Your subscription business deserves better than outdated payment rails that bleed money through fees and delays. Traditional systems weren’t built for today’s global, digital-first economy.

We at Web3 Enabler see businesses losing 3-5% of revenue to payment processors while waiting days for international transfers. Recurring crypto payments flip this script entirely.

The technology is here, tested, and ready to transform how you collect payments from customers worldwide.

Why Traditional Payment Systems Bleed Your Business Dry

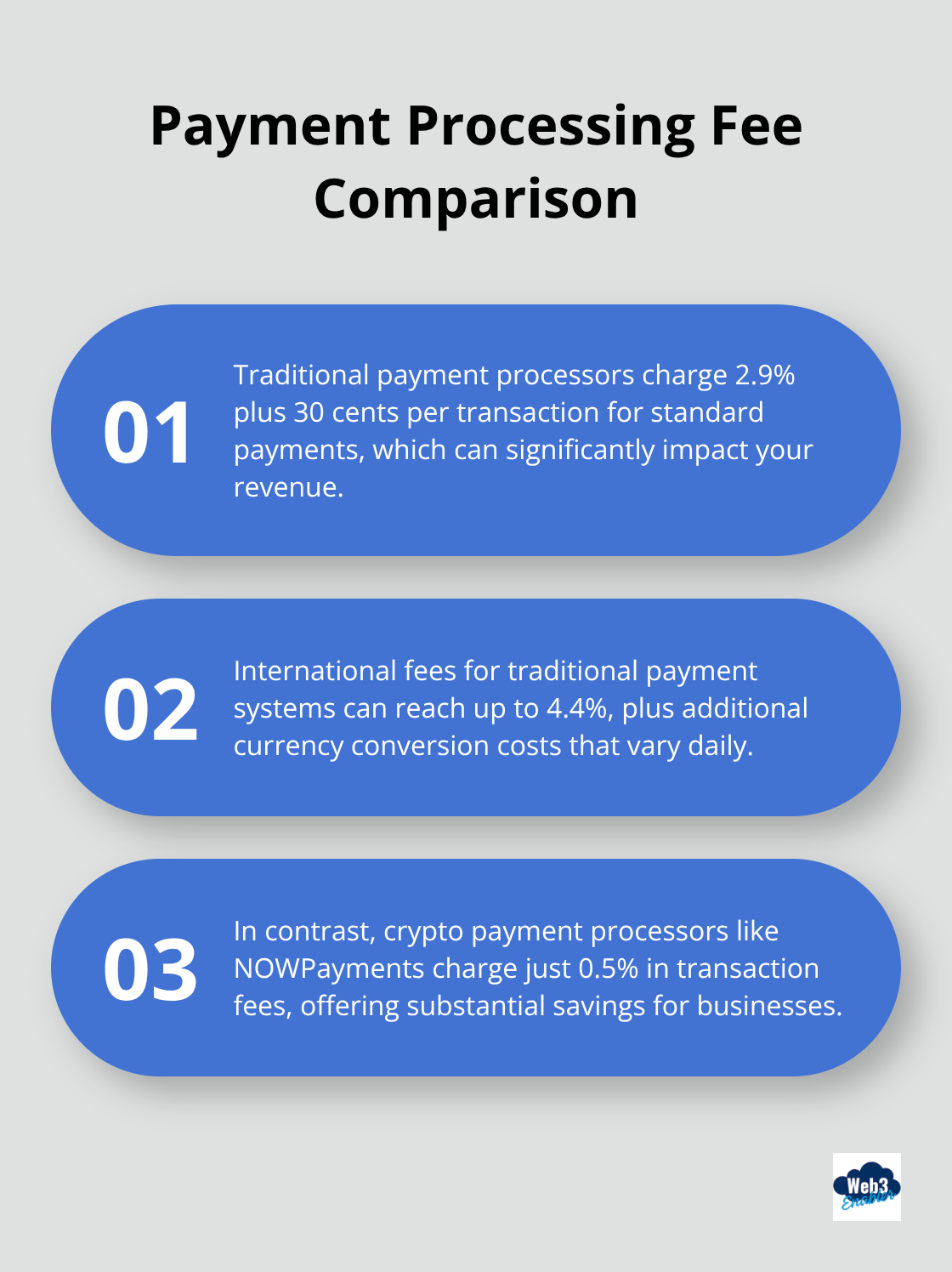

Traditional payment systems never considered subscription businesses when engineers built them decades ago, and your bottom line shows the damage. Payment processors like Stripe and PayPal charge 2.9% plus 30 cents per transaction, which means a $100 monthly subscription costs you $3.20 every single month. Scale that across thousands of customers, and serious money walks out the door. Cross-border transactions get even messier, with international fees that reach 4.4% plus currency conversion costs that change daily.

Processing Fees Scale With Your Success

The cruel irony of traditional payment systems hits hardest when your business grows. Your payment processor takes their cut whether your customer pays from New York or New Zealand. International wire transfers through traditional banks take 1-5 business days and cost between $15-50 per transaction (making global subscriptions a logistical nightmare). IBM’s 2024 Cost of a Data Breach Report shows financial institutions face average costs that exceed $6 million per breach, 22% above the global average.

Chargebacks Turn Profit Into Pain

Chargebacks destroy more than individual transactions. They trigger investigation fees, penalty rates, and can push your business into high-risk merchant categories. When customers dispute charges, you lose the original payment plus additional fees that range from $20-100 per incident. Traditional systems give customers up to 120 days to file disputes, which means your “settled” revenue sits in constant jeopardy.

The Hidden Costs Add Up Fast

Payment processors don’t stop at transaction fees. Monthly gateway fees, PCI compliance costs, and international processing surcharges stack up quickly. Currency conversion alone can cost 2-4% on top of base fees, and banks often apply their own exchange rates that favor the house. These systems force you to maintain multiple merchant accounts for different regions, each with its own fee structure and compliance requirements.

Now imagine a payment system that processes transactions in seconds, charges less than 1% in fees, and never allows chargebacks to reverse completed payments.

How Crypto Payments Process Subscriptions

Crypto recurring payments operate through programmable blockchain networks that execute transactions automatically without traditional banking intermediaries. Stablecoins like USDC and USDT maintain dollar parity through reserve backing, which eliminates the price swings that make pure cryptocurrencies impractical for business operations. NOWPayments processes over 300 cryptocurrencies with transaction fees of just 0.5%, compared to traditional processors that charge 2.9% plus fixed fees per transaction.

Stablecoins Replace Volatile Cryptocurrencies

Business payments demand predictability, which makes stablecoins the obvious choice over Bitcoin or Ethereum for recurring transactions. Circle’s USDC maintains strict dollar backing through regulated financial institutions, while Tether’s USDT processes over $50 billion in daily volume according to recent market data. These digital dollars move across blockchain networks in minutes rather than the 1-5 business days that international wire transfers require. McKinsey projects stablecoin usage will reach $2 trillion by 2028, driven primarily by business adoption rather than speculation.

Blockchain Networks Handle the Heavy Work

Blockchain networks process payments 24/7 without banking holidays or weekend delays that plague traditional systems. Ethereum, Polygon, and other networks charge transaction fees based on network usage rather than payment amounts, which means a $10 payment costs the same to process as a $10,000 payment. Automated payment processes can achieve high accuracy rates, which eliminates the manual reconciliation that creates errors in traditional systems.

Integration Happens Through APIs and Plugins

Modern crypto payment systems integrate with existing business infrastructure through standard APIs that connect to accounting software like QuickBooks and enterprise systems such as Salesforce. Payment platforms like BitPay offer plugins for WooCommerce, Shopify, and other e-commerce systems that require minimal technical setup. These integrations allow businesses to process stablecoin payments directly within their existing workflows without switching platforms or learning new systems.

The real question isn’t whether crypto payments work technically-they do. The question is what specific benefits your business gains when you make the switch from traditional payment rails.

What Happens When Your Business Switches to Crypto Payments

Your business gains immediate access to a global payment network that operates without weekend shutdowns or banking holidays that cost traditional businesses money. Crypto payments settle within 2-10 minutes regardless of geography, which means your European customers pay your US business instantly rather than wait 3-5 business days for wire transfers. NOWPayments charges 0.5% transaction fees compared to PayPal’s 2.9% plus fixed fees, which saves a business that processes $100,000 monthly in subscriptions over $2,400 per month in fees alone. U.S. merchant crypto adoption is projected to rise significantly, potentially over 80% growth from 2024 to 2026, driven by cost savings that directly impact profit margins.

Transaction Fees Drop to Nearly Zero

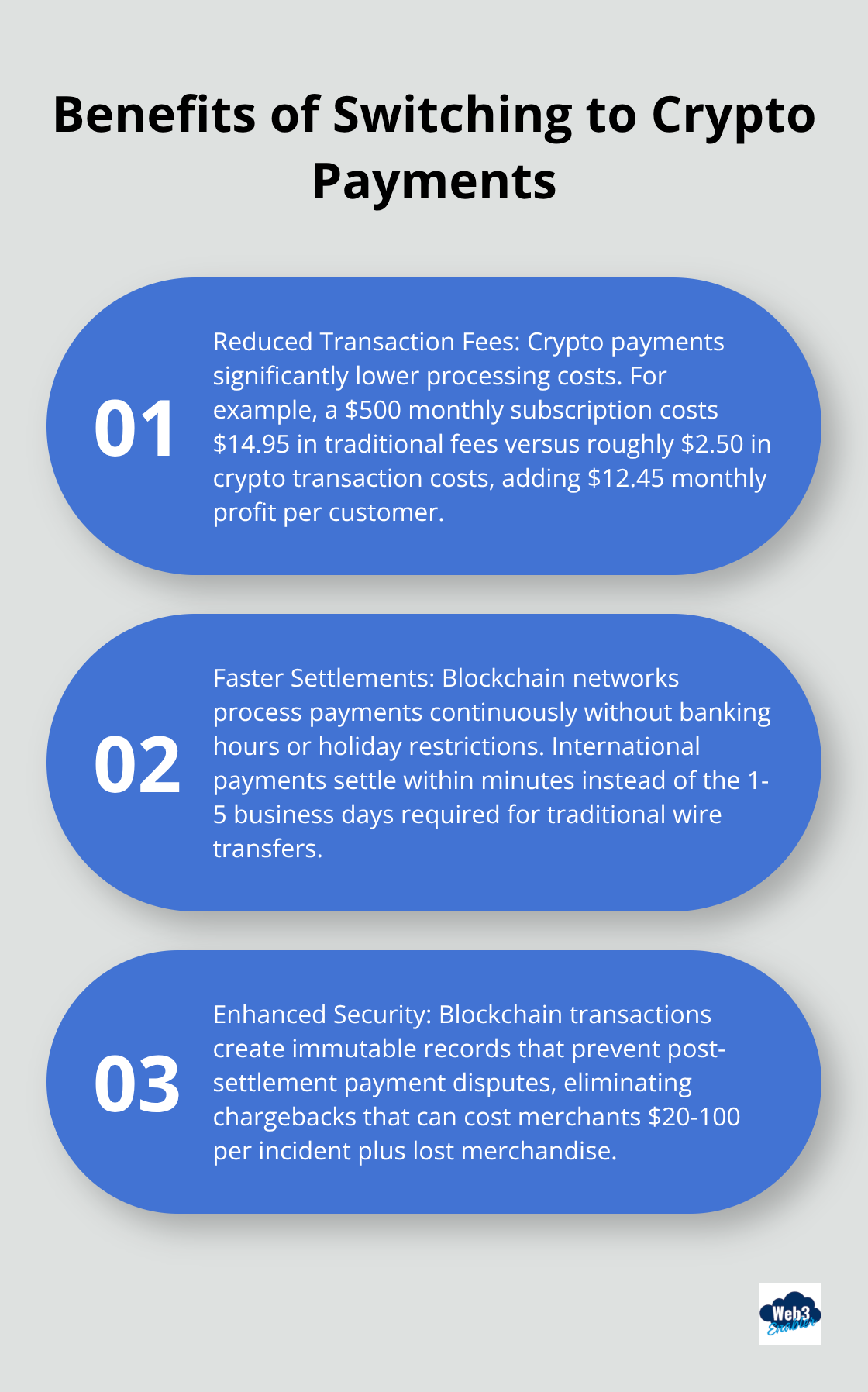

Traditional payment processors extract 2.9-4.4% from every transaction plus fixed fees that compound with international transfers, while blockchain networks charge based on network activity rather than payment amounts. A $500 monthly subscription costs $14.95 in traditional fees versus roughly $2.50 in crypto transaction costs, which adds $12.45 monthly profit per customer. Cross-border transactions through traditional banks include currency conversion spreads of 2-4% on top of base fees, but stablecoin payments eliminate conversion costs entirely because USDC maintains dollar parity globally.

Speed Transforms Cash Flow Management

International wire transfers take 1-5 business days and often get delayed by compliance checks or correspondent bank procedures (especially frustrating when you need cash flow predictability). Blockchain networks process payments continuously without banking hours or holiday restrictions that freeze traditional payment systems. Your customers in Tokyo can pay your New York office at 3 AM on Christmas Day, and the payment settles before your morning coffee gets cold.

Security Through Transparency Beats Hidden Vulnerabilities

Blockchain transactions create immutable records that prevent payment disputes after settlement, which eliminates the chargeback nightmare that costs traditional merchants $20-100 per incident plus lost merchandise. IBM’s data breach research shows financial institutions face costs that exceed $6 million per security incident, but blockchain’s distributed architecture removes central points of failure that hackers typically target. Every crypto payment generates a permanent transaction hash that provides complete audit trails for compliance reports, while traditional systems rely on internal databases that can be altered or corrupted.

Final Thoughts

Recurring crypto payments have evolved from experimental technology into practical business solutions that solve real problems. The numbers speak clearly: businesses save over $2,400 monthly on $100,000 in subscription revenue while they gain instant global settlement capabilities that traditional systems cannot match. Implementation starts when you choose the right stablecoin payment processor and integrate their API into your existing billing system.

Most businesses begin when they offer crypto payments alongside traditional options, then gradually shift more volume as they experience the cost savings and operational benefits firsthand. The payment landscape shifts rapidly toward blockchain-based solutions. Major financial institutions like JP Morgan and Visa already integrate stablecoin technologies, while McKinsey projects $2 trillion in stablecoin usage by 2028 (driven primarily by business adoption rather than speculation).

Businesses that adopt recurring crypto payments now position themselves ahead of this inevitable transition. We at Web3 Enabler help businesses implement blockchain payment solutions that make the transition seamless for companies. The technology works, the savings are real, and your competitors are probably already exploring their options.