Your business sends money across borders and watches it vanish into the banking system for days. Wire transfers eat into margins, hidden fees surprise you, and your cash flow suffers while intermediaries take their cut.

At Web3 Enabler, we’ve seen how crypto cross border payments change this game entirely. Stablecoins settle in minutes instead of days, cut out the middlemen, and show you exactly what you’re paying.

Why Your Bank Still Thinks It’s 1995

Your bank’s cross-border infrastructure hasn’t fundamentally changed since the 1980s. SWIFT connects more than 11,000 financial institutions worldwide, but it processes payments in batches, not in real time. When you send money across borders, it bounces through multiple intermediary banks, each one taking a cut and adding processing time. A wire transfer that should take hours routinely takes three to five business days because the payment travels through correspondent banking networks where each institution operates on its own schedule, in its own time zone, using its own data formats. Traditional cross-border payments rely on these correspondent banking networks, and data-format fragmentation combined with different operating hours drives costs up and speed down. Remittance costs alone can reach up to 20 percent of the transaction amount.

Your business doesn’t just lose time; it loses money to foreign exchange markups, intermediary fees, and charges you’ll never fully understand.

The Stacking Fee Problem

Hidden fees compound at every step. Your bank charges an outgoing wire fee. The receiving bank charges an incoming fee. The intermediary banks in between each take a handling fee. Currency conversion happens at unfavorable rates because each intermediary marks up the exchange rate for their own profit. A single cross-border transaction can pass through four, five, or even six different banks before it reaches its destination. A single blockchain ledger simplifies cross-border information and reduces steps and costs-exactly what traditional banking refuses to do. You pay for inefficiency baked into a system that treats cross-border movement like it requires physical transportation. Your finance team spends hours tracking payments, reconciling discrepancies, and explaining to stakeholders why money that left your account three days ago hasn’t arrived yet. Meanwhile, your cash flow stalls because you can’t plan around unpredictable settlement windows.

Weekend Delays and Time Zone Chaos

Banks don’t operate on weekends or holidays, and they certainly don’t work across time zones seamlessly. If you send a payment on Friday afternoon, it won’t process until Monday morning at the earliest. If you send it to a region that’s already in tomorrow, add another day. This artificial scarcity of settlement windows exists nowhere except in traditional banking. Your business operates 24/7, but your payment infrastructure operates on a schedule designed for a world where people mailed checks. Cross-border transaction costs with traditional methods stay stubbornly high because you pay for the privilege of waiting.

Stablecoins eliminate these friction points entirely. They settle in minutes, any day, any time, and they show you exactly what you’re paying. The next section shows how this actually works in practice.

How Stablecoins Actually Settle Payments

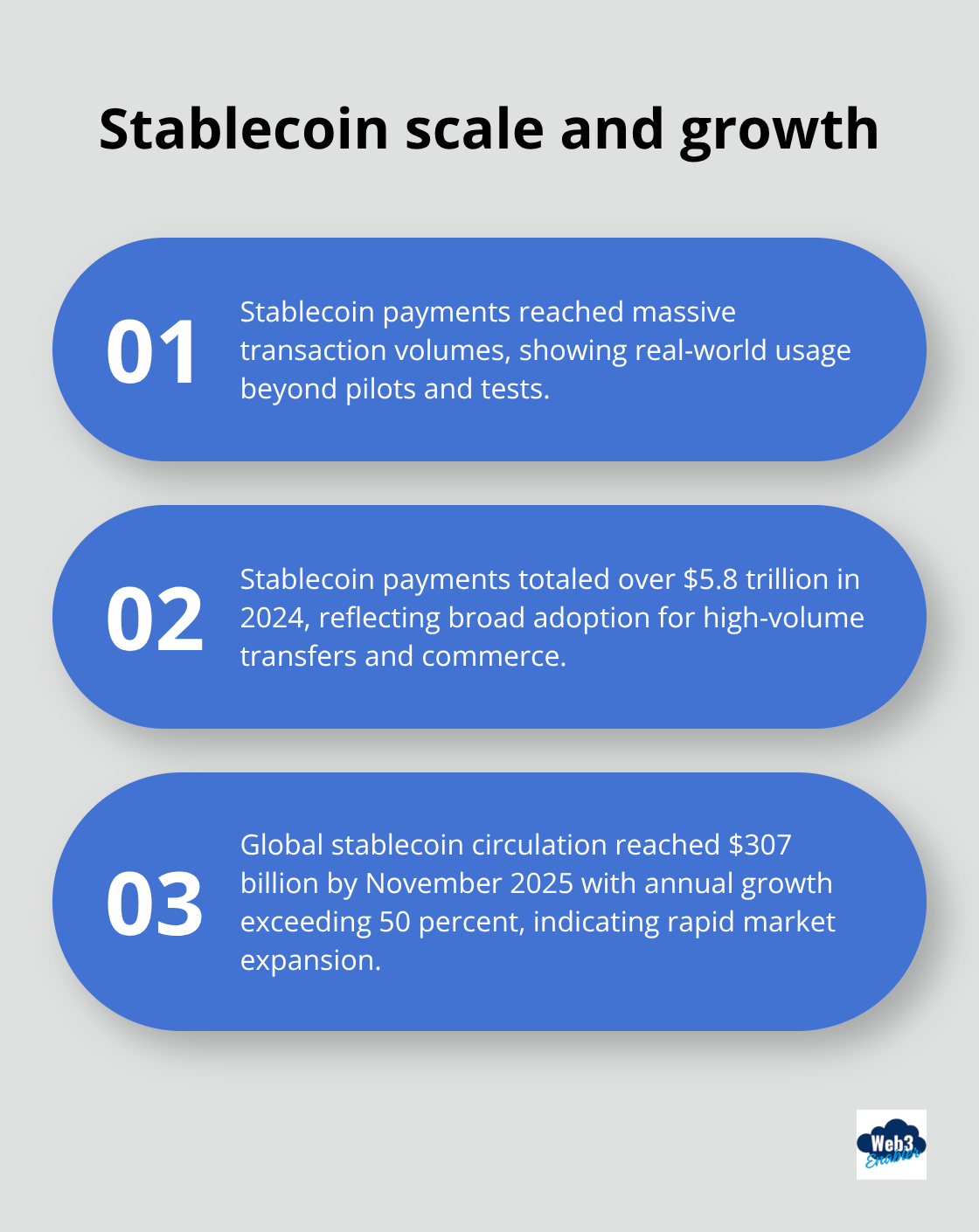

Stablecoins move money in minutes because they operate on blockchains that never sleep. When you send USDC or USDT across borders, the transaction confirms on-chain within seconds via a simple wallet connection or payment link. No intermediaries, no batch processing, no waiting for Monday morning. Visa’s recent pilot with Cross River Bank and Lead Bank demonstrates this shift toward real-world rails: they use USDC on Solana to settle payments directly, with seven-day availability that removes weekend delays entirely. That means merchants receive payment on Saturday. That means your cash flow doesn’t pause because some bank in Frankfurt closes its doors. The Stripe data tells the story plainly: stablecoin payments totaled over 5.8 trillion dollars in 2024, and global stablecoin circulation reached 307 billion dollars by November 2025 with annual growth exceeding 50 percent. These aren’t theoretical experiments anymore.

They’re the backbone of actual commerce.

Why Peer-to-Peer Actually Works

Direct transfers cut out the entire correspondent banking network in one move. Instead of your payment bouncing through four, five, or six intermediaries, it moves directly from your wallet to the recipient’s wallet on the same blockchain. A single blockchain ledger simplifies cross-border information and reduces steps and costs-exactly what happens when you remove the middlemen. Cross-border transaction costs with stablecoins drop to a few cents per transfer instead of the percentage-based fees traditional banks charge. That matters when you move money regularly across regions. Stripe supports stablecoin payments that settle as fiat directly into your Stripe balance, combining crypto speed with accounting you actually understand. Your finance team stops tracking phantom payments and starts reconciling completed transactions.

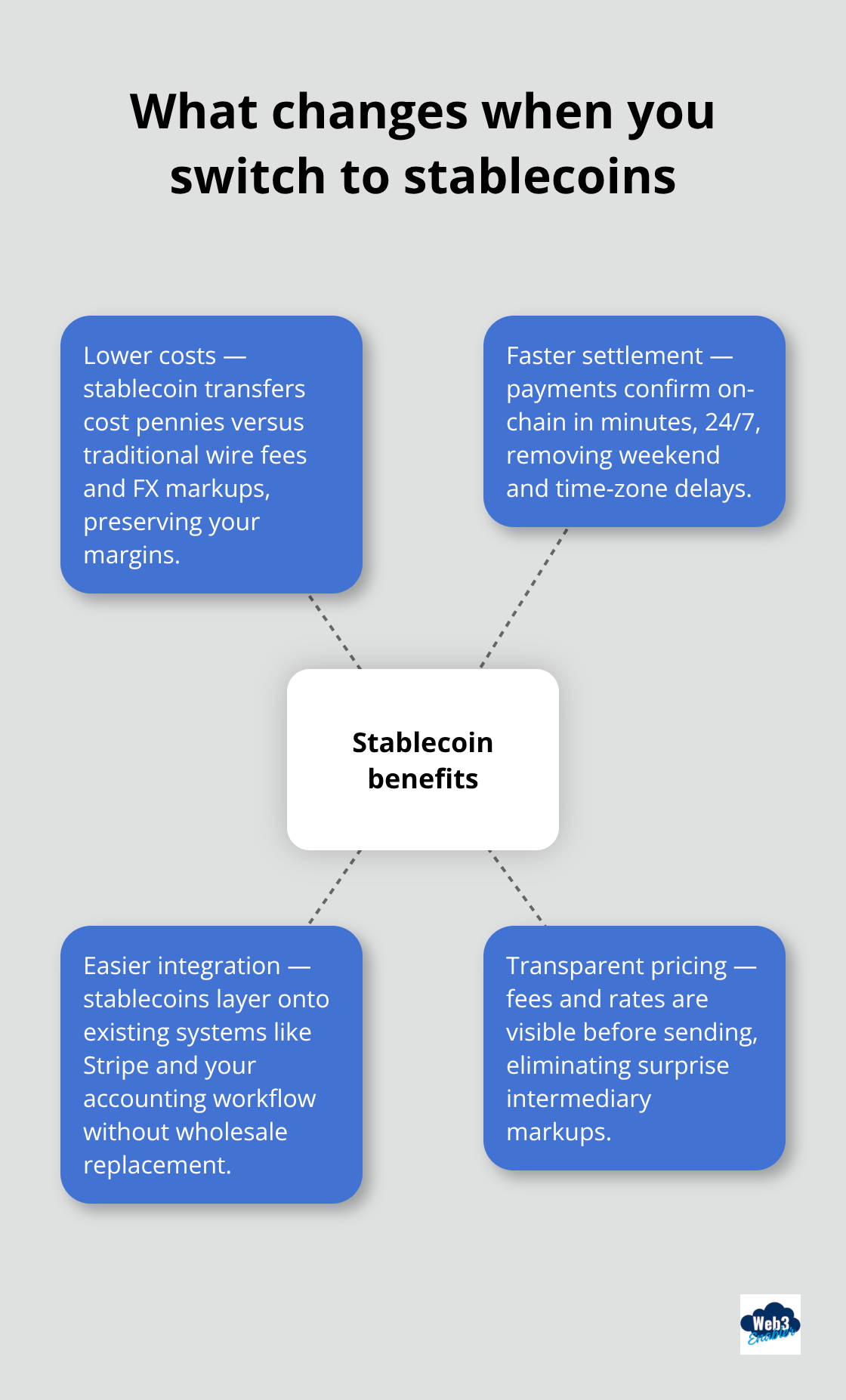

Transparent Fees That Don’t Hide

Stablecoin fees are visible before you hit send. You see the exact amount, the exact rate, the exact destination. No foreign exchange markup hides in the fine print. No intermediary fees surprise you three days later when the money finally arrives short. Stablecoins provide price stability for accounting: one USDC equals one dollar, simplifying pricing and financial reporting across every geography. This transparency matters for budgeting. It matters for explaining payment costs to your CFO. It matters for competing on price when you know exactly what you’re actually paying versus what your traditional bank charges for the same corridor.

The real question isn’t whether stablecoins work-the data proves they do. The question is how your business actually implements them without disrupting existing systems. That’s where the practical benefits start to compound.

What Actually Changes When You Switch to Stablecoins

Your margin on a $10,000 international transaction vanishes into fees before the money even leaves your bank.

Traditional wire transfers cost between $15 and $50 per transaction, plus foreign exchange markups that swing 1 to 3 percent depending on the corridor and time of day. Stablecoin transfers cost pennies. Stripe data shows cross-border transaction costs with stablecoins drop to just a few cents per transfer, which means a $10,000 payment costs you roughly 10 cents instead of $200 to $400 when you factor in all the hidden markups. That’s not incremental savings-that’s the difference between healthy margins and watching profit evaporate. For businesses sending regular payments across regions (payroll, vendor payments, customer refunds), the cumulative impact reshapes your P&L. A company processing 100 international payments monthly saves between $20,000 and $40,000 annually by switching from wire transfers to stablecoin settlements. That money goes straight to your bottom line or funds growth initiatives instead of padding bank profits.

Settlement Speed Transforms Cash Flow Planning

Your cash flow improves the moment stablecoin payments settle in minutes instead of days. Traditional cross-border payments create artificial delays that force you to hold excess working capital. You send a payment on Monday expecting it to arrive Wednesday, but it actually clears Friday, tying up capital for three extra days. Multiply that across dozens of international transactions monthly and you’re funding your vendors’ operations with your own cash. Stablecoins eliminate this friction. Settlement happens in minutes, 24 hours a day, 7 days a week. Visa’s pilot with Cross River Bank and Lead Bank uses USDC on Solana to demonstrate real-world impact: merchants receive payment on Saturdays and Sundays because blockchains don’t recognize weekends. Your vendors get paid faster, your cash cycles compress, and you reduce the working capital buffer you need to maintain. For businesses with tight cash flow or rapid growth, this difference between three-day and three-minute settlement fundamentally changes how you manage liquidity. You forecast with accuracy instead of padding estimates for banking delays.

Integration Happens Without Replacing Your Systems

Stablecoins work within your existing infrastructure, not against it. You don’t need to replace your accounting software, your ERP, or your payment reconciliation process. Stablecoin payments integrate as another payment method alongside traditional wires and ACH transfers. Stripe handles stablecoin settlements that convert to fiat in your Stripe balance, meaning your accounting team records transactions in the same format they always have. Your finance operations stay stable while your settlement speed and costs improve. This matters because implementation risk kills most fintech projects. Your team resists change, integration takes months, and the project gets shelved. Stablecoin payments avoid this trap because they layer on top of existing workflows rather than replacing them. You add a new payment rail without disrupting the processes that keep your business running. The complexity lives in the blockchain layer, not in your internal systems.

Transparent Pricing Replaces Hidden Markups

Stablecoin fees appear before you hit send. You see the exact amount, the exact rate, the exact destination. No foreign exchange markup hides in the fine print. No intermediary fees surprise you three days later when the money finally arrives short. One USDC equals one dollar, simplifying pricing and financial reporting across every geography. This transparency matters for budgeting. It matters for explaining payment costs to your CFO. It matters for competing on price when you know exactly what you’re actually paying versus what your traditional bank charges for the same corridor. Cutting transaction fees by 5% could save up to $16 billion per year according to the World Bank, extending beyond cost savings to operational predictability that traditional banking simply cannot match.

Final Thoughts

Traditional banking’s stranglehold on cross-border payments is loosening, and stablecoins are the reason. You’ve seen the math: settlement in minutes instead of days, fees measured in cents instead of percentages, and cash flow that actually works in your favor. These aren’t marginal improvements-they’re fundamental shifts in how money moves globally. Stablecoin payments hit $5.8 trillion in 2024, and global stablecoin circulation reached $307 billion by November 2025 with growth exceeding 50 percent annually.

Crypto cross-border payments solve problems that banks have ignored for decades because the current system profits them. Your business pays the price through hidden fees, artificial delays, and working capital trapped in settlement queues. Stablecoins eliminate these friction points without requiring you to rebuild your entire financial infrastructure, and you layer them on top of existing systems while your accounting team records transactions normally.

Your competitors are already testing stablecoin payments, and some are implementing them now. We at Web3 Enabler help businesses connect blockchain technology with existing corporate infrastructure through Salesforce-native solutions that let you accept stablecoin payments and send global payments faster. Explore how we enable crypto cross-border payments for businesses that refuse to accept banking’s outdated speed and cost structure.