Blockchain technology is reshaping how businesses operate across every industry. Smart entrepreneurs are spotting massive opportunities to build profitable companies using this revolutionary technology.

We at Web3 Enabler see countless blockchain business ideas emerging daily. The key is identifying which opportunities offer the strongest potential for sustainable growth and real-world impact.

How Payment Processing Gets Disrupted by Blockchain

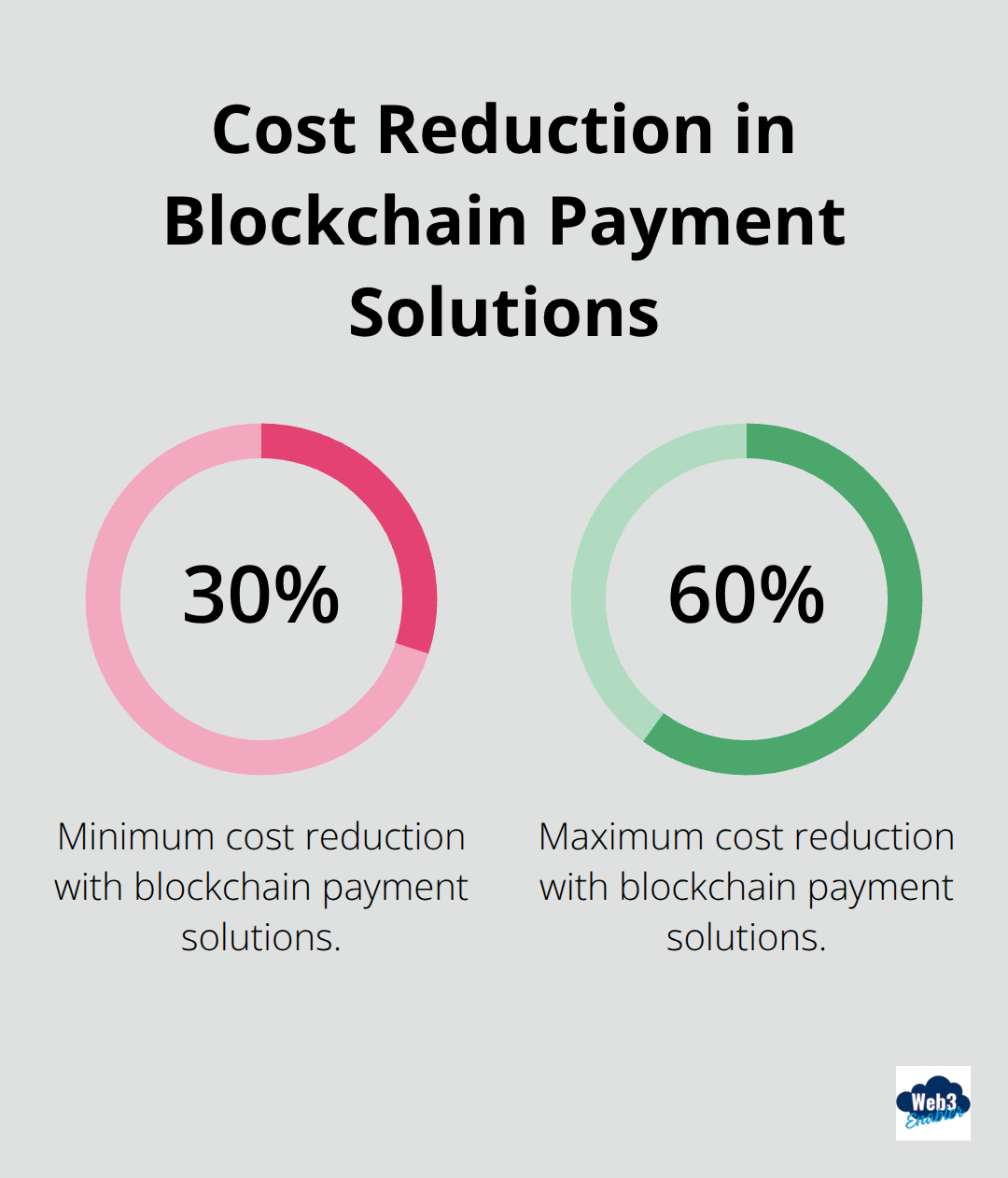

Payment processing faces a fundamental problem that blockchain solves perfectly. Traditional systems take days to settle, charge hefty fees, and create cash flow nightmares for businesses. Blockchain payment solutions cut settlement times from days to minutes while slashing costs by 30-60% according to recent Paystand research.

Stablecoin Processing Changes Everything for Online Stores

E-commerce businesses lose thousands monthly to payment processor fees and chargebacks. Stablecoin payments eliminate these pain points entirely. Transaction costs on layer-2 networks like Polygon average half a cent for small payments, compared to 2.9% plus fees from traditional processors.

Online retailers who process $100,000 monthly save roughly $2,900 in fees alone. The U.S. Treasury’s recent stablecoin oversight framework seeks public comment on potential regulations to provide regulatory clarity, which makes adoption safer for businesses. Customers pay instantly, merchants receive funds immediately, and chargebacks become impossible.

Global B2B Payments Get Faster and Cheaper

Cross-border business payments through traditional banks take 3-5 days and cost $15-50 per transaction. Blockchain payments complete in minutes for under $1. Companies that send $50,000 monthly to international suppliers save $750-2,500 in fees while they improve cash flow dramatically.

Fortune 100 companies explore blockchain payment strategies, with over 50% actively testing implementations. The speed advantage becomes massive when companies manage multiple international vendors across different time zones.

Invoice Management Becomes Automated

Manual invoice processing costs businesses $12-15 per invoice through administrative overhead. Blockchain payment links automate the entire process. Vendors embed payment links directly in invoices, which eliminates payment delays and reduces processing errors by 90%.

Finance teams cut monthly closure time by 40% because blockchain transactions provide instant audit trails. Freelancers and contractors receive payments within hours instead of waiting weeks for check processing (traditional methods often require multiple approval steps).

These payment innovations represent just the beginning of blockchain’s business transformation. Supply chain operations face similar inefficiencies that blockchain technology addresses with equal effectiveness.

How Supply Chains Become Fraud-Proof Through Blockchain

Counterfeit Products Cost Billions Annually

Counterfeit goods cause significant global economic losses, with businesses losing money on fake products that fail to meet expectations or disappear quickly. Luxury brands lose 10-15% of revenue to fake products, while pharmaceutical counterfeits kill 200,000 people yearly. Blockchain creates immutable product records that make counterfeits nearly impossible to produce.

Each authentic product receives a unique digital fingerprint stored on the blockchain. Customers scan QR codes to verify authenticity instantly, while retailers track every item from manufacturer to final sale. This system eliminates the guesswork that allows fake products to enter legitimate supply chains.

Supply Chain Visibility Eliminates Operational Blindness

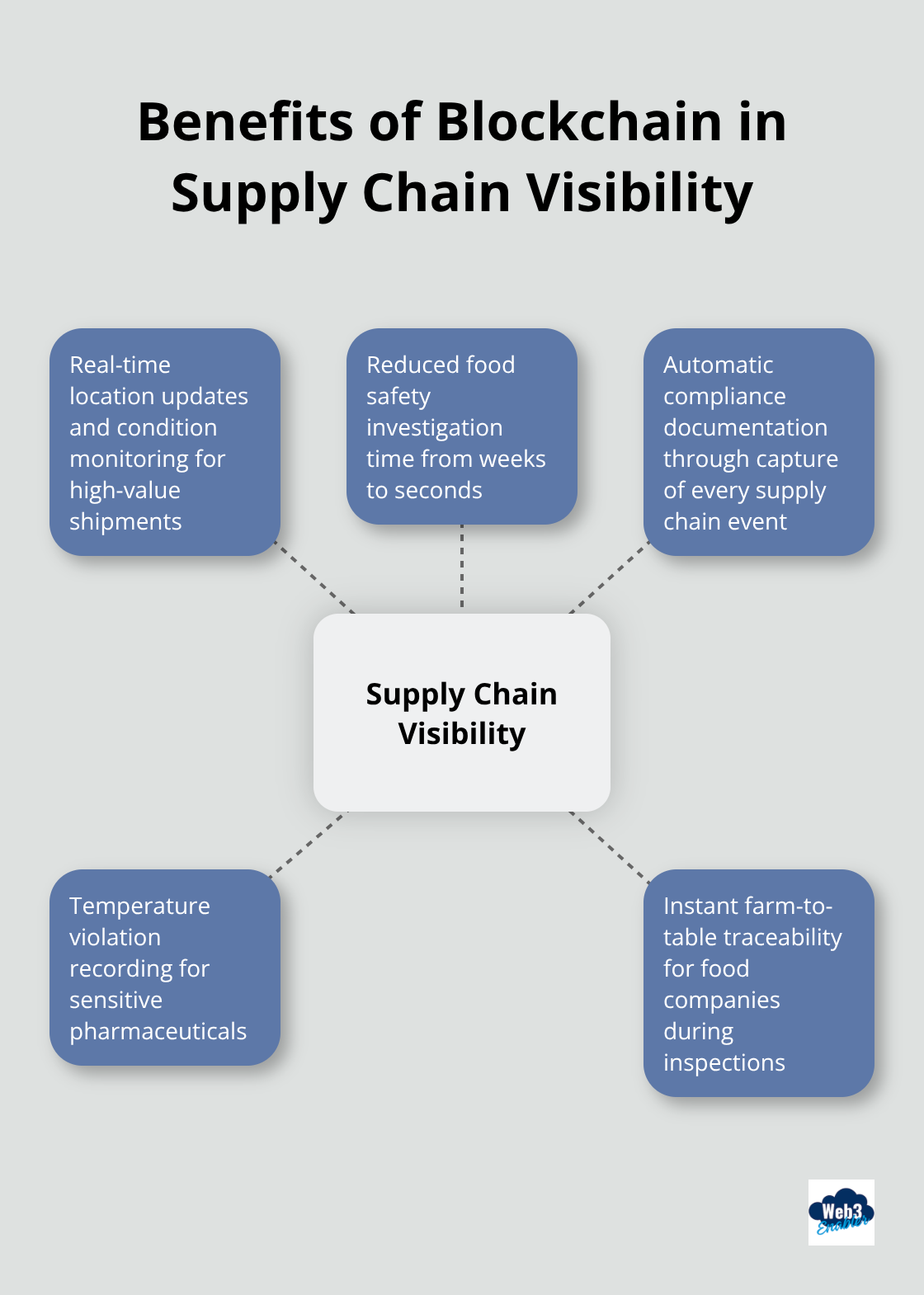

Companies lose $62 billion annually to supply chain disruptions because they lack real-time visibility. Traditional systems update every 24-48 hours, which creates dangerous information gaps. Blockchain provides minute-by-minute location updates and condition monitoring for high-value shipments.

Walmart reduced food safety investigation time from weeks to seconds through blockchain tracking. Temperature-sensitive pharmaceuticals maintain compliance automatically through sensor integration that records temperature violations permanently on-chain. This level of transparency prevents costly recalls and protects brand reputation.

Regulatory Compliance Becomes Automatic

Manual compliance reporting costs large manufacturers $3.5 million annually per facility according to McKinsey research. Blockchain automates compliance documentation through automatic capture of every supply chain event. Regulatory audits that previously required months of document gathering now complete in days.

Food companies demonstrate farm-to-table traceability instantly during FDA inspections. Automotive manufacturers prove parts authenticity without manual paperwork searches. This automation reduces compliance costs by 60% while accuracy rates improve to 99.9% (compared to 85% for manual systems).

These supply chain innovations create transparent, efficient operations that build customer trust. Financial services present equally compelling opportunities for blockchain entrepreneurs who want to transform how businesses manage money and investments.

How Financial Services Transform Through Blockchain Innovation

Portfolio Management Gets Professional Grade Tools

Traditional cryptocurrency portfolio management forces businesses to juggle multiple exchanges, wallets, and spreadsheets. This fragmented approach costs financial advisors 15-20 hours weekly on manual data entry and reconciliation. Professional-grade portfolio management tools built on blockchain infrastructure eliminate this administrative burden entirely.

Real-time portfolio tracking across all major exchanges and DeFi protocols provides advisors with complete client visibility in one dashboard. Asset managers report 40% time savings when they switch from manual tracking to automated blockchain-based solutions. Client reports that previously required days of data compilation now generate instantly with accurate real-time valuations.

Decentralized Lending Markets Bypass Traditional Banking Bottlenecks

Traditional business loans require weeks of paperwork, credit checks, and approval processes. Blockchain-based platforms complete loan origination in hours through automated collateral verification and smart contract execution. Small businesses access working capital at 5-12% annual rates compared to 15-25% from traditional lenders.

Collateralized loans eliminate credit score requirements because blockchain assets secure loans automatically. DeFi protocols have grown significantly, with TVL metrics serving as key indicators for assessing decentralized finance project quality. Business owners pledge cryptocurrency holdings as collateral to access immediate cash flow without selling appreciating assets (this preserves long-term investment positions while solving short-term liquidity needs).

Identity Verification Eliminates KYC Friction

Financial services spend $500 million annually on Know Your Customer compliance according to Thomson Reuters research. Traditional identity verification takes 3-5 business days and requires customers to submit documents repeatedly to different service providers. Blockchain-based identity systems create reusable digital credentials that customers control completely.

Once verified on-chain, customers authenticate instantly with any participating financial service provider. Banks reduce onboarding costs by 70% through blockchain identity verification while customer satisfaction increases dramatically. Regulatory compliance improves because identity records remain tamper-proof and auditable.

Cross-border financial services benefit most because blockchain identity works globally without country-specific documentation requirements. This technology particularly helps fintech companies expand internationally without building separate compliance infrastructure for each jurisdiction (which traditionally costs millions in regulatory setup fees).

Final Thoughts

The blockchain business ideas we explored represent a $943 billion market opportunity by 2032. Payment processing, supply chain transparency, and financial services offer the strongest entry points for entrepreneurs ready to build profitable blockchain companies. These sectors provide measurable advantages that translate directly into cost savings and operational efficiency.

Your blockchain implementation requires three strategic steps to succeed. First, identify specific pain points in your target market where blockchain provides clear advantages over traditional methods. Second, choose proven platforms that offer interoperability across multiple networks to avoid vendor lock-in risks (this protects your long-term investment). Third, launch small-scale pilots to demonstrate value before you scale operations.

We at Web3 Enabler help businesses navigate this transformation through our native Salesforce blockchain solutions. Over 50% of Fortune 100 companies actively explore blockchain strategies, while transaction costs drop 30-60% compared to traditional methods. Entrepreneurs who build blockchain solutions today position themselves perfectly for the next wave of business transformation that will reshape entire industries.