At Web3 Enabler, we’ve been tracking this explosive growth and its ripple effects across economies worldwide. Investigating the impact of global stablecoins requires looking beyond simple adoption numbers to understand how they’re changing everything from cross-border payments to monetary policy.

Where Are Stablecoins Actually Growing?

The stablecoin market has exploded to approximately $270 billion by August 2025, up from $161.2 billion just one year earlier according to Boston Consulting Group data. This represents a staggering 67% growth rate that puts most traditional financial products to shame. The real story isn’t just the size though – it’s where this growth happens and who drives it. Annual transaction volumes now exceed $27 trillion, which makes stablecoins a legitimate competitor to traditional payment rails like SWIFT.

The Geographic Hotspots That Matter

Southeast Asia leads the charge with over 43% of B2B cross-border payments now conducted with stablecoins. This doesn’t happen by accident – regulatory clarity in countries like Singapore and Hong Kong has created favorable conditions for institutional adoption. Meanwhile, Latin America shows explosive growth in stablecoin-enabled card programs, driven by partnerships between companies like Thredd and Reap. The pattern is clear: regions with inefficient traditional banking infrastructure embrace stablecoins fastest.

Market Concentration Tells the Real Story

USDT and USDC dominate with 93.5% of the fiat-backed stablecoin market between them. Tether alone holds around $127 billion in U.S. Treasury bills, which makes it one of the largest non-sovereign holders globally. This concentration isn’t necessarily bad – it creates liquidity and stability that businesses need for reliable operations. Circle’s partnerships with traditional banks (like those enabled through Finastra) bring institutional-grade infrastructure to stablecoin payments, while PayPal’s overseas stablecoin transfers normalize usage for everyday consumers.

B2B Adoption Accelerates Beyond Expectations

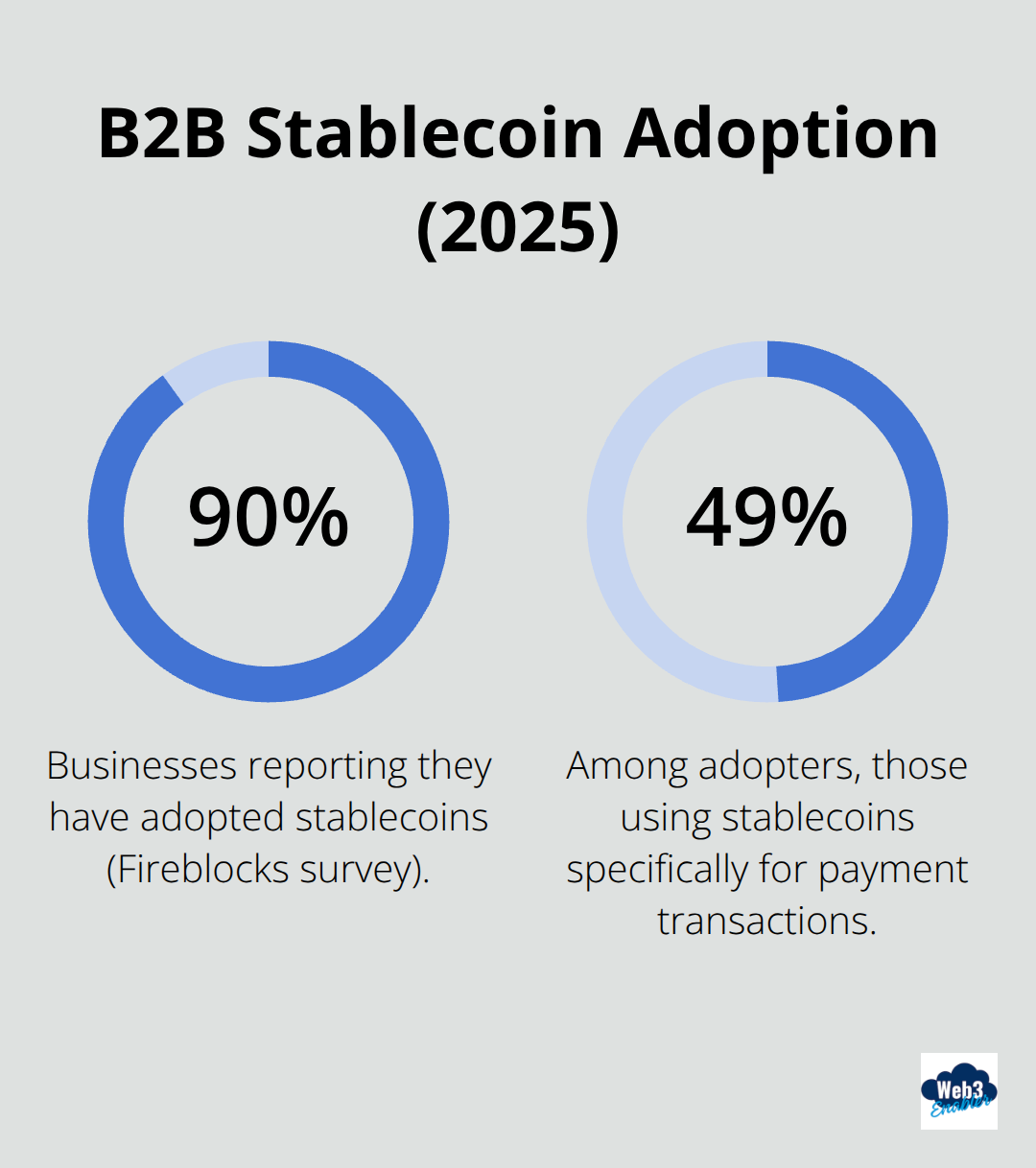

B2B payments with stablecoins have grown significantly, with payment volumes reaching $19.4B year-to-date in 2025. Nearly 90% of survey respondents from Fireblocks have adopted stablecoins into their business practices (according to their latest research). Out of those users, 49% reported they utilize them for payment transactions, which emphasizes practical application over speculation.

This shift reveals how businesses prioritize efficiency over traditional banking relationships when real money is at stake.

These adoption patterns set the stage for a deeper analysis of how stablecoins actually measure up against traditional payment systems in terms of speed, cost, and accessibility.

How Do You Actually Measure Stablecoin Impact

Stablecoin impact measurement requires specific metrics that traditional finance doesn’t track. Cross-border payment efficiency starts with settlement speed comparisons – stablecoins settle in minutes while SWIFT transfers take 3-5 business days on average. Transaction costs tell an even starker story, with stablecoins reducing fees by up to 80% compared to traditional wire transfers according to McKinsey research. Volume velocity matters too – the $8.9 trillion in on-chain stablecoin volume processed in the first half of 2025 shows real liquidity moving through these systems.

Financial Access Metrics That Actually Count

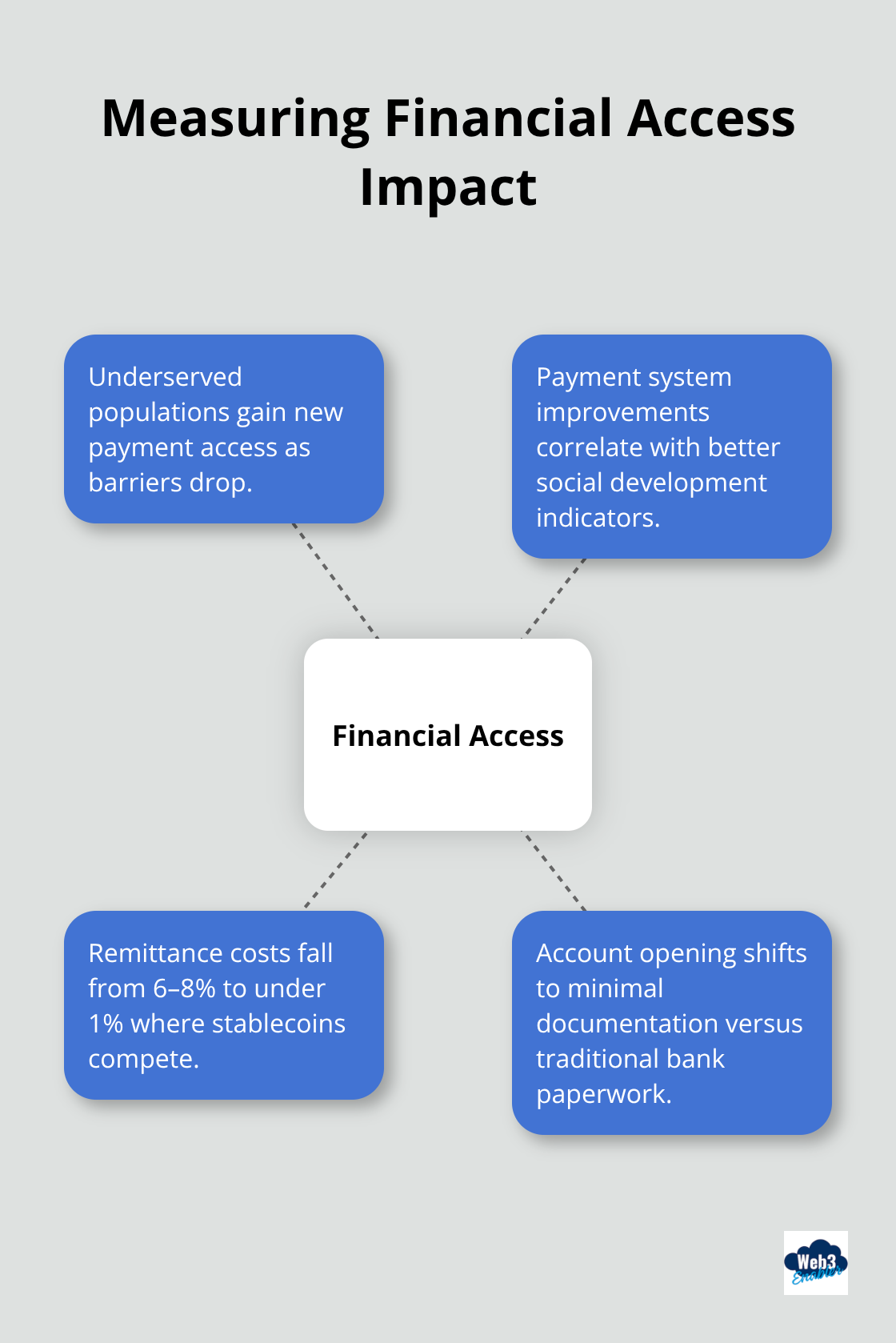

Financial inclusion measurements focus on previously underserved populations gaining payment access. Research shows correlations between payment system improvements and social development indicators, with studies analyzing social backwardness indices revealing patterns in financial access evolution. Stablecoin adoption in regions with weak banking infrastructure provides concrete data points – remittance costs drop from 6-8% to under 1% in corridors where stablecoins compete with traditional services. Account opening requirements also shift dramatically, with stablecoin wallets requiring minimal documentation compared to traditional bank accounts that often demand extensive paperwork and minimum balances.

Banking Disruption Indicators You Can Track

Traditional banking disruption shows up in deposit outflows and payment volume migration. Major stablecoin issuers now hold more U.S. Treasury bills than many regional banks, with Tether’s $127 billion position making it a significant non-sovereign holder. Payment processor revenue shifts provide another indicator – when businesses choose stablecoin rails over card networks, interchange fees disappear entirely. The 30-fold increase in B2B stablecoin payments over two years directly correlates with reduced SWIFT message volumes in those same corridors.

Reserve Transparency Creates New Benchmarks

Reserve backing transparency has become a measurable factor in stablecoin stability and adoption. Around 68% of major stablecoin issuers now provide monthly reserve attestations (thanks to legislative requirements like the GENIUS Act). Real-time proof-of-reserves dashboards appear on 60-75% of major issuer platforms, creating unprecedented visibility into backing assets. Research from the Bank for International Settlements indicates that better public disclosure of reserve assets mitigates systemic risk and correlates with fewer peg deviations.

These measurement frameworks reveal patterns that extend far beyond simple adoption numbers, particularly when governments and central banks respond to stablecoin growth with their own digital currency initiatives.

How Are Governments Actually Responding to Stablecoins?

The regulatory response to stablecoins reveals a clear pattern: governments that act decisively gain competitive advantages while those that hesitate lose financial innovation to more proactive jurisdictions. The GENIUS Act in the United States mandates monthly audits for stablecoin issuers with over $50 billion in circulation and creates federal oversight for payment-stablecoin issuers that exceed $10 billion outstanding. The UK takes a different approach and develops comprehensive regulatory frameworks for systemic stablecoins by treating them as critical payment systems rather than securities. MiCA in the EU represents another regulatory shift that moves payment stablecoins toward mainstream usage through standardized compliance requirements.

Central Banks Launch Digital Currency Projects in Response

Central bank digital currency development accelerates directly in response to stablecoin adoption patterns. The Federal Reserve launched its FedNow system partly to compete with stablecoin settlement speeds, though it still can’t match the 24/7 global availability that stablecoins provide. China expands its digital yuan pilot programs rapidly in regions where Tether usage was previously high (which suggests defensive positioning against dollar-denominated stablecoins). The European Central Bank’s digital euro project specifically addresses concerns about stablecoin dollarization effects on monetary sovereignty.

International Coordination Faces New Challenges

Cross-border monetary policy coordination becomes more complex when stablecoins operate across multiple jurisdictions simultaneously. The Bank for International Settlements now tracks stablecoin flows between countries to understand their impact on traditional monetary transmission mechanisms. Dollar-backed stablecoins create “dollarization” effects that undermine local currencies in emerging markets, forcing central banks to respond with their own digital currency initiatives. International financial institutions like the IMF urge countries to establish clear engagement criteria for stablecoin oversight.

Consumer Protection Standards Get Specific Requirements

Consumer protection frameworks now include specific stablecoin provisions that didn’t exist three years ago. The American Institute of Certified Public Accountants introduced 2025 Criteria for Stablecoin Reporting to standardize disclosure practices and requires real-time proof-of-reserves dashboards that 60-75% of major issuers now provide. Risk management frameworks focus on reserve transparency, with research from the Bank for International Settlements showing that better public disclosure correlates with fewer peg deviations and faster redemptions. These frameworks create measurable standards that businesses can evaluate when they choose stablecoin providers for treasury management or payment operations through Web3 services.

Final Thoughts

Investigating the impact of global stablecoins reveals a financial transformation that happens faster than most institutions anticipated. The $270 billion market with $27 trillion in annual transaction volume represents a fundamental shift in how money moves globally. Southeast Asia’s 43% B2B cross-border payment adoption and the 30-fold increase in business stablecoin usage over two years prove that efficiency wins over tradition when real money is at stake.

The regulatory response patterns show clear winners and losers across different jurisdictions. Countries with proactive frameworks like the GENIUS Act and MiCA gain competitive advantages while hesitant jurisdictions watch financial innovation migrate elsewhere. Central banks launch digital currencies in direct response to stablecoin growth, which confirms the disruptive impact on monetary sovereignty.

Future research should focus on measuring dollarization effects in emerging markets and tracking traditional banking deposit outflows as stablecoin adoption accelerates. The correlation between reserve transparency and market stability needs deeper analysis (particularly as 68% of major issuers now provide monthly attestations). For businesses and financial institutions, the implications are straightforward: stablecoin integration becomes a competitive necessity rather than an experimental option. At Web3 Enabler, we help businesses navigate this transformation through practical blockchain solutions.