Web3 Enabler has successfully concluded its Republic campaign, marking a significant milestone in bringing B2B blockchain transactions to the enterprise sector. With a mission to seamlessly integrate blockchain technology into corporate ecosystems, the company is strategically positioned within the Salesforce ecosystem to drive mass adoption.

A Successful Fundraising Campaign

The campaign raised $175,000, surpassing both the original goal of $75,000 and the stretch goal of $140,000. This strong investor support validates Web3 Enabler’s vision and the growing demand for enterprise blockchain solutions. The funds will help accelerate product development, expand partnerships, and enhance compliance-focused blockchain payment solutions.

Why B2B Blockchain Transactions Are a Game-Changer

Traditional B2B transactions involve high fees, slow processing times, and complex compliance requirements. Each year, $150 trillion moves through global B2B payment systems, with businesses incurring excessive costs due to intermediary banks and currency exchange markups.

By leveraging blockchain technology, enterprises can:

- Reduce transaction fees by up to 90%

- Speed up international payments

- Eliminate hidden currency exchange costs

- Ensure compliance with anti-money laundering (AML) regulations

Global consulting firms like Deloitte, PwC, EY, and KPMG have already recognized blockchain’s potential to reshape financial operations. As Web3 Enabler integrates blockchain with Salesforce, companies can now access efficient, cost-effective, and fully compliant crypto payment solutions, driving new opportunities for sales growth.

Salesforce: The Key to Enterprise Blockchain Adoption

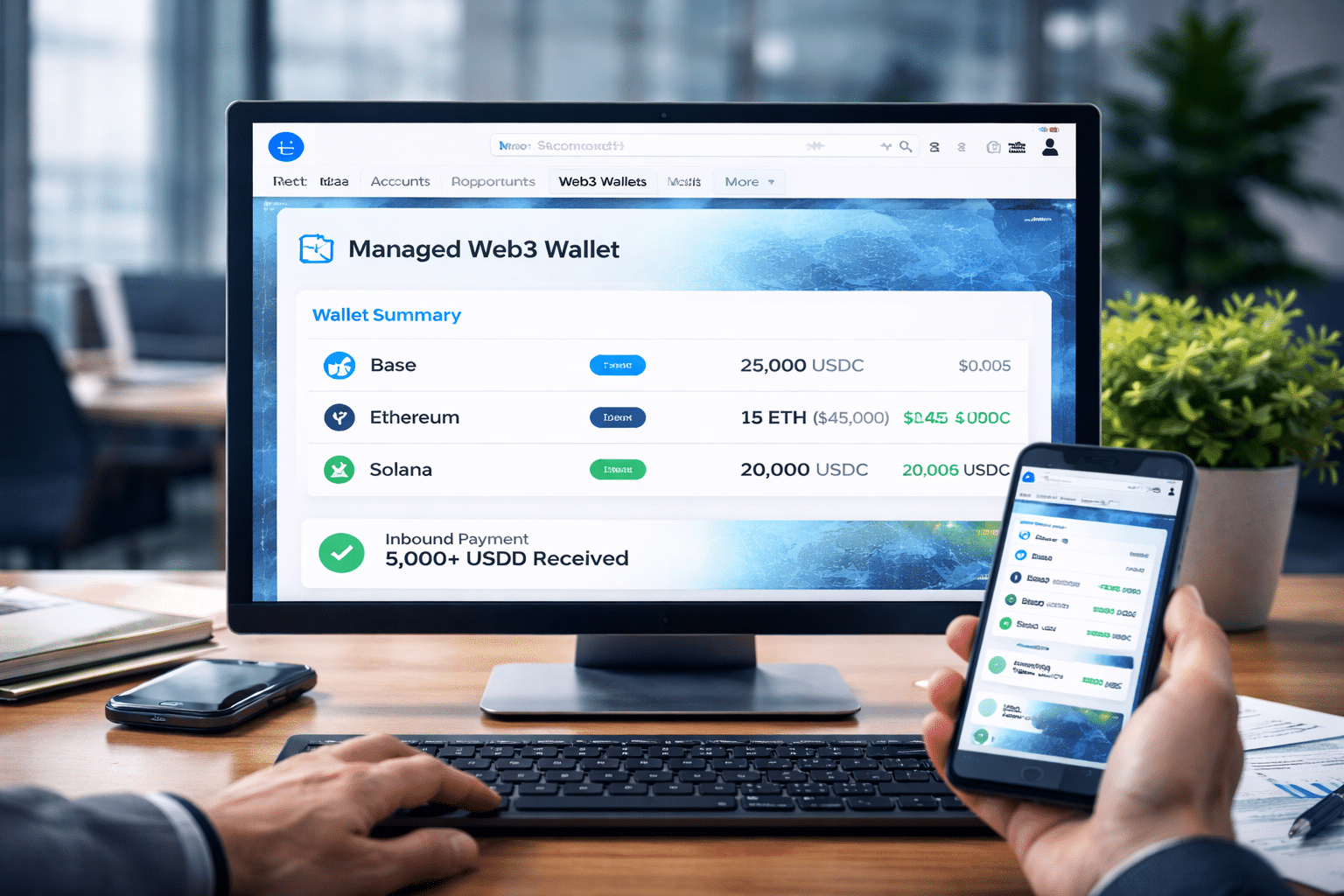

Salesforce dominates the enterprise ecosystem, serving 150,000 companies, including 91% of the Fortune 500. Web3 Enabler’s deep integration into Salesforce’s Commerce Cloud and AppExchange ensures that businesses can adopt blockchain payments seamlessly.

More than 13,500 Commerce Cloud companies conduct billions in transactions annually. Web3 Enabler is working to integrate peer-to-peer crypto payments into their checkout process—unlocking major savings and efficiency gains for businesses.

Global Partnerships Enhancing Enterprise Payments

To strengthen its blockchain payment solutions, Web3 Enabler has partnered with industry leaders:

- Circle – Enabling seamless on-ramps and off-ramps for USDC transactions

- XRP (Ripple) – Facilitating global cross-border payments

- PoundToken – Supporting transactions in the UK financial ecosystem

These partnerships ensure that businesses can transact globally without reliance on traditional banking intermediaries.

Ensuring Compliance in B2B Blockchain Transactions

Enterprise adoption of blockchain requires robust AML and KYC compliance. Web3 Enabler has integrated tools from Blockchain Intelligence Group and BitRank Verified to help businesses verify transaction integrity.

- Prevents transactions with sanctioned entities

- Ensures regulatory compliance for high-risk industries

- Provides audit-ready proof of due diligence

This is a key feature for industries dealing with dual-use technology, international trade, and financial services, where regulatory oversight is critical.

Conclusion: The Future of Enterprise Payments is On-Chain

The conclusion of Web3 Enabler’s Republic campaign marks the beginning of a new era for enterprise blockchain adoption. By simplifying B2B blockchain transactions, ensuring compliance, and integrating with Salesforce’s massive ecosystem, Web3 Enabler is poised to lead the next wave of enterprise blockchain transformation.

As corporate demand for blockchain payments grows, Web3 Enabler’s solutions will play a pivotal role in shaping the future of financial transactions.

Related Resources

- Accept XRP in Salesforce

- Accept Bitcoin in Salesforce

- Accept USDC in Salesforce

- Accept USDT in Salesforce

Learn more about blockchain payments on Salesforce: AppExchange Listing