Today marked an important milestone in cryptocurrency and USDC adoption, highlighted by Circle’s special session on the 2025 State of the USDC Economy Report, led by Josh Burke and moderated by Jonas Pavos. The report, a concise 20-page document, offers valuable insights into the burgeoning digital dollar economy, capturing the attention of regulators and banks alike. As one of the inaugural members of the Circle Alliance program, we are positioned to integrate USDC into the Salesforce ecosystem seamlessly. This event underscored the potential for blockchain technology to revolutionize international payments, drawing parallels to the mainstream adoption of Salesforce in cloud computing.

Growth of the USDC Economy

The 2025 State of the USDC Economy Report provides a comprehensive overview of how the digital dollar is gaining traction globally. Banks, regulators, and financial institutions are closely examining USDC as a stable, scalable solution for cross-border payments. The report highlights key market trends, demonstrating how digital currencies are becoming an integral part of the global financial landscape.

Circle’s Impact on Enterprise Adoption

We are proud to be an early member of the Circle Alliance program, solidifying our position as the premier solution for integrating USDC within Salesforce. During the session, Jonas Pavos discussed how Circle’s adoption is approaching what he termed the “Salesforce moment”—a pivotal point when businesses recognize the necessity of blockchain for international transaction – a fantatsic shoutout to our efforts to enable USDC on Salesforce. This recognition further validates the importance of Web3 solutions in modern business operations.

Financial Inclusion and Stablecoins

One of the most exciting aspects of the report is its focus on financial inclusivity. Companies like New Bank and Lemon are leveraging USDC to provide banking services to the unbanked across Latin America. Stablecoins like USDC and USDT enable businesses to conduct transactions more efficiently, reducing costs and increasing accessibility for businesses worldwide.

EURC and European Crypto Regulation

The discussion also covered the adoption of EURC, a euro-backed stablecoin that is compliant with new EU cryptocurrency regulations under MICA. This opens the door for businesses across the Eurozone to seamlessly process digital euro transactions through Salesforce. With our infrastructure, companies operating in SEPA countries can receive euro payments that are automatically deposited into their bank accounts.

Web3 Enabler’s Role in Driving Adoption

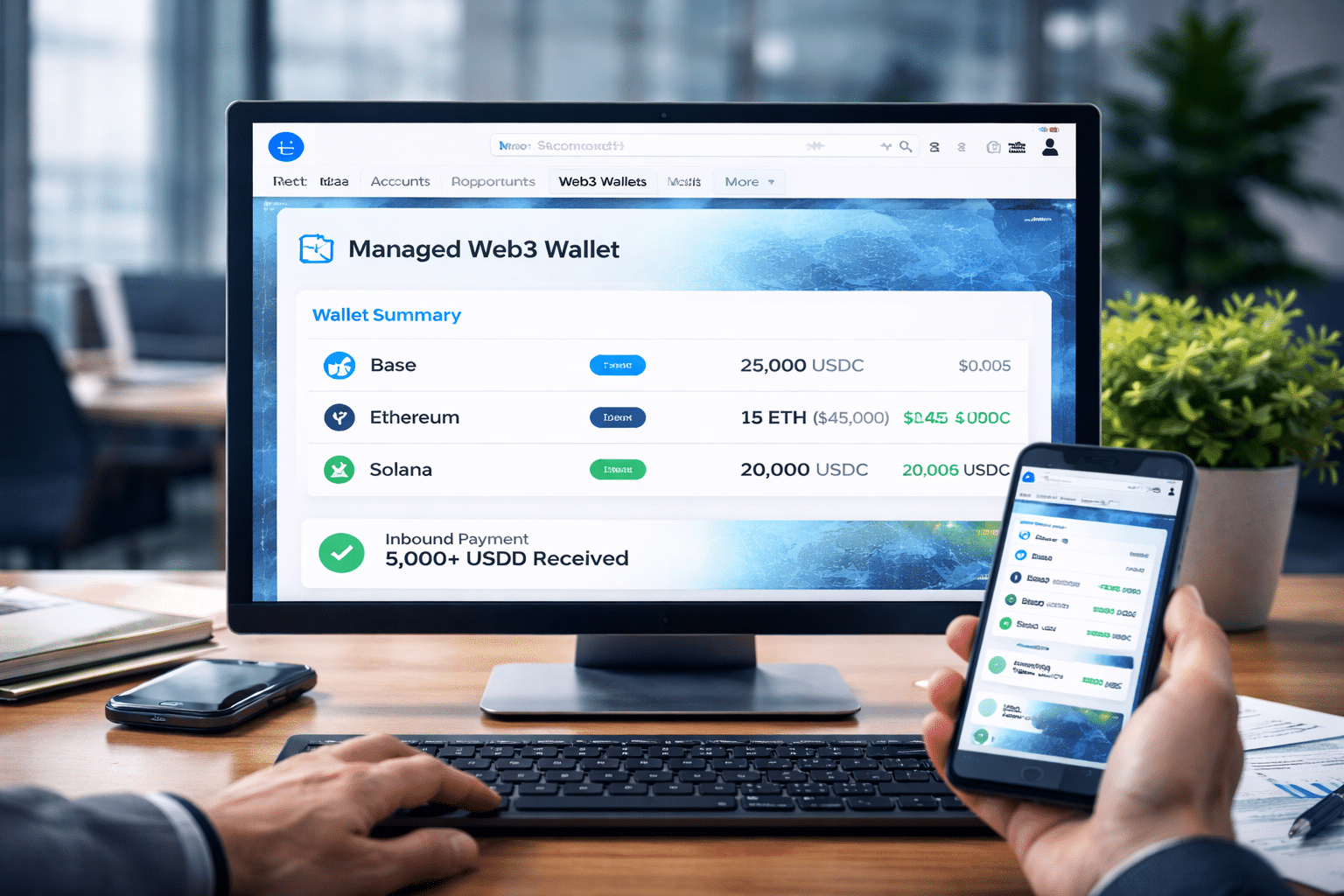

For businesses using Salesforce, there is no reason not to accept USDC. We provide a streamlined setup that allows enterprises to receive USDC on Ethereum and Base, with automatic deposits into their bank accounts. Additionally, we support USDT on Tron and Ethereum, XRP, RLUSD, and PayPal USD, enabling seamless international transactions with lower fees and faster settlements.

Investment Opportunities with Web3 Enabler

As we continue to scale, we invite investors to join us in our Republic crowd-raising initiative. With over 246 investors contributing $130,000 to date, we are gaining significant momentum. This is an exciting opportunity for early investors to be part of a company driving real-world blockchain adoption within Salesforce, a platform used by one-third of all businesses and 90% of Fortune 500 companies.

Conclusion

The insights from the 2025 State of the USDC Economy Report reaffirm the growing adoption of stablecoins and the transformative impact of blockchain technology in global finance. As regulatory clarity increases and businesses recognize the efficiency gains from digital currencies, Web3 Enabler is well-positioned to lead this movement. Whether through Salesforce, ERP integrations, or real-time financial automation, we are committed to making crypto adoption seamless for enterprises worldwide.

To support this initiative, consider investing in Web3 Enabler on Republic and sharing our vision for a blockchain-powered financial future.