, and your settlement infrastructure. When these layers operate independently, you lose the real-time visibility that makes stablecoins valuable in conservative financial environments. Web3 Enabler connects all three directly into Salesforce, eliminating the data silos where operational inefficiencies hide and compliance gaps emerge.

Transform Operational Efficiency

The result is not just faster settlement but fundamentally different operational efficiency, where stablecoin transactions integrate seamlessly into your existing Salesforce processes. Your institution processes digital asset movements with the same ease and auditability as traditional transactions, reducing the operational complexity that typically slows stablecoin adoption in financial services.

Final Thoughts

Financial Services Cloud stablecoin integration delivers three concrete advantages that matter to your institution right now. Settlement speed and cost reduction translate directly to your bottom line-your operations team processes transactions in minutes instead of days, and your treasury department redeploys capital faster without correspondent banking overhead. Compliance becomes embedded in transaction execution rather than bolted on afterward, giving your regulators the immutable audit trails they demand while your compliance team works from a single Salesforce environment instead of juggling multiple systems. Your advisors gain real-time visibility into client digital asset positions and wallet balances, enabling more informed conversations and faster responses to liquidity needs.

We at Web3 Enabler built these capabilities directly into Salesforce because financial institutions told us they needed stablecoin functionality without abandoning the CRM platform their teams already use daily. Our platform connects your customer records, digital asset tracking, and settlement infrastructure into one unified environment where finance, compliance, and operations teams collaborate seamlessly. You accept and send stablecoin payments, streamline global settlements, and maintain full auditability through native Salesforce objects and automation-all without leaving the CRM.

The regulatory environment moves forward with or without your institution. The EU’s Markets in Crypto-Assets Regulation enforcement accelerates this year, and institutional adoption of stablecoins continues climbing globally. Financial institutions that modernize now gain competitive advantage in speed, cost, and compliance maturity, while those that wait risk falling behind competitors who’ve already integrated blockchain-powered payments into their core operations. Visit Web3 Enabler to explore how Financial Services Cloud stablecoin capabilities integrate into your Salesforce environment and schedule a conversation with our team to map your specific settlement corridors, compliance requirements, and operational workflows.