Your business probably sends money across borders regularly. If you’re still using traditional banking channels, you’re losing time and money to slow processing and hidden fees.

We at Web3 Enabler have seen firsthand how real-time cross-border payments change the game for treasury teams. Blockchain-based systems eliminate the middlemen and settle transactions in minutes instead of days.

How Real-Time Cross-Border Payments Work

Traditional banking moves money across borders through a network of correspondent banks, each taking a cut and adding processing time. A wire transfer between the US and Europe typically costs 7% or more and takes two to five business days because multiple intermediaries handle the transaction sequentially. The Federal Reserve Bank of New York confirmed that domestic real-time rails like FedNow settle in seconds, yet cross-border payments still rely on decades-old infrastructure that wasn’t designed for speed.

Blockchain Eliminates the Middlemen

Blockchain-based systems remove this chain of intermediaries entirely. When you send a stablecoin like USDC across borders, the transaction settles on-chain in minutes with fees measured in cents rather than percentage points. According to Allium Labs, legitimate stablecoin transfers grew from 3.29 trillion dollars in 2021 to 5.68 trillion dollars in 2024-an 80% increase that reflects real businesses adopting this technology for actual payments. A blockchain doesn’t care about time zones or banking hours.

Your payment moves 24/7 with immediate finality, no reversals, and complete transparency.

Why Traditional Banking Creates Friction

Your treasury team probably spends hours each week tracking wire transfers that vanish into the correspondent banking system. You don’t know where the money is, what fees will be deducted at each step, or when it will actually arrive. Hidden FX spreads add another 1% to 3% on top of stated fees. The G20 target to reduce cross-border retail payment costs to 1% by 2027 tells you how broken the current system is. Stablecoins eliminate these pain points because they exist on permissionless blockchains that don’t require approval from multiple banks. You send USDC from your wallet to a vendor’s wallet, and it arrives with full visibility into the transaction. No surprises, no hidden deductions, no waiting.

Real-Time Settlement Transforms Cash Flow

When treasury teams adopt blockchain-based payments, the first thing they notice is the cash flow impact. Vendors in emerging markets receive payments same-day instead of waiting a week for a wire to clear. That means you can negotiate better payment terms because you’re actually delivering funds faster than traditional banking allows. Merchants who added stablecoin checkout options saw payment completion rates increase by more than a third according to transaction data from payment processors. Stablecoins are digital representations of fiat currency backed by reserves held by issuers like Circle. USDC, for example, is fully reserved and audited quarterly. When you hold USDC, you hold a direct claim on those reserves. Settlement happens on the blockchain itself, not through a banking intermediary, which is why it’s instant.

What This Means for Your Operations

Real-time cross-border payments eliminate the operational headaches that slow down your finance team. Your vendors get paid faster, your cash position becomes transparent, and your reconciliation process shifts from manual tracking to automated on-chain verification. The next section shows exactly how much time and money your business can save when you move away from traditional banking infrastructure.

How Much You Actually Save With Real-Time Payments

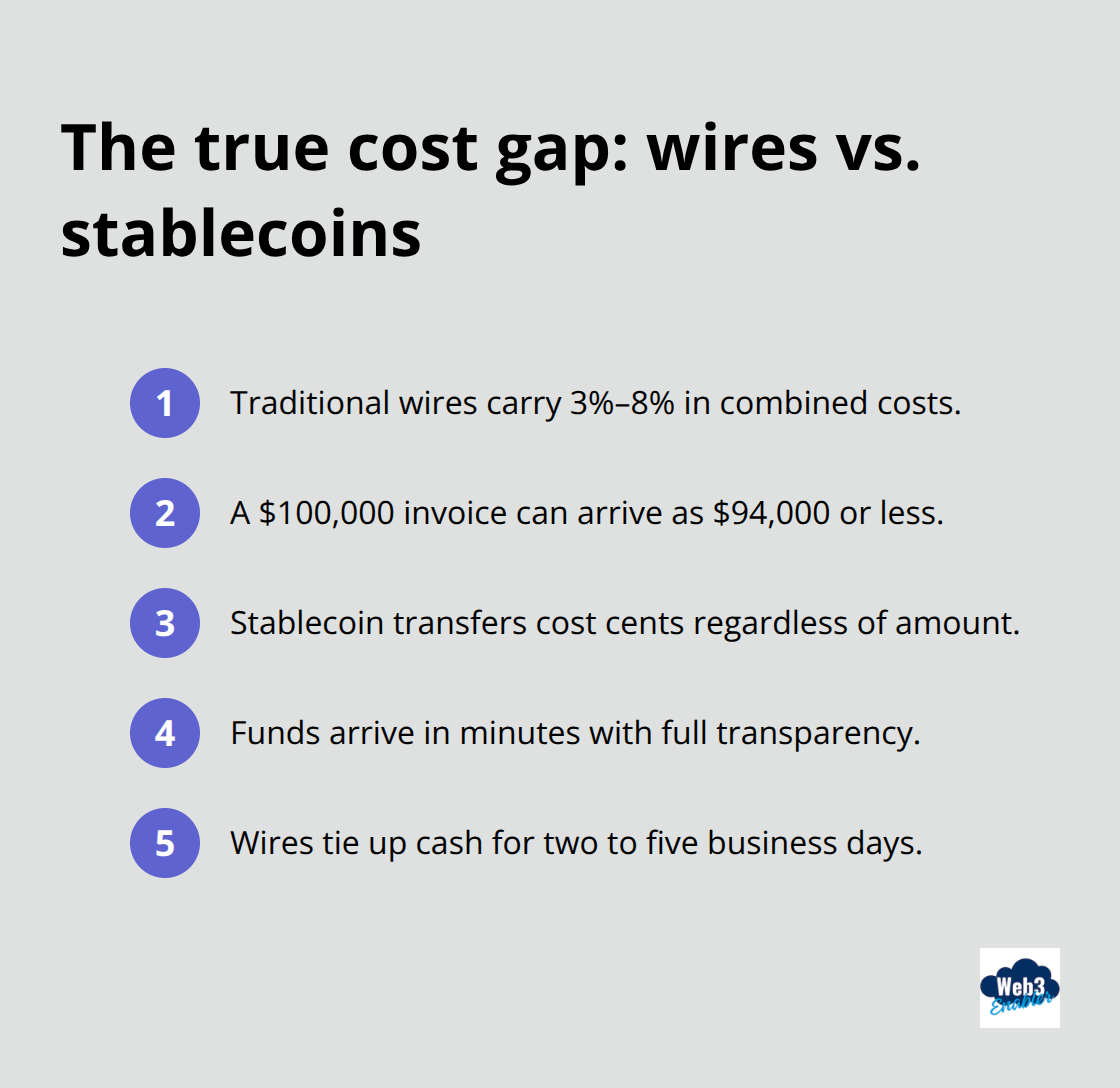

The True Cost of Traditional Banking

The math on cross-border payments is brutal if you still use traditional banking. Your business probably pays between 3% and 8% in combined fees, FX markups, and hidden deductions when you wire money internationally. A vendor invoice for $100,000 arrives as $94,000 or less after the banking system takes its cut.

Stablecoin transfers cost cents to a few dollars regardless of amount, which means sending that same $100,000 costs you less than a dollar and arrives in minutes with full transparency.

The cross-border payments market for small and medium businesses exceeds $200 billion annually and grows at more than 7% per year, yet most companies still accept these massive fee structures because they don’t realize alternatives exist. Traditional wires take two to five business days, which means your cash position shows as committed but unavailable until the receiving bank processes the payment on their end.

Immediate Recovery of Transaction Value

Switching to blockchain-based payments recovers 2% to 5% of transaction value simply through eliminating intermediaries. That’s not theoretical savings-that’s cash that stays in your account instead of vanishing into correspondent banking networks. Larger treasury teams track dozens of payments in flight simultaneously, creating artificial cash shortages that force unnecessary borrowing or delay payables.

Real-time settlement eliminates this friction entirely. When you send a stablecoin payment to a vendor in Southeast Asia, the funds arrive instantly and become immediately usable. You know exactly where every dollar is at any moment, and your liquidity position improves dramatically because settlement happens in real-time instead of floating in limbo for days.

Operational Overhead Drops Significantly

Your operational overhead drops because treasury staff stops spending hours tracking transfers through the banking system. No more calls to correspondent banks asking where a payment disappeared. No more reconciliation nightmares when FX rates shift mid-transaction. Merchants who integrated stablecoin checkout saw payment completion rates jump by more than a third because customers no longer experience failed transactions or lengthy processing delays.

Your team switches from reactive firefighting to strategic work like optimizing payment timing and managing liquidity forecasts. The operational savings compound quickly once you realize how much time your finance team wastes on manual payment tracking and exception handling.

Real-Time Visibility Transforms Treasury Operations

Real-time cross-border payments eliminate the operational headaches that slow down your finance team. Your vendors receive payment faster, your cash position becomes transparent, and your reconciliation process shifts from manual tracking to automated on-chain verification. When you integrate blockchain-based payments with your existing systems (particularly if you use Salesforce), your finance team gains immediate visibility into transaction status without leaving their workflow.

This visibility matters because it changes how you manage vendor relationships and negotiate payment terms. Vendors in emerging markets receive payments same-day instead of waiting a week for a wire to clear, which means you can negotiate better payment terms because you’re actually delivering funds faster than traditional banking allows. Your team no longer needs to explain delays or track down missing transfers-the blockchain provides permanent, auditable records that both parties can access instantly.

How Real-Time Payments Fit Into Your Current Workflow

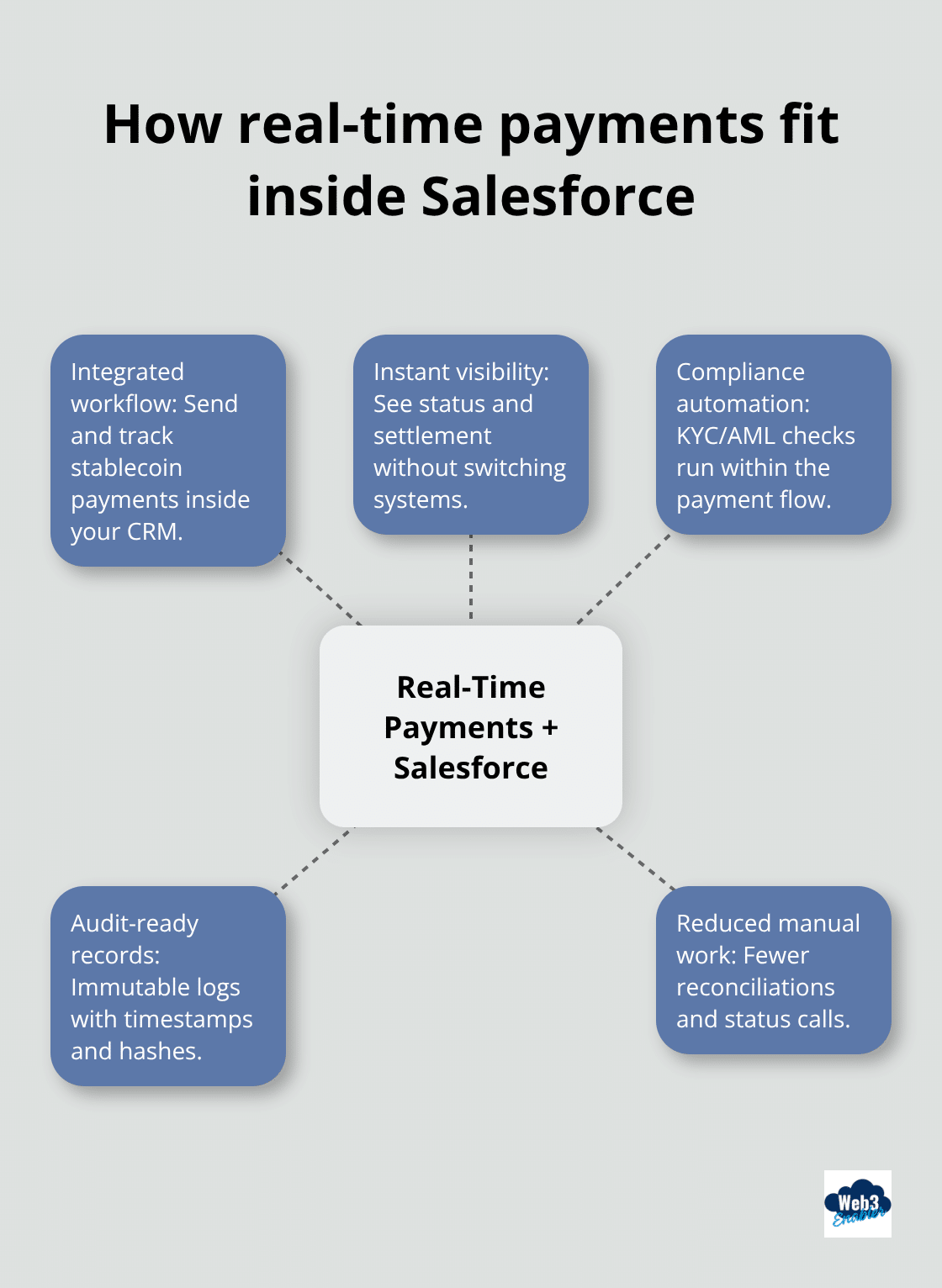

The biggest mistake companies make when evaluating blockchain payments is treating them as a replacement system that requires ripping out existing infrastructure. That approach fails because your finance team already knows how to work within Salesforce, your ERP, and your accounting systems. Real-time cross-border payments should integrate seamlessly into these tools rather than forcing your team to learn new platforms or manually track transactions outside your normal workflow.

Web3 Enabler built its platform as a native Salesforce application specifically because treasury teams live in Salesforce. When you send a stablecoin payment to a vendor, the transaction appears directly in your CRM with full visibility into payment status, settlement confirmation, and reconciliation data. Your team never leaves Salesforce to manage blockchain transactions. This matters because integration eliminates the operational friction that kills adoption. When payment data lives in your existing system rather than scattered across blockchain explorers and separate portals, your finance team can actually use real-time cross-border payments as part of their daily workflow instead of treating it as a separate process they tolerate.

Where Visibility Actually Changes Operations

Real-time settlement only delivers value if you can see what happened and act on that information immediately. Traditional banking hides transaction details in email confirmations and bank statements that arrive days after settlement. Blockchain-based payments settle in seconds or minutes rather than days, giving your team on-chain visibility the moment the transaction settles so you can reconcile payments in real-time instead of waiting for monthly bank statements.

When you integrate stablecoin payments directly into Salesforce, your finance team sees vendor payment status without switching between systems or manually tracking spreadsheets. A payment to a supplier in Singapore settles in minutes with a permanent, auditable record that your compliance team can access instantly. This visibility transforms how you manage cash positions because you know exactly where funds are at any moment rather than estimating based on banking timelines.

Your liquidity forecasts become accurate instead of conservative, which means you stop holding excess cash reserves to cover payments floating in the banking system.

How Integration Frees Your Team From Manual Work

The operational benefit compounds because your team stops spending time on exception handling and payment tracking. Your finance staff redirects capacity toward strategic work like optimizing payment timing or negotiating terms based on actual settlement speed rather than banking delays. Traditional banking forces your team to chase down missing transfers, call correspondent banks for status updates, and reconcile FX rate shifts that occur mid-transaction. Blockchain eliminates these tasks entirely because the system itself provides permanent records and immediate settlement confirmation.

When payment data flows directly into Salesforce, your team accesses transaction history without requesting records from multiple banks or reconstructing payment flows from scattered documentation. The system automatically logs every detail-sender, receiver, amount, timestamp, and verification hash-without manual intervention. Your staff no longer needs to maintain separate spreadsheets or external tracking systems to monitor payments in flight.

Compliance and Audit Trails That Work in Your Favor

Blockchain transactions create permanent, tamper-proof records that actually make compliance easier than traditional banking. Every payment sits on an immutable ledger with complete transaction details that cannot be altered. Your audit team gains complete transaction history without requesting records from multiple banks or reconstructing payment flows from scattered documentation.

When compliance and payments integrate within Salesforce, your team can run compliance checks before payments execute rather than investigating after the fact. KYC and AML screening happens automatically as part of the payment workflow, which means your finance team catches potential issues before funds move instead of discovering problems during quarterly audits. The audit trail requirement that banks struggle to meet becomes trivial because blockchain provides proof of every transaction automatically.

Organizations using real-time payment systems report faster audit cycles and reduced compliance risk because the technology itself creates the documentation that regulators require. Your compliance team can generate reports directly from transaction data without manual reconciliation or requesting historical records from banking partners. The immutable nature of blockchain records means your organization maintains proof of every transaction indefinitely, which simplifies regulatory inquiries and reduces the burden on your compliance staff.

Final Thoughts

Real-time cross-border payments deliver three concrete advantages that transform how your business operates. You recover 2% to 5% of transaction value by eliminating intermediaries, which means a $100,000 payment costs cents instead of thousands in hidden fees. Your cash position becomes transparent because settlement happens in minutes rather than days, allowing your team to manage liquidity accurately instead of holding excess reserves. Your finance staff redirects time from manual payment tracking toward strategic work like optimizing vendor terms and forecasting cash flow.

Getting started requires less disruption than you might expect because your team already works within Salesforce. Real-time cross-border payments integrate directly into your existing workflow rather than forcing adoption of separate platforms. Web3 Enabler built its platform as a native Salesforce application specifically for this reason, enabling your finance team to send stablecoin payments and track settlement without leaving your CRM. When you integrate blockchain payments into the systems your team already uses daily, adoption happens naturally because the technology becomes invisible.

Legitimate stablecoin transfers grew 80% from 2021 to 2024, reflecting real businesses adopting this technology for actual operations rather than speculation. Central banks and payment networks are building interoperability frameworks to connect blockchain rails with traditional banking infrastructure. Web3 Enabler helps financial institutions and enterprises integrate blockchain payments directly into Salesforce, enabling your team to send stablecoins, track settlements in real-time, and maintain full compliance without leaving your existing workflow.