Enterprise digital transformation demands more than basic cryptocurrency adoption. Companies need comprehensive infrastructure that handles everything from treasury operations to vendor payments seamlessly.

We at Web3 Enabler see businesses struggling with fragmented digital assets ecosystem approaches that create operational bottlenecks and compliance headaches.

The solution lies in building integrated systems that connect blockchain payments with existing financial workflows while maintaining enterprise-grade security standards.

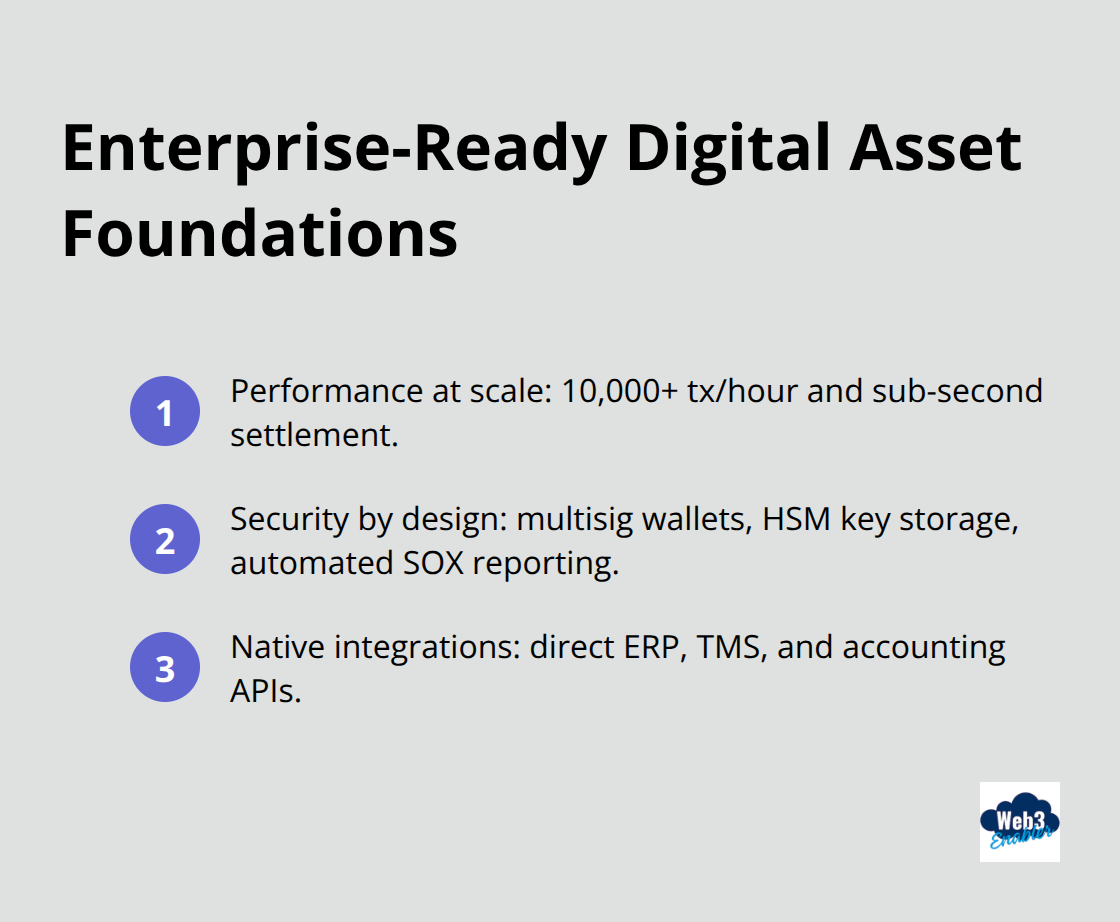

What Makes Digital Asset Infrastructure Enterprise-Ready

Enterprise digital asset infrastructure requires three non-negotiable foundations that most companies get wrong from the start. The technology stack must handle 10,000+ transactions per hour while maintaining sub-second settlement times, which means choosing blockchain networks that process payments in real-time rather than legacy systems that take 2-3 days. Security frameworks need multi-signature wallet controls, hardware security modules for private key storage, and automated compliance reports that satisfy SOX requirements without manual intervention. Integration capabilities determine success or failure – your digital asset platform must connect directly with existing ERP systems, treasury management software, and accounting platforms through native APIs rather than costly middleware solutions.

Real-Time Settlement Architecture

Modern treasury operations demand infrastructure that processes cross-border payments 24/7 without banking hour restrictions. Stablecoin rails reduce transaction costs by 60-90% compared to traditional SWIFT transfers while providing instant settlement that frees trapped liquidity immediately. Companies that process over $10 million monthly in international payments see the biggest impact from switching to blockchain settlement rails. The key technical requirement involves choosing platforms that offer both USD Coin and Tether support since different regions prefer different stablecoins for regulatory compliance (particularly in Asia-Pacific markets where Tether dominates).

Compliance Integration That Actually Works

Automated compliance reports save treasury teams 15-20 hours weekly compared to manual transaction reconciliation processes. Your digital asset infrastructure must generate audit trails that map directly to existing financial requirements while providing real-time transaction monitoring for anti-money laundering compliance. The most effective approach involves platforms that create native accounting entries in your general ledger system automatically, which eliminates the need for separate reconciliation processes that create operational risk and delay month-end close procedures.

Performance Monitoring and Analytics

Real-time transaction visibility transforms how treasury teams manage cash flow and vendor payments across multiple currencies. Advanced analytics platforms track settlement times, transaction costs, and liquidity positions across all payment rails (both traditional and blockchain-based). These insights help finance teams optimize payment routing decisions and identify cost savings opportunities that traditional banking relationships cannot provide. The next step involves implementing comprehensive digital asset management strategies that leverage this infrastructure foundation.

How Treasury Teams Cut Payment Costs by 80%

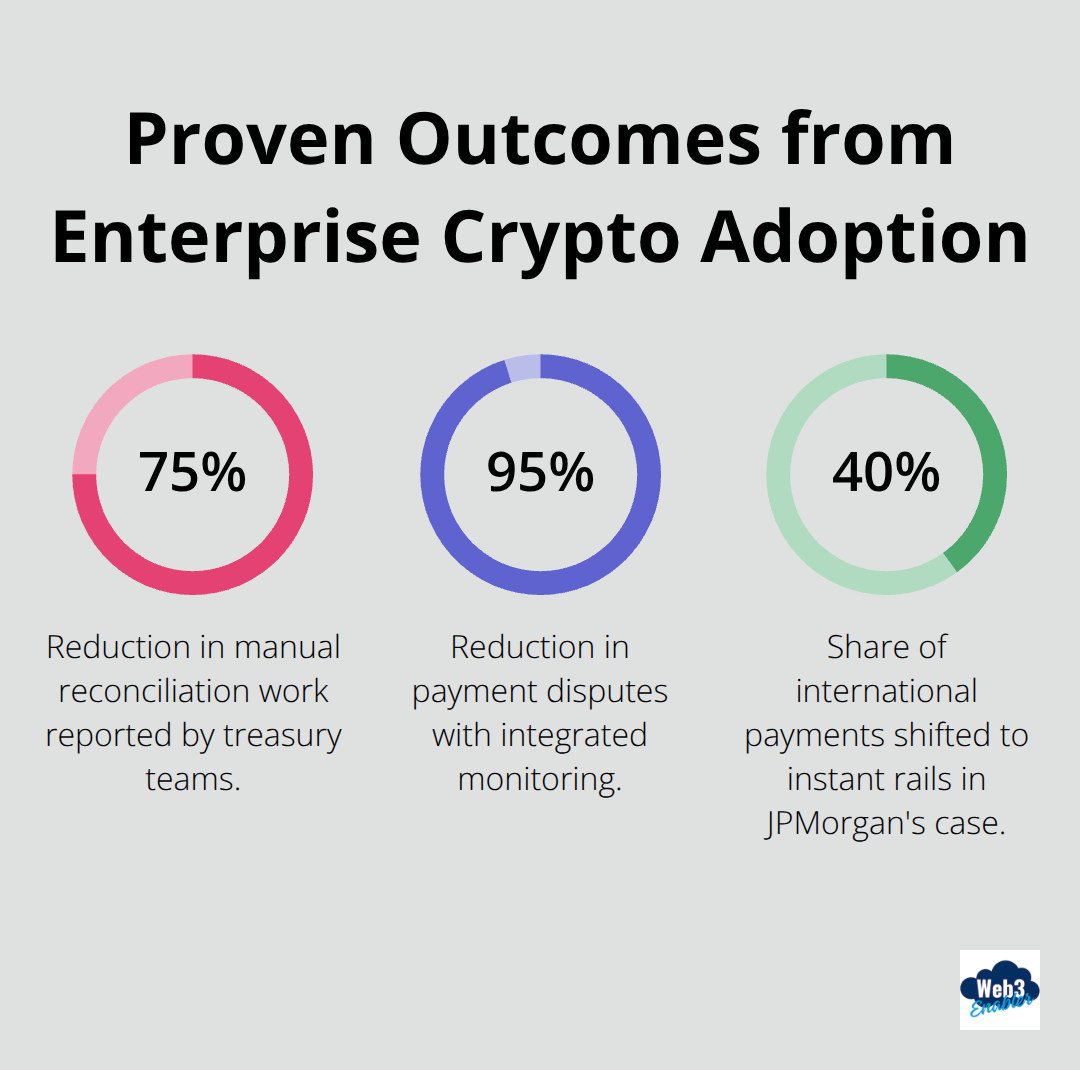

Treasury departments that implement digital asset infrastructure report average cost reductions on cross-border payments compared to traditional SWIFT transfers. JPMorgan documented $2.3 million in freed liquidity after the bank shifted 40% of international payments to instant settlement rails, while their treasury team reduced manual reconciliation work by 75%. The key lies in selecting platforms that integrate directly with existing ERP systems rather than creating separate workflows that increase operational complexity.

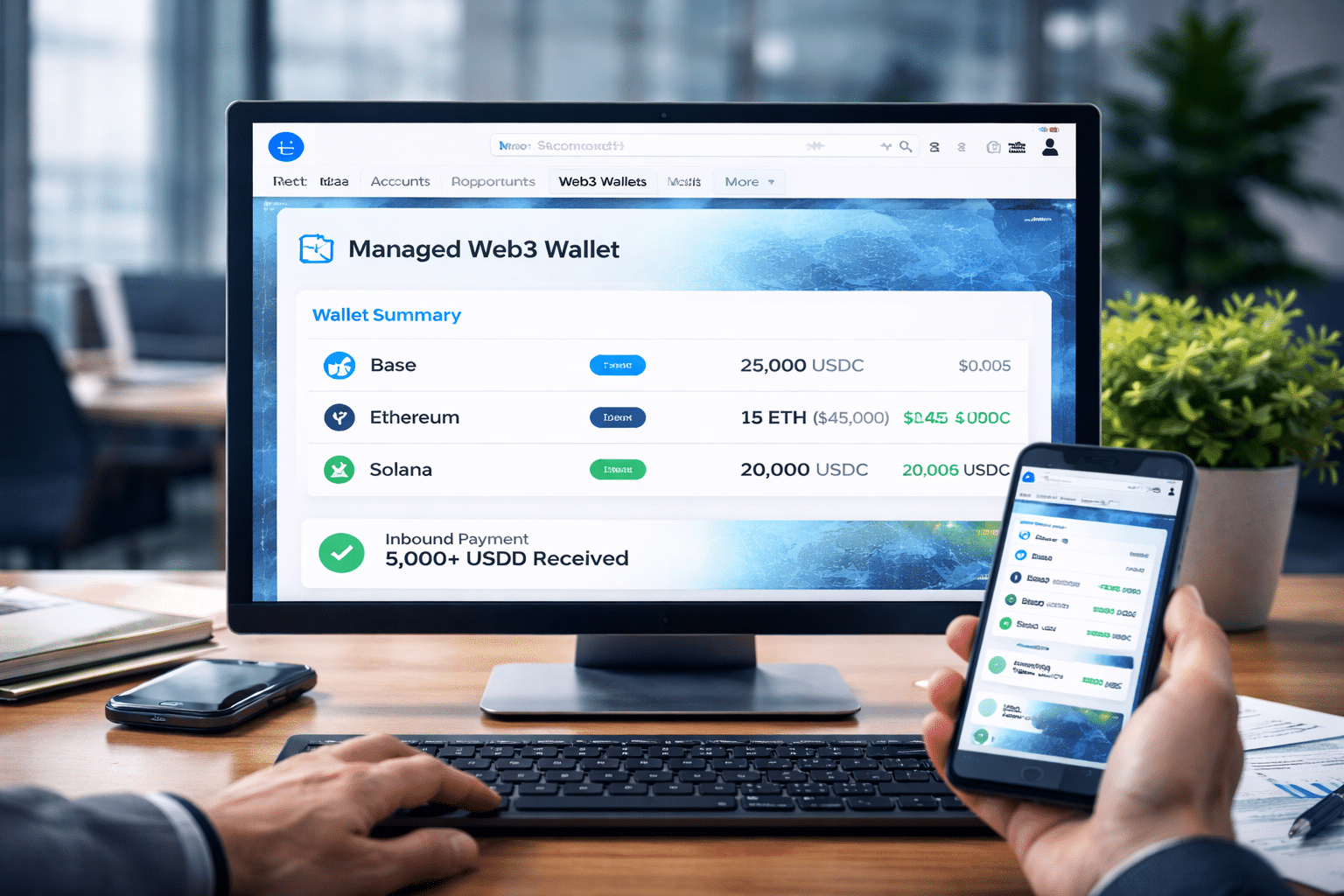

Stablecoin Payment Processing That Finance Teams Actually Use

Finance teams that process over $10 million monthly in international payments see immediate benefits from USD Coin and Tether integration with existing treasury management systems. The most successful implementations connect stablecoin settlements directly to accounts payable workflows, which enables automatic vendor payments that settle in 15 seconds instead of 2-3 banking days. Regional preferences matter significantly – Asian suppliers typically prefer Tether while European vendors favor USD Coin for regulatory compliance (particularly in jurisdictions with strict digital asset guidelines). Treasury teams should establish dual-currency capabilities from day one to avoid payment delays caused by stablecoin availability issues.

Transaction Monitoring That Eliminates Reconciliation Headaches

Automated transaction monitoring platforms reduce month-end close procedures by 15-20 hours through real-time general ledger integration. The most effective approach involves systems that generate native accounting entries automatically while providing audit trails that satisfy SOX requirements without manual intervention. Finance teams that use these integrated monitoring solutions report 95% reduction in payment disputes and complete elimination of trapped liquidity issues that traditionally plague international wire transfers.

Real-Time Visibility Transforms Cash Flow Management

Advanced analytics platforms track settlement times, transaction costs, and liquidity positions across all payment rails (both traditional and blockchain-based). These insights help finance teams optimize payment routing decisions and identify cost savings opportunities that traditional banking relationships cannot provide. Treasury departments gain complete visibility into payment status updates, which eliminates the uncertainty that comes with traditional wire transfers where funds remain “in flight” for days. This foundation sets the stage for comprehensive risk management frameworks that protect digital asset operations.

What Separates Successful Digital Asset Operations From Failed Implementations

Enterprise digital asset operations fail when companies treat blockchain payments like traditional IT projects instead of fundamental business transformations that require specific operational disciplines. Risk management frameworks must establish multi-signature wallet controls with hardware security modules while implementing automated transaction limits that prevent single points of failure. Companies that skip these controls face average losses of $1.2 million according to Chainalysis data from 2023. Team training programs need hands-on workshops with live transaction scenarios rather than theoretical blockchain education, since treasury staff require practical experience with stablecoin settlement processes and real-time reconciliation workflows.

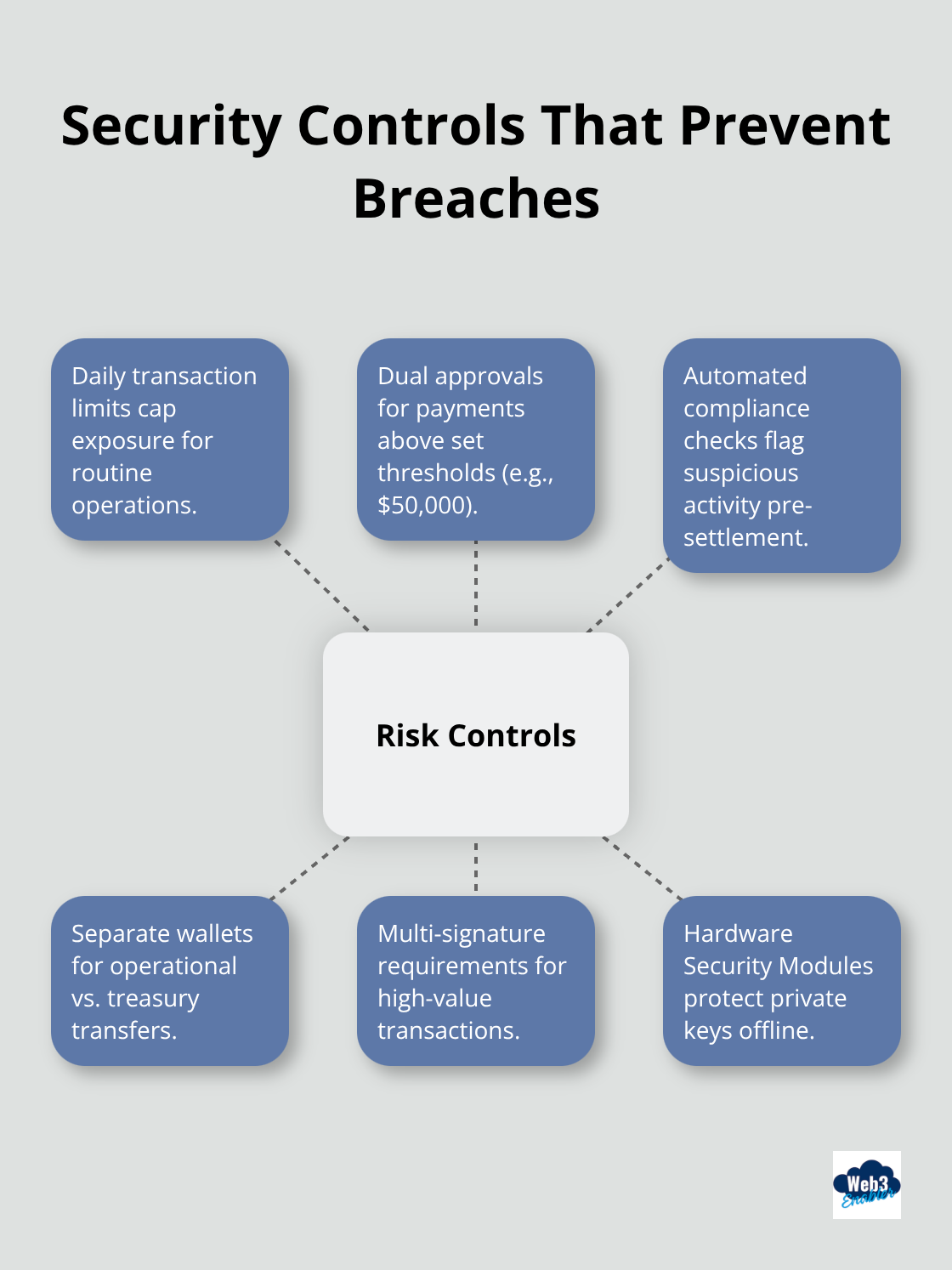

Risk Controls That Prevent Security Breaches

Treasury teams must implement daily transaction limits, mandatory dual approval processes for payments above $50,000, and automated compliance checks that flag suspicious transactions before settlement occurs. The most effective approach involves separate wallet structures for different payment types – operational wallets for routine vendor payments with lower security requirements, and treasury wallets for large transfers that require multiple signature approvals and hardware security module protection.

Finance departments that establish these controls from day one report zero security incidents compared to 23% of companies that implement controls after initial deployment. Multi-signature wallets require at least three authorized signers for transactions above predetermined thresholds (typically $100,000 for most enterprises). Hardware security modules store private keys offline and generate signatures through secure enclaves that prevent unauthorized access even during system compromises.

Team Training That Actually Works

Treasury staff need specific training on wallet management procedures, private key storage protocols, and emergency response procedures for network outages or security breaches. Monthly hands-on practice sessions work better than annual compliance training because digital asset operations require muscle memory for critical procedures. Finance teams should practice transaction approval workflows, reconciliation processes, and incident response procedures in sandbox environments that mirror production systems.

The most successful training programs include live transaction scenarios where team members process actual stablecoin payments while learning proper verification procedures. Staff members must understand the difference between hot wallets (connected to the internet for daily operations) and cold storage wallets (offline storage for large reserves). Emergency procedures should cover network congestion scenarios, failed transactions, and security incident response protocols.

Performance Metrics That Drive Results

Successful digital asset operations track settlement speed, transaction costs per payment corridor, and system uptime across all blockchain networks to identify optimization opportunities immediately. Treasury teams should monitor average settlement times by payment destination – Asian markets typically settle fastest through Tether while European payments perform better with USD Coin infrastructure.

Key performance indicators include transaction success rates above 99.5%, average processing times of one to five business days, and cost savings that exceed 70% compared to traditional wire transfers. These metrics help finance teams make data-driven decisions about payment routing and vendor selection while identifying potential issues before they impact business operations. Performance optimization demands continuous monitoring of transaction throughput and settlement times across different blockchain networks, with automatic failover systems that switch payment rails when primary networks experience congestion.

Final Thoughts

Companies that implement comprehensive digital assets ecosystem strategies report average cost reductions of 60-90% on cross-border payments while they eliminate 2-3 day settlement delays that trap working capital. Treasury teams gain 24/7 payment processing capabilities that traditional banks cannot match, plus real-time transaction visibility that reduces reconciliation work by 75%. The operational benefits extend beyond cost savings as automated compliance reports, instant settlement confirmation, and integrated accounting workflows transform how finance departments manage global operations.

Future growth opportunities center on expanded stablecoin adoption across more payment corridors and integrated blockchain infrastructure with existing ERP systems for seamless operations. Companies that establish digital asset capabilities now position themselves to capture market advantages as regulatory frameworks mature and blockchain adoption accelerates across industries. Organizations must select platforms that integrate directly with existing financial systems rather than create separate workflows (which increase operational complexity and costs).

Enterprise implementation success requires pilot programs focused on high-volume international payment corridors where cost savings and efficiency gains deliver immediate measurable results. We at Web3 Enabler help organizations modernize their payment infrastructure through native Salesforce integration that brings blockchain capabilities directly into existing CRM and financial workflows. Start with controlled testing environments that demonstrate tangible benefits before full-scale deployment across all payment operations.