Cash is becoming a relic. Contactless payments, mobile wallets, and instant transfers are now how commerce actually works.

We at Web3 Enabler have watched the digital payments revolution reshape everything from checkout lines to cross-border transactions. Businesses that adapt win. Those that don’t get left behind.

Why Consumers Won’t Go Back to Digital Payments

The Contactless Tipping Point

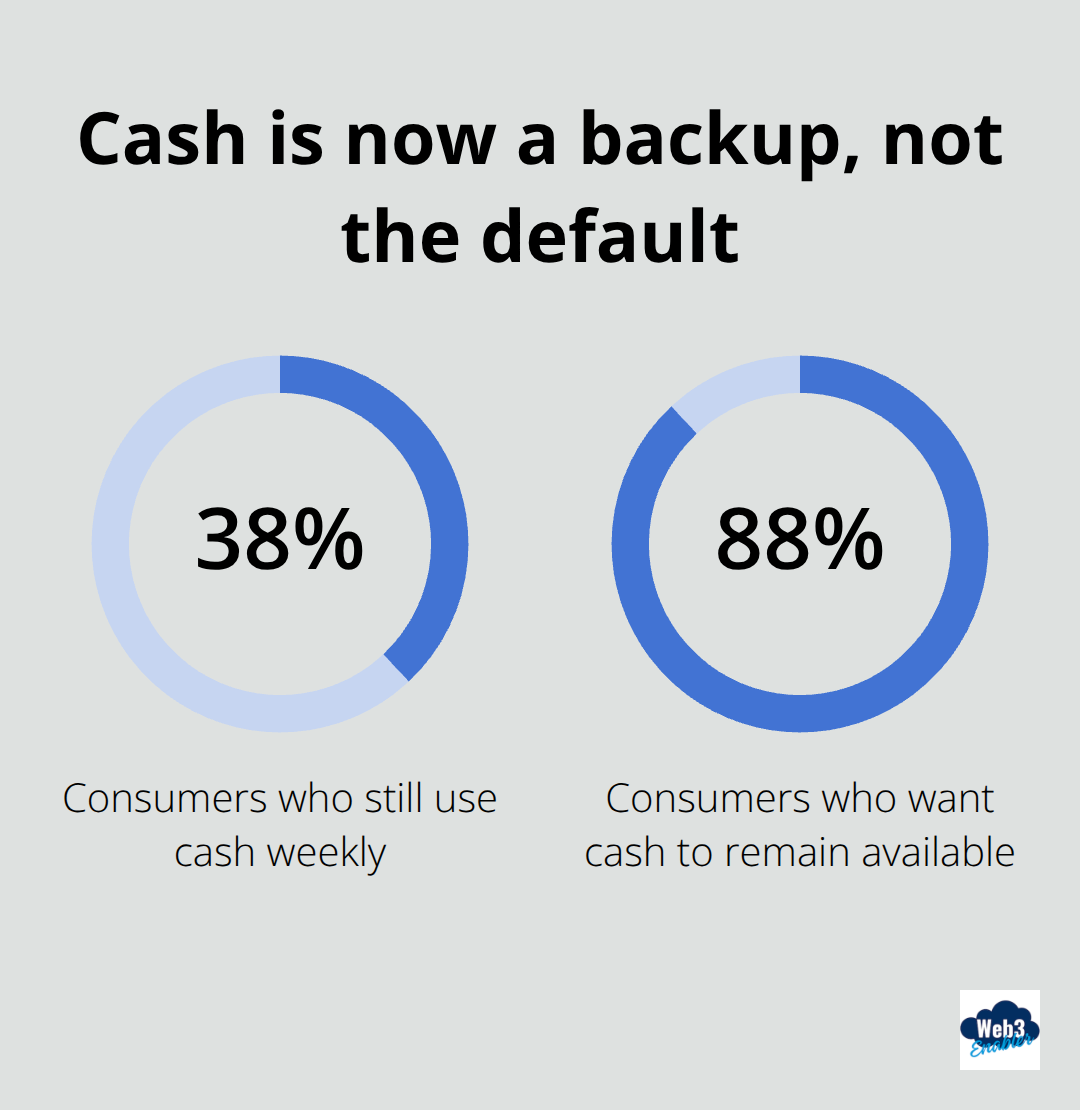

Contactless payments hit a tipping point around 2020, and they never looked back. The Payments Association reports that 2025 digital payment volumes reached approximately £18.6 trillion, with mobile point-of-sale technology expanding far beyond fixed checkout locations. What’s telling isn’t just the volume-it’s the behaviour shift. While 38% of consumers still use cash weekly and 88% want cash to remain available, these numbers reveal a hard truth: cash now serves as a backup option, not the default.

How Value Moves Today

Mobile wallets, account-to-account payments, and open banking scale rapidly, fundamentally changing how value moves through commerce. Consumers expect instant transactions without friction, and businesses that haven’t adapted their payment infrastructure lose customers to competitors who have. The speed advantage matters. A merchant accepting digital payments processes transactions in seconds; one relying on cash or legacy card networks watches customers abandon their carts.

Cross-Border Payments: Where the Real Opportunity Lives

The real action happens in cross-border payments, where traditional systems crumble under their own complexity. Cross-border payment flows will reach $250 trillion by 2027, yet the old correspondent banking model still dominates-slow, opaque, and expensive. More than 70 countries now operate instant payment systems, signalling that infrastructure for real-time global commerce exists. The gap between what’s technically possible and what most businesses actually offer creates genuine opportunity.

Stablecoins like USDC already settle payments through Visa, demonstrating that faster, cheaper cross-border flows aren’t theoretical-they’re operational today. For merchants handling international transactions, ignoring these rails means leaving money on the table through unnecessary delays and currency conversion costs (sometimes 3–5% per transaction). The businesses winning right now move beyond asking whether to adopt digital payments and instead ask which payment rails solve their specific problem.

What This Means for Your Business

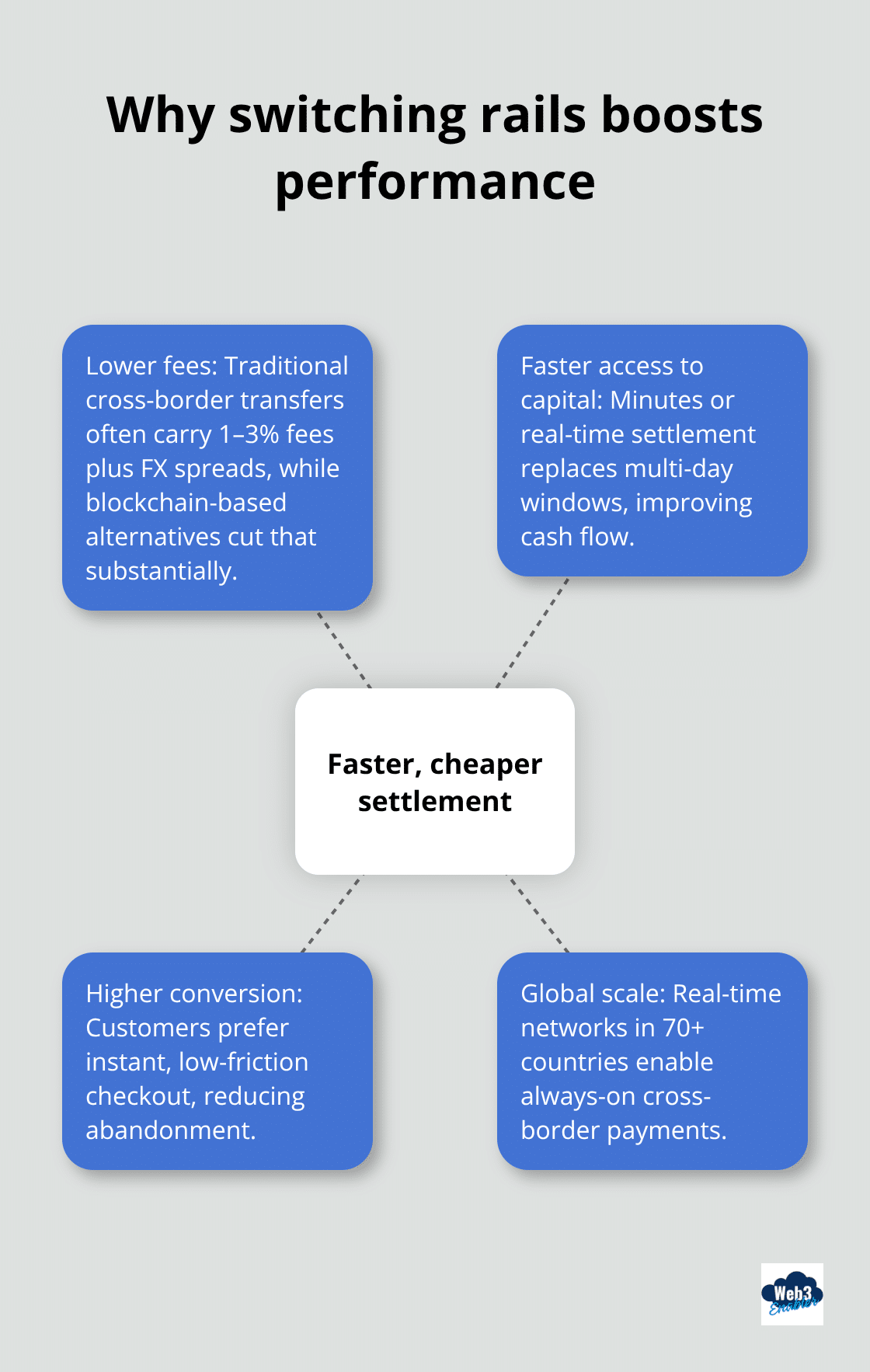

Merchants handling cross-border sales face a choice: stick with correspondent banking and accept multi-day settlement windows, or explore stablecoin rails and real-time networks that settle in minutes. The cost difference alone justifies the shift. Traditional cross-border transfers often carry fees of 1–3% plus FX spreads; blockchain-based alternatives cut that substantially. Speed matters equally-faster settlement means faster access to capital, which compounds over thousands of transactions.

Why Speed and Savings Matter More Than You Think

Settlement Speed Transforms Cash Flow

Settlement speed directly impacts cash flow, and digital payment systems compress days into hours or minutes. Traditional card networks settle in 1–3 business days; blockchain-based rails and real-time payment systems settle in minutes or instantly. For a business processing £100,000 daily in cross-border transactions, the difference between three-day and same-day settlement means access to capital weeks earlier each month. That’s not theoretical-it’s working capital you can reinvest immediately.

Fraud Detection Stops Losses Before They Happen

UK authorities restrained GBP 383 million in suspected criminal assets during the financial year ending March 2025. Digital payment systems reduce fraud exposure through cryptographic verification and immutable transaction records. A merchant using blockchain-based stablecoins like USDC eliminates chargebacks entirely because transactions settle with finality-no reversals, no disputes months later. Traditional card networks still carry chargeback risk; a single high-value reversal wipes out margins on dozens of legitimate transactions.

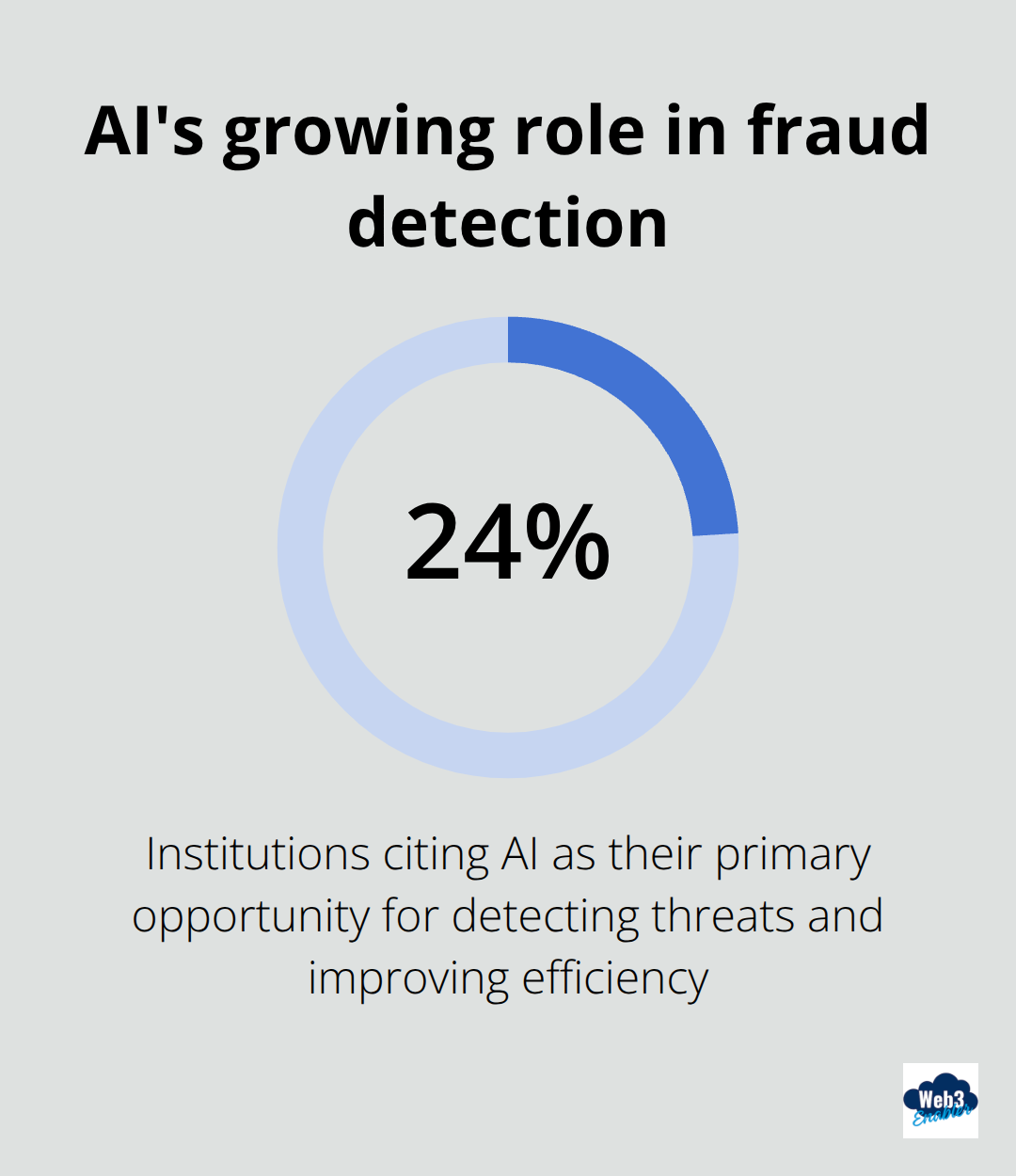

AI-powered fraud detection now leads the response to financial crime, with 24% of institutions citing AI as their primary opportunity for detecting threats and improving efficiency. Hybrid models combining AI with traditional controls become increasingly standard, meaning your payment provider should already run automated risk screening on every transaction.

Operational Costs Reveal the Real Prize

Cross-border transfers through correspondent banking typically cost 1–3% per transaction plus currency conversion spreads; stablecoin rails cut this to fractions of a percent. A business sending £50,000 to a supplier in Europe via traditional banking might pay £750–£1,500 in fees and FX costs; the same transaction on a stablecoin network costs under £50. Over 12 months, that difference compounds into meaningful savings.

Real-time payment networks and instant settlement eliminate reconciliation overhead entirely. Traditional processes require teams to manually match transactions across systems over multiple days; on-chain transactions provide a single source of truth, cutting reconciliation costs dramatically. Financial institutions using blockchain-based settlement report half-day reconciliation versus multi-person, multi-day fiat processes. For finance teams, this means fewer staff hours spent on exceptions and more time on strategy.

Integration Connects Everything Seamlessly

Modern payment systems connect directly into your existing business infrastructure-accounting software, inventory management, and customer relationship systems all sync automatically. No more manual data entry or waiting for batch settlements. Merchants accepting digital payments alongside traditional rails capture customers who prefer instant checkout, reducing cart abandonment. Mobile wallets and account-to-account payments scale rapidly because they offer speed without friction; businesses that support these rails see higher conversion rates and faster payment confirmation.

The real competitive advantage emerges when you stop treating payments as a separate function and start treating them as a core business system. That integration-connecting blockchain rails with your existing Salesforce infrastructure or other enterprise tools-determines whether you capture the efficiency gains or leave them on the table. The businesses winning right now move beyond asking whether to adopt digital payments and instead ask which payment rails integrate with their existing operations.

The Infrastructure That Makes Fast Payments Possible

Blockchain networks operate 24/7 worldwide, so your cross-border payments skip banking hours and correspondent bank queues entirely. Stablecoins like USDC settle directly through networks like Ethereum or Solana, eliminating intermediaries that slow traditional payments. When you send USDC to a supplier in Singapore, the transaction confirms in minutes, not days. According to Boston Consulting Group, tokenized markets could surpass US$16 trillion by 2030, signalling that on-chain settlement has moved from experimental to standard infrastructure. Real-time payment networks now operate in more than 70 countries, and the gap between legacy systems and what’s technically possible has never been wider. Your business either adopts these rails or watches competitors capture faster cash flow and lower costs.

Why Stablecoins Beat Crypto Volatility

Stablecoins work particularly well for businesses because they eliminate crypto volatility while preserving settlement speed. A merchant accepting USDC knows the exact fiat value at transaction time-no surprises, no price swings between order and settlement. Settlement finality means no chargebacks, no reversals months later. The transaction becomes permanent and irrevocable. For high-volume merchants, this eliminates an entire category of operational risk that traditional card networks still carry.

How Integration Connects Your Systems

The real competitive advantage emerges when blockchain rails connect directly into your existing systems. Payment data flows automatically into customer records, accounting software, and inventory systems. Manual data entry disappears. Reconciliation time collapses. A finance team that previously spent two days matching transactions across systems now watches it happen instantly. Businesses handling multi-currency flows see the biggest gains-virtual accounts let you hold EUR, GBP, and USD simultaneously, enabling instant cross-currency settlement without waiting for conversion windows. Direct SEPA access means your euro payments settle 24/7, not just during banking hours.

Building Payment Infrastructure as a Competitive Asset

When you integrate stablecoin payments into your business systems, you replace complexity with automation rather than adding layers. The merchants winning right now treat payment infrastructure as a competitive asset, not a commodity function. They ask which payment rails integrate seamlessly with their existing tech stack, then build around that foundation. That integration determines whether you capture the efficiency gains or leave them on the table. Web3 Enabler specializes in connecting blockchain technology with Salesforce infrastructure, meaning your payment data flows automatically into your existing systems without manual intervention.

Final Thoughts

The digital payments revolution has already reshaped how businesses move money across borders and process transactions-this isn’t a future scenario but today’s reality. £18.6 trillion in digital payment volumes flowed through systems in 2025, more than 70 countries operate instant payment networks, and stablecoins now settle through mainstream channels like Visa. Your competitors who integrated faster settlement into their operations already pulled ahead; those still relying on legacy systems watch their working capital sit idle while others access funds in minutes instead of days.

Speed and cost savings compound across thousands of monthly transactions, creating structural advantages that reshape profitability. A merchant saving 2–3% on cross-border fees gains meaningful working capital advantages, while settlement that happens in minutes instead of days accelerates cash flow and reduces fraud exposure before losses occur. These aren’t marginal improvements-they fundamentally change how your business competes. The infrastructure exists, stablecoins work, and real-time networks operate globally, so the question shifts from whether digital payments will dominate commerce to whether you’ll capture the efficiency gains or watch competitors do it first.

Getting started means choosing payment partners who connect blockchain rails directly into your existing systems without requiring you to rip out current infrastructure or become a crypto expert. We at Web3 Enabler specialize in exactly this-connecting blockchain technology with your existing corporate infrastructure through Salesforce-native solutions that let you accept stablecoin payments, send global payments faster, and maintain full visibility into your payment operations without leaving your existing systems.

Frequently Asked Questions

Digital Payments Revolution: How It’s Changing Commerce

What is the digital payments revolution?

The digital payments revolution refers to the shift away from cash and legacy banking systems toward contactless payments, mobile wallets, real-time transfers, and blockchain-based settlement. These technologies enable faster, cheaper, and more transparent transactions.

Why are consumers moving away from cash?

Consumers prefer digital payments because they are faster, more convenient, and work across devices and borders. Cash is increasingly used as a backup option rather than a primary payment method.

What role do contactless and mobile payments play in this shift?

Contactless cards, mobile wallets, and account-to-account payments allow transactions to complete in seconds. This speed reduces checkout friction and has permanently changed consumer expectations around payment experiences.

How are cross-border payments changing?

Cross-border payments are moving away from correspondent banking toward real-time payment systems and blockchain-based rails. These new methods reduce settlement time from days to minutes and lower transaction and currency conversion costs.

Why are stablecoins important in the digital payments revolution?

Stablecoins like USDC provide the speed of blockchain settlement without price volatility. They enable instant, low-cost cross-border payments while maintaining predictable fiat value for businesses.

How does faster settlement impact business cash flow?

Faster settlement gives businesses access to funds sooner, improving liquidity and working capital. This allows companies to reinvest, pay suppliers earlier, and scale operations more efficiently.

Do digital payments reduce fraud and chargebacks?

Yes. Many digital payment systems use cryptographic verification, real-time monitoring, and immutable transaction records. Blockchain-based settlements also eliminate chargebacks by providing transaction finality.

How do digital payments lower operational costs?

Digital payments reduce fees, eliminate manual reconciliation, and lower labor costs associated with cash handling and delayed settlement. Over time, these savings compound across high transaction volumes.

Why does integration matter for digital payments?

Integration allows payment data to flow directly into accounting, CRM, and inventory systems. This removes manual data entry, improves visibility, and ensures reconciliation happens automatically.

What infrastructure enables fast digital payments?

Fast payments rely on real-time payment networks and blockchain infrastructure that operate 24/7. These systems bypass banking hours and correspondent banks, enabling instant settlement worldwide.

How do stablecoins compare to traditional card payments?

Stablecoins offer faster settlement, lower cross-border fees, and no chargebacks. Traditional card payments still involve intermediaries, settlement delays, and reversal risk.

Can digital payments work with existing business systems?

Yes. Modern digital payment solutions integrate directly with existing systems such as Salesforce, accounting software, and ERP platforms without requiring businesses to replace their infrastructure.

How does Web3 Enabler support the digital payments revolution?

Web3 Enabler provides Salesforce-native blockchain solutions that connect stablecoin payments and real-time settlement directly into existing business systems, enabling faster payments with full visibility and compliance.