Digital assets are reshaping how businesses handle payments and treasury management. Companies worldwide are adopting blockchain-based solutions at unprecedented rates.

We at Web3 Enabler analyzed the latest digital assets report data to understand this transformation. The findings reveal significant cost savings and operational improvements for forward-thinking organizations.

Current State of Digital Asset Adoption

Enterprise Adoption Rates Reach Critical Mass

Enterprise adoption of digital assets hit a tipping point in 2025, with financial institutions announcing new digital asset initiatives across multiple jurisdictions. This surge stems from regulatory clarity that emerged globally. Companies with significant cross-border payment volumes lead this adoption wave, driven by measurable cost reductions compared to traditional payment methods that typically charge substantial fees for international transfers.

Stablecoins Dominate Corporate Treasury Operations

Stablecoins drive enterprise digital asset adoption with substantial market presence and high transaction volumes. Fortune 500 companies report significant improvements in working capital optimization, with major corporations documenting substantial reductions in trapped liquidity after implementing instant settlement for international payments. Organizations now execute urgent treasury operations during non-banking hours without expensive wire services, while blockchain’s 24/7/365 settlement capability transforms cross-border transactions from multi-day delays to seconds.

Geographic Leaders Set Implementation Standards

North America and Europe lead digital asset implementation, with regulatory frameworks like the EU’s MiCA regulation setting global standards for stablecoin oversight. The UAE consolidated digital asset regulations as part of its national strategy, while Canada restricted permissible stablecoins to fiat-backed coins pegged to CAD or USD. Hundreds of financial institutions now utilize established networks like Ripple’s infrastructure, which provides documented results and operational reliability across wide geographic coverage.

These adoption patterns reveal the specific benefits that drive organizations to integrate digital assets into their operations.

Key Benefits Driving Digital Asset Integration

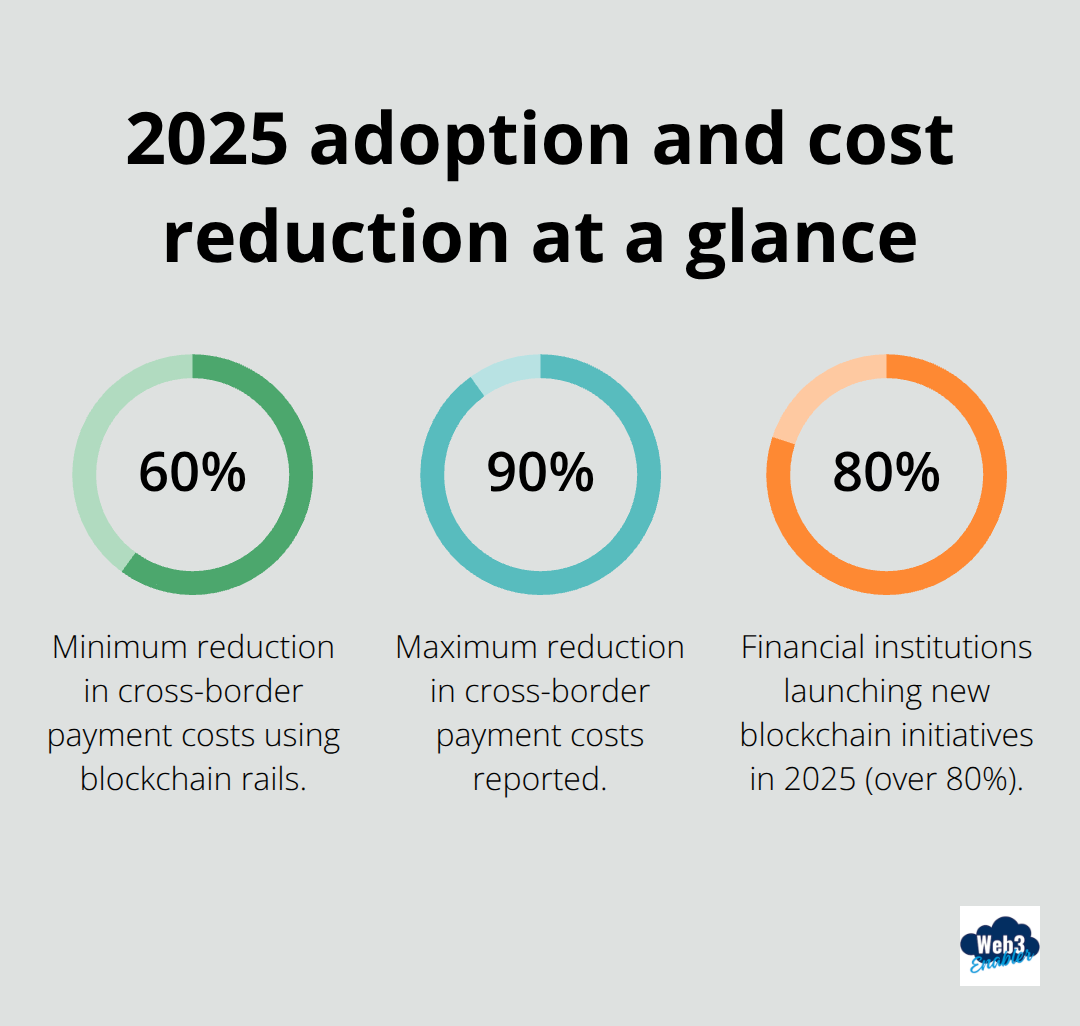

Cross-Border Payment Costs Drop by 90%

Traditional cross-border payments incur fees of 3-7%, while blockchain payments reduce these costs by 60-90%. Organizations with high cross-border payment volumes over $10 million monthly see immediate impact from digital asset infrastructure. A Fortune 500 company reported a decrease of $2.3 million in trapped liquidity after it integrated instant settlement for international payments. Same-day payments with stablecoins optimize working capital by minimizing delays in cash deployment, while real-time transaction confirmation enhances tracking capabilities that traditional wire transfers cannot match.

Settlement Speed Reaches Real-Time Standards

Blockchain technology enables 24/7/365 settlement and reduces cross-border transaction delays from days to seconds. This capability eliminates the weekend and holiday delays that plague traditional banking systems. Companies execute urgent treasury operations during non-banking hours without expensive wire services. Automated payments through smart contracts streamline supplier payments upon delivery confirmation and reduce manual processing time significantly. The reduction in trapped liquidity due to faster payment settlements creates measurable improvements in cash flow management for treasury teams.

Audit Trails Become Permanently Verifiable

Each transaction on blockchain receives a timestamp and permanent record, which significantly mitigates fraud and corruption risks in procurement processes. Common visibility across all participants builds trust by eliminating hidden costs and unauthorized changes. Complete traceability from raw materials to finished goods helps organizations react faster to recalls or supply disruptions. The immutability of blockchain records creates data integrity and security against unauthorized access (making procurement records trustworthy for auditors and compliance teams).

Infrastructure Providers Deliver Proven Results

Over 300 financial institutions utilize established networks like Ripple’s infrastructure, which provides documented results and operational reliability with wide geographic coverage. These proven platforms allow organizations to make tactical decisions based on real transaction data rather than theoretical capabilities. Companies can access measurable results from digital asset infrastructure integration, including significant reductions in both time and transaction costs (with some organizations reporting improvements within weeks of implementation).

Despite these compelling benefits, organizations still face significant obstacles when implementing digital asset solutions.

Challenges and Barriers to Digital Asset Adoption

Organizations face three primary obstacles when they implement digital asset solutions, despite clear financial benefits. Regulatory compliance demands create the most significant barrier, with over 70% of jurisdictions advancing stablecoin regulatory frameworks in 2025. Companies must navigate different requirements across markets, from the EU’s MiCA regulation to Canada’s restriction of stablecoins to only CAD or USD-pegged coins. The Basel Committee announced a review of proposed prudential rules for banks’ crypto exposures, which creates uncertainty for financial institutions that plan digital asset integration.

Technical Integration Complexity Slows Adoption

Existing enterprise systems require substantial modifications to support blockchain payments and treasury operations. Legacy banking infrastructure cannot process 24/7/365 settlements that digital assets enable, which forces companies to build parallel systems. Organizations need new compliance monitoring capabilities to track on-chain transactions and maintain audit trails. Staff training becomes mandatory as treasury teams must understand blockchain transaction mechanics and wallet management. The complexity increases for companies that operate across multiple jurisdictions, where each market demands different technical specifications for regulatory compliance.

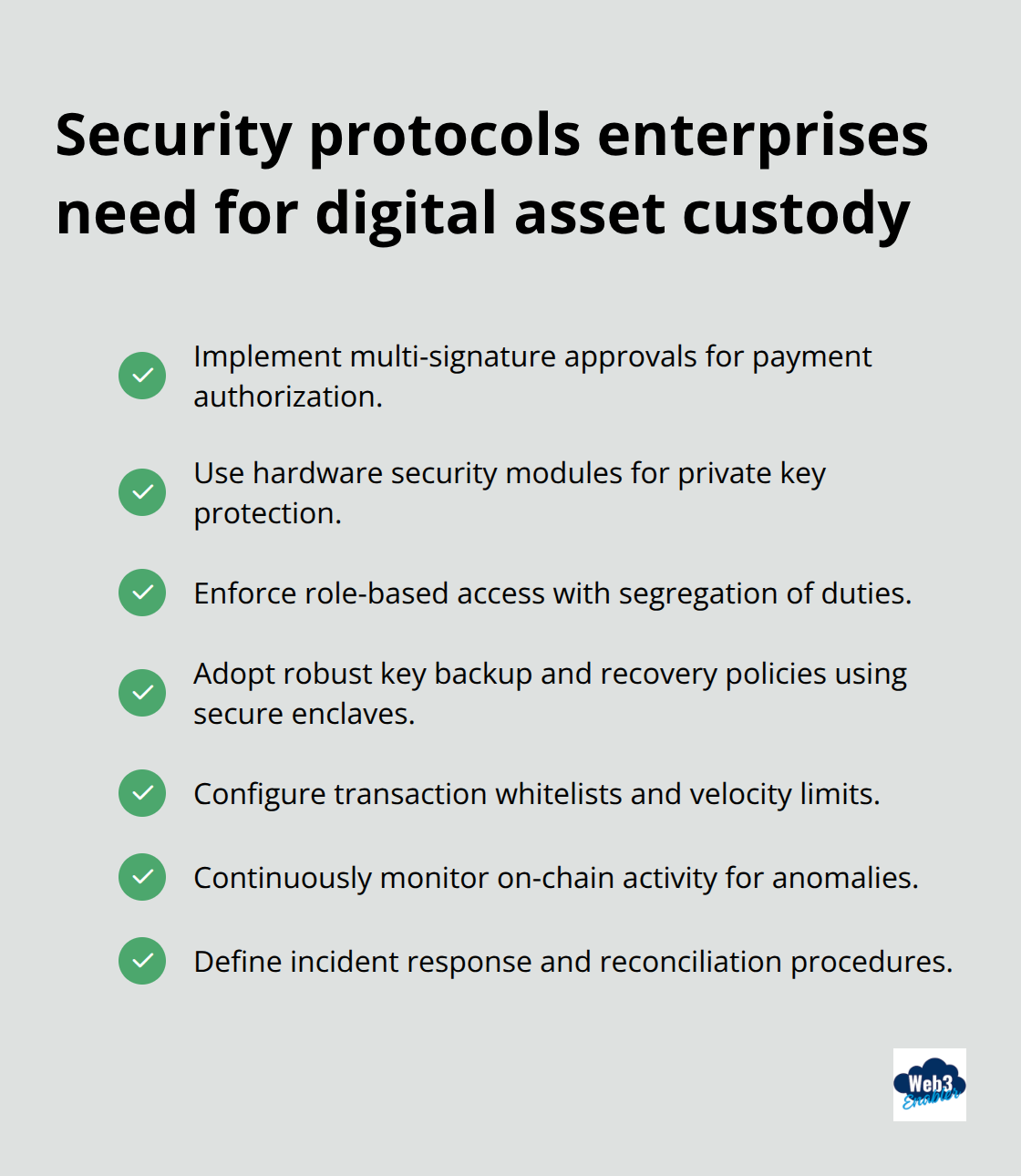

Security Standards Demand New Protocols

Digital asset custody requires fundamentally different security approaches than traditional banking systems. Private key management becomes a critical operational risk, as lost keys mean permanent loss of funds. Companies must implement multi-signature protocols and hardware security modules to protect digital assets. The immutable nature of blockchain transactions means errors cannot be reversed (which demands higher accuracy standards for payment processing).

Organizations need new risk management frameworks to assess counterparty risks in decentralized networks, while they maintain compliance with existing financial crime prevention requirements across all jurisdictions where they operate.

Implementation Costs Create Budget Pressures

High upfront implementation costs challenge organizations that consider digital asset infrastructure. Companies must invest in new technology platforms, staff training, and compliance systems before they see returns. The need for integration with existing systems adds complexity and expense to implementation projects. Organizations face ongoing costs for security monitoring, regulatory compliance, and system maintenance that traditional payment methods do not require (making budget planning more complex for finance teams).

Final Thoughts

The digital assets report findings show enterprise adoption reached critical mass in 2025, with over 80% of financial institutions announcing new blockchain initiatives. Organizations that implement digital asset infrastructure report cost reductions of 60-90% on cross-border payments and significant improvements in working capital management. Companies with monthly cross-border volumes that exceed $10 million see immediate benefits from 24/7/365 settlement capabilities.

Future enterprise adoption will accelerate as regulatory frameworks mature globally. The EU’s MiCA regulation and similar standards create the compliance clarity organizations need for widespread implementation. Stablecoin transaction volumes that average $1.1 trillion monthly demonstrate market readiness for mainstream business adoption.

Organizations should start with pilot programs that focus on high-volume cross-border payments to demonstrate measurable returns. Treasury teams need platforms that integrate blockchain capabilities with existing financial systems (while maintaining full auditability and compliance controls that enterprises require). Web3 Enabler provides blockchain solutions that enable finance teams to manage stablecoin payments and digital asset operations directly within their existing workflows.

![Flexible Payment Terms Using Stablecoin Technology [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-terms-hero-1764936594.jpeg)