Traditional banks love making international transfers feel like rocket science – complete with astronomical fees and glacial processing times.

Traditional banks love making international transfers feel like rocket science – complete with astronomical fees and glacial processing times.

Cross border payments crypto solutions flip this script entirely. We at Web3 Enabler see businesses cutting transfer costs by up to 90% while settling payments in minutes instead of days.

The old system is broken, but the fix is surprisingly simple.

Why Traditional Cross Border Payments Are Broken

Traditional cross border payments are a masterclass in inefficiency. Banks charge between $25 to $35 per transaction according to industry data, but that’s just the start. Hidden exchange rate markups add another 2-4% on top of advertised fees. KPMG research shows approximately $150 trillion moves annually through these sluggish correspondent banking networks, which creates massive profits for intermediaries while businesses absorb the costs.

The Multi-Day Payment Marathon

Speed reveals where traditional systems really show their age. Wire transfers take 3-5 business days for standard processing, with some international transfers that stretch to two weeks. Each transaction bounces between multiple correspondent banks, which creates delays at every hop. JPMorgan processes around $2 billion daily on blockchain platforms precisely because traditional rails move too slowly for modern business needs.

Compliance Paperwork Overload

Documentation requirements turn simple payments into administrative nightmares. Banks demand detailed invoices, compliance certificates, and purpose codes for each transfer. Anti-money laundering regulations force manual reviews that add days to processing times. The FSB’s four-point action plan addresses declining correspondent banking relationships specifically because smaller banks can’t handle the compliance burden (this creates payment deserts where businesses struggle to access basic international transfer services).

The Real Cost of Broken Infrastructure

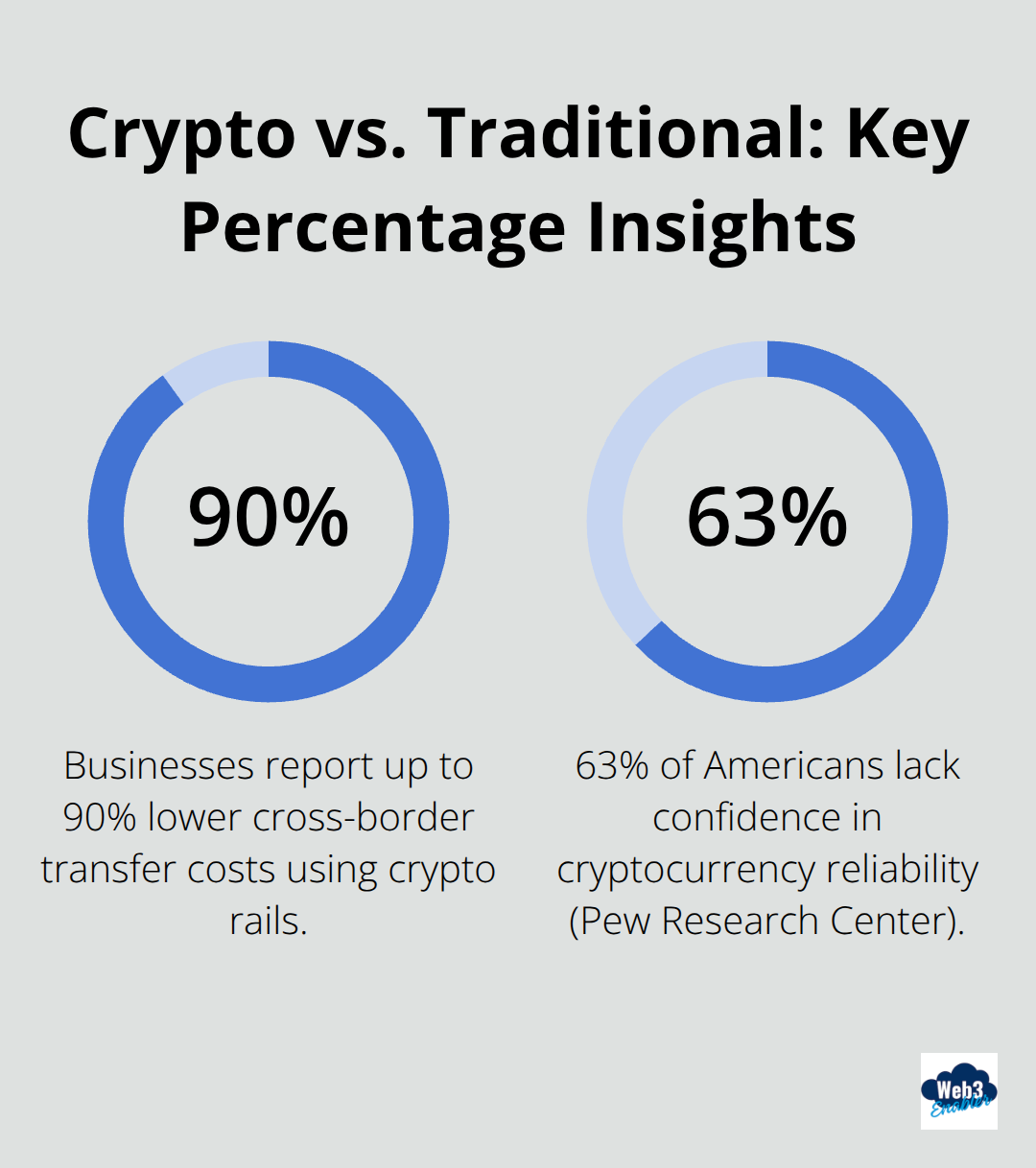

The current system traps capital in nostro and vostro accounts, which requires banks to prefund international transfers. This inefficiency gets passed directly to customers through higher fees and slower service. Pew Research Center found 63% of Americans lack confidence in cryptocurrency reliability, but traditional banking’s track record on cross border payments is objectively worse. The system works for banks that collect fees at every step, not for businesses that try to operate globally.

Fortunately, crypto technology offers a completely different approach that addresses each of these fundamental problems.

How Crypto Transforms International Money Transfers

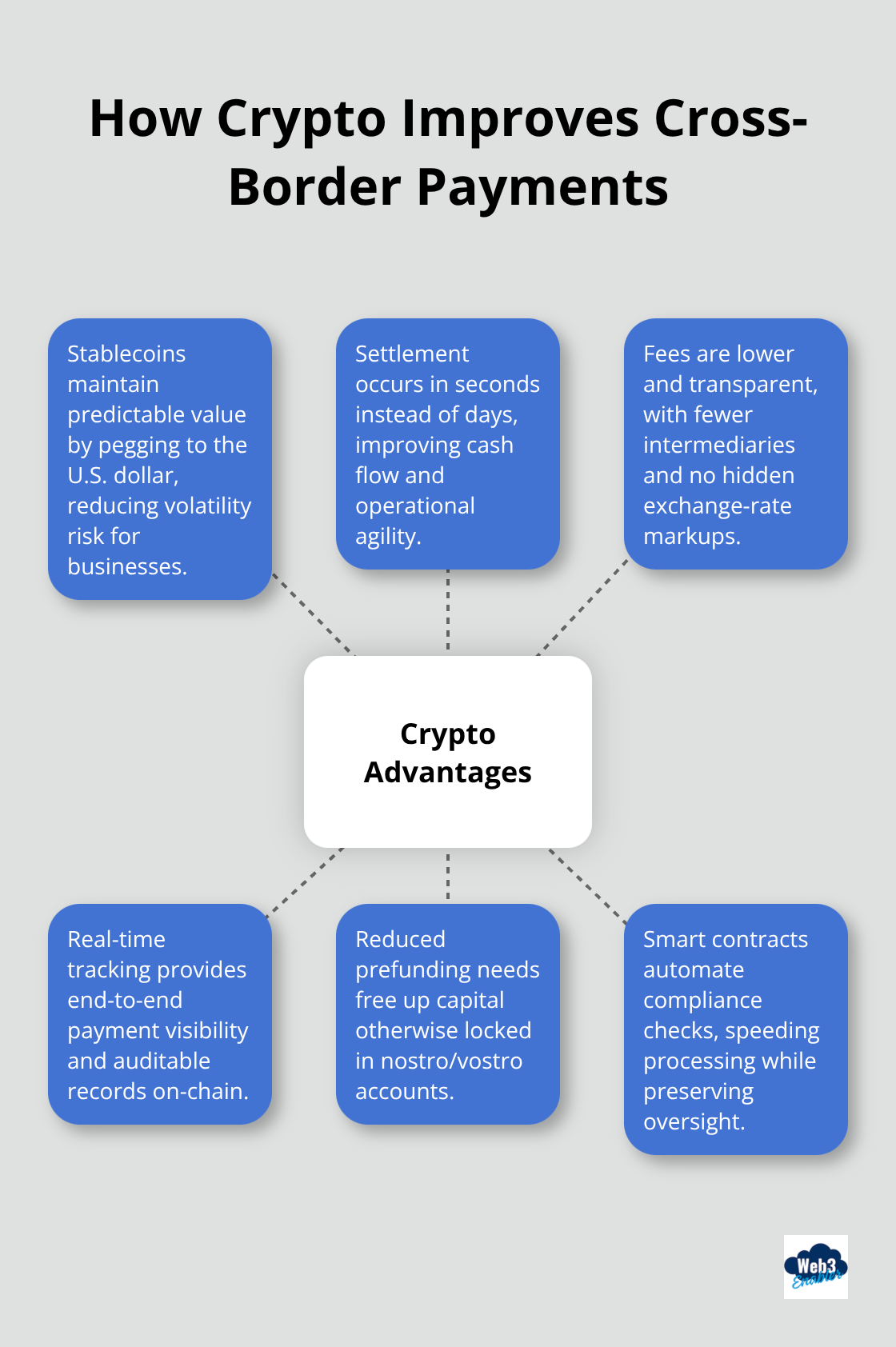

Crypto solves the three biggest problems that make traditional banking so frustrating for international transfers. Stablecoins like USDC eliminate volatility by pegging to the US dollar, which means your $10,000 payment stays $10,000 throughout the entire transfer process. PayPal’s stablecoin launched in 2023 and already hit $1.17 billion in market cap because businesses finally found a digital currency that doesn’t fluctuate wildly during transactions.

Stablecoins Eliminate Volatility Concerns

Traditional cryptocurrencies swing wildly in value, but stablecoins maintain stable prices by backing each token with reserve assets. This stability makes them perfect for business payments where predictable values matter more than speculative gains. The GENIUS Act aims to regulate stablecoins by limiting reserve assets to highly liquid items, which enhances their safety and reliability for commercial use.

Near-Instant Settlement Times

KPMG reports stablecoins reduce settlement times from several days to mere seconds, which transforms how businesses manage cash flow. JPMorgan processes $2 billion daily on blockchain platforms specifically because traditional correspondent banking creates unnecessary delays. The stablecoin market reached $19.4 billion in transaction volume year-to-date in 2025 according to industry data, proving businesses prefer instant settlement over multi-day processing.

Real-time tracking through blockchain systems provides complete visibility into payment status (unlike traditional wire transfers that disappear into correspondent banking black holes for days). Smart contracts automate many compliance checks, which speeds up processing while maintaining regulatory oversight.

Lower Transaction Costs and Transparent Fees

Transaction costs drop dramatically with crypto payments. KPMG research shows stablecoins can reduce cross-border payment costs significantly compared to traditional methods that charge $25-$35 per transaction plus hidden exchange rate markups. Lower prefunding requirements eliminate the need for banks to tie up capital in nostro accounts, which directly reduces costs passed to customers.

Blockchain technology removes multiple intermediaries from each transaction, which streamlines operations while maintaining transparency and auditability that traditional systems simply cannot match. Fees are transparent and predictable (no surprise charges appear days later like with traditional banking).

Now that you understand how crypto payments work better than traditional methods, the next step involves setting up these systems for your specific business needs.

Setting Up Crypto Cross Border Payments for Your Business

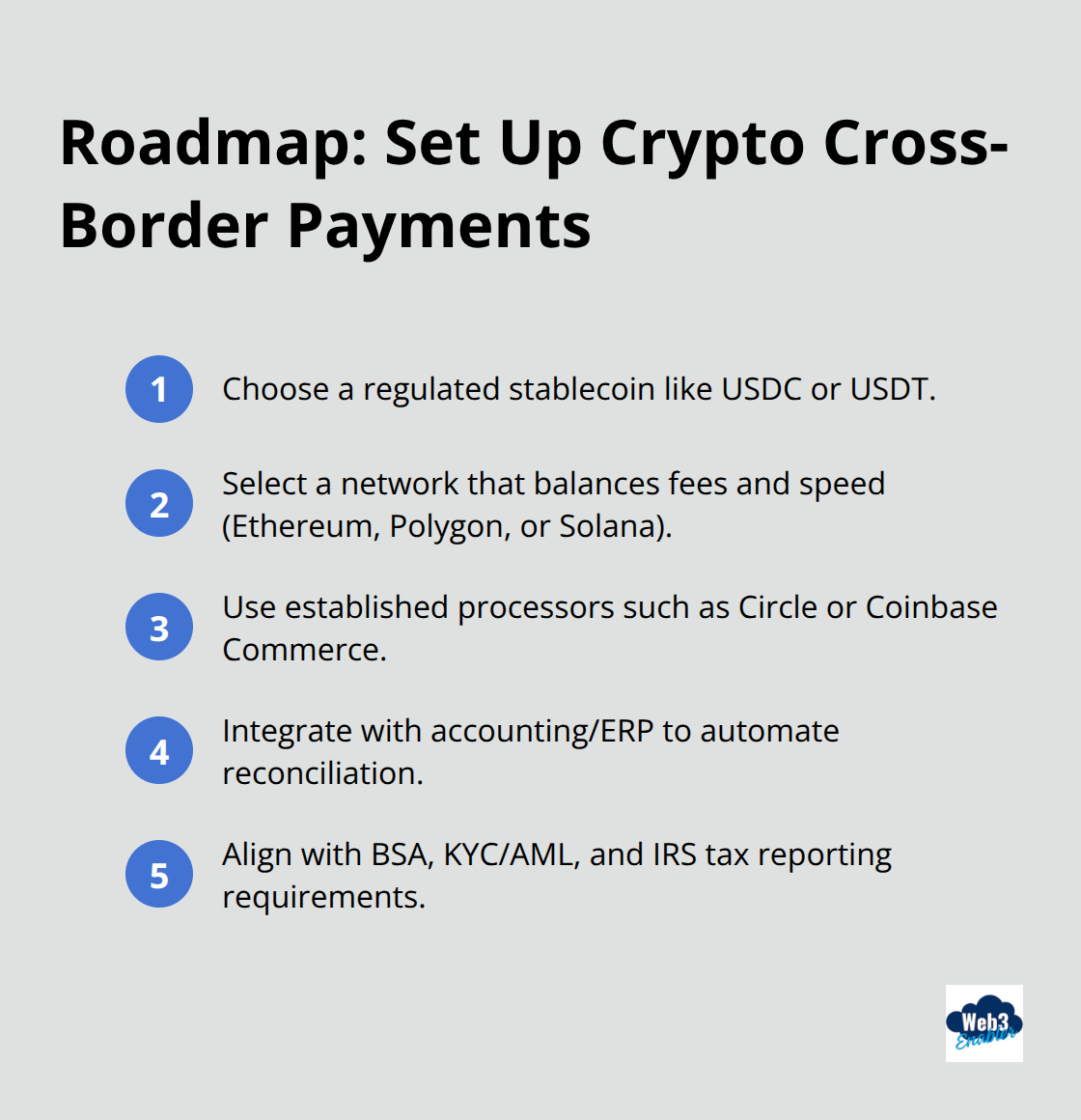

Setting up crypto cross border payments requires three strategic decisions that determine your success. Start with USDC or USDT as your stablecoin choice since these maintain dollar parity and offer the most liquidity across major exchanges. Ethereum provides the most extensive infrastructure but costs $15-30 per transaction during network congestion. Polygon reduces fees to under $1 per transaction while maintains Ethereum compatibility, which makes it the smart choice for frequent payments.

Solana processes transactions for pennies but has fewer bank connections than Ethereum-based networks.

Choose Your Stablecoin and Network

Your stablecoin selection impacts everything from transaction costs to regulatory compliance. USDC offers the strongest regulatory backing with regular attestations from major accounting firms. USDT provides the highest liquidity across global exchanges but faces more regulatory scrutiny. PayPal has expanded its PYUSD stablecoin to nine new blockchains, proving institutional demand for regulated digital currencies.

Network selection determines your operational costs and speed. Ethereum processes the most stablecoin volume but charges premium fees during peak usage. Polygon delivers Ethereum compatibility at fraction of the cost (making it perfect for businesses that process multiple payments daily). Solana offers the fastest settlement times but requires more technical expertise to implement properly.

Integrate with Your Financial Systems

Your existing accounting software needs direct connection with blockchain networks to avoid manual reconciliation headaches. QuickBooks Enterprise and SAP already support crypto payment modules, while smaller businesses can use payment processors like Circle or Coinbase Commerce that handle blockchain complexity behind user-friendly interfaces. Never build custom blockchain connections from scratch unless you have dedicated development resources.

Most businesses waste months trying to code their own solutions when proven payment rails already exist. Your bank relationships matter more than technical preferences since you still need fiat off-ramps for local operations. Choose processors that offer direct bank deposits to maintain smooth cash flow management.

Meet Regulatory Requirements

Regulatory compliance becomes manageable when you follow established frameworks instead of guessing at requirements. The Bank Secrecy Act requires reporting crypto transactions over $10,000, just like traditional wire transfers. Document every payment with sender information, recipient details, and business purpose to satisfy anti-money laundering requirements.

Choose stablecoin issuers that publish regular attestations of their reserves since unaudited tokens create regulatory red flags. Most countries allow crypto payments for business expenses but require local currency for employee salaries (so structure your payment flows accordingly). Track fair market value at payment time for tax reporting since the IRS treats crypto as property for tax purposes.

Final Thoughts

Cross border payments crypto solutions deliver measurable advantages that traditional banks cannot match. Businesses cut transaction costs by up to 90% while they settle payments in seconds instead of days. Stablecoins eliminate volatility concerns while blockchain technology provides transparent tracking and lower fees than correspondent networks.

Success depends on how you choose the right stablecoin and network combination for your transaction volume. USDC on Polygon offers the best balance of regulatory compliance and cost efficiency for most businesses. Integration with existing financial systems requires proven payment processors rather than custom development approaches (which often create more problems than they solve).

Major financial institutions already process billions daily on blockchain platforms, which proves institutional adoption accelerates rapidly. We at Web3 Enabler provide Salesforce Native blockchain solutions that connect crypto payments with existing corporate infrastructure. The future belongs to businesses that adopt efficient payment technologies today rather than wait for traditional banks to modernize.

![Ensuring Regulatory Compliance in Crypto Transactions [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-compliance-hero-1758197377.jpeg)