Cryptocurrency has become a game-changer in the financial world, and savvy advisors are taking notice. At Web3 Enabler, we’ve seen a surge in demand for crypto advisory services as more investors seek guidance on digital assets.

Cryptocurrency has become a game-changer in the financial world, and savvy advisors are taking notice. At Web3 Enabler, we’ve seen a surge in demand for crypto advisory services as more investors seek guidance on digital assets.

Financial advisors who embrace this trend can unlock new revenue streams and stay ahead of the curve. This post will guide you through integrating cryptocurrency expertise into your practice, helping you meet evolving client needs and thrive in the digital age.

Why Investors Demand Crypto Expertise

The Cryptocurrency Market Explosion

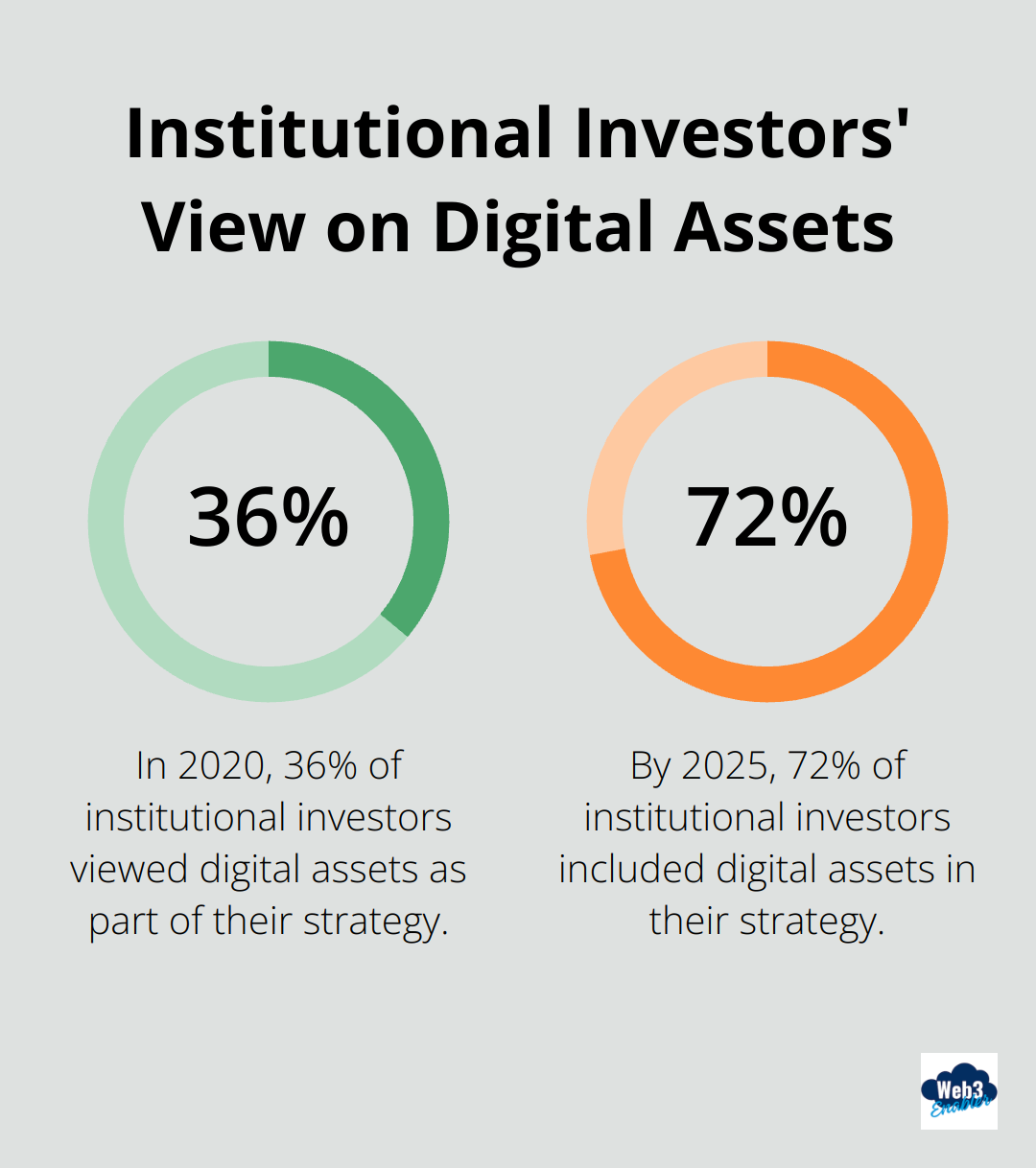

The cryptocurrency market has exploded in recent years, and investors clamor for guidance. A 2025 survey by Fidelity Digital Assets found that 72% of institutional investors now view digital assets as part of their investment strategy (up from 36% in 2020). This surge in interest isn’t limited to institutional players; individual investors also jump on board.

Retail Investors Lead the Charge

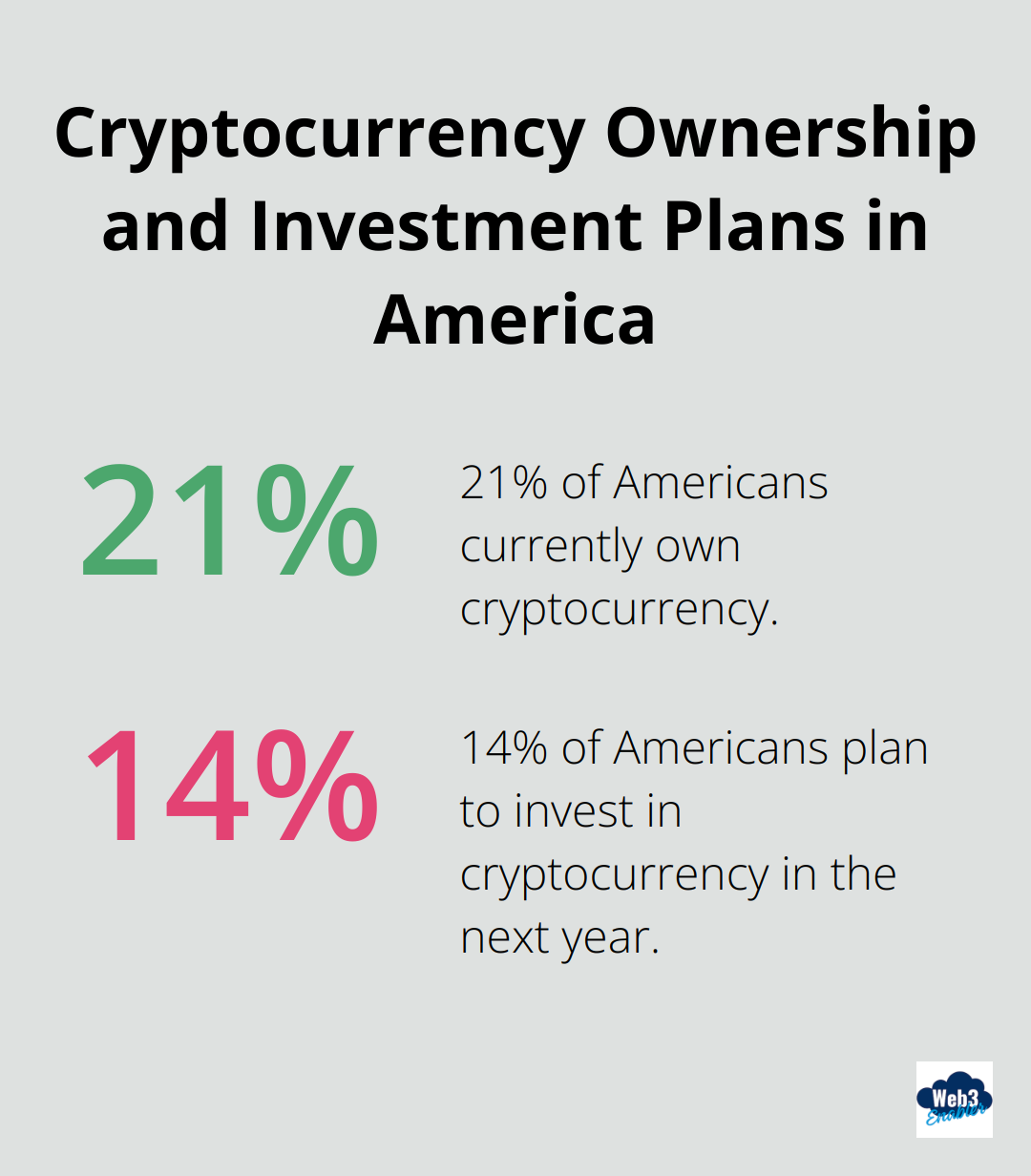

Retail investors drive much of this growth. A recent study by Gemini revealed that 21% of Americans now own cryptocurrency, with another 14% planning to invest in the next year. This shift represents a massive opportunity for financial advisors who can provide expert guidance on digital assets.

Clients Expect More from Their Advisors

As cryptocurrency becomes mainstream, clients demand more from their financial advisors. They no longer feel satisfied with traditional investment advice alone. A 2025 J.D. Power survey found that 68% of wealth management clients expect their advisors to offer cryptocurrency guidance. Advisors who can’t meet this demand risk losing clients to more crypto-savvy competitors.

The Substantial Revenue Potential

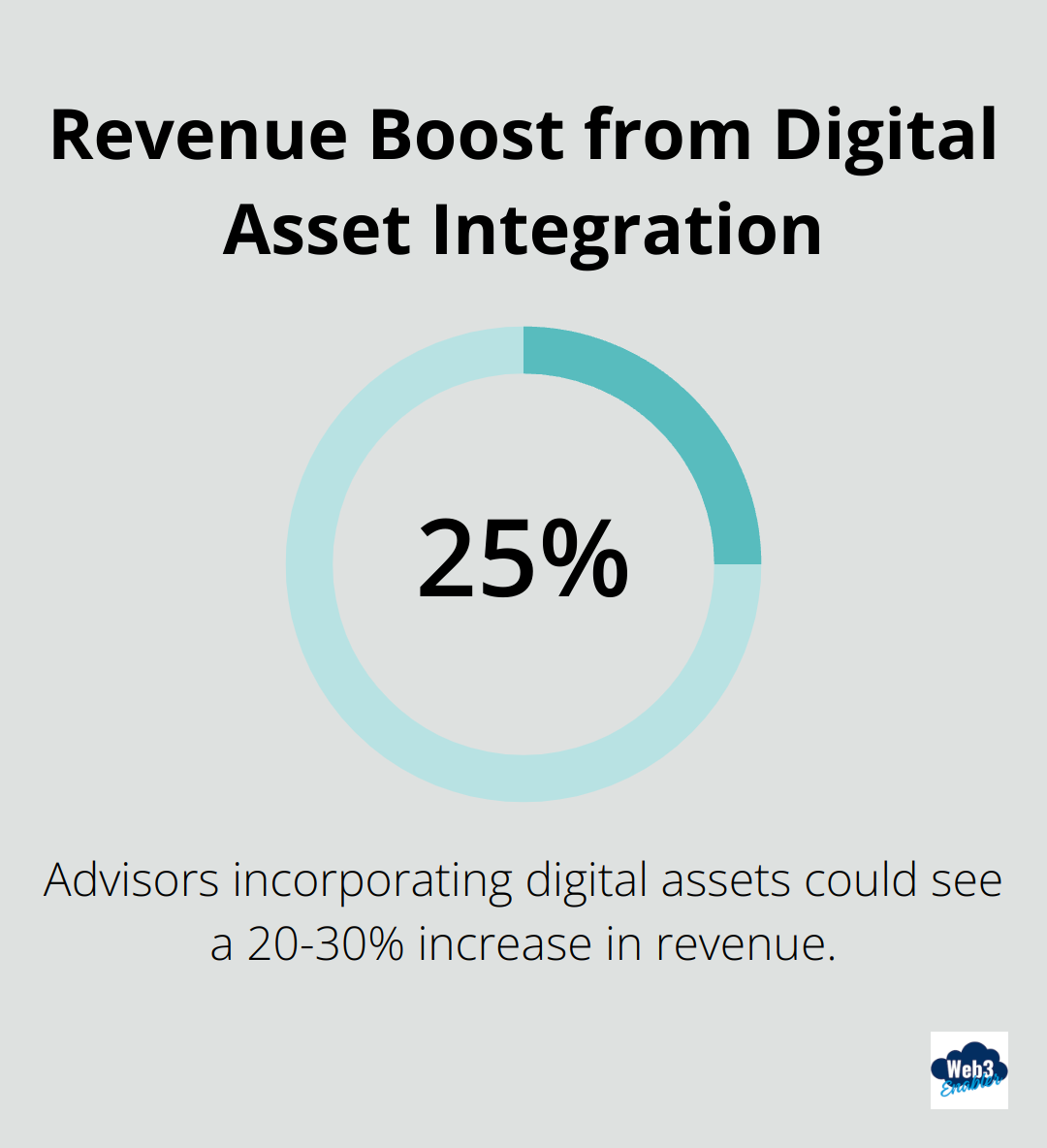

For financial advisors willing to embrace cryptocurrency, the revenue potential proves significant. A 2025 report by Cerulli Associates estimated that advisors who incorporate digital assets into their practice could see a 20-30% increase in revenue. This boost comes from both new client acquisition and increased fees for specialized crypto advisory services.

Financial advisors can leverage platforms to tap into this growing market. By integrating cryptocurrency data directly into their existing systems (such as Salesforce), advisors can offer comprehensive digital asset management alongside traditional investments, creating a powerful value proposition for clients.

The demand for cryptocurrency expertise in financial advisory continues to grow. Advisors who adapt to this new reality stand to gain a significant competitive advantage. The next section will explore how financial advisors can integrate cryptocurrency services into their practice effectively.

How to Integrate Crypto Services into Your Practice

Master Blockchain Technology

Financial advisors must acquire a solid understanding of blockchain technology to offer valuable cryptocurrency advice. Enroll in reputable online courses from platforms like Coursera and edX, which offer comprehensive blockchain programs from top universities. The Blockchain Council provides certification courses tailored for financial professionals (a great option for those seeking industry-specific knowledge).

Stay current on the latest developments by attending industry conferences and webinars. The annual Consensus conference, organized by CoinDesk, is a must-attend event for crypto professionals. For a more finance-focused perspective, the Blockchain for Financial Services conference offers valuable insights.

Craft a Crypto Investment Strategy

A robust cryptocurrency investment strategy is essential for success. Define clear investment objectives and risk tolerance levels for different client segments. Consider factors such as portfolio allocation, diversification across various cryptocurrencies, and rebalancing frequency.

Recent data can inform your strategy development. Use this type of information to shape your approach, but always tailor advice to individual client needs.

Implement Crypto Tracking Technology

If your business operates on Salesforce Financial Services Cloud, Web3 Enabler’s Digital Asset Wallet brings self custody cryptocurrency data into your standard Salesforce process. If your business is operating on other platforms, work with your technology supplier to have access to this data. Regardless of whether you custody cryptocurrency for your clients, your clients do have digital assets and it needs to be incorporated into your advisory plans, and you should launch a digital asset strategy soon.

Educate Your Team

Integrating crypto services into your practice is not a solo endeavor. Educate your entire team on blockchain technology and cryptocurrency basics. Organize regular training sessions and encourage team members to pursue relevant certifications. A knowledgeable team will inspire confidence in clients and improve the overall quality of your crypto advisory services.

Address Compliance and Regulatory Concerns

The regulatory landscape for cryptocurrencies is complex and evolving. Stay informed about the latest regulations and compliance requirements in your jurisdiction. Consult with legal experts specializing in digital assets to ensure your crypto advisory services adhere to all applicable laws and regulations.

As you integrate these elements into your practice, you’ll be well-positioned to offer comprehensive crypto advisory services. However, this integration process comes with its own set of challenges. In the next section, we’ll explore how to overcome common obstacles in cryptocurrency advisory.

To effectively manage client assets, consider tracking client crypto assets in Salesforce, which can streamline your operations and provide better insights. Additionally, enhancing client cryptocurrency visibility is crucial for improving understanding and financial management in this evolving sector.

Overcoming Challenges in Cryptocurrency Advisory

Navigating Regulatory Uncertainties

The regulatory landscape for cryptocurrencies changes rapidly. Financial advisors must stay informed about the latest developments. Create a dedicated team or assign a point person to monitor regulatory updates. Subscribe to notifications from key regulatory bodies (SEC, CFTC, and FinCEN). The Blockchain Association’s regulatory tracker offers a comprehensive resource to keep you up-to-date on legislative developments related to blockchain, cryptocurrencies, and digital assets at both federal and state levels.

Collaborate with legal experts who specialize in digital assets. Firms with dedicated blockchain practices can provide invaluable guidance. Allocate budget for regular legal consultations to ensure your crypto advisory services maintain compliance.

Addressing Security Concerns

Security is critical in the crypto world. Implement a multi-layered approach to protect your clients’ digital assets. Use hardware wallets for cold storage of significant holdings. For hot wallets, recommend reputable options, but emphasize the importance of proper seed phrase management.

Educate clients on security best practices. Create a checklist that covers topics such as two-factor authentication, phishing awareness, and the risks of sharing private keys. Consider partnerships with cybersecurity firms to offer enhanced protection and monitoring services.

Managing Volatility and Risk

Cryptocurrency volatility can intimidate clients. Develop strategies to mitigate its impact on portfolios. Dollar-cost averaging can help smooth out price fluctuations over time. Set up automated buying plans for clients interested in building long-term crypto positions.

Use advanced portfolio management tools to implement stop-loss orders and automate rebalancing. These platforms can help maintain target allocations despite market swings.

For risk-averse clients, recommend crypto-adjacent investments. Blockchain ETFs or stocks of companies with significant crypto exposure can provide exposure to the sector with potentially less volatility.

Continuous Education and Adaptation

The crypto landscape evolves rapidly. Financial advisors must commit to ongoing learning. Attend industry conferences, webinars, and workshops regularly. Encourage your team to pursue relevant certifications and stay updated on the latest trends.

Establish a knowledge-sharing system within your practice. Regular team meetings to discuss new developments and challenges can foster a culture of continuous improvement and innovation in your crypto advisory services.

Final Thoughts

Financial advisors must integrate crypto advisory services to remain competitive in today’s evolving financial landscape. The demand for cryptocurrency expertise continues to grow, driven by both institutional and retail investors seeking guidance in this complex market. Financial advisors who embrace cryptocurrency can unlock new revenue streams, attract tech-savvy clients, and position themselves as industry leaders.

Success in crypto advisory requires a commitment to education, robust security measures, and adaptability to regulatory changes and market volatility. The crypto landscape evolves rapidly, necessitating continuous learning and networking with industry peers. Web3 Enabler offers native blockchain solutions that integrate with existing systems, enabling advisors to provide comprehensive digital asset management alongside traditional investments.

Cryptocurrency’s role in wealth management will likely expand further as institutional adoption increases and regulatory frameworks mature. Financial advisors who lay the groundwork now will capitalize on future opportunities and guide clients through the digital asset world (including emerging crypto products and services). The future of wealth management is here, powered by blockchain technology and cryptocurrency.