Your business probably moves money around constantly. Invoices, payroll, vendor payments, customer refunds-it’s endless. Here at Web3 Enabler, we’ve watched companies waste time and money on these transfers, and we know there’s a better way.

Your business probably moves money around constantly. Invoices, payroll, vendor payments, customer refunds-it’s endless. Here at Web3 Enabler, we’ve watched companies waste time and money on these transfers, and we know there’s a better way.

Digital asset payments cut through the noise. They’re faster, cheaper, and they work across borders without the usual banking headaches. This guide shows you exactly how to make it happen.

What Are Digital Asset Payments

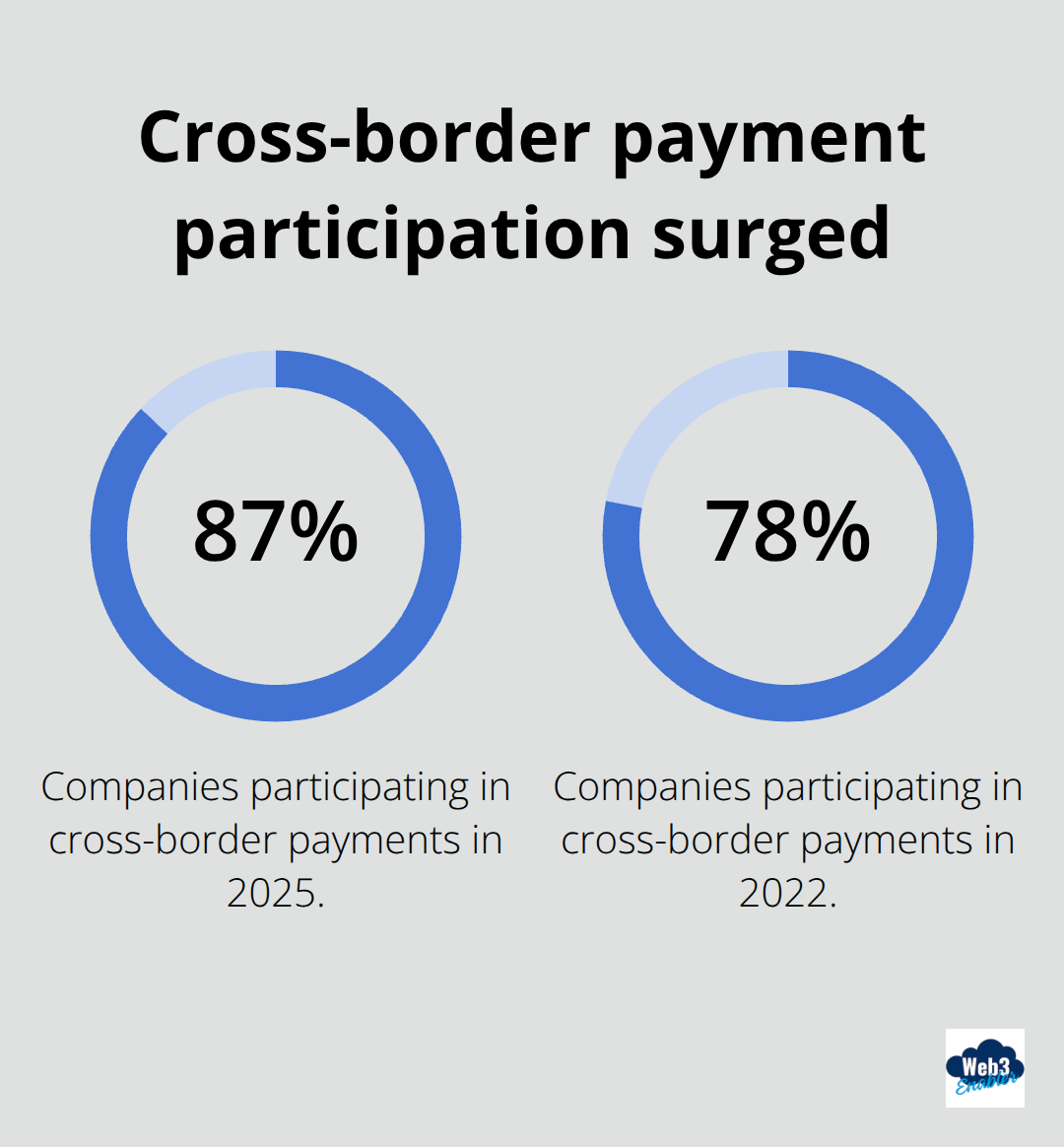

Digital asset payments are transactions conducted using cryptocurrencies or stablecoins instead of traditional fiat currency. The key difference is speed and geography. A wire transfer across borders takes 3-5 business days and costs 10-50 basis points in fees. A stablecoin payment settles in minutes for a fraction of a cent, and it works the same way whether you’re paying someone in the next city or another continent. According to the 2025 AFP Digital Payments Survey, cross-border payment participation jumped to 87% in 2025 from 78% in 2022, showing that companies are desperate for faster international transaction options.

Stablecoins have surged to over 30% of on-chain transaction volume, and their trading volume hit approximately 23 trillion dollars in 2024, up 90% from the prior year, according to IMF analysis. This isn’t niche activity anymore. Asia leads in stablecoin volume, but Africa, the Middle East, and Latin America show intense stablecoin flows relative to GDP, signaling that regions with weaker traditional banking infrastructure are adopting these rails fast.

Why stablecoins matter for business

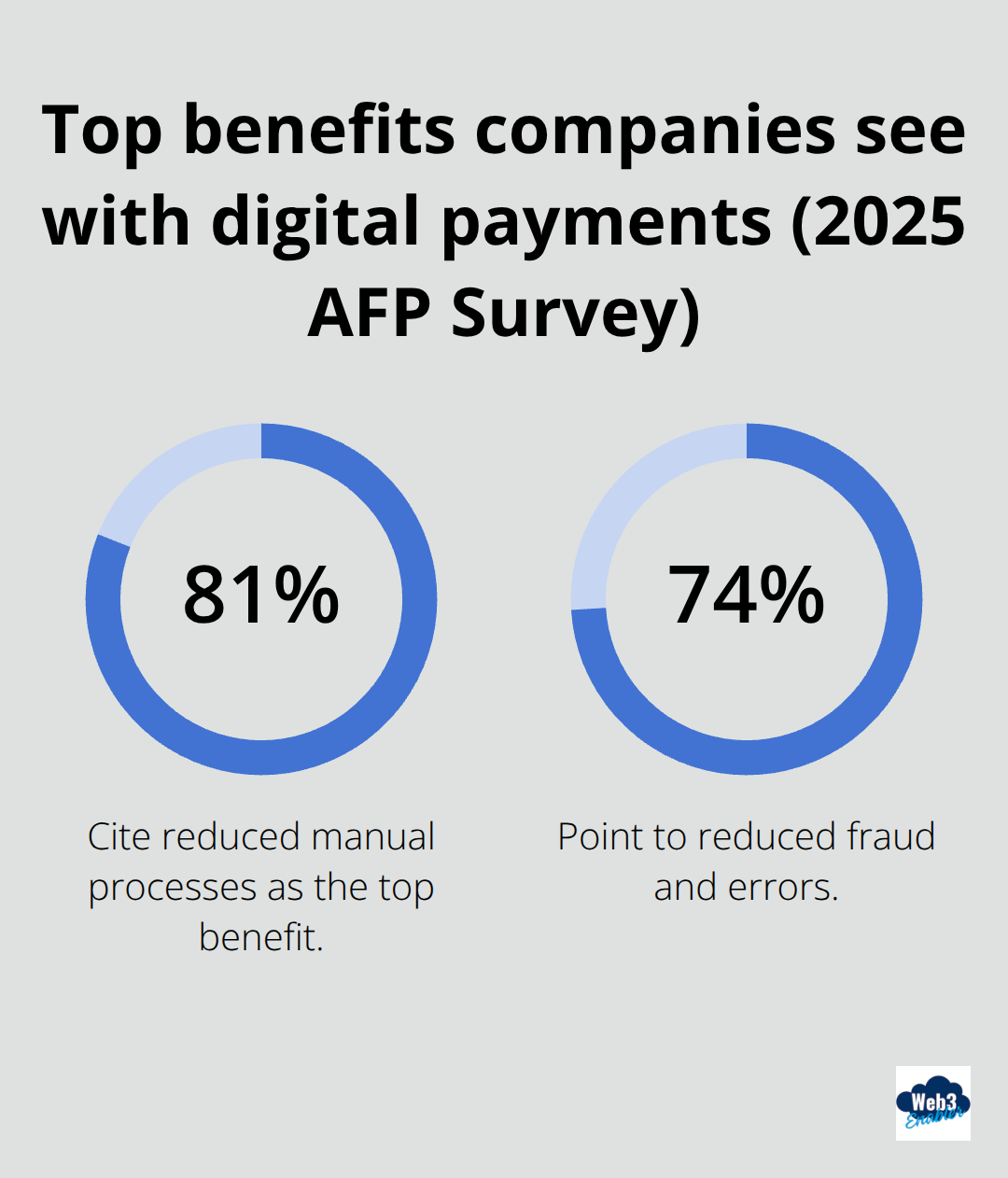

Stablecoins are the practical workhorse of digital asset payments because they eliminate volatility. A payment in Bitcoin or Ethereum could swing 10% in value between the time you send it and the time it settles. Stablecoins like USDC and USDT are pegged to the US dollar or other fiat currencies, so the value stays stable. The combined market capitalization of the two largest stablecoins reached approximately 260 billion dollars as of 2024. For merchants, accepting a stablecoin payment means you can hold it for hours or days if needed, then convert it to fiat when it suits your cash flow. No surprise currency losses. The 2025 AFP survey found that 81% of companies cite reduced manual processes as the top benefit of digital payments adoption, and 74% point to reduced fraud and errors. Stablecoin transactions are irreversible and transparent, so chargebacks and payment disputes shrink dramatically.

For businesses processing international payments, stablecoins address the remittance problem head-on. Some traditional remittances cost up to 20% of the amount sent. Stablecoins enable faster and cheaper cross-border flows that settle in minutes rather than days.

The settlement advantage

Traditional payments rely on networks of correspondent banks, multiple data formats, and differing operating hours. This infrastructure was built in the 1970s and hasn’t fundamentally changed. Blockchains bypass all of that. A stablecoin payment from your company to a vendor in Singapore settles instantly on networks like Solana or Polygon, where transaction times are under 5 seconds. Ethereum typically completes payments in 1-3 minutes. You don’t need a bank account in Singapore, don’t need to convert currencies through intermediaries, and don’t need to wait for clearing windows. The vendor receives the stablecoin immediately and can convert it to local currency on a local exchange if they choose. The 2025 AFP survey shows that over 30% of financial professionals report faster payments positively impacting their organizations, with 28% seeing benefits specifically in B2B transactions. Companies adopting digital asset payments are cutting settlement times from days to minutes and reducing the cost per transaction by orders of magnitude (a competitive edge for global businesses).

What makes stablecoins different from crypto volatility

Stablecoins solve the volatility problem that makes Bitcoin and Ethereum impractical for everyday business transactions. While those assets can swing wildly in value, stablecoins maintain a fixed peg to fiat currencies. This stability makes them suitable for invoicing, payroll, and vendor payments without the risk of sudden losses. The irreversible nature of blockchain transactions also means payment disputes and chargebacks become nearly impossible, protecting both payers and receivers. For companies moving money across borders, this combination of stability and finality transforms how international operations work.

Moving from traditional rails to digital asset infrastructure

The shift toward digital asset payments reflects a fundamental change in how businesses think about moving money. Traditional correspondent banking networks introduce delays, costs, and complexity that digital assets eliminate. When you send a stablecoin payment, settlement happens in minutes on public blockchains, not days through banking intermediaries. This speed advantage compounds across thousands of transactions annually, freeing up working capital and reducing operational friction. The data backs this up: companies that adopt faster payment methods report measurable improvements in cash flow and operational efficiency.

Why Companies Switch to Digital Asset Payments

The math is brutal for traditional payments. A 2025 AFP Digital Payments Survey shows that companies adopting digital payments cite reduced manual processes and reduced fraud and errors as primary benefits. When you process hundreds or thousands of transactions monthly, these improvements stack fast. A wire transfer to Europe costs 10-50 basis points and takes 3-5 business days. A stablecoin payment costs fractions of a cent and settles in minutes. Over a year, a mid-market company sending 500 international payments saves tens of thousands in fees alone, not counting the working capital freed up when settlement happens faster. That’s not theoretical-those are real companies seeing real cash flow improvements.

The technology barrier has already fallen

The barrier to adoption isn’t the technology anymore. It’s inertia and the misconception that digital asset payments are risky or complex. They’re neither. Companies like Bitstamp have partnered with regulated custody providers to settle payments off-exchange since 2016, proving that institutional-grade security and compliance are solved problems. BitGo processes approximately 3 trillion dollars in funds across 90+ countries with OCC-approved custody, showing that the infrastructure exists and scales. The companies moving fastest aren’t waiting for perfect conditions. They start with one payment corridor-maybe a vendor in a high-friction market or a customer demanding faster settlement-then expand from there.

Compliance and transparency transform your audit trail

Traditional correspondent banking leaves audit trails scattered across multiple institutions, making reconciliation a nightmare. Blockchain transactions are immutable and transparent-every transaction records permanently and verification happens instantly. For companies operating in regulated industries, this transparency becomes a competitive advantage, not a burden. The irreversible nature of stablecoin payments also eliminates chargebacks and payment disputes that plague traditional systems.

Customer and supplier acceptance is the real hurdle

The real problem to solve isn’t technology or security-it’s getting your customers and suppliers on board. When your finance team can accept stablecoin payments without leaving their existing systems, and when those payments settle in minutes instead of days, adoption becomes a no-brainer. The companies that move fastest start small-one vendor, one customer, one payment corridor-then scale what works.

Making Digital Asset Payments Work in Your Business

Start with one payment corridor, not your entire operation. The companies moving fastest aren’t overhauling their entire payment infrastructure overnight. They pick a specific problem-a vendor in a market with expensive wire transfers, a customer wanting faster settlement, or a high-volume payment stream where fees drain cash-and solve that first. Stripe processes payments across 195 countries in 135+ currencies and supports stablecoin settlement directly to fiat in your Stripe balance, meaning you can test digital asset payments without rebuilding your treasury function. BitGo’s REST APIs and SDKs let developers integrate custody and settlement into existing workflows in weeks, not months. The integration doesn’t require you to rip out your current systems. It adds a new payment rail alongside what you already have. Your ERP still handles invoicing and accounting. Your bank account still exists. You simply add stablecoin payments as an option for specific corridors where the speed and cost savings justify the effort. Once one payment corridor works smoothly, expanding to others becomes obvious because the operational friction disappears.

Security stops being theoretical when real money moves

Don’t outsource security thinking to your vendor. Understand what you protect and where the actual risks live. Regulated custody providers like BitGo hold the stablecoins themselves, so your company never controls the private keys. This eliminates the single biggest security risk in crypto-key management. You still need to protect the addresses you send from and receive to. Phishing attacks that redirect payments to attacker-controlled wallets happen constantly. Verify the middle characters of wallet addresses, use hardware 2FA or security keys instead of SMS, and store seed phrases offline in a hardware wallet if you manage any keys yourself. For tax purposes in the US, the IRS requires brokers to report digital asset data starting 2025 through new 1099-DA forms, and spending stablecoins triggers taxable events. UK companies face similar complexity-the £3,000 capital gains tax allowance means spending crypto for daily purchases requires careful planning. Work with your accountant before you start, not after. Compliance isn’t optional and it’s not expensive relative to the payment savings you’ll realize.

Pick a solution that matches your actual workflow

Platforms like Stripe and BitGo handle different problems. Stripe works if you accept customer payments online or in-person and want settlement in fiat immediately. BitGo works if you send international payments to vendors, manage custody at scale, or build internal settlement infrastructure.

The 2025 AFP survey found that 43% of companies cite barriers to digital payment adoption, with customer and supplier acceptance topping the list. Your solution needs to make it easy for the other party to accept payment without learning blockchain basics. A customer paying you in stablecoins needs a checkout experience that feels like any other payment method. A vendor receiving stablecoin payments needs clear instructions on converting to local currency if they choose, or holding stablecoins if their business operates internationally. The friction disappears when stablecoin payments integrate seamlessly into existing workflows instead of creating parallel processes.

Start small and expand what works

Try one vendor first-ideally someone in a market where traditional wire transfers cost significant fees or take days to settle. Send them a stablecoin payment and measure what happens. Does settlement speed improve your cash flow? Do fees drop enough to matter? Does the vendor accept the payment without friction? These answers tell you whether digital asset payments solve a real problem in your operation. The companies that move fastest don’t wait for perfect conditions. They start with one corridor, prove the concept works, then expand to others. Most discover that once the first payment succeeds, the second and third become routine because the operational complexity was never as high as they feared.

Compliance and transparency transform your audit trail

Traditional correspondent banking leaves audit trails scattered across multiple institutions, making reconciliation a nightmare. Blockchain transactions are immutable and transparent-every transaction records permanently and verification happens instantly. For companies operating in regulated industries, this transparency becomes a competitive advantage, not a burden. The irreversible nature of stablecoin payments also eliminates chargebacks and payment disputes that plague traditional systems. Your finance team gains visibility into every transaction, settlement status, and conversion event without waiting for bank statements or reconciliation reports.

Final Thoughts

Digital asset payments aren’t coming-they’re here now. The 2025 AFP survey shows 87% of companies participate in cross-border payments, up from 78% just three years ago, and stablecoin trading volume hit 23 trillion dollars in 2024, a 90% jump year-over-year. These numbers reflect real businesses solving real problems, not speculative hype.

The math works because companies adopting digital asset payments report 81% reduction in manual processes and 74% fewer fraud and errors. Settlement times drop from days to minutes, and fees collapse from basis points to fractions of a cent. When you process hundreds of international payments annually, those savings compound into meaningful cash flow improvements and operational efficiency gains (regulated custody providers like BitGo now process 3 trillion dollars across 90+ countries with OCC approval, proving the infrastructure exists at scale).

Pick one payment corridor where digital asset payments solve a specific problem-maybe a vendor in a market with expensive wire transfers or a customer demanding faster settlement. Start there, measure the results, then expand what works. We at Web3 Enabler help businesses connect blockchain technology to existing corporate infrastructure through Salesforce-native solutions that make digital asset payments practical for business operations, not speculation.

Frequently Asked Questions: Digital Asset Payments

What are digital asset payments?

Digital asset payments are payments made using cryptocurrencies or stablecoins instead of traditional fiat rails like wires, ACH, or card networks. For most businesses, this typically means using stablecoins (like USDC or USDT) to move value faster, with clearer settlement visibility, especially for cross-border transactions.

Are digital asset payments the same as crypto payments?

Digital asset payments is the broader category. It includes crypto payments (Bitcoin, ETH, etc.) and stablecoin payments (USDC, USDT, and other fiat-pegged tokens). Businesses often prefer stablecoins because they reduce price volatility while still using blockchain settlement rails.

Why do businesses use stablecoins for payments instead of Bitcoin or Ethereum?

Stablecoins are designed to track a fiat currency value, which makes them more practical for invoicing, vendor payments, payroll, and customer settlements. Traditional cryptocurrencies can fluctuate in value, which can create accounting headaches and unexpected gains or losses between invoicing and settlement.

How fast do digital asset payments settle compared to wires?

Traditional cross-border wires can take days due to banking hours, intermediaries, and compliance checks. Digital asset payments can settle much faster on-chain, often within minutes depending on the network and confirmation requirements. Faster settlement improves cash flow certainty and reduces payment status chasing.

Do digital asset payments reduce cross-border fees?

They can. Traditional cross-border payments often include multiple layers of fees (bank fees, intermediary fees, FX spreads, and operational overhead). Stablecoin payments can reduce these costs by using a shared settlement rail and minimizing intermediaries, which is why many companies start with high-friction payment corridors first.

What do we need to start accepting or sending digital asset payments?

At minimum you need: (1) a stablecoin policy (what you accept and on which networks), (2) wallet infrastructure or a payments provider, (3) a way to connect payments to invoices and customer/vendor records, and (4) a reconciliation and reporting process that captures transaction IDs, timestamps, and USD equivalents.

Do customers or vendors need a wallet to use digital asset payments?

Yes. To send or receive on-chain payments, the other party needs a compatible wallet address on the correct network. For smoother adoption, businesses often provide a short “payment instructions” checklist that includes network selection, address verification, and how to confirm the transaction.

How do we handle accounting for stablecoin payments?

Most businesses track each payment with the USD equivalent at the time of settlement and store supporting details such as the transaction hash, wallet address, date/time, network, and any fees. This creates an audit-friendly trail. Your exact treatment depends on jurisdiction and your accounting policy, so involve your accountant early.

Are digital asset payments compliant with regulations and taxes?

Compliance depends on where you operate and who you transact with. Many businesses implement KYC/AML checks, maintain vendor/customer records, and document payment purpose and settlement details. Tax and reporting rules vary by country and can change over time, so it’s smart to confirm requirements with qualified tax and legal advisors.

What are the biggest security risks with digital asset payments?

The biggest risks are operational: sending to the wrong address, phishing attempts, and poor access controls. Common best practices include approval workflows (multi-approval), strict address verification procedures, hardware-based authentication, and limiting who can initiate transfers. If you use custody or a payments provider, confirm how keys, approvals, and controls are handled.

How should a business pilot digital asset payments without disrupting operations?

Start with one corridor: a single vendor, customer, or region where wires are slow or expensive. Define stablecoin and network standards, run a small test payment, measure settlement speed and cost impact, and document the reconciliation process. Once the pilot is repeatable, expand corridor by corridor.

How does Web3 Enabler help businesses implement digital asset payments?

Web3 Enabler helps businesses make digital asset payments operational by connecting blockchain payment activity to existing workflows. For teams that live in Salesforce, Salesforce-native payment visibility and transaction records can reduce tool sprawl, improve audit trails, and make stablecoin payments easier to manage at scale.