Hey there, crypto curious! Ready to spice up your financial advisory game?

At Web3 Enabler, we’ve noticed a surge in clients asking their advisors about Bitcoin, Ethereum, and other digital assets. But many financial pros are still scratching their heads when it comes to crypto.

That’s why we’re here to help crypto advisors level up their blockchain know-how and keep clients happy. Let’s dive into how you can become the go-to guru for all things crypto in the financial world!

Why Financial Advisors Can’t Ignore Crypto

Crypto’s Gone Mainstream, Baby!

Let’s face it, crypto isn’t just some fringe internet money anymore. It’s become the financial world’s earworm – you can’t escape it, and your clients are singing along.

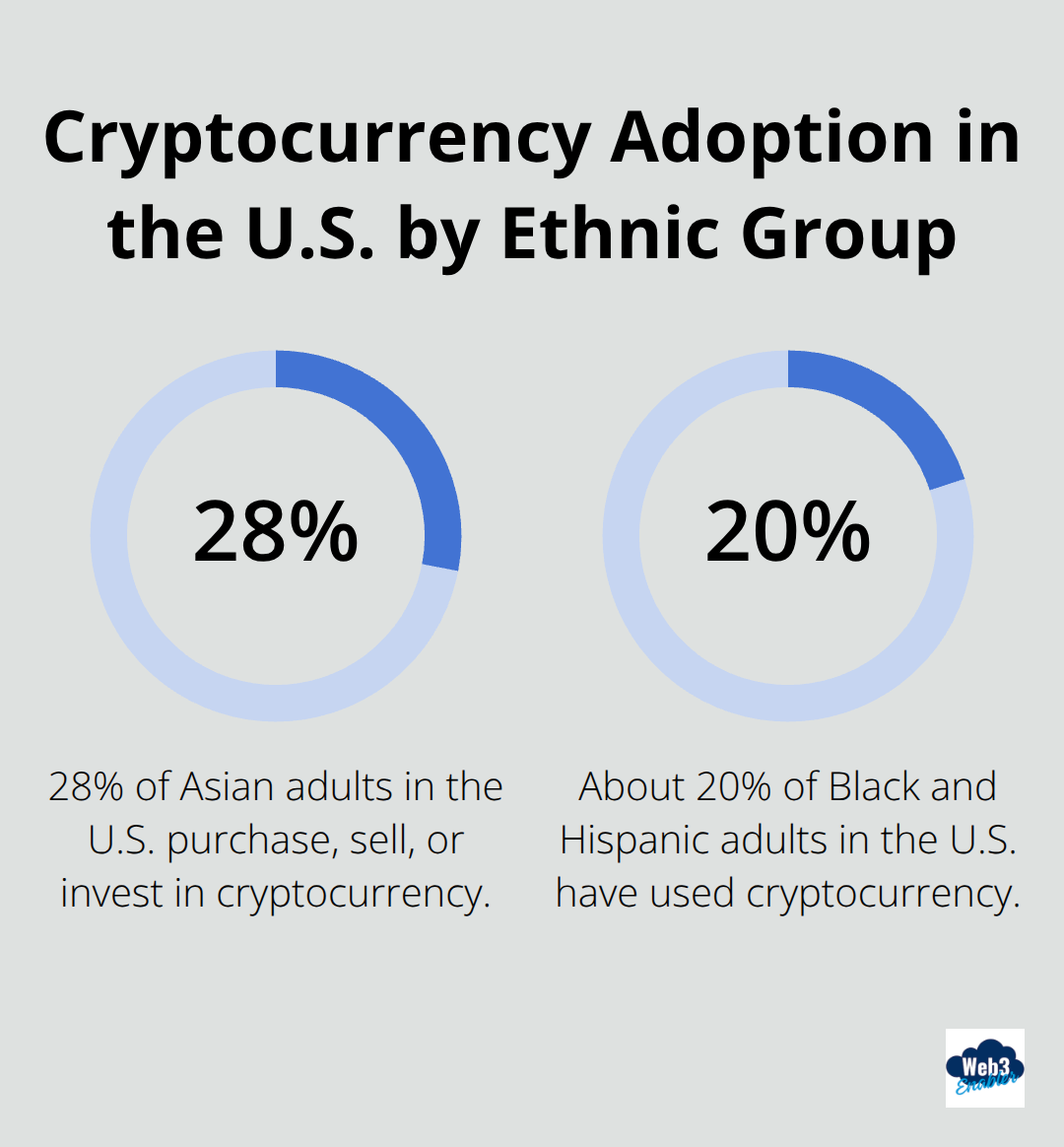

A recent survey revealed that 28% of Asian adults in the United States purchase, sell, or invest in Cryptocurrency. About one-in-five Black and Hispanic adults have also used cryptocurrency. That’s a significant chunk of people walking around with digital assets in their virtual wallets. And it’s not just tech-savvy millennials – your dentist, your kid’s teacher, and (gasp!) maybe even your grandma are getting in on the action.

Financial Advisors, Time to Level Up

Here’s the kicker: while your clients buy the crypto dip, many financial advisors still live in the stone age of traditional assets. A 2022 Bitwise/VettaFi survey found that only 15% of financial advisors allocated to crypto in client accounts. Talk about a mismatch!

You need to care because your clients make moves with or without you. They watch those crypto charts like hawks, and if you can’t speak their language, you might as well be Charlie Brown’s teacher – all they’ll hear is “wah wah wah.”

The Crypto Tracking Conundrum

Now, let’s address the elephant in the room – tracking client crypto holdings. It’s like trying to nail jello to a wall. Traditional portfolio management tools are about as useful for tracking crypto as a chocolate teapot.

Clients spread across multiple exchanges, hardware wallets, and maybe even some sketchy sites you’d rather not know about. And let’s not forget those who “lost their keys” (wink wink). It’s a nightmare for compliance and a headache for advisors trying to get a clear picture of their clients’ financial health.

The Solution to Crypto Chaos

This is where cutting-edge tools come in like a knight in shining armor. Modern solutions integrate seamlessly with your existing systems, giving you a bird’s-eye view of your clients’ crypto adventures right alongside their boring old stocks and bonds. No more piecing together screenshots from 17 different apps or trusting your client’s “rough estimates.”

Financial advisors, it’s time to embrace your inner crypto nerd. Your clients are already there, and they look to you for guidance. Don’t let them down – or worse, don’t let them wander off to that “crypto guru” who’s really just a guy with a YouTube channel and a dream.

As we move forward, we’ll explore how to turn this crypto chaos into your secret weapon for client satisfaction. And trust us, it’s a lot more fun than explaining the intricacies of municipal bonds at your next dinner party. Get ready to discover how integrating crypto insights into your advisory platform can revolutionize your practice!

How Can Advisors Supercharge Their CRM with Crypto Insights?

Salesforce on Steroids: Native Crypto Integration

Your trusty CRM is your financial advisory Swiss Army knife. But in the wild world of crypto, it lacks a crucial blade. Integrating crypto insights transforms your CRM from a butter knife into a lightsaber of financial wisdom.

Picture this: You scroll through your Salesforce dashboard, and right next to Mrs. Johnson’s stock portfolio, you spot her crypto holdings. No more alt-tabbing between seventeen different apps or trusting your client’s “rough estimates” (we all know how that goes).

Web3 Enabler’s tools slot right into your existing Salesforce setup like the missing piece of a jigsaw puzzle. Suddenly, you’ve got a 360-degree view of your client’s financial universe, crypto constellations and all. It’s like upgrading from a flip phone to the latest iPhone – same basic function, but now with all the bells and whistles.

X-Ray Vision for Client Crypto Holdings

Tracking crypto used to feel like trying to catch smoke with your bare hands. Those days are over, my friend. With integrated tools, you get crystal-clear visibility into your clients’ crypto adventures.

You’ll see exactly how much Bitcoin, Ethereum, or even DogeCoin (yes, really) your clients hodl. No more guesswork, no more “I forgot about that wallet” surprises. It’s all there, neatly organized and ready for your expert analysis.

Real-Time Data: Because Yesterday’s News is So… Yesterday

In the crypto world, things move faster than a caffeinated cheetah. That’s why real-time data becomes your new best friend. With Web3 Enabler’s tools, you don’t just get a snapshot – you receive a live feed.

You can spot trends as they happen, react to market shifts in real-time, and make informed decisions faster than you can say “blockchain.” It’s like having a financial crystal ball, minus the smoke and mirrors.

The Power of Integration

Integrated crypto insights don’t just make your life easier – they revolutionize how you serve your clients. You’ll provide more comprehensive advice, spot potential risks and opportunities across all asset classes, and position yourself as the go-to expert for the modern investor.

But wait, there’s more! (Cue infomercial voice.) As we venture into the next chapter, we’ll explore how these supercharged CRM capabilities can help you navigate the treacherous waters of crypto compliance and regulation. Buckle up, because things are about to get both exciting and legally compliant!

Crypto Compliance: Navigating the Regulatory Maze

The Current State of Crypto Regulations

Crypto regulations resemble a Rubik’s cube without instructions. The SEC, FINRA, and other alphabet agencies still grapple with how to tame this digital beast. But don’t think you can throw caution to the wind and YOLO into crypto advice.

As of 2025, financial advisors must tread carefully. The SEC has declared most cryptocurrencies as securities, subjecting them to existing regulations. (Yes, even your favorite meme coin might fall under the same rules as blue-chip stocks.)

Compliance Tools: Your New Best Friend

Here’s where things get spicy. Those integrated tools we mentioned earlier? They’re not just for tracking your clients’ Dogecoin obsession. These bad boys can become your secret weapon in the compliance game.

Salesforce-native solutions (like those offered by Web3 Enabler) come with built-in compliance features. They flag potential issues, generate reports for regulators, and help you stay on top of the ever-changing regulatory landscape. It’s like having a compliance officer on steroids (minus the awkward water cooler conversations).

Talking Crypto Without Losing Your License

Now, let’s address the elephant in the room: how do you discuss crypto with clients without accidentally stepping on a regulatory landmine? Here are some pro tips:

- Stick to the facts: Don’t promise moon shots or lambos. Focus on educating clients about the technology, potential use cases, and yes, the risks.

- Document everything: Record every conversation, recommendation, and decision. Your future self will thank you when the regulators come knocking.

- Know your limits: If you’re not a crypto expert, don’t pretend to be one. It’s okay to bring in specialists or refer clients to dedicated crypto advisors.

- Use compliant tools: Leverage platforms designed with regulatory requirements in mind. They can help you avoid accidental slip-ups and keep your practice squeaky clean.

- Stay updated: The crypto world moves fast, and regulations try to keep up. Make it a habit to stay informed about the latest regulatory developments. (Subscribe to industry newsletters, attend webinars, or join professional groups focused on crypto compliance.)

The Power of Integration in Compliance

Integrated crypto insights don’t just make your life easier – they revolutionize how you serve your clients. You’ll provide more comprehensive advice, spot potential risks and opportunities across all asset classes, and position yourself as the go-to expert for the modern investor.

With the right tools and knowledge, you can confidently navigate the Crypto Tax Maze. Embracing crypto doesn’t mean throwing caution to the wind. It’s about adapting your existing best practices to this new asset class.

Wrapping Up

Crypto advisors face a rapidly evolving landscape where digital assets have become mainstream. Your clients dive into the crypto pool, and they need you as their lifeguard. With the right tools, you can transform from a crypto novice to a blockchain boss in no time.

Web3 Enabler offers Salesforce-native solutions that act as a Swiss Army knife for crypto advisors. These tools integrate seamlessly into your existing advisory practice, allowing you to offer comprehensive financial advice across traditional and digital assets. You’ll become the advisor who “gets it,” fluent in both mutual funds and memecoins.

The crypto train leaves the station, and you don’t want to miss it. Embrace these crypto-savvy tools, level up your advisory game, and watch your practice transform. Your clients (and your bottom line) will thank you for conquering the digital frontier!