Stablecoins are reshaping how merchants handle B2B payments in Commerce Cloud. More businesses are ditching traditional payment methods because crypto offers lower fees, faster settlements, and happier customers worldwide.

We at Web3 Enabler have built the tools to make this shift simple. This guide shows you exactly how to start accepting stablecoins and why early movers gain a real competitive edge.

Why Merchants Accept Stablecoins Now

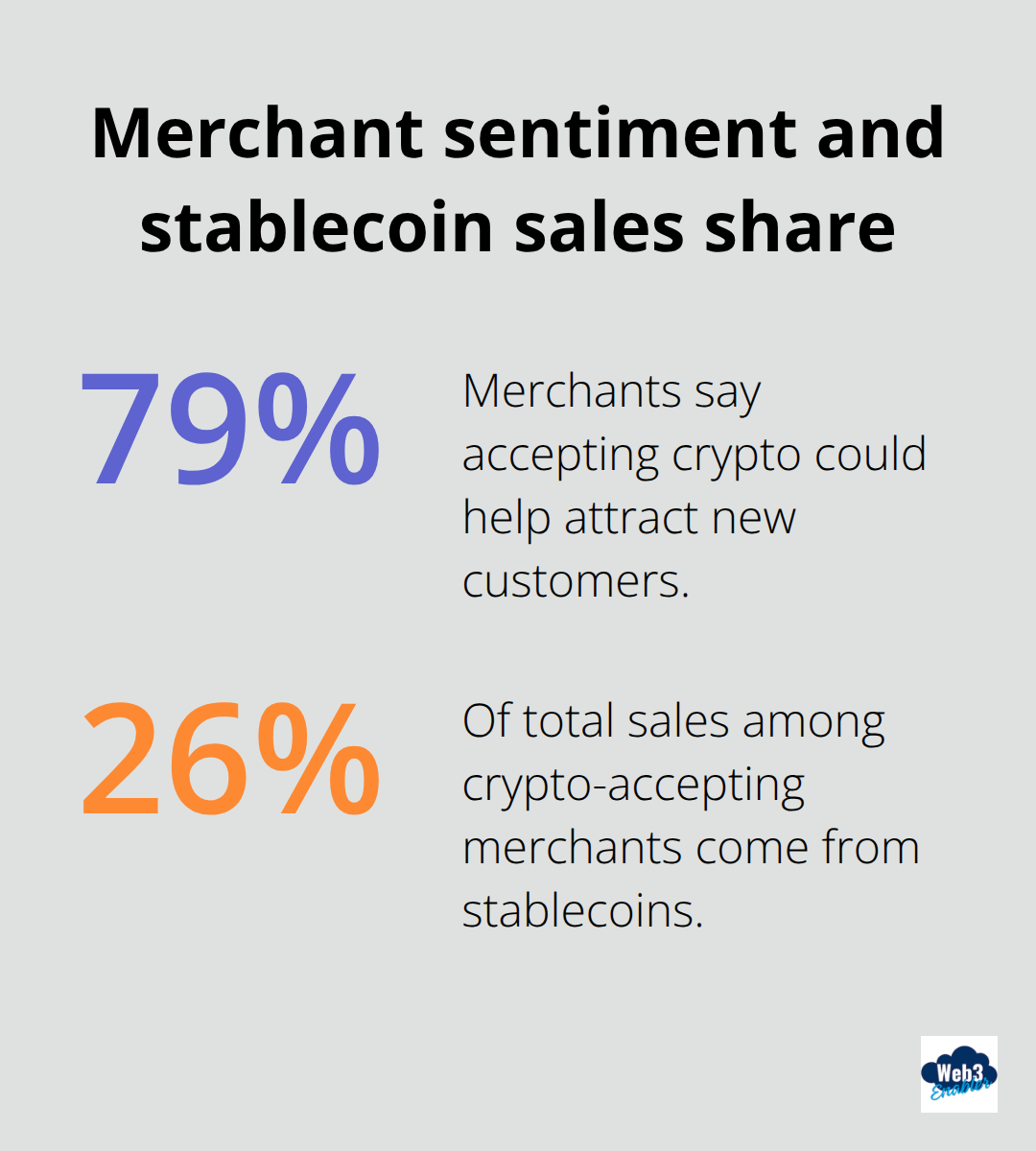

Merchants aren’t waiting around anymore. Four in five merchants (79%) agree that accepting crypto could help them attract new customers, and the economics make sense. Among merchants already accepting crypto, stablecoin sales account for roughly 26% of total sales, which means this isn’t a niche experiment. It’s becoming a meaningful revenue stream.

Customers Demand Faster Payment Options

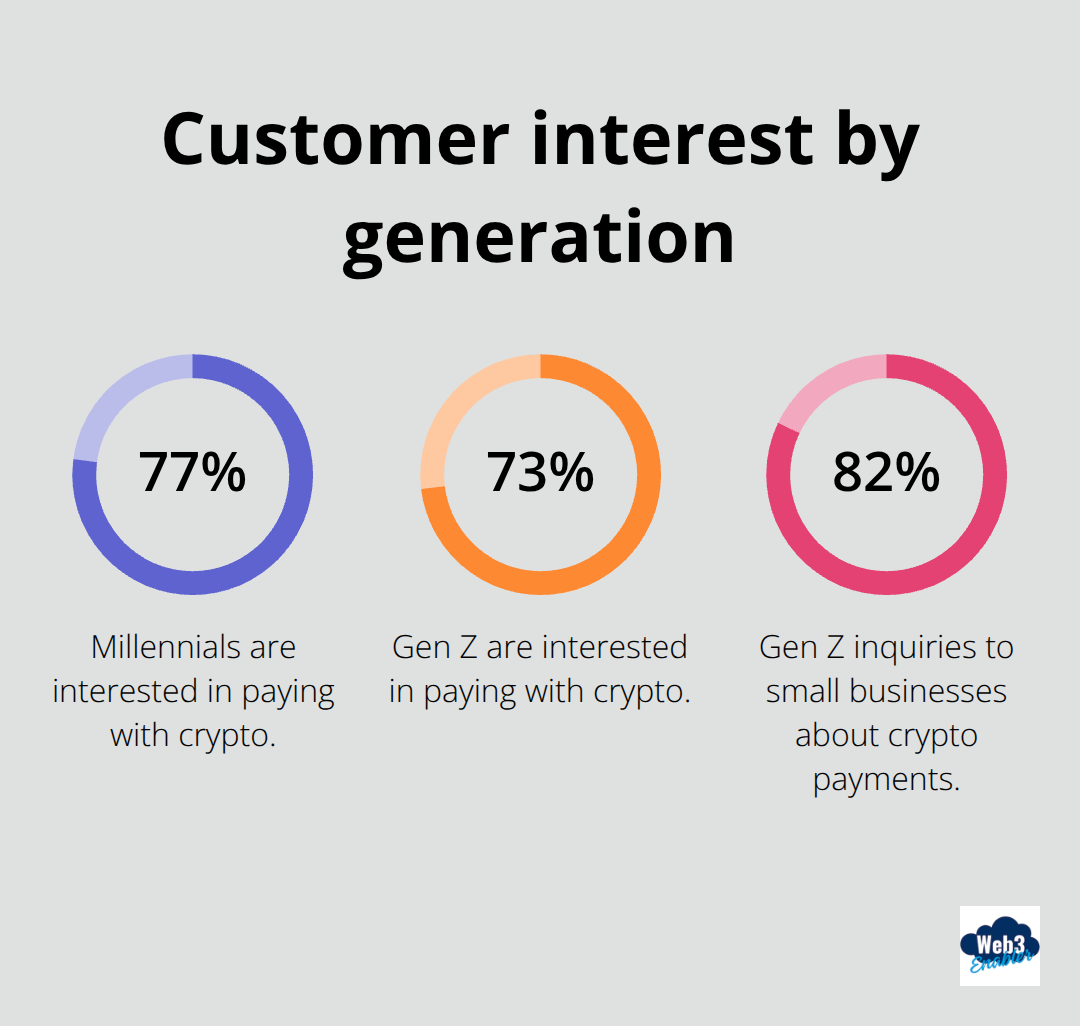

The demand signal is unmistakable. Merchants report strong customer interest in crypto payments, with younger generations leading the charge. Millennials and Gen Z show particularly strong interest in paying with crypto, and for small businesses specifically, Gen Z inquiries signal that younger generations expect crypto as a standard payment option. When customers repeatedly ask for a payment method, ignoring that demand means leaving money on the table. Merchants who accept stablecoins tap into this growing customer base directly.

Settlement Speed Transforms Cash Flow

Traditional payment processors charge merchants 2.9% plus per-transaction fees, and settlement typically takes three to five business days. Stablecoins change that equation. Settlement happens in minutes, not days, which improves cash flow immediately. A merchant processing $100,000 in monthly sales saves weeks of float every year. Faster settlement also means reduced working capital needs and better financial forecasting.

International Transactions Cost Less

The cost advantage compounds when merchants operate internationally. Cross-border transactions with traditional methods incur currency conversion fees, intermediary bank charges, and compliance overhead. Stablecoins eliminate most of that friction. These aren’t theoretical advantages-they’re concrete operational improvements that directly impact profitability.

The question isn’t whether stablecoins fit your Commerce Cloud strategy. The question is how quickly you can set them up to capture this growing revenue stream.

Getting Stablecoins Live in Commerce Cloud

Install and Configure Your Payment Gateway

Setting up stablecoin payments in Commerce Cloud requires three concrete steps: configuring your payment defaults, granting permission to your B2B customers, and testing the flow before going live. Web3 Enabler’s new Blockchain Payments for Commerce Cloud integrates natively with Commerce Cloud, which means you don’t need separate systems or middleware. The setup process takes hours, not weeks.

Start by installing the Web3 Enabler extension from the Salesforce AppExchange, then configure which stablecoins you want to accept-USDT, USDC, and PyUSD are supported immediately. Next, specify your receiving wallet address and set conversion preferences if you want instant settlement into fiat currency. Commerce Cloud automatically tracks every transaction in your order management system, so your finance and fulfillment teams see stablecoin orders the same way they see credit card orders.

Eliminate Manual Reconciliation

This native integration eliminates manual reconciliation and reduces errors significantly. Your existing Commerce Cloud workflows continue unchanged; stablecoins simply become another payment method customers select at checkout. The transaction data flows directly into your Salesforce order records with full auditability-customer wallet address, transaction hash, settlement time, and conversion rate all stored in Commerce Cloud.

This transparency matters for compliance and customer service. If a customer disputes a transaction, you have cryptographic proof of the exchange. Your team manages everything from the Commerce Cloud dashboard-no separate crypto accounting software required.

Connect Wallets Without Friction

Customer authentication happens through wallet connection, not usernames and passwords. When a customer chooses stablecoin payment, they scan a QR code or click a wallet link, sign the transaction in their wallet app, and the payment settles instantly. Web3 Enabler handles wallet compatibility across MetaMask, Trust Wallet, and other major providers, so your customers use whatever wallet they already have.

Simplify Global Currency Handling

For merchants operating across multiple regions, Commerce Cloud stablecoin payments simplify currency handling. A customer in Singapore paying in USDC settles at the same rate as a customer in London, eliminating currency conversion spreads that traditional processors charge. The faster settlement directly improves working capital, and the reduced operational overhead from eliminating intermediaries compounds over time as transaction volume grows.

With stablecoin infrastructure in place, merchants unlock a second advantage: real-time visibility into customer payment behavior and transaction patterns that traditional processors never expose.

Stablecoin Adoption Reshapes Global Commerce

Merchants across hospitality, travel, digital goods, and e-commerce capture real revenue from stablecoin payments today. Hospitality and travel lead adoption at 81%, followed by digital goods, gaming, and luxury at 76%, with general retail and e-commerce at 69%, according to a Harris Poll survey conducted in October 2025 for the National Cryptocurrency Association and PayPal. These aren’t experimental pilots anymore. Seventy-two percent of crypto-accepting merchants report that their crypto sales increased over the past year, and for those already processing stablecoins, crypto represents approximately 26% of total sales. That’s a meaningful revenue stream, not a rounding error. Large enterprises with over $500 million in annual revenue lead the way at 50% adoption, compared to 34% of small businesses and 32% of midsize firms. The gap matters because it shows adoption isn’t confined to tech-forward startups-traditional, established merchants move fast.

The Economics of Stablecoin Payments

The financial case for stablecoins in Commerce Cloud is straightforward. Traditional credit card processors charge merchants between 2.9% and 3.5% per transaction plus per-item fees, and settlement takes three to five business days. Stablecoins settle in minutes at a fraction of that cost. For a merchant processing $500,000 monthly in sales, the difference between 3% processing fees and stablecoin fees compounds to substantial savings annually.

Chargeback rates drop dramatically because blockchain transactions are immutable and instantly verifiable. A customer cannot claim they never received goods or dispute a transaction after blockchain confirmation. Merchants also eliminate currency conversion spreads on international orders. A customer in Tokyo paying in USDC settles at the same rate as a customer in New York, removing the 2-4% currency conversion markup that traditional processors embed into cross-border transactions. These aren’t theoretical advantages-they directly impact profit margins.

Customer Demand Accelerates Implementation

Forty-five percent of merchants cite faster transaction speed as a key benefit of accepting crypto, and 45% specifically mention gaining access to new customers. Younger demographics expect crypto options. Millennials show 77% interest in paying with crypto, and Gen Z pushes even higher at 73%, with Gen Z inquiries to small businesses reaching 82%. This demand matters.

When 88% of merchants report customer inquiries about crypto payments and 69% say customers want to use crypto at least once monthly, the signal is clear: customers view stablecoins as a standard payment method, not a novelty.

Merchants who delay implementation lose competitive advantage. Eighty-four percent of merchants expect crypto payments to become common within five years, which means the infrastructure gap between early movers and laggards will widen. Web3 Enabler’s native integration with Commerce Cloud removes the technical barrier that slowed adoption previously. Merchants can accept USDT, USDC, and PyUSD immediately without rebuilding payment infrastructure or managing separate accounting systems. That speed matters in competitive markets.

Final Thoughts

Stablecoins in Commerce Cloud represent a fundamental shift in how merchants operate globally. The benefits are concrete: faster settlement improves cash flow within hours instead of days, lower transaction costs directly increase profit margins, and access to a growing customer base that expects crypto as a payment option. Merchants accepting stablecoins today report meaningful revenue impact, with crypto representing roughly 26% of total sales for early adopters.

The data speaks clearly. Eighty-four percent of merchants expect crypto payments to become standard within five years, and 72% of those already accepting crypto report year-over-year sales growth. Large enterprises have already moved, with 50% accepting crypto compared to smaller competitors still evaluating the opportunity. The merchants capturing this revenue stream today will build operational advantages and customer relationships that laggards cannot replicate quickly.

Web3 Enabler empowers your team to accept USDT, USDC, and PyUSD immediately while maintaining complete visibility into every transaction. Your customers connect their wallets, sign transactions, and payments settle in minutes-no separate accounting systems, no manual reconciliation, no operational friction. Start accepting Commerce Cloud stablecoins today and capture this growing revenue stream before competitors do.