We at Web3 Enabler know blockchain CRM changes this game completely. Every transaction becomes crystal clear, trackable, and impossible to dispute.

What Changes When Payments Become Truly Visible

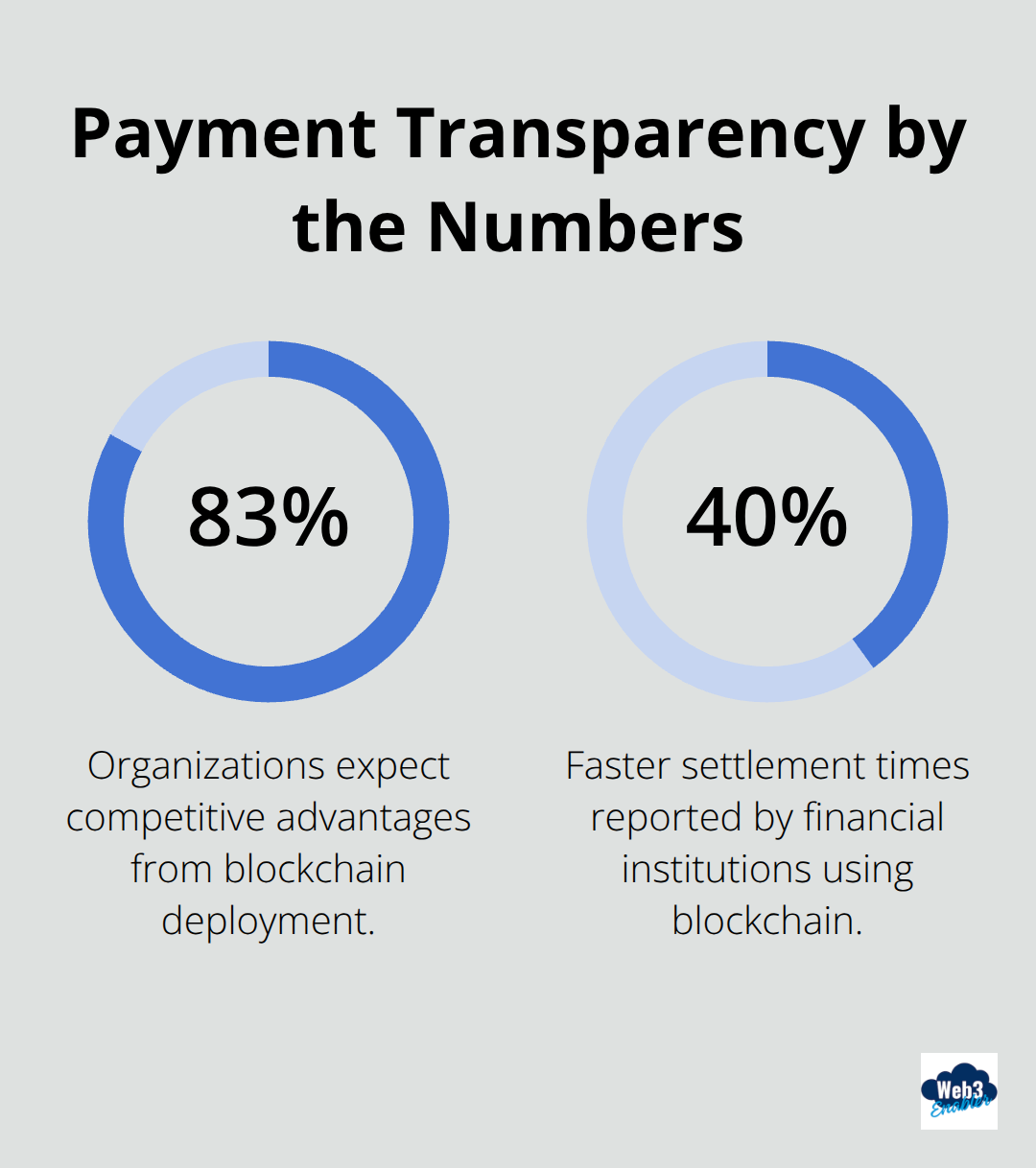

Blockchain CRM flips the payment visibility script from guesswork to absolute certainty. Traditional systems show you a payment left Point A and maybe arrived at Point B three days later, but blockchain CRM shows you every millisecond of that journey. According to Deloitte research, 83% of organizations expect competitive advantages from blockchain deployment, and payment transparency sits at the heart of this transformation.

Transaction Monitoring That Actually Works

Real-time tracking means you watch payments move across networks like you watch a GPS navigation system. Each transaction gets timestamped, verified, and recorded the moment it happens. Financial institutions that use blockchain report 40% faster settlement times compared to traditional banking networks (and who doesn’t love faster money?). Payment disputes drop to nearly zero because every participant sees identical transaction data. No more calls to banks asking where your money went or why a payment failed – the blockchain shows you exactly what happened and when.

Permanent Records That Never Lie

Immutable audit trails create financial records that cannot be altered, deleted, or disputed. Each payment creates a permanent fingerprint that includes amount, timestamp, sender, receiver, and transaction fees. Companies are increasingly adopting blockchain technology for enhanced audit capabilities and transparency. Customer payment histories become complete narratives instead of fragmented snapshots. Regulatory compliance becomes straightforward because every transaction automatically generates the documentation regulators require.

Customer Payment History Gets a Complete Makeover

Traditional CRM systems store payment data in silos that rarely talk to each other. Blockchain CRM connects every payment touchpoint into one unified view. You see when customers made payments, which methods they prefer, and their complete transaction patterns. This visibility helps you spot payment trends, identify potential issues before they become problems, and offer personalized payment options that customers actually want to use.

These transparency features set the stage for even more powerful automation capabilities that transform how businesses handle payment processes.

Key Features That Drive Payment Transparency

Automated payment reconciliation transforms the monthly nightmare of matching transactions into a continuous, real-time process. Traditional reconciliation requires finance teams to spend hours comparing bank statements with internal records, but blockchain CRM systems automatically match payments as they occur. The system flags discrepancies instantly rather than weeks later during month-end closing, and payment exceptions get resolved within minutes instead of days.

Automated Reconciliation That Works Around the Clock

Finance teams no longer need to dedicate entire days to matching transactions across multiple systems. Blockchain CRM platforms continuously monitor payment flows and automatically reconcile transactions as they happen. The system identifies mismatches immediately and alerts relevant team members before small issues become major problems. Payment data flows directly from blockchain networks into your CRM, eliminating the manual data entry that causes most reconciliation headaches (and those late nights during month-end closing).

Multi-Currency Support Without Banking Complexity

Multi-currency blockchain payments remove the complexity of managing dozens of banking relationships across different countries. Businesses can accept payments in over 150 currencies through a single blockchain interface, with automatic conversion to their preferred settlement currency. Stable digital currencies provide businesses with reliable payment options for international transactions. Payment settlement happens within seconds regardless of geographic distance, compared to traditional wire transfers that take 3-5 business days and cost $15-50 per transaction.

Payment Automation That Eliminates Manual Bottlenecks

Smart contract integration automates payment workflows that previously required manual intervention at every step. Payment terms get encoded directly into the blockchain, triggering automatic releases when conditions are met – no more chasing approvals or waiting for manual processing. Blockchain payment platforms can significantly reduce processing costs while eliminating payment delays caused by manual approval bottlenecks. Recurring payments, installment plans, and subscription billing execute automatically according to predetermined schedules.

These automation features create the foundation for significant business improvements that extend far beyond simple payment processing efficiency.

Implementation Benefits for Modern Businesses

Processing Speed Increases Revenue Velocity

Traditional payment systems trap your cash flow in a maze of processing delays that cost real money. Blockchain CRM eliminates these bottlenecks with settlement times under 30 seconds compared to 3-5 business days for international wire transfers.

Companies that adopt blockchain payment systems report 75% reduction in transaction processing costs according to recent IBM research. Payment failures drop from 15% to under 2% because blockchain networks operate 24/7 without banking hour restrictions or weekend delays.

Finance teams spend 80% less time on payment follow-ups and dispute resolution. This shift frees resources for strategic initiatives instead of administrative busy work (and who doesn’t love fewer spreadsheet headaches?).

Compliance Becomes Automatic Instead of Painful

Regulatory compliance transforms from a quarterly scramble into an automated process that runs continuously. Every transaction generates complete audit documentation automatically, including timestamps, participant verification, and compliance checks.

Financial institutions report 60% reduction in compliance preparation time when they use blockchain systems compared to traditional payment networks. Anti-money laundering requirements get satisfied through built-in transaction monitoring that flags suspicious patterns instantly rather than during monthly reviews.

Tax reporting becomes straightforward because blockchain records provide exact transaction details with no missing data or reconciliation gaps. Your accountant will actually thank you (a rare occurrence in the business world).

Customer Trust Reaches New Heights

Customer trust increases measurably when businesses demonstrate complete payment transparency. Studies show 73% of customers expect real-time order tracking across all touchpoints, with more than 98% saying the delivery process impacts their brand perception.

Payment disputes virtually disappear because customers can track their transactions in real-time. Support teams handle fewer payment-related inquiries, and customer satisfaction scores improve across all payment touchpoints.

Transparent payment processes create competitive advantages that extend far beyond simple transaction processing. Customers choose businesses they can trust with their money, and blockchain CRM delivers that trust through verifiable transparency.

Final Thoughts

Payment transparency represents the future of business finance, where every transaction becomes visible, verifiable, and instantly accessible. The shift from opaque traditional systems to blockchain-powered transparency isn’t just a technological upgrade – it fundamentally reimagines how money moves through business operations. Companies that embrace transparent payment systems now position themselves ahead of competitors still wrestling with reconciliation headaches and customer payment disputes.

The technology has matured beyond experimental phases into production-ready solutions that integrate seamlessly with existing business infrastructure. Web3 Enabler provides Salesforce Native blockchain solutions available on the AppExchange, which enables businesses to accept stablecoin payments and send global payments faster within their existing Salesforce environment. Finance teams can start with basic transaction tracking and expand their capabilities as they become more comfortable with blockchain payment systems.

Advanced payment transparency involves expansion beyond basic transaction tracking to comprehensive financial visibility across all business touchpoints. This evolution transforms finance teams from reactive problem-solvers into proactive strategic partners who can predict cash flow patterns and optimize payment processes before issues arise (goodbye monthly reconciliation nightmares). The future belongs to businesses that make every payment transaction as clear as their morning coffee.

![Navigating Compliance in the Blockchain Era [2025]](https://web3enabler.com/wp-content/uploads/emplibot/blockchain-compliance-hero-1761160171.jpeg)