Payment processing in business is due for a major overhaul, and companies running Salesforce are no exception. Businesses face numerous challenges with traditional methods, including high fees, slow transactions, and security concerns.

At Web3 Enabler, we’ve developed a groundbreaking solution that leverages blockchain technology to address these pain points. Our native Salesforce integration is set to revolutionize how companies handle payments, offering enhanced security, speed, and cost-effectiveness.

Why Current Payment Methods Fall Short in Salesforce

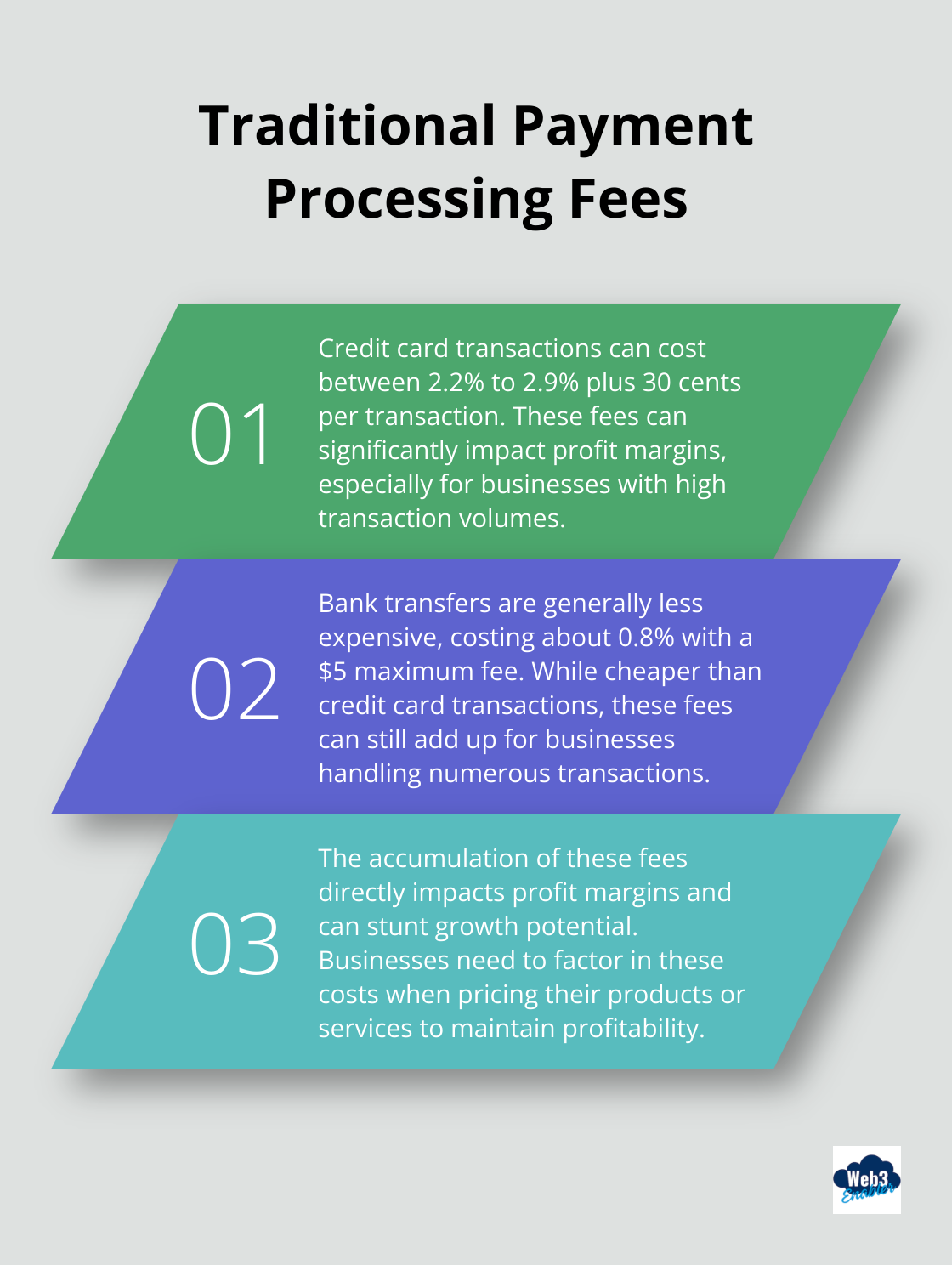

High Fees Erode Profits

Salesforce has revolutionized customer relationship management, but payment processing remains a significant challenge for many businesses. Traditional payment methods can cost between 2.2% to 2.9% plus 30 cents per credit card transaction, or about 0.8% for bank transfers with a $5 maximum fee. These fees quickly accumulate, directly impacting profit margins and stunting growth potential.

Liquidation Wallets are Simply Better

The liquidation wallet, offered by Web3 Enabler, is simply a better merchant account option. If you aren’t ready to work with cryptocurrencies in your business, you can simply accept them anyway. They are automatically liquidated and converted to fiat currency in your bank account. The transactions are near instantaneous for SEPA and Wires, and overnight for ACH.

Slow Transactions Frustrate Customers

In today’s fast-paced digital economy, customers expect instant results. However, traditional payment methods often involve multiple intermediaries, each adding time to the process. This delay not only irritates customers but also ties up working capital that businesses could use more effectively elsewhere.

Security Vulnerabilities Keep Executives Vigilant

The evolving landscape of cyber threats makes payment data security a top priority for businesses. Traditional payment systems often use centralized structures, making them attractive targets for hackers. A single breach can result in catastrophic financial losses and irreparable damage to a company’s reputation.

Compliance Challenges Drain Resources

Navigating the complex web of financial regulations presents a significant hurdle for businesses using Salesforce for payments. As regulatory requirements become more stringent, companies must allocate more resources to ensure compliance. This increase in operational costs diverts attention from core business activities.

Limited Global Reach Hinders Expansion

In our interconnected world, businesses need payment solutions that can handle international transactions seamlessly. Traditional methods often fall short when it comes to cross-border payments, with issues ranging from high fees to lengthy processing times. This limitation can severely hamper a company’s ability to expand into new markets and serve a global customer base.

The shortcomings of current payment processing methods in Salesforce are evident. Businesses urgently need a solution that addresses these pain points head-on, offering lower fees, faster transactions, enhanced security, and global capabilities. Blockchain technology emerges as a promising solution to these longstanding issues. The integration of blockchain with Salesforce could transform payment processing as we know it, ushering in a new era of efficiency and security for businesses worldwide.

How Blockchain Transforms Payment Processing

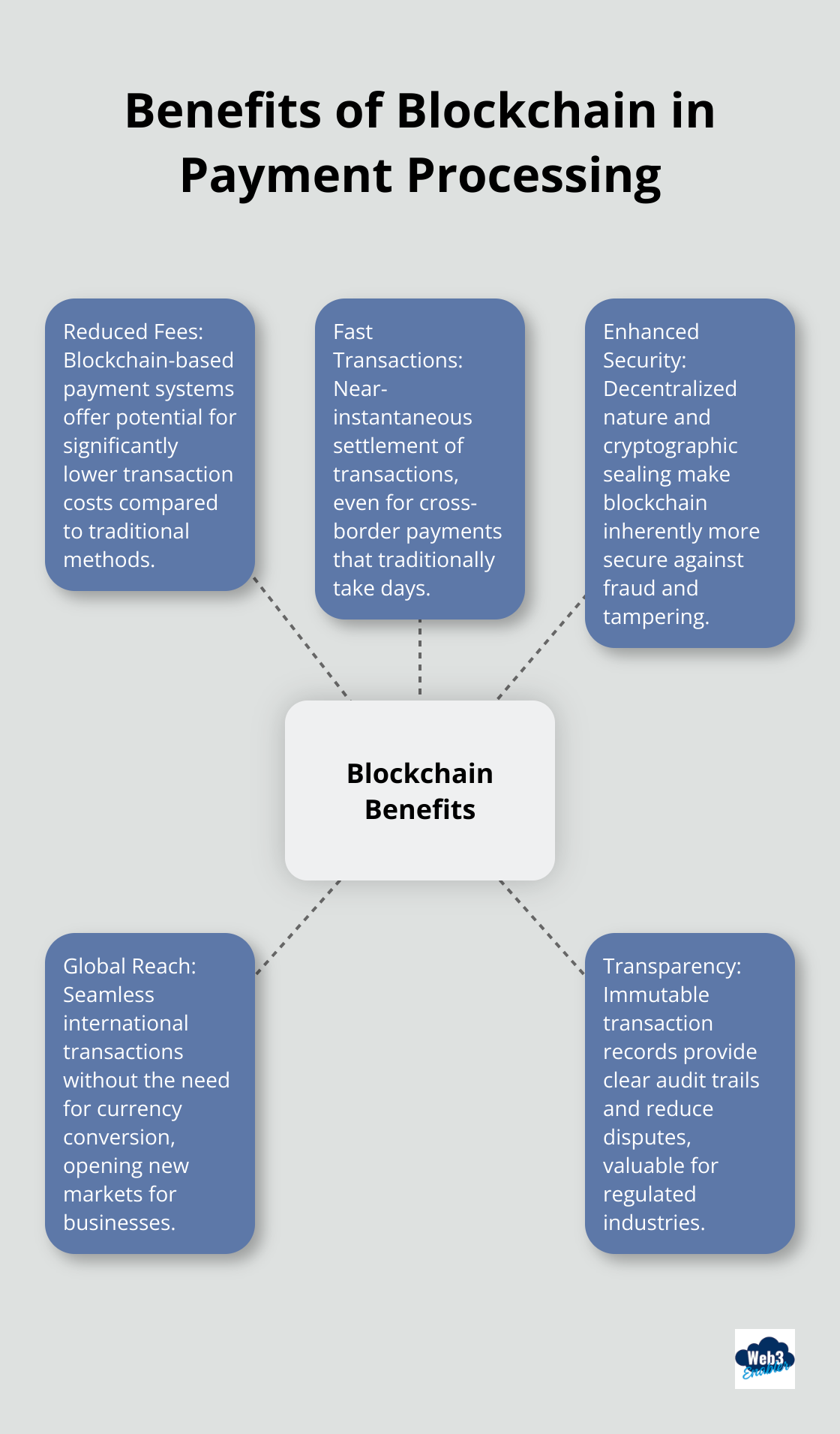

Blockchain technology revolutionizes payment processing, addressing many pain points businesses face with traditional methods. This decentralized, digital ledger records transactions across a network of computers, eliminating intermediaries and significantly reducing processing times and fees.

Dramatic Fee Reduction

Blockchain-based payment systems are changing the landscape of financial transactions. While traditional payment methods can be costly, blockchain offers potential for reduced fees. The exact savings depend on various factors and can vary significantly between different blockchain solutions.

Lightning-Fast Transactions

Blockchain technology enables near-instantaneous transactions, regardless of geographical location. While traditional cross-border payments can take days to settle, blockchain-based systems complete these transactions in minutes or even seconds. This speed improves cash flow for businesses and enhances customer satisfaction.

Enhanced Security and Transparency

The decentralized nature of blockchain makes it inherently more secure than centralized systems. Each transaction is cryptographically sealed and linked to previous transactions, creating an immutable record. This feature significantly reduces the risk of fraud and data tampering.

Transparency is another key benefit. All parties involved in a transaction can view the entire transaction history, which reduces disputes and simplifies audits. This level of transparency proves particularly valuable for businesses operating in highly regulated industries.

Seamless Global Transactions

Blockchain offers a frictionless solution for international payments. It eliminates the need for currency conversion and reduces the number of intermediaries involved, making cross-border transactions as simple and cost-effective as domestic ones. This capability opens up new markets and revenue streams for businesses of all sizes.

The implementation of blockchain-based payment processing in Salesforce can transform how businesses handle transactions. It addresses the key pain points of high fees, slow processing times, security vulnerabilities, and limited global reach. As more companies recognize these benefits, the adoption of blockchain solutions continues to increase, particularly among forward-thinking businesses aiming to stay ahead in an increasingly digital economy. The next chapter will explore how businesses can integrate these powerful blockchain capabilities directly into their Salesforce environment.

How to Integrate Blockchain Payments in Salesforce

Integrating blockchain-based payment processing into Salesforce isn’t just a theoretical concept – it’s a practical reality that’s transforming how businesses handle transactions. The Salesforce AppExchange now offers a native blockchain solution – Blockchain Payments, making it easier than ever for businesses to leverage this powerful technology. Successfully funded and closed on March 12, 2025, this is the only native solution for blockchain / web3 services and payments in the Salesforce AppExchange.

Seamless Integration with Existing Workflows

Blockchain payment solutions integrate directly into existing Salesforce environments, requiring minimal changes to current workflows. This allows businesses to start benefiting from blockchain technology without disrupting their operations or requiring extensive staff training.

A large e-commerce company (which implemented a blockchain solution) saw a 30% reduction in payment processing time within the first month. Their customer service team reported fewer payment-related inquiries, allowing them to focus on other aspects of customer satisfaction.

Enhanced Security and Compliance

One of the key advantages of blockchain integration is the enhanced security it provides. Each transaction is cryptographically sealed and added to an immutable ledger, which significantly reduces the risk of fraud or data tampering.

A financial services firm (using a blockchain solution) reported a 40% decrease in fraud-related incidents after implementation. They also noted improved compliance with regulatory requirements, as the blockchain’s transparent nature simplified their audit processes.

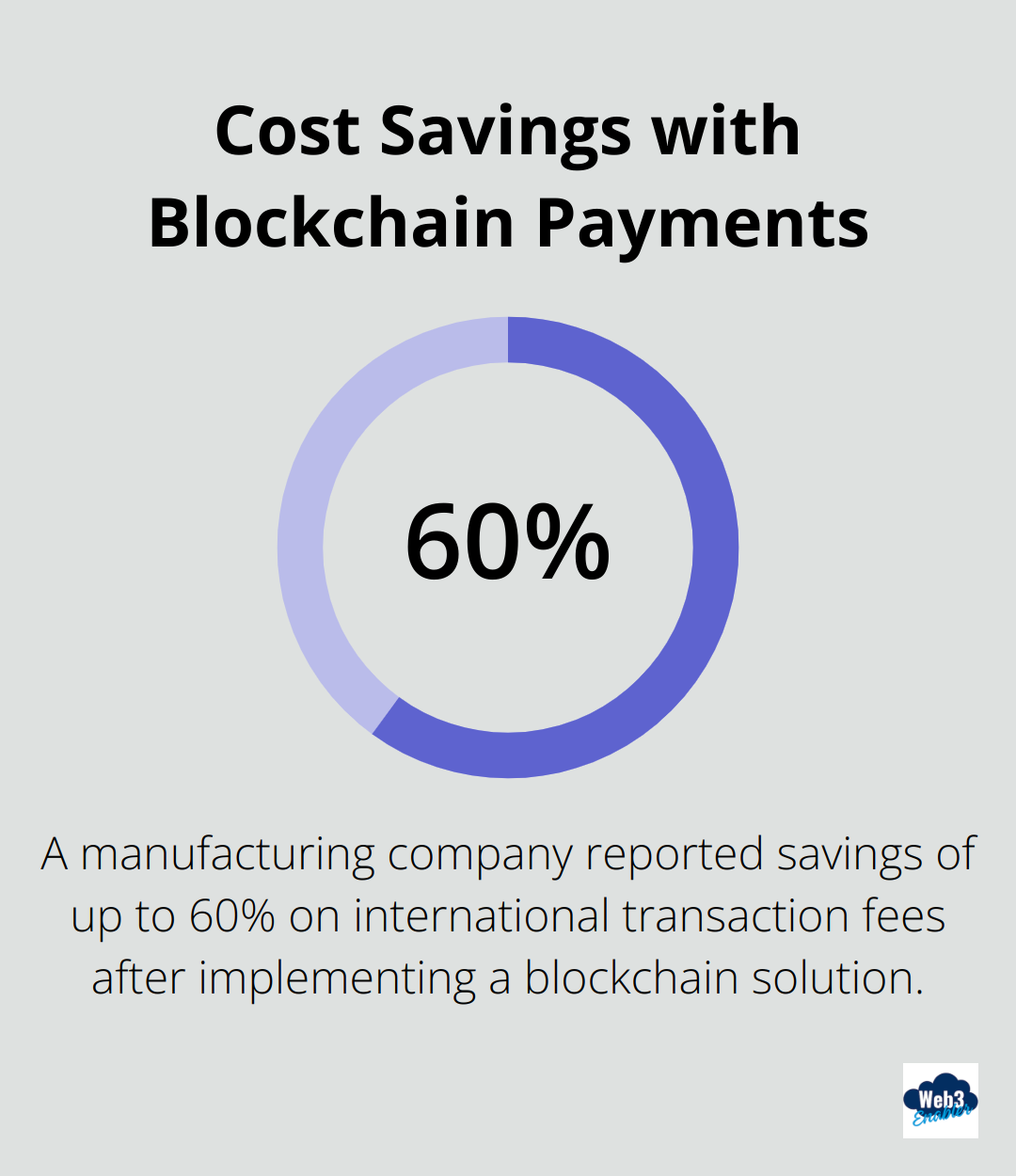

Cost-Effective Global Transactions

Blockchain solutions in Salesforce enable businesses to conduct international transactions more efficiently and cost-effectively. The elimination of intermediaries and reduction of currency conversion fees allows companies to save significantly on cross-border payments.

A manufacturing company with global operations implemented a blockchain solution and reported savings of up to 60% on international transaction fees. They reinvested these savings into expanding their product line, which directly contributed to business growth.

Customizable Solutions for Diverse Needs

Blockchain integration in Salesforce offers customizable solutions to meet diverse business needs. Companies can tailor the blockchain functionality to their specific requirements, whether it’s for payment processing, supply chain management, or contract execution.

Future-Proofing Your Business

Adopting blockchain technology in Salesforce positions businesses at the forefront of financial innovation. As blockchain continues to evolve and gain wider acceptance, early adopters will have a significant advantage in terms of experience and infrastructure.

Final Thoughts

Blockchain-based payment processing in Salesforce represents a significant advancement for businesses. This technology addresses key issues of traditional methods, offering reduced fees, faster processing, and enhanced security. The transparency and immutability of blockchain transactions provide unmatched trust and accountability, while seamless cross-border capabilities open new growth opportunities.

Web3 Enabler provides a comprehensive solution for integrating blockchain payment processing into Salesforce. As the native blockchain solution on the Salesforce AppExchange, Web3 Enabler equips businesses with tools to effectively leverage this technology. The benefits extend beyond payment processing, encompassing improved compliance, automation, and enhanced visibility into cryptocurrency holdings. The free plugin for Sales Cloud is already in the AppExchange. The plugin for Revenue Cloud, Commerce Cloud, and Salesforce Payments will be available as a free add on in a few weeks.

Companies that embrace this innovation will position themselves for success in the evolving landscape of digital finance. The future of payment processing has arrived, powered by blockchain technology. Web3 Enabler stands ready to guide businesses through this transformation, ensuring they remain at the forefront of financial innovation.