Enterprise blockchain services are transforming how businesses operate, offering unprecedented transparency and efficiency gains. Companies implementing these solutions report 40% faster payment processing and 60% reduction in administrative overhead.

We at Web3 Enabler see organizations struggling with outdated systems that slow down vendor payments and client collections. The right blockchain implementation strategy can revolutionize your business operations within months, not years.

What Makes Enterprise Blockchain Different

Enterprise blockchain architecture consists of four core components that determine success or failure. The distributed ledger acts as your central transaction record, while consensus mechanisms validate every payment and data exchange. Smart contract functionality automates vendor payments and client billing processes, reducing manual oversight by up to 80% (according to Siemens treasury operations). The fourth component, your network layer, controls who accesses what information and when transactions process.

Private Networks Deliver Superior Control

Private blockchain networks offer complete control over participant access and transaction visibility, making them the obvious choice for enterprise payments. Fortune Business Insights projects the blockchain market will reach $69 billion by 2027, with private networks capturing the majority of enterprise adoption. Public networks expose your payment data to competitors and create regulatory headaches that most CFOs refuse to accept. Private networks process payments faster, cost less to operate, and integrate seamlessly with existing ERP systems without exposing sensitive vendor relationships or payment amounts.

Security Requirements Start With Access Control

Enterprise blockchain security centers on three non-negotiable requirements that separate professional implementations from amateur attempts. Multi-signature authentication prevents single points of failure in payment approvals, while role-based access controls limit transaction visibility to authorized personnel only. Encryption standards must meet SOC 2 compliance requirements, and your blockchain provider must demonstrate proven regulatory frameworks. Boards and C-suite executives are working together in new ways to navigate volatility and keep growth on the agenda, but only implementations with proper security architecture deliver the promised efficiency gains without creating new vulnerabilities.

Platform Selection Drives Implementation Success

Your choice of blockchain platform determines how quickly you can deploy payment automation and integrate with existing systems. Hyperledger Fabric dominates enterprise deployments because it offers permissioned networks and modular architecture that adapts to complex business requirements. Stellar’s reputation as a fast, cost-effective, and energy-efficient blockchain makes it particularly well-suited for enterprise applications. The platform you select must support your current payment volumes while scaling to accommodate future growth without compromising transaction speed or security standards.

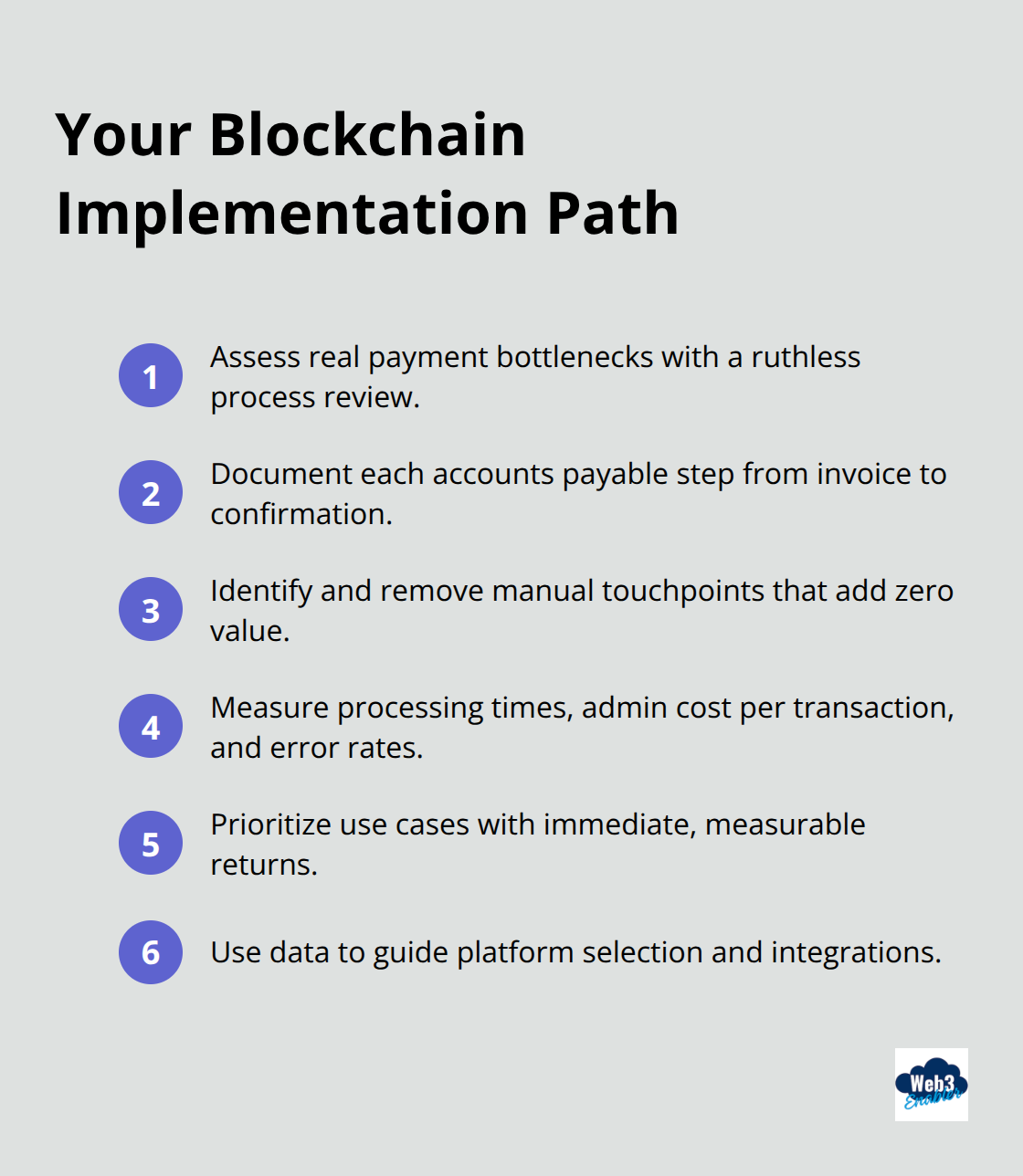

How Do You Map Your Implementation Path

Most finance executives waste months analyzing blockchain technology instead of examining their actual payment bottlenecks. Your implementation strategy must start with ruthless assessment of current processes that drain time and money. Document every step in your accounts payable workflow, from vendor invoice receipt to final payment confirmation. Siemens achieved 80% automation in cash application processes after they first identified manual touchpoints that added zero value. Measure your current payment processing times, administrative costs per transaction, and error rates that require manual correction. The data reveals where blockchain delivers immediate returns versus theoretical benefits.

Target Specific Pain Points First

Focus your blockchain implementation on payment processes that cost your organization the most time and money. Cross-border vendor payments represent the highest-impact target, with traditional cross-border payments through banks costing 2-7% when accounting for transfer fees, FX spreads, and intermediary charges while blockchain payments reduce costs to 0.5-1%. Recurring vendor payments offer another quick win, as automation eliminates manual invoice processing and approval workflows. Client payment collection delays cost businesses significant cash flow impact, but blockchain settlements complete in under 3 minutes compared to 3-5 business days for traditional transfers. McKinsey research indicates that companies that invest in blockchain gain competitive advantage within their industry, but only when implementations target measurable pain points rather than broad digital transformation goals.

Build Teams Around Proven Expertise

Your implementation team requires specific blockchain expertise that most internal IT departments lack. Partner with established blockchain service providers who demonstrate proven enterprise deployments rather than attempt to build capabilities from scratch. IBM reports that over 70% of organizations that explore blockchain succeed when they leverage external expertise for technical implementation while they maintain internal control over business processes. Your team needs one executive sponsor who understands payment operations, one technical lead familiar with your ERP systems, and one compliance officer who manages regulatory requirements. Training existing staff on blockchain concepts wastes time and delays implementation, while strategic partnerships with Web3 specialists accelerate deployment timelines.

Set Measurable Success Metrics

Define specific metrics that demonstrate blockchain value before you begin implementation. Payment processing time reduction, transaction cost savings, and error rate improvements provide concrete measurements that justify investment decisions. Visa reports that stablecoin transaction volumes reached $5.7 trillion in payment transactions during 2024, proving that measurable adoption drives business results. Track vendor payment approval cycles, client collection periods, and administrative overhead costs to establish baseline performance. These metrics guide platform selection and integration decisions that determine whether your blockchain deployment succeeds or fails.

Which Deployment Approach Delivers Results

Platform selection separates successful blockchain implementations from expensive failures, and the choice comes down to proven enterprise capabilities rather than marketing promises. Hyperledger Fabric handles complex business requirements through its permissioned network architecture, while Stellar delivers the speed and cost efficiency that finance teams demand. Organizations waste months when they evaluate platforms instead of focus on integration capabilities and vendor support quality. The platform must connect seamlessly with your existing ERP system, process your current payment volumes without performance degradation, and scale to handle future transaction growth. Fortune Business Insights projects blockchain market growth to $69 billion by 2027, but only implementations built on robust platforms capture this opportunity.

Integration Strategy Determines Speed to Value

Your blockchain deployment succeeds or fails based on how well it connects with existing systems, not on the sophistication of the underlying technology. API compatibility with your current accounting software, ERP platform, and payment processing systems determines implementation timeline and operational efficiency. Companies are leveraging AI solutions to enhance their integration capabilities, demonstrating that proper integration architecture delivers immediate operational benefits. Start with your accounts payable system as the primary integration point, then expand to accounts receivable and treasury management functions. The integration must maintain data consistency across all systems while it eliminates manual data entry that creates errors and delays.

Validation Process Protects Your Investment

Run pilot programs with small payment amounts and trusted vendors before you commit to full-scale deployment across your organization. Controlled tests reveal both capabilities and limitations before they impact business operations. Your validation process must test payment processing under peak transaction volumes, measure actual cost savings against projected benefits, and verify regulatory compliance across all relevant jurisdictions. Document every transaction, error, and system response during the pilot phase to identify potential issues that could disrupt operations during full deployment.

Testing Protocols Validate Performance

The testing phase should last 90 days minimum and include at least 100 transactions to generate meaningful performance data. Test payment processing under peak transaction volumes to identify system limitations before they affect daily operations. Measure actual processing times against baseline performance metrics from your current payment systems. Verify that error rates decrease compared to traditional payment methods (rather than simply assume blockchain eliminates all processing errors). The testing must validate every integration point under real transaction volumes before you process actual vendor payments or client collections.

Final Thoughts

Enterprise blockchain services implementation success depends on three factors that separate effective deployments from expensive mistakes. Focus on specific payment pain points rather than broad digital transformation goals, partner with proven blockchain specialists instead of internal capability development, and measure concrete results through rigorous testing protocols. Organizations that follow this approach achieve 40% faster payment processing and 60% reduction in administrative overhead within months of deployment.

The long-term benefits extend far beyond initial cost savings and efficiency gains. Blockchain payments eliminate the 3-5 day settlement delays that constrain cash flow, while automated vendor payments reduce administrative overhead by up to 80%. Cross-border payment costs drop from 2-7% to 0.5-1% (delivering immediate bottom-line impact that compounds over time), and the transparency of blockchain transactions strengthens compliance frameworks while reducing audit costs across your organization.

Action requires partnership with experienced blockchain integration specialists who understand enterprise requirements. Web3 Enabler offers native blockchain solutions trusted by industry leaders, with proven expertise that enables businesses to accept stablecoin payments and send global payments faster and cheaper. The key involves moving from analysis to action with controlled pilot programs that demonstrate measurable value before full-scale deployment.