Your customers want to pay with crypto, but your Salesforce Revenue Cloud is stuck in the stone age of traditional payments. USDC integration changes that game completely.

We at Web3 Enabler know the pain of watching potential revenue walk away because your payment system can’t handle stablecoins. This guide shows you exactly how to bridge that gap and start accepting USDC payments directly through Revenue Cloud.

What Infrastructure Do You Need for USDC Payments

Web3 Enabler’s Blockchain Payments is a 100% Salesforce Native solution. You can integrate it directly into the payment request workflow. Even better, our free Revenue Cloud Plugin let’s you utilize Blockchain Payments within the Salesforce Payments infrastructure. Behind the scenes, you might have Bridge doing on-ramps and off-ramps, Circle programmable wallets, and other APIs, but you just interact with 100% native Salesforce objects.

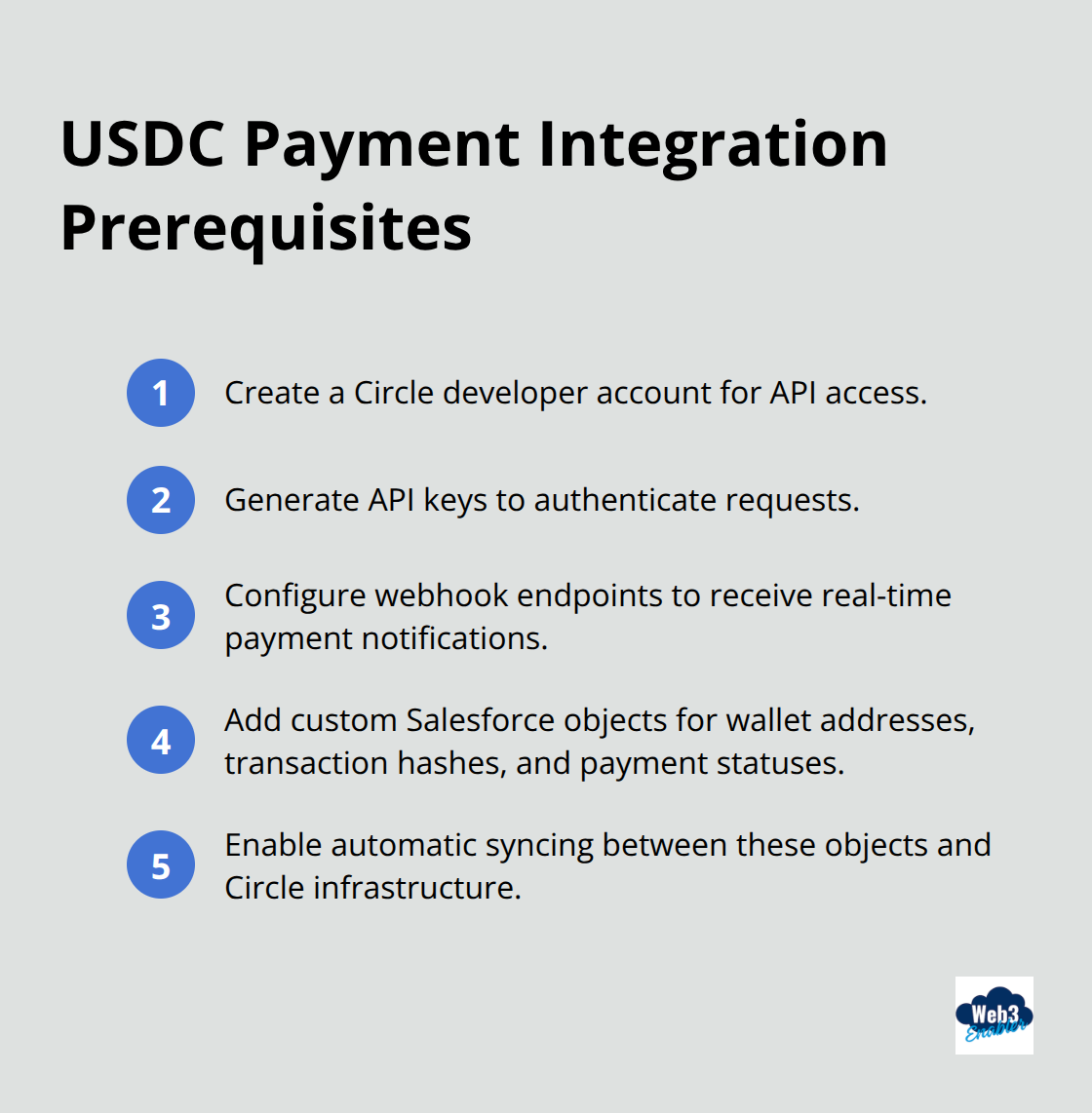

On your own, you need a Circle developer account, API keys, and webhook endpoints that receive real-time payment notifications. The integration requires custom Salesforce objects that store wallet addresses, transaction hashes, and payment statuses. These objects sync automatically with Circle’s infrastructure.

But with Blockchain Payments, you just install it and configure the automations like you did with Credit Cards and wires.

Security and Compliance Setup

Multi-signature wallet configurations reduce security risks, but add complexity. Salesforce native wallets give an audit trail and safety. Liquidation wallets eliminate the wallet entirely, letting your payments go directly to your bank.

Set up automated compliance through Salesforce flows that flag transactions for additional review. Base these flags on amount thresholds, geographic restrictions, or customer risk profiles (all configurable within your existing processes).

Configure encrypted API credential storage with Salesforce Named Credentials. Never store private keys within your Salesforce org. Real-time compliance monitoring integrates with your existing Revenue Cloud approval processes and maintains audit trails for regulatory requirements.

With your infrastructure foundation solid, the next step involves connecting these Circle APIs directly to your Salesforce custom objects and building the automated workflows that make payments seamless.

Payment Workflow Automation

Salesforce flows activate when transaction webhooks are pushed to your org with payment status updates. These flows update Opportunity, Order, or Invoice records automatically, send confirmation emails to customers, and trigger Revenue Cloud recognition processes without manual work. Configure your flows to handle three payment states: pending, confirmed, and failed.

Real-Time Status Updates

Platform events broadcast payment status changes across your entire Salesforce org instantly. These events trigger Lightning components that display live payment progress to users without page refreshes (no more hitting F5 like it’s 2005). Configure retry logic in your Apex classes that attempts failed Circle API calls up to three times before creating exception records for manual review.

Circle’s 99.9% uptime means failed calls typically result from network issues rather than API problems. Custom notifications alert your finance team when large transactions exceed $50,000 or when compliance flags need immediate attention.

Error Handling and Exception Management

Exception handling becomes critical when blockchain meets enterprise software. Your Apex classes need try-catch blocks that capture API timeouts, malformed responses, and rate limit errors. Create custom exception objects that store error details, timestamps, and retry attempts for debugging purposes.

With Blockchain Payments, all that hard work is done for you.

If you are US based, things are easy, 1 USDC = $1. But for International users, you might need to mark them to market. Blockchain Payments does this for you, using Coingecko’s API for real time price updates.

With your API connections solid and workflows automated, the next challenge involves tracking these USDC transactions properly within Revenue Cloud’s financial reporting structure. Web3 Enabler provides specialized solutions for integrating blockchain payments with Salesforce native applications. Our new addon for Revenue Cloud makes this a breeze.

How Do You Track USDC Revenue in Salesforce

Revenue Cloud requires specific field mappings that capture USDC transaction data alongside traditional payment information. You could create custom fields on Opportunity records for USDC amounts, transaction hashes, and blockchain confirmation timestamps… or just use Blockchain Payments to get a Web3 Payment Request and Inbound Blockchain Transaction entries.

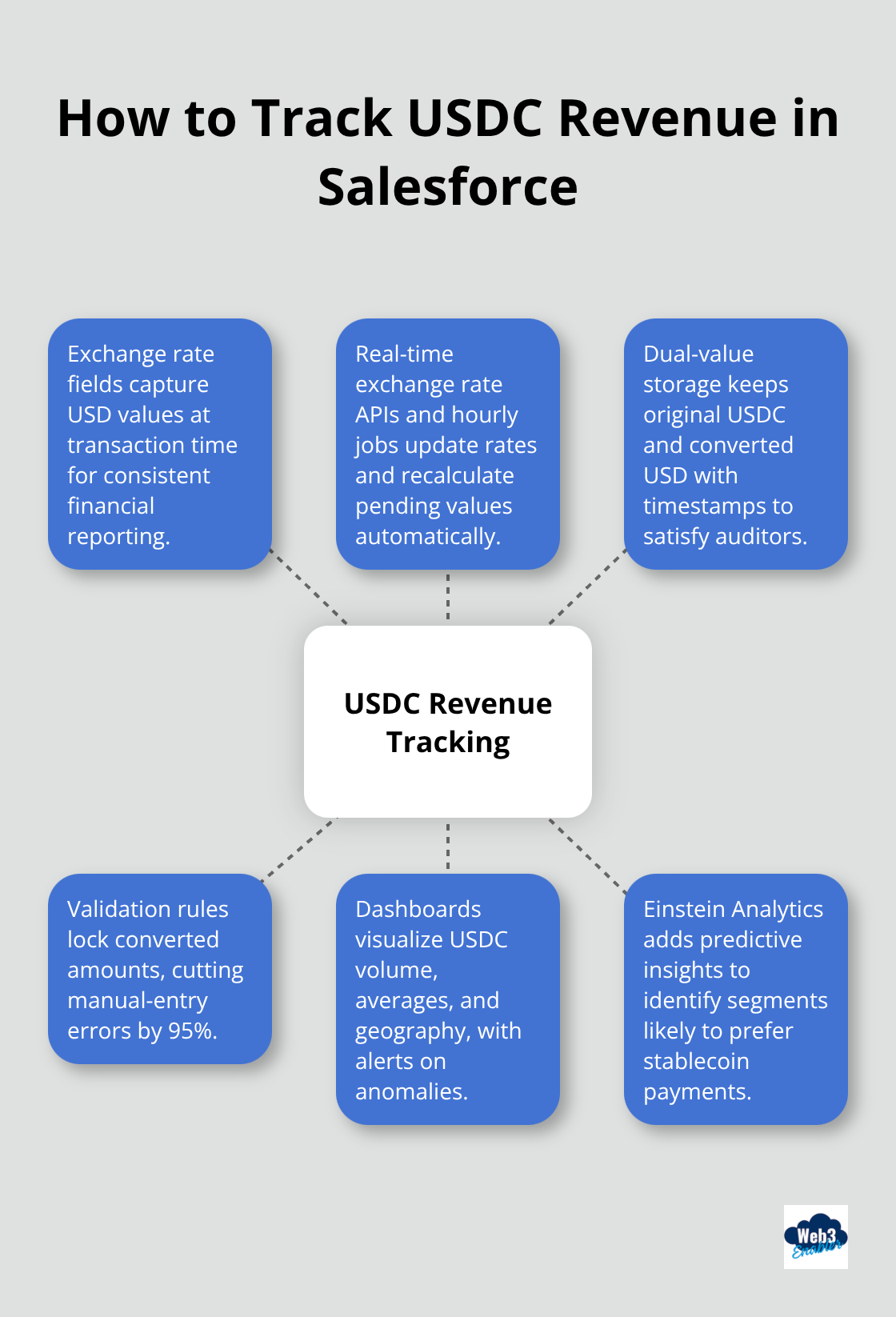

Configure exchange rate fields that store USD conversion values at transaction time since Revenue Cloud needs consistent currency reporting for financial statements. Nearly half of institutions use stablecoins, which makes proper tracking essential for competitive businesses.

Converting Crypto Values for Financial Reports

Real-time exchange rate APIs from CoinGecko or CoinMarketCap provide accurate USDC-to-USD conversions for Revenue Cloud reports. Schedule hourly Apex jobs that update exchange rates and recalculate pending transaction values automatically. Your custom objects store both original USDC amounts and converted USD values with timestamps that show exact conversion rates used.

This dual-value approach satisfies auditors who need transaction trails while it maintains Revenue Cloud’s native reporting capabilities. Configure validation rules that prevent manual edits to converted amounts since automated calculations reduce errors by 95% compared to manual entry.

Building Payment Analytics Dashboards

Lightning dashboards display USDC payment trends, conversion rates, and processing times through custom report types that combine Opportunity and Payment Transaction data. Create dashboard components that show daily USDC volume, average transaction values, and geographic payment distribution from your customer data.

Configure automated alerts when USDC payments exceed normal thresholds or when conversion rates fluctuate beyond acceptable ranges. Revenue Cloud’s Einstein Analytics integration provides predictive insights about crypto payment adoption patterns among your customer segments (helping sales teams identify prospects most likely to prefer stablecoin payments).

Automated Revenue Recognition

Revenue Cloud automatically recognizes USDC payments once blockchain confirmations reach your configured threshold. Set up recognition rules that treat confirmed USDC transactions identically to traditional payments for accounting purposes. Your finance team can schedule recognition batches that process multiple USDC transactions simultaneously.

Configure milestone-based recognition for subscription payments where USDC transactions trigger automatic renewal processes. This automation reduces manual work by 70% while it maintains compliance with revenue recognition standards (particularly important for public companies with strict reporting requirements).

Final Thoughts

USDC integration transforms Revenue Cloud from a traditional payment processor into a modern financial powerhouse. Your business gains 80% faster transaction processing, eliminates currency conversion fees, and attracts tech-savvy customers who prefer stablecoin payments. The automated workflows reduce manual data entry by 85% while they maintain full compliance with existing financial reporting standards.

Your USDC payment system requires regular monitoring of exchange rates, webhook performance, and compliance flags. Schedule weekly reviews of transaction volumes and error logs to catch issues before they impact customer experience. Keep your Circle API credentials updated and test webhook endpoints monthly to maintain seamless payment processing.

Ready to expand beyond USDC? Consider other stablecoins like USDT or explore programmable payment workflows through smart contracts. Web3 Enabler provides 100% Salesforce Native blockchain solutions that integrate directly with Revenue Cloud (backed by trusted partners like Circle and Ripple). Our AppExchange solutions handle the technical complexity while you focus on revenue growth through crypto payments.