Europe’s MiCA regulation is reshaping the stablecoin landscape, and businesses need to pay attention. The new rules are creating a clear divide between compliant and non-compliant digital currencies.

We at Web3 Enabler see this as a game-changer for companies looking to integrate blockchain payments. MiCA compliant stablecoins offer the stability businesses crave with the regulatory backing they need.

What MiCA Actually Changes

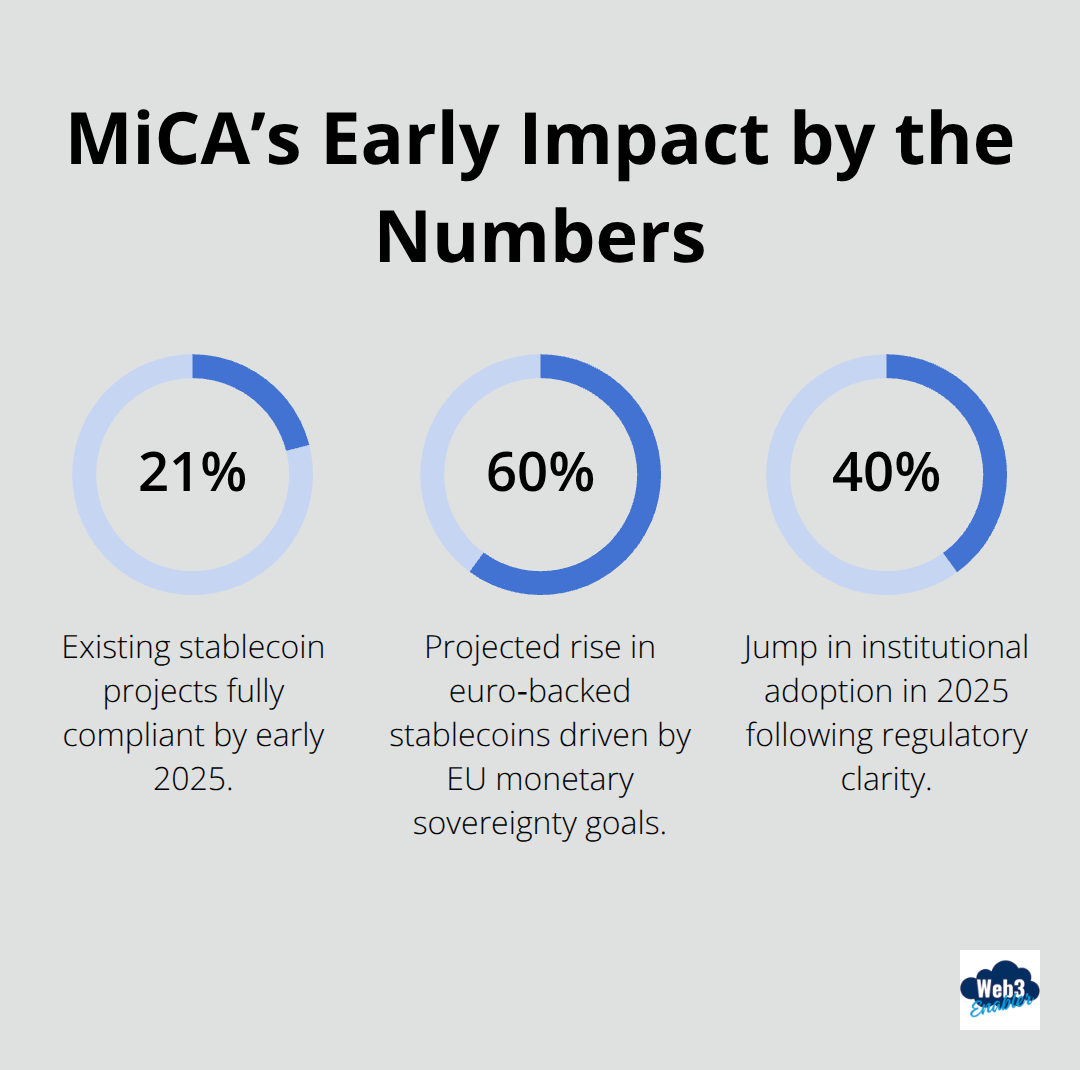

MiCA became fully applicable in December 2024, and the numbers tell a stark story. Only 21% of existing stablecoin projects satisfied full MiCA compliance standards by early 2025. This isn’t just regulatory theater – it’s a complete market restructure that forces real change across the industry.

The Hard Requirements That Matter

Stablecoin issuers under MiCA must hold 100% liquid reserves that back their entire supply – no exceptions, no creative accounting. The regulation prohibits interest payments on stablecoin balances to prevent them from competing with traditional savings instruments. Monthly audits are mandatory, and the European Central Bank holds veto rights over large stablecoin issuers deemed systemic risks.

These aren’t suggestions – they’re requirements with real consequences.

Timeline Reality Check

Non-EU issuers like Tether (USDT) and Circle (USDC) must meet these same standards to access the EU market. The compliance costs are real, making this a business-critical decision rather than a compliance checkbox. Fines for non-compliance reach €15 million or 3% of annual turnover (whichever is higher).

Market Impact Numbers

Euro-backed stablecoins are projected to rise by 60%, driven by the European Central Bank’s push for monetary sovereignty. This growth will particularly benefit cross-border transactions and international settlements.

This regulatory shake-up creates clear winners and losers in the stablecoin space. But which specific stablecoins actually meet these tough new standards?

Which Stablecoins Actually Pass MiCA Standards

The reality check hits hard: most stablecoins won’t survive MiCA’s requirements. Circle’s USDC leads the compliance race after it secured its Electronic Money Institution license in France and maintains full reserve transparency through monthly attestations by Grant Thornton. Circle invested heavily in EU infrastructure, established European operations, and partnered with regulated financial institutions to meet the 100% liquid reserve requirements. Their proactive approach paid off as institutional adoption continues to grow in Europe.

The European Newcomers That Command Attention

EURI stands out as the first euro-backed stablecoin that was designed specifically for MiCA compliance from day one. Banking Circle S.A. issues EURI under MiCA regulation, and each EURI token maintains 1:1 parity with the euro through cash deposits and low-risk liquid assets that licensed credit institutions hold. Users enjoy full legal redemption rights and fee-free transactions, and EURI operates on both Ethereum and BNB Smart Chain.

StablR’s USDR represents another smart play that achieved significant market growth while meeting strict European regulatory requirements for reserve backing. Monthly audits guarantee full backing, and integration with Oobit allows users to spend USDR anywhere Visa accepts payments worldwide.

The Compliance Cost Reality That Changes Everything

The numbers reveal the true barrier to entry: compliance costs under MiCA create significant challenges for stablecoin issuers, with regulators maintaining strict standards for applications. Numerous crypto firms have submitted license requests, but only established players with serious financial backing survive the process.

Non-compliant stablecoins face delisting risks that reduce market liquidity, creating a clear competitive advantage for compliant alternatives. The European Central Bank’s veto power over systemic risks means even compliant issuers must prove their operational resilience and financial stability continuously.

What This Means for Business Adoption

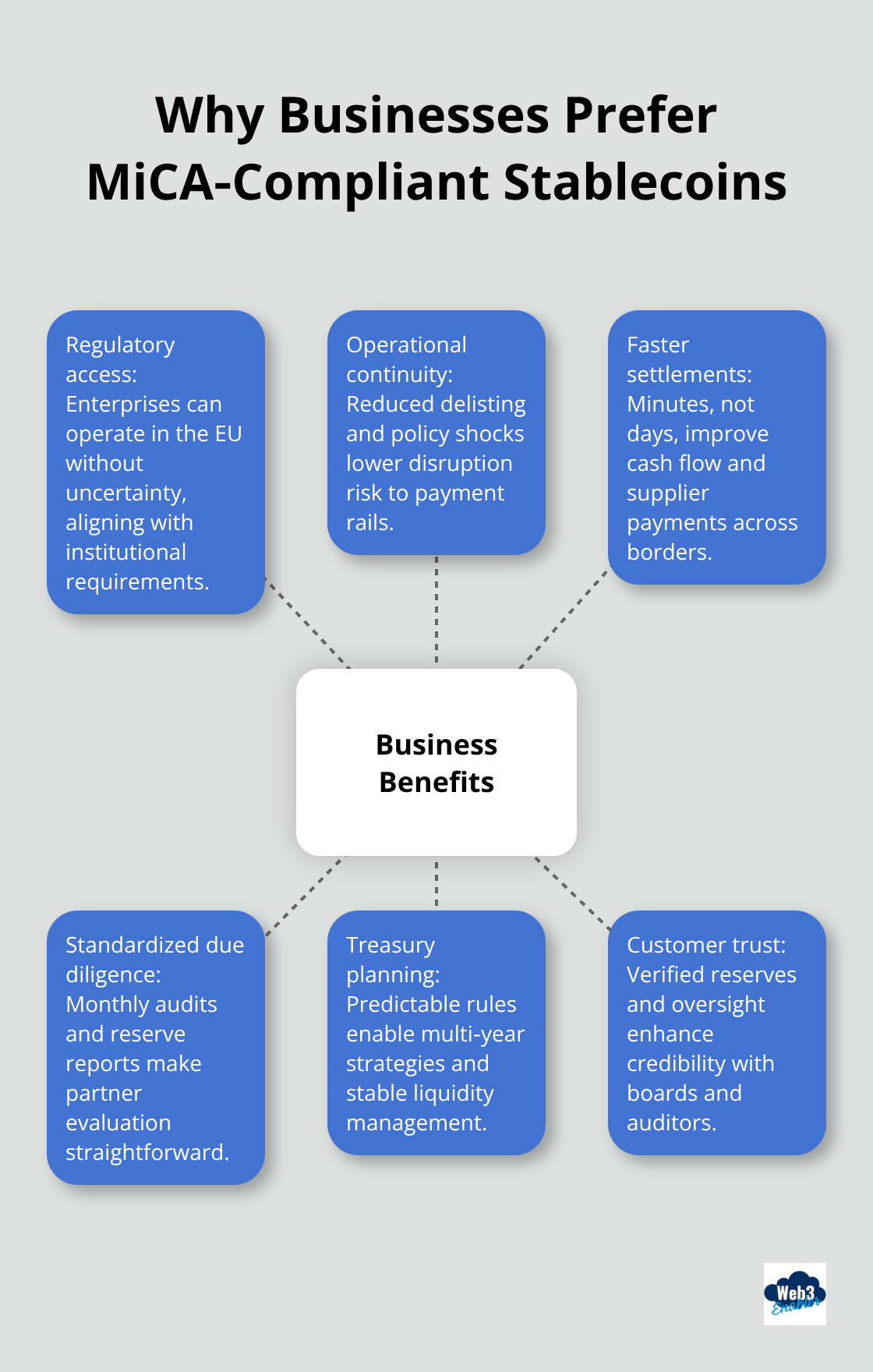

The compliance divide creates two distinct markets: regulated stablecoins that institutions trust and unregulated tokens that face increasing restrictions. Companies that choose MiCA-compliant options gain access to European markets without regulatory uncertainty, while those that stick with non-compliant alternatives risk operational disruptions and compliance headaches.

This regulatory clarity transforms how businesses approach stablecoin adoption, but what does this actually mean for your company’s bottom line and operational efficiency?

How MiCA Changes Business Operations

MiCA compliance transforms stablecoins from experimental payment tools into legitimate business infrastructure. Institutional adoption rates jumped 40% in 2025 due to clearer regulatory rules, and companies now integrate stablecoins into core payment systems without fear of regulatory backlash. The compliance framework eliminates the guesswork that previously kept CFOs awake at night.

Major corporations can finally justify stablecoin adoption to their boards because MiCA provides the regulatory certainty that enterprise risk management demands. Finance teams no longer need to explain why they chose experimental payment methods over traditional banking relationships.

Trust Becomes Measurable

The transparency requirements under MiCA create measurable trust metrics that businesses can evaluate with confidence. Monthly audits and mandatory reserve reports mean companies can verify stablecoin reserves in real-time rather than hope issuers tell the truth. This transparency reduces counterparty risk to levels that match traditional bank relationships.

Finance teams can now conduct proper due diligence on stablecoin partners with standardized compliance reports rather than rely on marketing materials and promises. The guesswork disappears when regulatory frameworks provide clear evaluation criteria.

Payment Speed Without Compliance Headaches

Transaction settlement times drop from days to minutes with MiCA-compliant stablecoins, and businesses can process international payments 24/7 without traditional bank hour restrictions. Cross-border logistics companies particularly benefit from instant settlement capabilities that improve cash flow management significantly.

The regulatory framework eliminates the compliance uncertainty that previously made stablecoin adoption risky for established businesses. Companies can now implement stablecoin payment systems with confidence they meet European regulatory standards from day one (no more legal department nightmares).

Risk Management Gets Simpler

MiCA compliance reduces regulatory risk to manageable levels because businesses know exactly which stablecoins meet European standards. Major EU-regulated platforms have either delisted USDT or limited it to “sell only” status, citing non-compliance with MiCA, which creates strong incentives for issuers to maintain compliance and protects businesses from sudden regulatory changes that could affect their payment infrastructure.

Companies can build long-term treasury strategies around MiCA-compliant stablecoins without worry about regulatory surprises that could disrupt operations. The predictable compliance framework allows CFOs to plan multi-year payment strategies with confidence rather than hope regulations won’t change overnight.

Final Thoughts

MiCA compliant stablecoins transform digital payments from experimental technology to enterprise-grade infrastructure. The regulatory framework removes uncertainty that kept businesses on the sidelines while it creates clear competitive advantages for companies that adopt compliant solutions early. Early adopters access faster payment rails, reduced compliance overhead, and enhanced customer trust before their competitors catch up.

Companies that implement MiCA compliant stablecoins now position themselves ahead of the regulatory curve while competitors scramble to understand compliance requirements. The transparency and audit requirements create operational advantages that extend beyond payments into treasury management and financial reporting. The 40% growth in institutional adoption demonstrates that businesses recognize the strategic value of regulated digital currencies over traditional payment methods.

The implementation path forward requires the right technology partner that understands both blockchain capabilities and enterprise requirements. Web3 Enabler connects MiCA compliant stablecoins with existing corporate infrastructure, which enables businesses to accept stablecoin payments and send global payments faster within their current systems. The regulated stablecoin era has arrived (and businesses that act decisively will capture the competitive advantages while others debate whether digital currencies belong in corporate treasury strategies).