Enterprise blockchain adoption has accelerated dramatically, with 87% of companies now exploring distributed ledger solutions for their operations.

Hyperledger blockchain for business offers a compelling alternative to public networks, providing the security and transparency benefits without compromising on privacy or control. We at Web3 Enabler have seen firsthand how this technology transforms payment processing and vendor relationships.

The framework delivers measurable results for companies ready to modernize their operations.

Why Hyperledger Beats Public Blockchains for Business

Permission-Based Networks Deliver Business Control

Hyperledger frameworks operate as permissioned networks where only verified participants can join and transact. This controlled environment eliminates the unpredictable transaction costs that plague public blockchains like Ethereum, where fees can spike to $50 per transaction during network congestion.

Companies that use Hyperledger enjoy predictable operational expenses and maintain complete control over who accesses their sensitive business data. The permission model means your financial transactions and supply chain information stay within your trusted network of partners, suppliers, and customers.

Proven Frameworks Drive Real Business Results

Hyperledger Fabric stands out as the most mature enterprise solution and powers major implementations across industries. Walmart reduced product traceability time from 7 days to 2.2 seconds with Fabric, which transformed their recall response capabilities and food safety protocols.

Maersk’s TradeLens platform processes over 10 million supply chain events weekly and cuts shipping document processing time by 40% compared to traditional methods. Change Healthcare leveraged Fabric to accelerate claim settlements while it reduced processing costs significantly.

These implementations demonstrate concrete ROI through faster payment cycles, reduced administrative overhead, and improved compliance capabilities.

Enterprise Adoption Spans Critical Industries

Financial services lead Hyperledger adoption, with JPMorgan Chase that developed blockchain-based payment systems which settle transactions in minutes rather than days. Healthcare organizations use the technology to create interoperable patient records while they maintain HIPAA compliance through built-in privacy controls.

Manufacturing companies track components from source to finished product, which reduces counterfeiting risks and improves quality assurance. Supply chain applications dominate because businesses need transparent, auditable records of product movement without exposure of competitive information to unauthorized parties.

The technology works particularly well for B2B payments where companies require faster settlement cycles and lower transaction fees than traditional banking systems provide. For your business, this translates to enhanced transparency, improved traceability, and increased efficiency. These real-world applications set the foundation for understanding the specific business benefits that Hyperledger implementation can deliver to your organization.

How Hyperledger Cuts Costs and Boosts Security

Enterprise-Grade Security Without Compromise

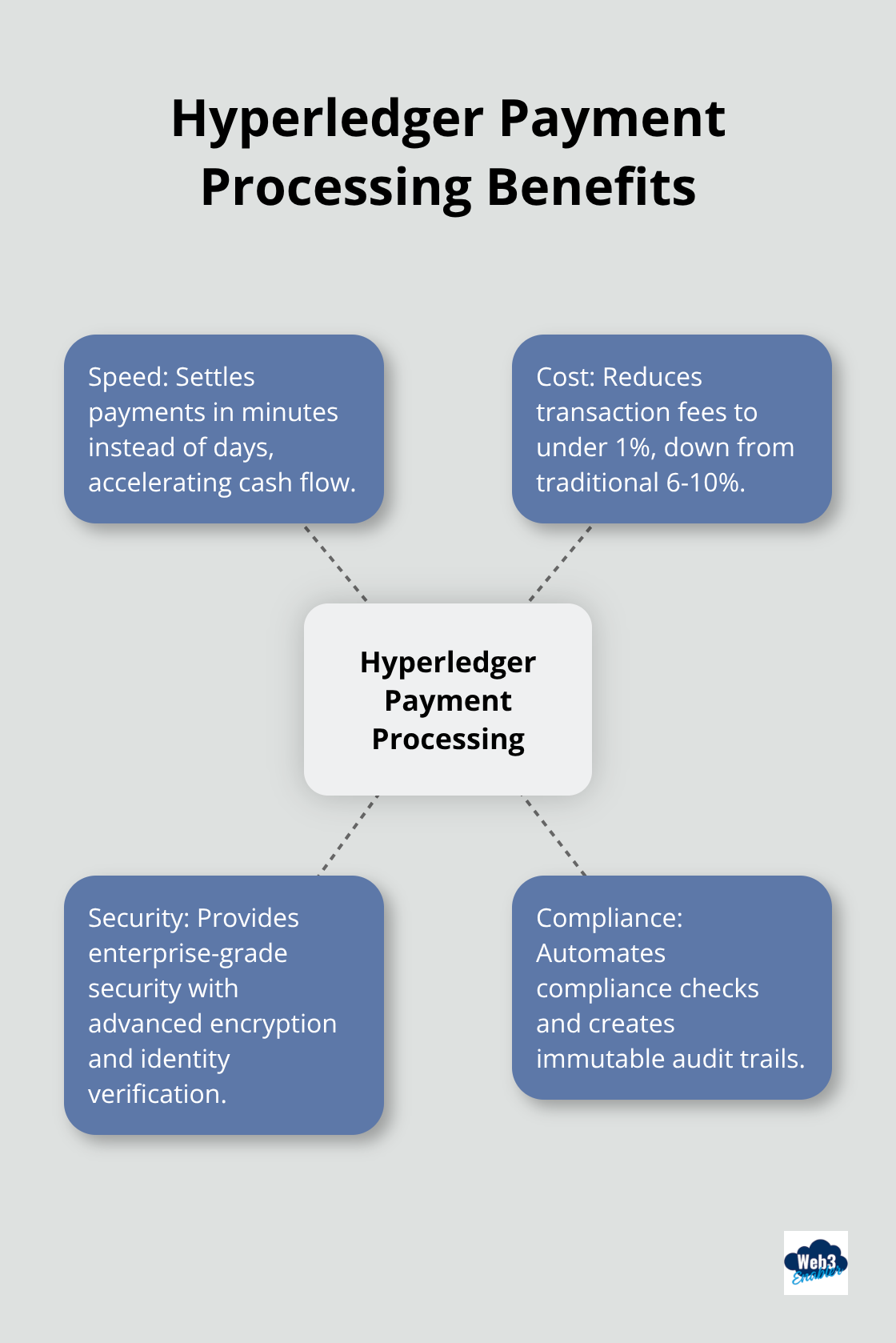

Hyperledger’s permissioned architecture delivers military-grade security that public blockchains cannot match for business applications. The framework uses advanced encryption and requires identity verification for every network participant, which eliminates anonymous threats that plague open networks. Companies maintain complete control over data access through channel-based privacy, where sensitive information remains visible only to authorized parties within specific business relationships.

The immutable ledger creates an audit trail that traces every transaction back to verified identities, which satisfies regulatory requirements for GDPR, HIPAA, and financial compliance standards. Cryptographic access controls and encrypted storage mechanisms preserve confidentiality while maintaining data integrity throughout the network.

Automated Compliance Reduces Human Error

Smart contracts automate compliance checks and enforce business rules automatically. This automation reduces human error and regulatory violations compared to manual processes. The system validates transactions against predefined rules before execution, which prevents costly compliance mistakes that traditional systems often miss.

Auditors can access complete transaction histories instantly rather than wait weeks for manual document collection. This transparency accelerates audit processes and reduces associated costs by eliminating time-intensive data gathering procedures.

Payment Processing That Actually Works

Hyperledger transforms payment operations by eliminating bottlenecks that cost businesses millions annually. Traditional cross-border payments take 3-5 days and charge fees between 6-10% of transaction value. Hyperledger-based systems settle payments in minutes with fees under 1%, which directly improves cash flow and vendor relationships.

Change Healthcare reduced claim processing costs by 30% and accelerated settlement times from weeks to days with Hyperledger Fabric. The technology enables real-time settlement between business partners without intermediary banks or clearinghouses.

Predictable Costs Enable Better Planning

Companies that process high-volume B2B transactions see immediate ROI through reduced administrative overhead and faster payment cycles. The predictable transaction costs allow accurate financial modeling (unlike volatile public blockchain fees), while automated reconciliation eliminates costly manual processes that typically require dedicated accounting staff.

These operational improvements create the foundation for successful blockchain integration, but choosing the right implementation approach requires careful assessment of your specific business needs and technical requirements.

How Do You Start Your Hyperledger Implementation

Evaluate Your Payment Processing Volumes First

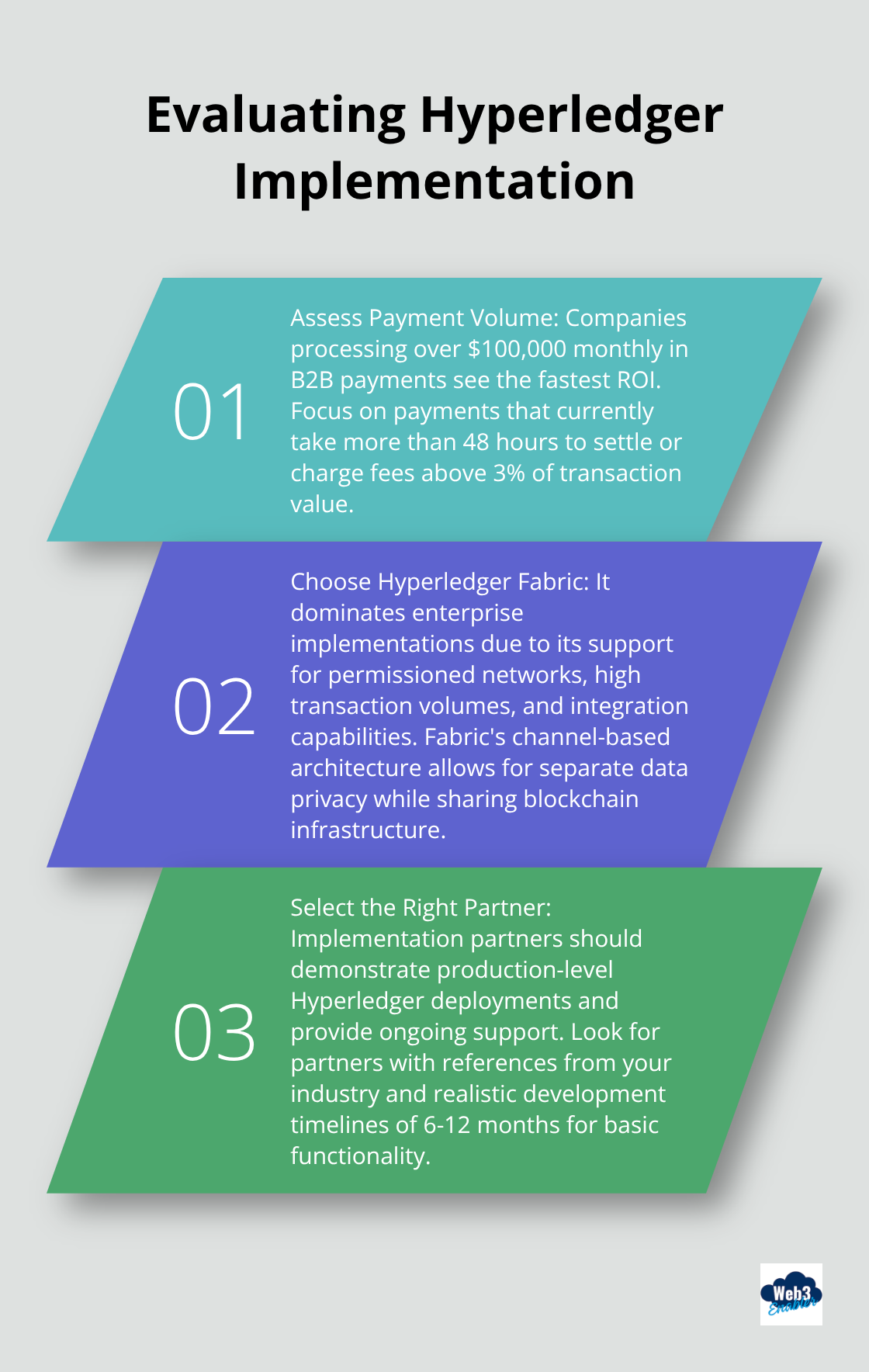

Companies that process over $100,000 monthly in B2B payments see the fastest ROI from Hyperledger implementation. Organizations with fewer than 50 monthly transactions typically don’t justify the initial development costs (which range from $40,000 to $300,000 depending on complexity). Focus on payment processes that currently take more than 48 hours to settle or charge fees above 3% of transaction value.

Manufacturing companies with complex supply chains and financial services firms that handle cross-border payments represent the strongest use cases. Healthcare organizations that manage patient data across multiple providers also benefit significantly from the privacy controls and interoperability features.

Choose Hyperledger Fabric for Most Business Applications

Hyperledger Fabric dominates enterprise implementations because it supports the permissioned networks that businesses require. The framework handles high transaction volumes and integrates with existing systems more effectively than alternatives like Sawtooth or Iroha.

Fabric’s channel-based architecture allows different business units to maintain separate data privacy while they share the same blockchain infrastructure. Companies in regulated industries choose Fabric specifically for its compliance capabilities with GDPR, HIPAA, and financial regulations. The modular design means you can add features like multi-currency support or automated reconciliation without rebuilding your entire system.

Partner Selection Determines Implementation Success

Implementation partners must demonstrate production-level Hyperledger deployments rather than just proof-of-concept projects. Request references from companies in your industry that have processed real transactions for at least 12 months. Partners should provide ongoing support for system updates, security patches, and scaling requirements as your transaction volumes grow.

The development timeline typically spans 6-12 months for basic payment processing functionality (with additional time required for integration with existing ERP systems). Avoid partners who promise unrealistic timelines under 3 months or cannot provide detailed technical documentation from previous implementations.

Final Thoughts

Hyperledger blockchain for business delivers measurable advantages that traditional payment systems cannot match. Companies reduce transaction costs from 6-10% to under 1% while they accelerate settlement times from days to minutes. The permissioned architecture provides enterprise-grade security and regulatory compliance without sacrifice of operational control.

The technology proves particularly valuable for organizations that process over $100,000 monthly in B2B payments. Manufacturing firms gain supply chain transparency, healthcare organizations achieve HIPAA-compliant data sharing, and financial services companies streamline cross-border transactions. Implementation success depends on choice of experienced partners and realistic timelines (most businesses require 6-12 months for basic functionality).

We at Web3 Enabler specialize in blockchain integration solutions that help businesses accept stablecoin payments and send global payments faster and cheaper. Our platform serves industry leaders like Circle, Ripple, and Cardano through custom implementations and grants that help businesses integrate blockchain technology into existing workflows. Contact us to explore how Hyperledger can transform your payment operations and vendor relationships.