Crypto asset allocation is reshaping the financial landscape, presenting both opportunities and challenges for advisors. At Web3 Enabler, we’ve seen firsthand how mastering this skill can set you apart in the competitive world of wealth management.

This guide will equip you with strategies to navigate the crypto market’s volatility while maximizing potential returns for your clients. We’ll explore key differences from traditional allocation methods and introduce cutting-edge tools to streamline your crypto portfolio management.

Understanding Crypto Asset Allocation

Defining Crypto Asset Allocation

Crypto asset allocation involves the strategic distribution of investments across various digital assets to balance risk and reward. At Web3 Enabler, we observe how this practice transforms the way financial advisors navigate the volatile crypto market.

The Dynamic Crypto Landscape

The crypto market moves at an unprecedented pace. This shift emphasizes the need for adaptable allocation strategies.

Crypto allocation differs from traditional methods in several key aspects:

- Heightened volatility: Price fluctuations occur frequently in crypto markets.

- Continuous trading: The absence of a closing bell results in non-stop market activity.

- Regulatory flux: Policy changes can occur rapidly, impacting asset values overnight.

Risk Management in the Crypto Space

Effective risk management in crypto requires a specialized approach. Key considerations include:

- Correlation analysis: Challenging its effectiveness as a portfolio diversifier.

- Liquidity risk: Even major cryptocurrencies face liquidity challenges.

- Counterparty risk: The FTX collapse in 2022 highlighted the importance of robust custody solutions. Hardware wallets or regulated custodians prove essential in mitigating this risk.

Practical Allocation Strategies

- The 5% rule: Many advisors initiate with a 5% allocation to crypto, adjusting based on individual client risk tolerance.

- Rebalancing frequency: Rebalancing is an important aspect of managing crypto portfolios.

- Stablecoin buffer: Allocating a portion of the crypto portfolio to stablecoins provides a cushion against volatility and enables quick repositioning.

Financial advisors must maintain agility in their crypto asset allocation strategies. The market’s rapid evolution demands continuous learning and adaptation. Tools like Web3 Enabler’s Salesforce integration provide real-time insights into clients’ crypto holdings, enabling more informed allocation decisions.

As we move forward, let’s explore specific strategies for crypto asset allocation that can help financial advisors optimize their clients’ portfolios in this dynamic market.

Strategies for Crypto Asset Allocation

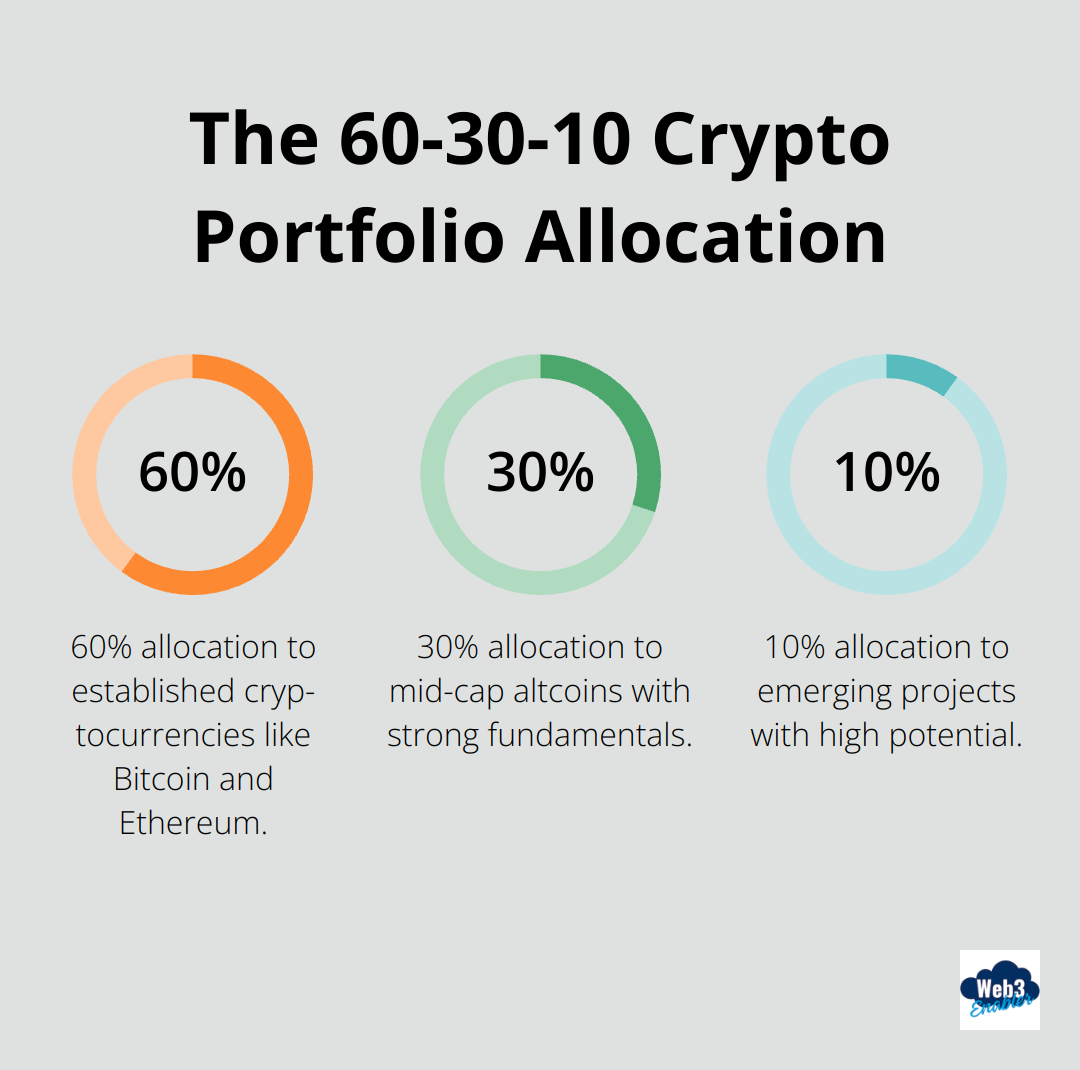

The 60-30-10 Approach

A balanced crypto portfolio can withstand market volatility and seize growth opportunities. The 60-30-10 approach offers an effective strategy for diversification:

- 60% in established cryptocurrencies (e.g., Bitcoin and Ethereum)

- 30% in mid-cap altcoins with strong fundamentals

- 10% in emerging projects with high potential

This allocation balances stability with growth potential. Bitcoin and Ethereum have proven track records and institutional support, while carefully selected altcoins can yield higher returns. The small allocation to emerging projects allows for potential outsized gains without risking the entire portfolio.

Stablecoins as Portfolio Stabilizers

Stablecoins play a vital role in portfolio management. An allocation of 10-20% to stablecoins (such as USDC or USDT) provides a buffer against volatility and enables quick repositioning during market shifts.

Stablecoins also offer attractive yield opportunities through lending platforms or decentralized finance (DeFi) protocols. However, financial advisors must thoroughly vet these platforms for security and regulatory compliance.

Exploring Blockchain-Based Assets

The blockchain ecosystem extends beyond cryptocurrencies. Consider allocating a portion of your portfolio to blockchain-based assets like:

- Non-fungible tokens (NFTs)

- Tokenized real estate

- Decentralized finance (DeFi) tokens

These assets provide unique exposure to different sectors of the blockchain economy. For example, DeFi tokens offer exposure to decentralized lending and borrowing markets, while NFTs represent ownership of digital art or virtual real estate.

Regular Rebalancing

Market volatility necessitates regular portfolio rebalancing. This practice ensures that your asset allocation remains aligned with your investment goals and risk tolerance. The frequency of rebalancing depends on market conditions and individual client needs (monthly, quarterly, or semi-annually).

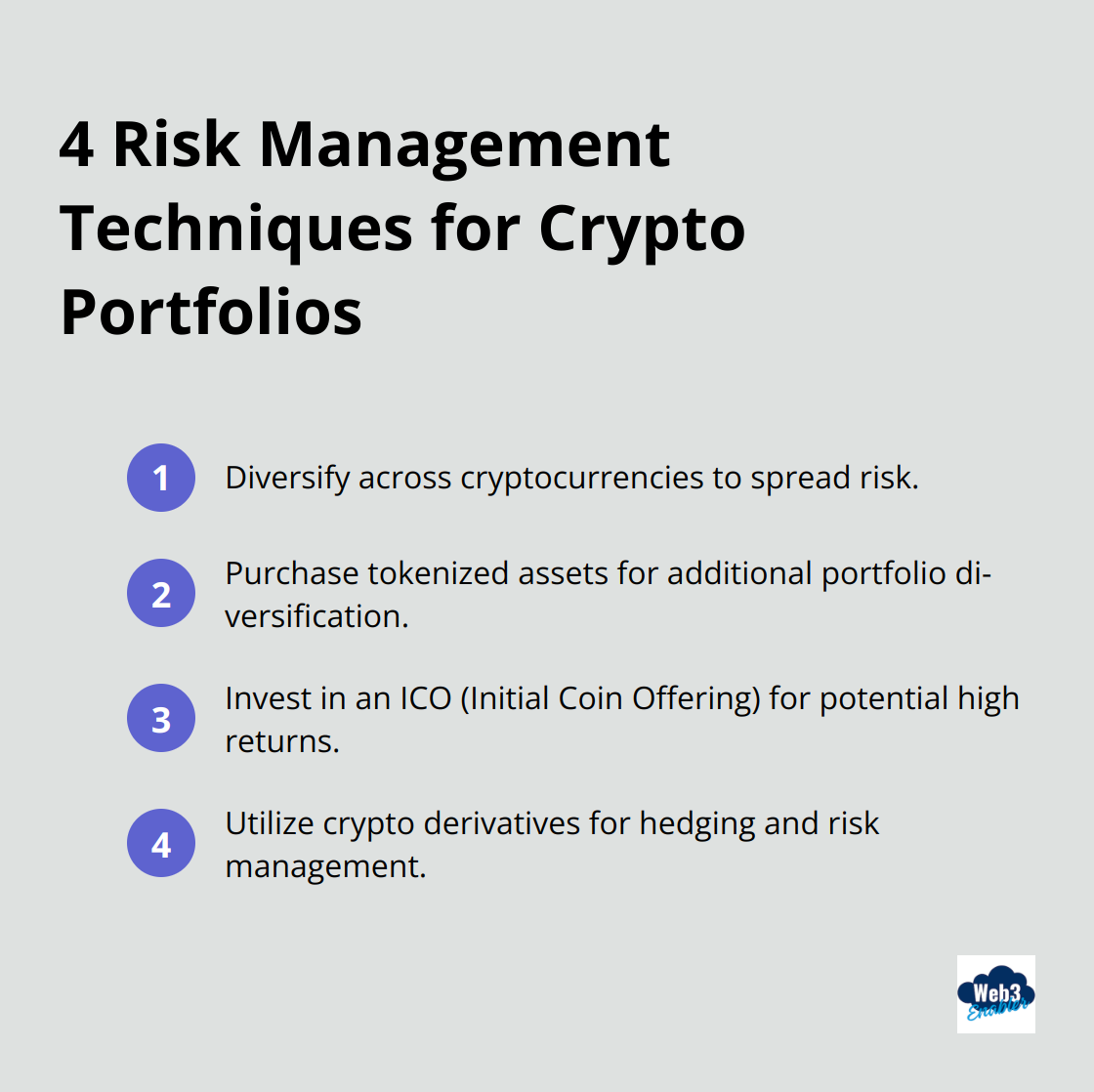

Risk Management Techniques

Implement risk management techniques to protect your crypto portfolio:

As the crypto landscape evolves, so should your allocation strategy. The next section will explore the tools and technologies that can help financial advisors effectively manage and monitor their clients’ crypto portfolios.

Streamlining Crypto Asset Management

The Evolution of Portfolio Tracking

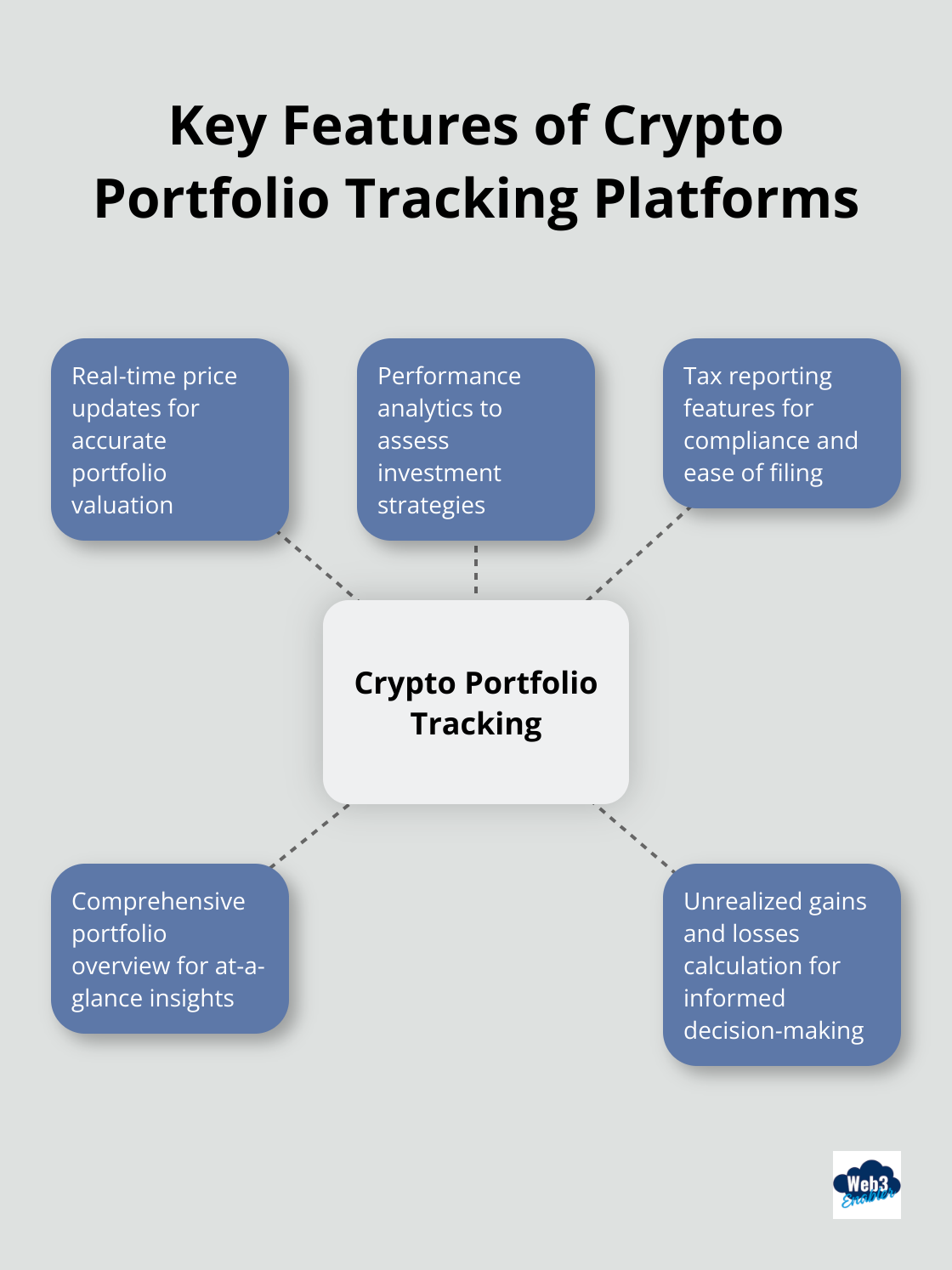

Financial advisors face unique challenges when managing crypto assets. The rapid pace of the market, coupled with the need for real-time data, demands robust tools and technologies. Crypto portfolio tracking platforms have become indispensable for financial advisors. These tools offer real-time price updates, performance analytics, and tax reporting features.

Popular platforms like CoinStats, CoinMarketCap, and CoinTracker provide comprehensive portfolio overviews, including unrealized gains and losses. However, these standalone solutions often lack integration with traditional financial systems, creating a disconnect in holistic wealth management.

Integrating Blockchain Data with Financial Systems

To overcome this challenge, forward-thinking advisors turn to solutions that integrate blockchain data with existing financial systems. This approach allows for a unified view of a client’s entire portfolio, including both traditional and crypto assets.

Web3 Enabler’s Salesforce integration stands out in this space. This solution brings crypto asset data directly into Salesforce, allowing advisors to manage all client assets from a single platform. The integration eliminates the need for manual data entry and reduces the risk of errors.

Real-time Insights for Informed Decisions

The volatile nature of crypto markets makes real-time data essential for effective asset management. Solutions that provide up-to-the-minute insights into clients’ crypto holdings enable advisors to make informed allocation decisions quickly.

For example, during the market downturn in early 2025, advisors using integrated platforms rebalanced client portfolios faster than those relying on manual tracking methods. This agility can make a significant difference in preserving client wealth during market turbulence.

The Future of Crypto Asset Management

Financial advisors must embrace these technological advancements to stay competitive in the evolving landscape of crypto asset management. Integrated solutions provide more comprehensive and responsive service to clients, ultimately driving better investment outcomes.

As the crypto market continues to mature, we expect to see more sophisticated tools emerge. These tools will likely incorporate artificial intelligence and machine learning to provide predictive analytics and automated rebalancing suggestions (based on predefined parameters).

Final Thoughts

Financial advisors must master crypto asset allocation to succeed in today’s market. The 60-30-10 method provides a solid foundation, while regular rebalancing helps navigate volatility. Advisors should stay informed about market trends and commit to ongoing education to provide the best service to their clients.

Advanced tools for crypto management are essential for comprehensive portfolio views. Web3 Enabler’s Salesforce integration offers real-time insights and streamlined management of crypto assets within Salesforce. This powerful tool enables advisors to make informed decisions quickly and efficiently.

The future of wealth management is digital. Financial advisors who embrace new technologies and master crypto asset allocation will thrive in this evolving landscape. They will deliver superior value to their clients and position themselves at the forefront of the industry (as early adopters of innovative solutions).