Digital assets investing has transformed from a niche market into a mainstream investment opportunity. Bitcoin alone reached a market cap of $1.9 trillion in 2024, while the total crypto market exceeded $3.5 trillion.

At Web3 Enabler, we see businesses increasingly allocating treasury funds to digital assets. Smart investment strategies can help navigate this volatile but potentially rewarding landscape.

Understanding Digital Assets Investment Landscape

What Digital Assets Should You Actually Consider?

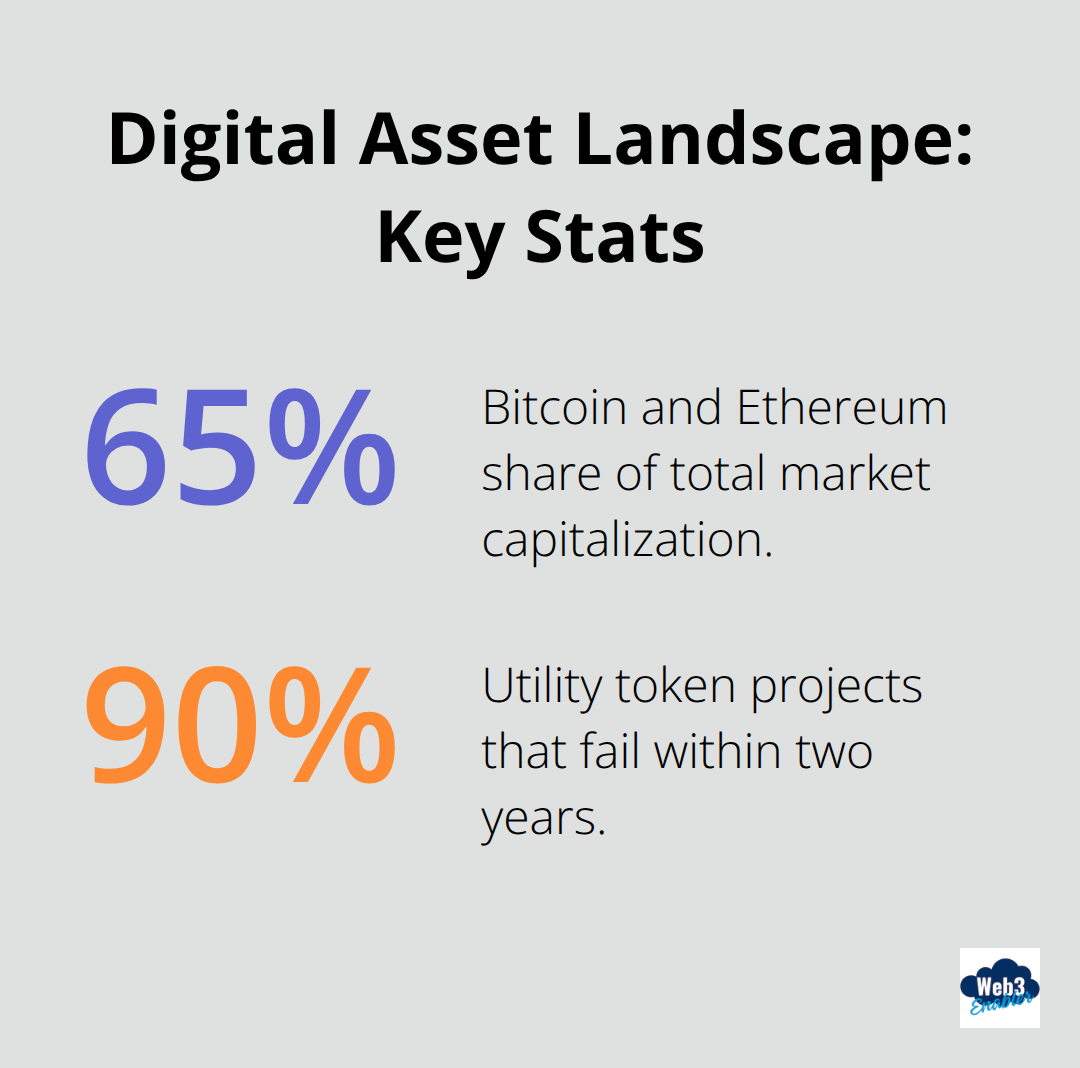

The digital asset landscape splits into three distinct categories that matter for serious investors. Bitcoin and Ethereum dominate as the foundational assets, representing 65% of total market capitalization according to CoinMarketCap data. These assets behave like digital commodities with established network effects and institutional adoption.

Stablecoins like USDC and USDT form the second tier, maintaining dollar-pegged values while enabling instant settlement and 24/7 liquidity. The third category includes utility tokens that power specific blockchain networks, though 90% of these projects fail within two years based on historical data.

Market Volatility Follows Predictable Patterns

Digital asset markets exhibit extreme volatility with Bitcoin experiencing average daily swings of 4-6%, compared to 1% for traditional stocks. However, this volatility follows cyclical patterns tied to institutional adoption waves and regulatory announcements. The cryptocurrency market correlation with traditional assets has increased from 0.2 to 0.6 since 2022, meaning diversification benefits have diminished. Trading volumes spike during Asian market hours, creating predictable liquidity windows that smart investors exploit for better execution prices.

Regulatory Clarity Creates Investment Opportunities

The SEC’s approval of Bitcoin and Ethereum ETFs in 2024 marked a watershed moment for institutional acceptance. Over 130 countries representing 98% of global GDP now actively explore central bank digital currencies, creating regulatory frameworks that benefit private digital assets. The regulatory landscape shift provides legal clarity for stablecoin operations, while 88% of financial advisors report increased client confidence following ETF approvals (according to the CoinShares survey). This regulatory progress eliminates compliance uncertainty that previously deterred institutional capital allocation.

Market Dynamics Shape Investment Timing

Institutional investors now control over $100 billion in digital assets, fundamentally changing market behavior patterns. The approval of spot Bitcoin ETFs attracted $87 billion in net inflows throughout 2024, demonstrating unprecedented institutional demand. Market makers and algorithmic traders dominate daily volume, creating more efficient price discovery but reducing retail trader advantages. These structural changes mean successful investment strategies must account for institutional-grade market dynamics rather than retail-driven speculation that characterized earlier market cycles.

Investment Strategies for Digital Assets

Dollar-Cost Averaging Beats Market Timing

Dollar-cost averaging delivers the most consistent results for digital asset investments, especially with Bitcoin’s extreme 4-6% daily price swings. Institutional investors like MicroStrategy have applied this method systematically, accumulating Bitcoin positions during market downturns while maintaining regular allocation schedules. The strategy works best when you automate purchases during specific market conditions rather than arbitrary time intervals. Position sizes should never exceed 5% of total portfolio value for individual digital assets, with Bitcoin and Ethereum forming the core allocation due to their established network effects and institutional adoption patterns.

Portfolio Construction Beyond Bitcoin

Smart portfolio construction requires understanding correlation patterns between digital asset classes and traditional investments. Stablecoins like USDC provide treasury optimization benefits through instant settlement and 24/7 liquidity access, reducing working capital requirements by up to 70% (according to Fortune 500 treasury operations data). The optimal digital asset allocation targets 60% Bitcoin, 25% Ethereum, and 15% stablecoins for treasury applications. This allocation captures growth potential while maintaining operational flexibility for business payments and settlements.

Risk management demands stop-loss orders at 15% below entry points for speculative positions, while core holdings require quarterly rebalancing based on market cap changes rather than price movements.

Advanced Risk Controls That Work

Successful digital asset investment requires sophisticated risk controls that institutional investors employ daily. Volatility targeting keeps portfolio risk constant by adjusting position sizes when Bitcoin’s 30-day volatility exceeds 80%, historically indicating market stress periods. Treasury teams should implement tiered liquidation strategies, selling 25% of positions when assets gain 100%, another 25% at 200% gains, while maintaining core positions for long-term appreciation. Geographic diversification across multiple exchanges and custody solutions prevents single points of failure, with 91% of advisors reporting improved client confidence through professional custody arrangements following ETF approvals.

These strategic foundations prepare investors for the next critical step: evaluating specific digital asset opportunities through systematic analysis methods.

Evaluating Digital Asset Opportunities

Network Activity Reveals True Value

Network fundamentals separate profitable investments from speculative bubbles in digital asset markets. Bitcoin processes 300,000 transactions daily with hash rate reaching 500 exahashes per second, which indicates robust network security that institutional investors demand. Ethereum handles over 1.2 million daily transactions while it maintains $60 billion in total value locked across DeFi protocols, which demonstrates real economic activity beyond price speculation.

Active addresses serve as the most reliable metric, with Bitcoin maintaining 900,000 daily active addresses and Ethereum sustaining 400,000 addresses consistently. Transaction fees provide another critical indicator – when Bitcoin fees exceed $20 per transaction, it signals network congestion and genuine demand rather than artificial pump schemes. Stablecoins like USDC show their utility through $94 billion in settled payments from January 2023 to February 2025, which proves actual business adoption rather than retail speculation.

Technical Patterns That Actually Work

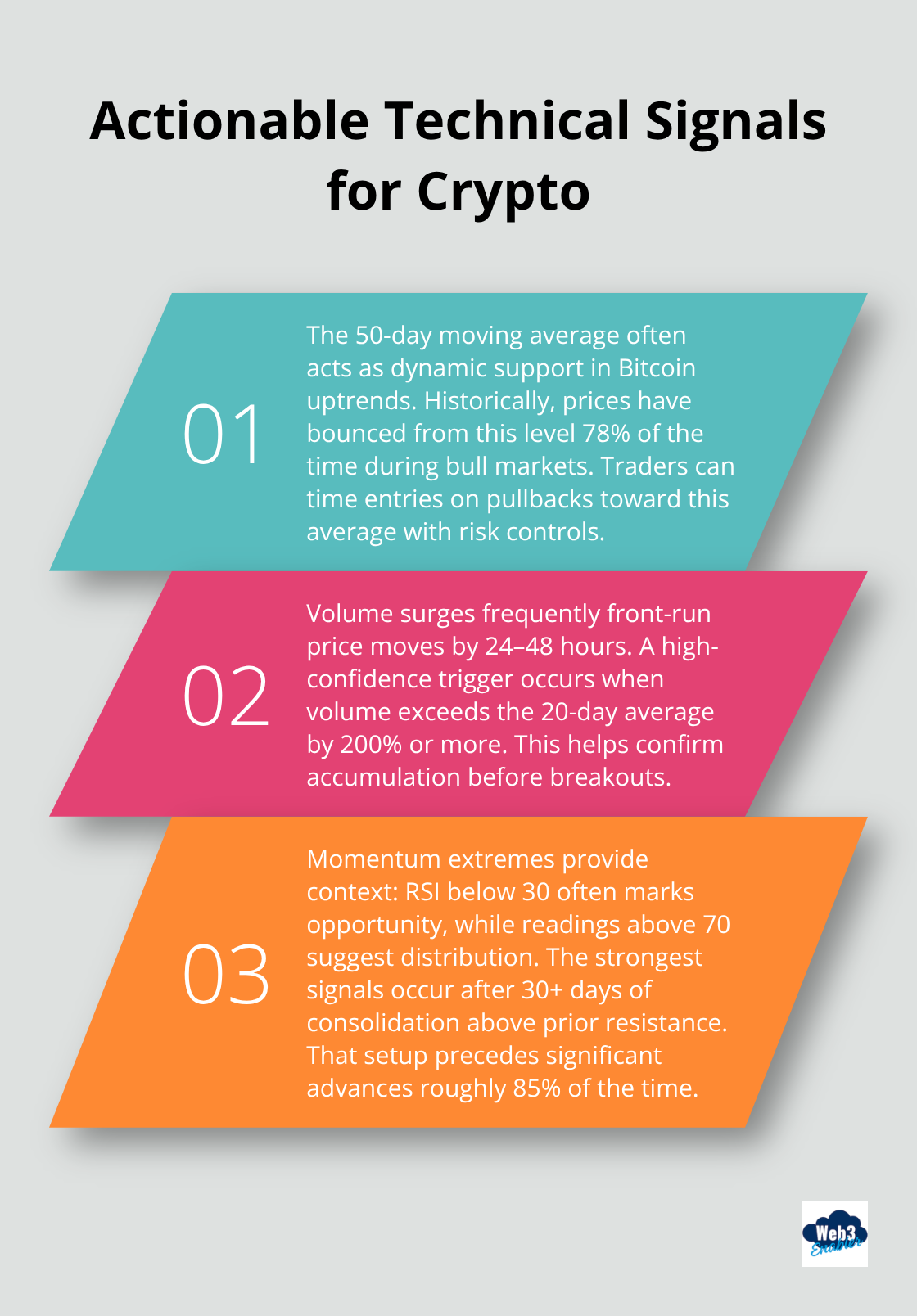

Moving averages and volume analysis provide the most actionable technical signals for digital asset investments. The 50-day moving average acts as dynamic support for Bitcoin, with prices bouncing from this level 78% of the time during bull markets (according to historical data). Volume spikes precede price movements by 24-48 hours and offer early entry signals, particularly when trading volume exceeds the 20-day average by 200% or more.

Relative Strength Index readings below 30 historically coincide with buying opportunities for Bitcoin and Ethereum, while RSI levels above 70 signal distribution phases where institutional investors typically reduce positions. The most reliable pattern involves price consolidation above previous resistance levels for 30+ days, which precedes significant upward moves 85% of the time.

Due Diligence Process for New Assets

Due diligence requires examination of tokenomics structures, with successful projects maintaining less than 5% annual inflation rates and transparent emission schedules. Team backgrounds matter significantly – projects with founders holding advanced degrees from top-tier institutions and previous successful exits demonstrate higher survival rates than anonymous teams.

Regulatory compliance becomes non-negotiable, with projects maintaining legal opinions from established law firms and proactive SEC communication strategies that demonstrate long-term viability over speculative alternatives. Projects must show clear utility beyond speculation, with measurable adoption metrics and revenue streams that justify their market valuations. Digital currency ETFs provide another avenue for exposure while maintaining regulatory oversight and professional management.

Final Thoughts

Digital assets investing demands disciplined execution rather than speculative trades. The most successful investors maintain 60% Bitcoin, 25% Ethereum, and 15% stablecoin allocations while they implement systematic dollar-cost averaging during market volatility. Risk management through position limits of 5% per asset and stop-loss orders at 15% below entry points protects capital during inevitable downturns.

Network fundamentals drive long-term value creation in this space. Bitcoin’s 500 exahash security level and Ethereum’s $60 billion in DeFi protocols demonstrate institutional-grade infrastructure that supports sustained growth. Technical analysis works best when investors combine it with volume confirmation and moving average support levels rather than isolated price patterns.

The regulatory environment continues to improve with 88% of advisors reporting increased client confidence following ETF approvals (according to CoinShares survey data). Stablecoin payment volumes that reach $94 billion prove real business adoption beyond speculation. At Web3 Enabler, we help financial institutions integrate blockchain payments directly within Salesforce for streamlined treasury operations and enhanced liquidity management. Digital assets investing success depends on treating these assets as emerging financial infrastructure rather than lottery tickets.

![Why Payment Automation is Essential for Salesforce Users [2025]](https://web3enabler.com/wp-content/uploads/emplibot/payment-automation-hero-1763035751.jpeg)