Crypto payments compliance in Africa and the Middle East requires navigating complex regulatory frameworks that vary significantly by country. Businesses operating across these regions face overlapping requirements for identity verification, transaction monitoring, and tax reporting.

We at Web3 Enabler have created this guide to help you understand the specific compliance obligations in key markets and build workflows that meet regulatory standards without slowing down your operations.

What Crypto Payment Rules Actually Apply to Your Business

Market Growth and Regulatory Reality

Africa’s crypto market received $105.6 billion in cryptocurrency between July 2020 and June 2021 according to Chainalysis, reflecting explosive growth that has attracted regulatory attention across the region. The Middle East follows a different path, with countries like the UAE embracing crypto infrastructure while others maintain strict prohibitions. Your compliance obligations depend entirely on where your customers and payment flows are located, not where you operate.

Country-Specific Restrictions You Must Know

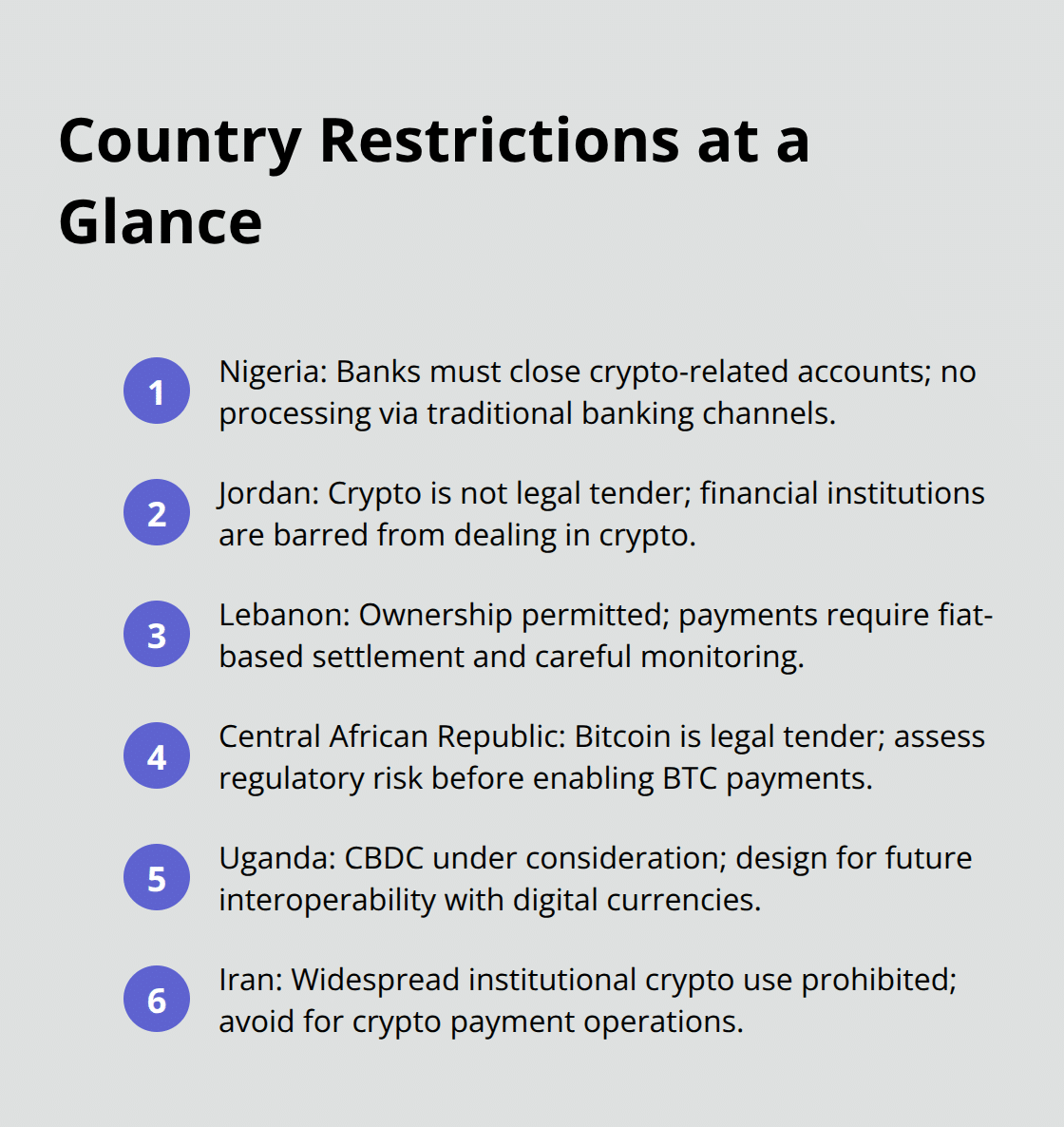

Nigeria’s central bank explicitly bans crypto trading and requires financial institutions to close crypto-related accounts, making it impossible to process crypto payments through traditional banking channels in that country. Jordan prohibits virtual currencies from being legal tender and bars banks, exchanges, and payment service providers from dealing in crypto entirely-routing payments through Jordanian institutions will trigger regulatory violations. Lebanon permits crypto ownership but regulates its acceptance as payment through fiat terms, so you must monitor regulatory developments before you enable payments there.

The Central African Republic adopted Bitcoin as official currency, becoming the first African country to do so, but this creates legal tender status and regulatory risk you should assess before you enable BTC payments in that jurisdiction. Uganda is considering a central bank digital currency, signaling rising interest in CBDCs that could interact with crypto payments-design your systems for interoperability with potential future digital currencies. Iran prohibits widespread crypto use by financial institutions and places restrictions on domestic crypto use, making it a jurisdiction you should avoid entirely for crypto payment operations.

Building Your KYC and AML Framework

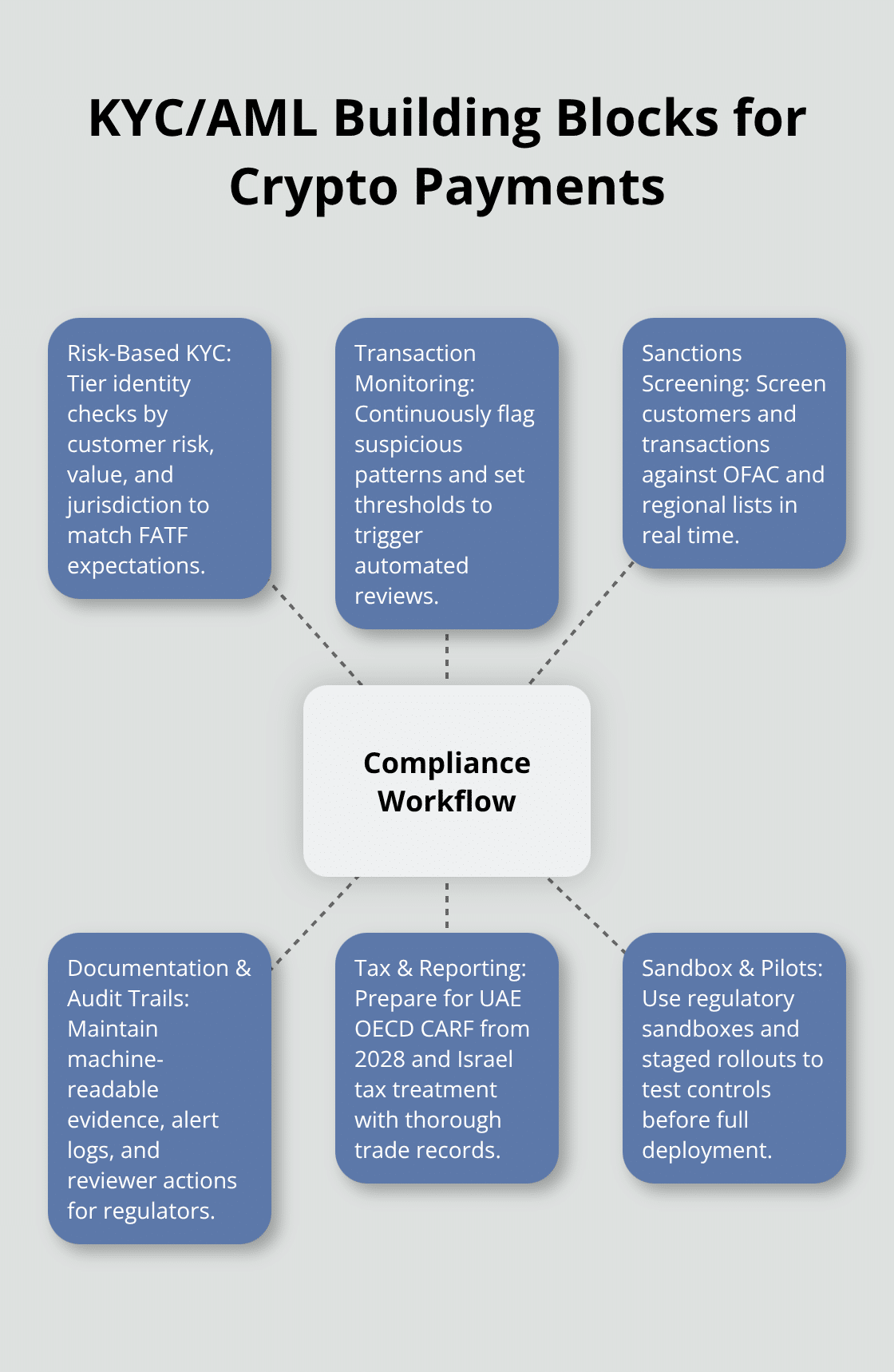

Your KYC and AML framework must follow FATF guidelines, which increasingly shape crypto compliance across the region. Implement a risk-based approach that includes customer due diligence, ongoing transaction monitoring, and sanctions screening aligned with international standards. The UAE adopted the OECD Crypto-Asset Reporting Framework, meaning from 2028 UAE-based exchanges, custodians, and wallet providers must collect and share client and crypto-transaction data with foreign authorities.

Mauritius operates a regulatory sandbox for crypto, illustrating a practical pathway to test crypto payment solutions and compliance controls before full rollout. Tax obligations vary significantly: the Israel Tax Authority views crypto as a means of virtual payment subject to taxation, requiring thorough documentation of crypto trades for accurate reporting, while Bank of Israel treats crypto assets as financial assets and not currency, warning of associated risks. For any token offerings, the Israel Securities Authority guidance suggests some tokens may be securities while others may be utilitarian, requiring proper classification and compliance.

Moving From Planning to Action

You should start with a pilot or sandbox approach before you expand across multiple jurisdictions, and you must engage local counsel continuously to monitor FATF and national regulator updates as rules evolve rapidly. The next section shows you how to translate these country-specific rules into actual workflows that your team can execute without creating bottlenecks in your payment operations.

How to Build Identity and Transaction Checks Into Your Payment System

Your compliance infrastructure must operate in real time, not as an afterthought. The moment a customer initiates a payment, your system must verify their identity, screen them against sanctions lists, and monitor the transaction for suspicious patterns. This happens in seconds or your payment fails.

Verify Identity at Onboarding

Start with identity verification when customers first sign up. Implement a tiered KYC approach where low-risk customers receive lighter checks while high-value or high-risk jurisdictions trigger deeper due diligence. Nigeria’s unregulated crypto environment demands stronger KYC controls to prevent illicit activity, while UAE customers benefit from the OECD Crypto-Asset Reporting Framework-meaning you already have regulatory infrastructure in place from 2028 onwards.

Verify customer residency, beneficial ownership for business accounts, and source of funds before you allow the first payment. Use API-based identity verification providers that integrate directly into your payment flow rather than offline manual processes. The system should reject payments from customers in jurisdictions where you cannot operate legally. Nigeria and Jordan are non-starters, while Lebanon requires fiat-based settlement only.

Document every verification decision in an auditable ledger so regulators can trace why you accepted or rejected a customer.

Screen Transactions Against Sanctions Lists

Transaction monitoring runs continuously after onboarding and catches suspicious patterns your initial KYC process missed. Screen every transaction against sanctions lists maintained by OFAC and regional authorities, since cross-border payments in Africa and the Middle East carry elevated sanctions risk. The Israel Bank regulates crypto as a financial asset, requiring documentation of every trade, so your system must capture transaction details with timestamp precision.

Set thresholds for transaction size, velocity, and destination that trigger automated reviews. A customer sending five payments of $99,999 each within minutes looks different from someone making legitimate business transfers, even if the total volume appears normal.

Monitor Behavioral Changes and Counterparty Risk

Implement continuous monitoring that flags changes in customer behavior, unusual geographic patterns, or suspicious counterparties. If a regular customer suddenly sends money to a high-risk jurisdiction, your system should halt the transaction pending manual review rather than process it automatically. Maintain a clear audit trail showing when alerts fired, who reviewed them, and what action was taken. This evidence matters when regulators examine your controls.

Test your transaction monitoring rules quarterly against real payment data to ensure they catch actual suspicious activity without creating false positives that paralyze your operations. The next section shows you how to select vendor platforms that automate these checks at scale, reducing manual review burden while maintaining the audit trails regulators expect.

Choosing Compliance Platforms That Actually Work at Scale

Your transaction monitoring rules mean nothing if your vendor cannot execute them reliably across thousands of concurrent payments. The platforms you select must integrate directly into your payment flow, screen customers and transactions in real time, and produce audit-ready evidence that regulators can examine. Fireblocks and BitGo dominate custody infrastructure with SOC 2 Type 2 attestations and insurance coverage, but custody alone does not solve your KYC and AML problem. You need layered solutions that handle identity verification, sanctions screening, transaction monitoring, and tax reporting without creating manual bottlenecks.

Selecting Vendors for Your Specific Jurisdictions

MoonPay, Ramp Network, and Transak handle fiat on-ramp and off-ramp services across Africa and the Middle East, but verify they hold appropriate licenses in each jurisdiction before you route customer funds through them. Coinbase Commerce and BitPay offer merchant-facing payment gateways with built-in compliance workflows, though their coverage in Nigeria and Jordan remains limited due to local regulatory bans. The critical mistake most businesses make is selecting vendors based on feature lists rather than testing their actual performance in your specific jurisdictions.

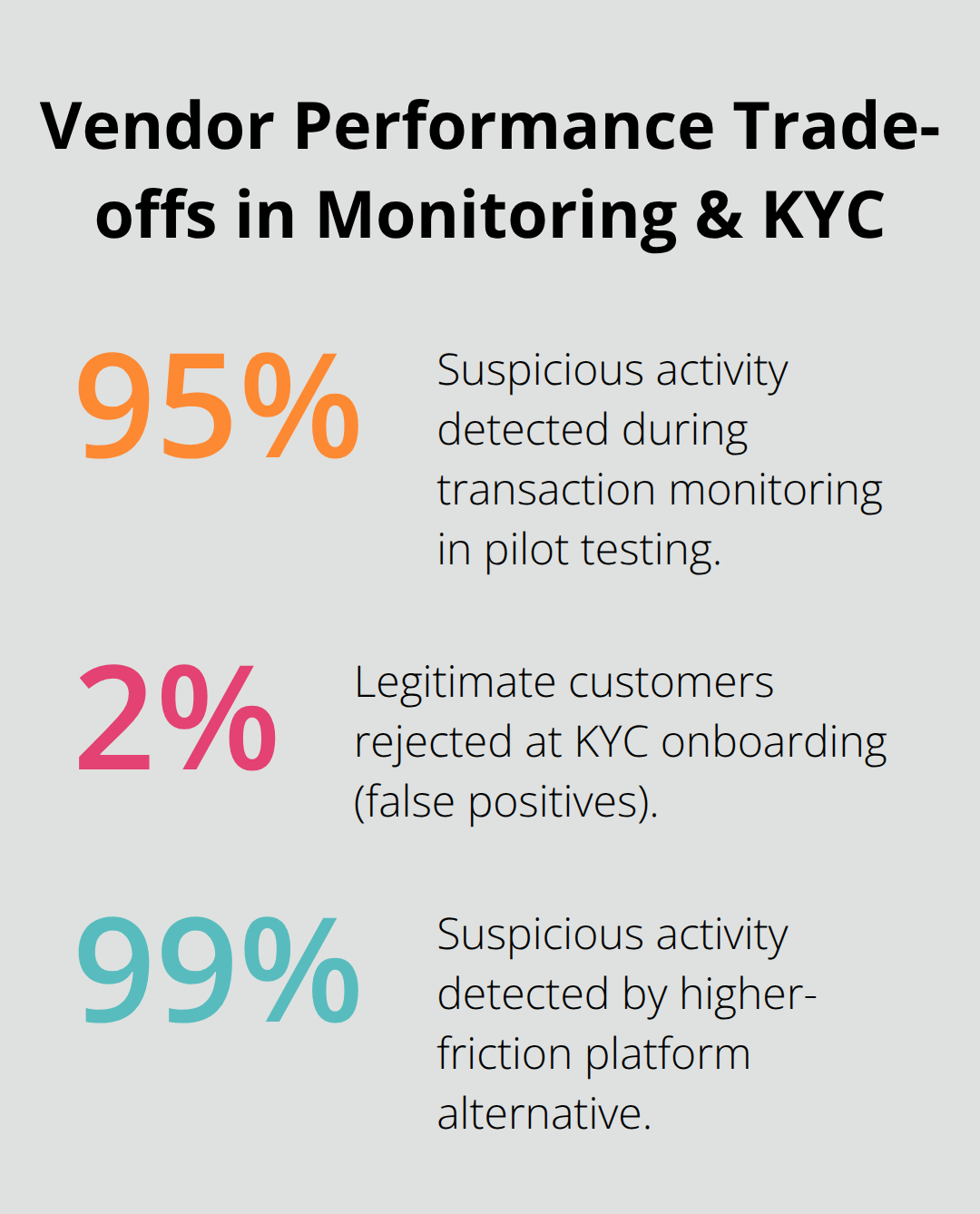

Set up pilot integrations with two to three vendors simultaneously and measure false-positive rates on transaction monitoring, customer rejection rates at KYC onboarding, and the speed of API responses under peak load. A platform that catches 95 percent of suspicious activity while rejecting only 2 percent of legitimate customers is dramatically better than one that catches 99 percent while creating friction that drives customers away.

Connecting Compliance Data to Your Core Platform

Your ledger system must feed compliance data bidirectionally to screening and monitoring platforms in near real time. When a customer’s risk profile changes, your ledger should immediately reflect that change across all connected systems, and your transaction monitoring should halt payments from that customer pending review. SDK.finance provides a ready-made core platform with auditable ledgers, compliance workflows, and multi-currency support built in, reducing your time to market significantly.

Implement webhook-based integrations that push customer data and transaction details to your screening vendors the moment they occur, then pull updated risk scores back into your ledger to power downstream decisions. This architecture means regulators see one unified system of record rather than disconnected spreadsheets and manual logs. Test your integration against sandbox environments first and measure end-to-end latency from transaction initiation to final screening result. Latency above five seconds will frustrate customers and create queue backlogs during peak payment volumes.

Building Audit Trails Regulators Can Examine

Your vendor selection must include platforms that produce machine-readable compliance evidence suitable for regulatory examination. Demand that any vendor you select can export complete transaction histories, customer due diligence records, sanctions screening results, and alert resolution logs in structured formats like CSV or JSON. The UAE’s adoption of the OECD Crypto-Asset Reporting Framework means from 2028 your system must automatically collect and structure customer and transaction data for foreign authority reporting. Build this capability into your vendor requirements today rather than retrofitting it later.

Regulators examining your controls will want to see when alerts triggered, what threshold caused them, who reviewed them, how long review took, and what action resulted. Platforms that support centralized, machine-readable regulatory libraries can map compliance obligations directly to control evidence. Your vendor should support this level of traceability without requiring manual documentation by your compliance team. Schedule product demos with vendors and request anonymized examples of audit reports they have produced for other customers in the region. If they cannot show you concrete examples, their audit capabilities are likely immature.

Final Thoughts

Crypto payments compliance in Africa and the Middle East demands a systematic approach that combines country-specific knowledge with automated controls. You cannot treat Nigeria the same as the UAE, and you cannot rely on manual spreadsheets to track sanctions screening or transaction monitoring at scale. The regulatory landscape will continue shifting, but the core requirements remain constant: verify customer identity, screen transactions against sanctions lists, monitor for suspicious behavior, and maintain auditable records that regulators can examine.

Your compliance framework succeeds when it operates invisibly to legitimate customers while catching actual risk. This means selecting vendors that integrate directly into your payment flow, testing their performance in your specific jurisdictions before full deployment, and building audit trails that prove your controls worked. The OECD Crypto-Asset Reporting Framework takes effect in the UAE from 2028, and similar reporting requirements will spread across the region-build your systems today to support structured data collection and automated reporting rather than scrambling to retrofit compliance later.

Start with a pilot in one or two jurisdictions where you have the strongest customer base and regulatory clarity. Web3 Enabler provides native Salesforce integration for cryptocurrencies and digital assets, enabling you to manage crypto payments, track transaction compliance, and handle international contractor payments within your existing corporate systems. Your compliance data flows seamlessly between your payment infrastructure and your business records, eliminating the disconnected systems that create audit gaps.