Central bank digital currency bills are popping up faster than crypto X/Twitter drama, and honestly? Most people have no clue what they’re reading.

We at Web3 Enabler think it’s time to change that. These legislative documents will reshape how money moves through our economy, so understanding them isn’t just smart-it’s essential for anyone in business or finance.

What Makes CBDC Bills Different From Regular Financial Laws?

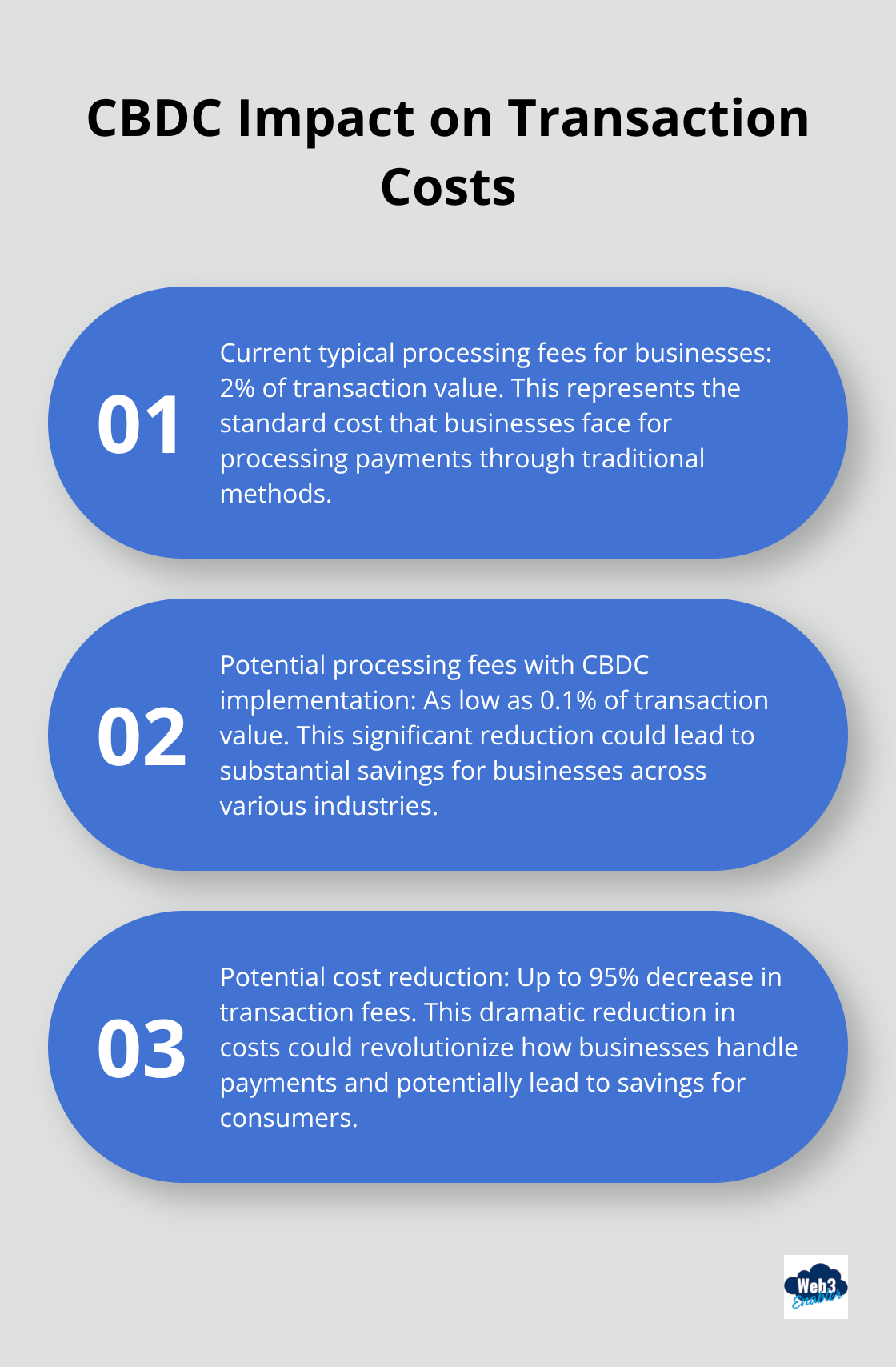

CBDC legislation stands apart from traditional financial regulations in three fundamental ways that business leaders must grasp. First, these bills establish direct relationships between central banks and consumers, which bypass commercial banks entirely in some scenarios. The Federal Reserve’s research shows this could reduce transaction costs from typical 2% processing fees to as low as 0.1% for businesses. Second, CBDC bills include programmable money features that allow governments to control how and when digital currency gets spent – something impossible with physical cash or traditional bank transfers.

Technical Infrastructure Requirements

CBDC bills mandate specific blockchain infrastructure that traditional banking laws never addressed. The European Central Bank’s digital euro preparation phase involves 70 fintech companies that build new payment rails from scratch. These bills require real-time settlement capabilities, quantum-resistant encryption, and offline transaction functionality. Most importantly, they establish legal frameworks for digital wallets that operate independently of existing banking systems. Traditional financial regulations assume bank intermediaries handle transactions, while CBDC bills create direct peer-to-peer payment systems backed by central bank guarantees.

Surveillance and Control Mechanisms

The privacy implications in CBDC legislation go far beyond anything in traditional banking laws. China’s digital yuan demonstrates programmable expiration dates and geographic spending restrictions – features that would be illegal under conventional financial regulations. CBDC bills typically include provisions for transaction monitoring that make current anti-money laundering requirements look primitive. Nigeria’s eNaira system tracks every transaction in real-time, which gives the central bank unprecedented visibility into economic activity. Traditional banking laws focus on reporting suspicious activities, while CBDC bills enable preemptive transaction blocking and real-time economic intervention.

Cross-Border Payment Revolution

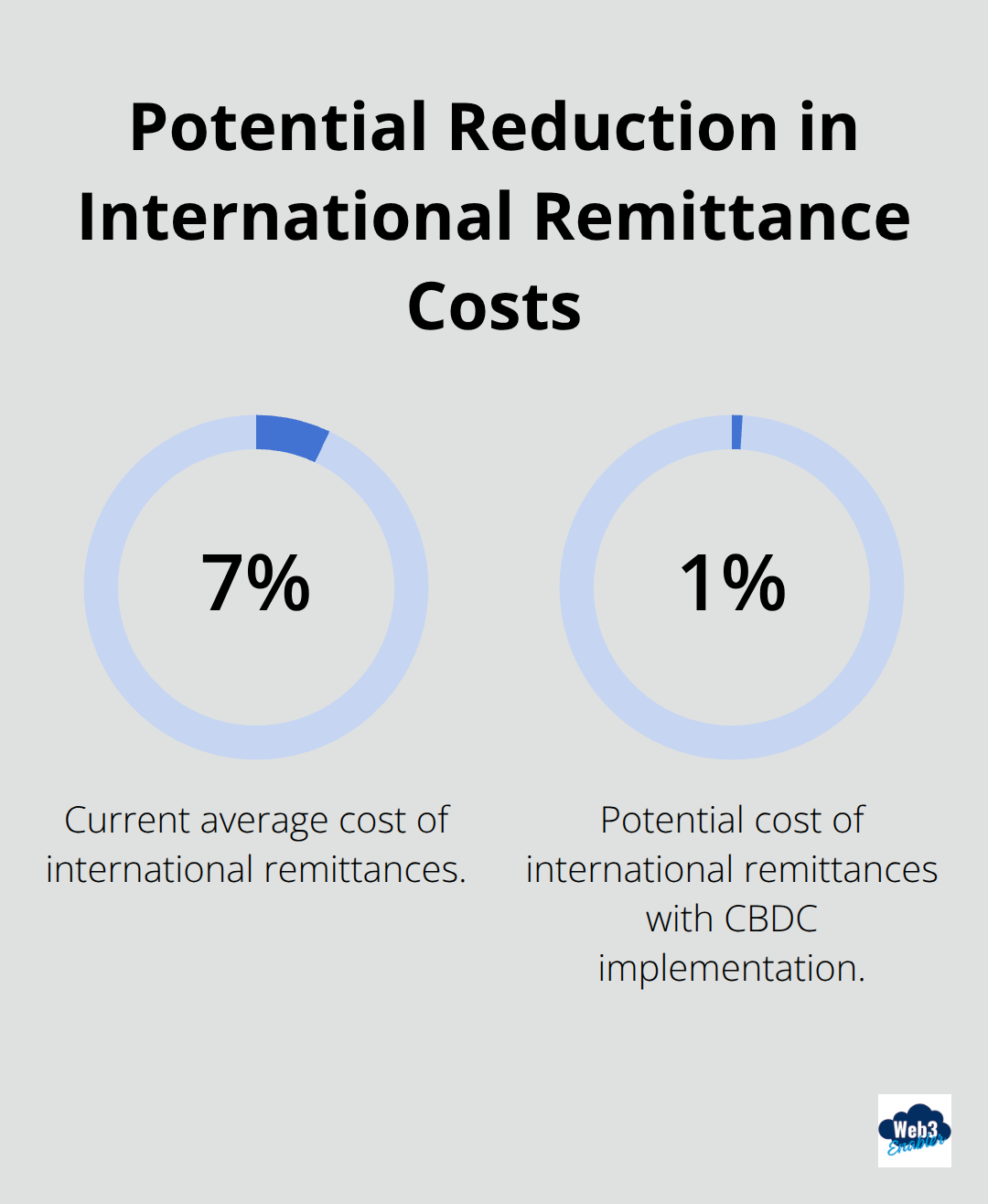

CBDC bills also tackle international payments in ways traditional banking laws never attempted. The Bahamas’ Sand Dollar demonstrates how CBDCs can facilitate instant cross-border transfers without correspondent banking networks. These bills establish new legal frameworks for currency interoperability between nations, potentially reducing the 7% average cost of international remittances to under 1%. Traditional banking regulations require multiple intermediaries for cross-border payments, but CBDC legislation creates direct central bank-to-central bank settlement systems that could transform global commerce within the next decade.

What Are the Real CBDC Bills Worth Reading?

The United States took a dramatically different path in 2025 with the Anti-CBDC Surveillance State Act, which explicitly prohibits the Federal Reserve from issuing any public digital currency. This legislation reflects deep concerns about government surveillance and programmable money controls. Instead, the GENIUS Act signed shortly after establishes strict regulations for privately-issued dollar-backed stablecoins, requiring full reserve backing and consumer protections.

The Federal Reserve now focuses exclusively on research into payment system improvements rather than development of a public digital dollar, which puts America at odds with global trends where 134 countries (representing 98% of global GDP) actively explore CBDCs.

Europe’s Privacy-First Digital Euro Framework

The European Central Bank’s digital euro legislation prioritizes privacy preservation above all other features, positioning it as a direct competitor to China’s surveillance-heavy system. Since November 2023, the preparation phase involves approximately 70 fintech companies that build infrastructure scheduled to conclude in late 2025. The ECB framework explicitly limits transaction monitoring capabilities and includes offline payment functionality to protect user privacy. European legislation mandates that digital euro transactions remain as private as cash payments, which creates technical challenges but demonstrates Europe’s commitment to financial privacy rights. This approach directly counters both Chinese programmable controls and American private stablecoin models.

China’s Advanced Programmable Currency System

China’s Digital Currency Electronic Payment project represents the most sophisticated CBDC implementation globally, with over 180 million personal wallets registered by 2024. Chinese legislation enables programmable features like expiration dates, geographic spending restrictions, and real-time economic intervention capabilities that would be impossible with traditional currencies. The digital yuan framework allows the People’s Bank of China to monitor every transaction instantly and implement targeted monetary policy at the individual level. This system demonstrates how CBDC bills can fundamentally reshape monetary policy tools, giving central banks unprecedented control over economic activity and consumer spending patterns.

Nigeria and Jamaica’s Implementation Lessons

Nigeria’s eNaira had NGN 18.31 billion in circulation by early 2025, though it represented only 0.37% of total Nigerian cash despite ambitious government promotion. Jamaica’s JAM-DEX became legal tender in mid-2024, focusing on enhanced financial inclusion despite modest initial uptake. Both countries provide real-world data on how CBDC legislation translates into actual adoption rates and economic impact. These implementations reveal the gap between legislative frameworks and public acceptance that other nations must consider when drafting their own CBDC bills.

Now that you understand which bills matter most globally, the next step involves knowing exactly what to look for when you actually read these complex legislative documents.

What Should You Look For in CBDC Bills?

CBDC legislation demands your attention on three critical areas that will directly impact how your business operates in the digital currency era. Privacy provisions represent the most contentious battleground, with China’s digital yuan that enables real-time transaction monitoring and programmable spending restrictions, while Europe’s digital euro framework explicitly limits surveillance capabilities to cash-equivalent levels.

Privacy and Surveillance Controls

The European Central Bank’s legislation mandates offline payment functionality and prohibits transaction tracking beyond anti-money laundering requirements. This creates a stark contrast with systems that allow governments to monitor every purchase. China’s framework demonstrates how CBDCs can track individual spending patterns and implement geographic restrictions on transactions. Nigeria’s eNaira system provides central banks with unprecedented visibility into economic activity through real-time monitoring capabilities that exceed traditional banking surveillance.

Financial Institution Compliance Requirements

Compliance requirements vary dramatically between jurisdictions, with the United States GENIUS Act that requires stablecoins to maintain full reserve backing and undergo regular audits. Jamaica’s JAM-DEX legislation allows banks to integrate CBDC services without additional licensing requirements. Nigeria’s eNaira framework demonstrates how compliance costs can impact mid-sized financial institutions due to real-time reporting requirements. The Bahamas Sand Dollar legislation requires financial institutions to implement new KYC procedures specifically designed for digital currency transactions.

Cross-Border Payment Revolution

Cross-border payment provisions in CBDC bills will revolutionize international trade by eliminating correspondent banking networks that currently charge high fees for remittances. The Bahamas Sand Dollar legislation enables instant international transfers with reduced transaction costs, while traditional wire transfers take several business days and involve significant fees per transaction. China’s digital yuan framework includes provisions for direct central bank settlements with participating nations (bypassing SWIFT networks entirely) and reduces settlement times from days to seconds. European digital euro legislation establishes technical standards for cross-border CBDC exchanges that could process international payments at domestic transaction speeds.

Final Thoughts

Central bank digital currency bills will reshape business operations through three key elements. Privacy provisions determine whether governments monitor transactions in real-time or maintain cash-equivalent anonymity. Financial institution compliance requirements establish new operational costs and technical infrastructure needs, while cross-border payment frameworks eliminate traditional correspondent banking networks and reduce international transfer costs from 7% to under 1%.

The business impact extends far beyond payment processing as companies must prepare for programmable money features that could restrict spending geographically or temporally. Financial services firms face new compliance burdens with real-time reporting requirements that exceed current banking regulations. The shift toward direct central bank relationships bypasses commercial banks entirely in some scenarios (fundamentally altering business banking relationships).

Businesses need to monitor legislative developments across multiple jurisdictions since CBDC implementation varies dramatically between nations. We at Web3 Enabler help businesses navigate this transition by providing Salesforce Native blockchain solutions that connect existing corporate infrastructure with emerging digital currency systems. Our tools support stablecoin payments and global transfers within familiar business environments, preparing companies for the CBDC era without disrupting current operations.

![Ensuring Regulatory Compliance in Crypto Transactions [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-compliance-hero-1758197377.jpeg)