Digital assets are everywhere in modern business-from brand files to financial records. Yet most organizations struggle with scattered storage, lost versions, and wasted time searching for what they need.

A well-designed digital asset management process flow transforms chaos into order. At Web3 Enabler, we’ve seen firsthand how companies that implement structured DAM systems recover hours each week and reduce compliance risks significantly.

What Digital Assets Really Include

Digital assets span far beyond marketing files. In cross-border operations, they include stablecoins held for supplier payments, USDC balances awaiting settlement, transaction records on blockchain networks, treasury positions in digital currencies, and compliance documentation tied to international transfers. For companies operating across African markets, digital assets also mean liquidity pools, on-ramp and off-ramp records from platforms like Yogupay, and audit trails proving asset provenance. A DAM system that ignores these financial assets creates dangerous blind spots. You cannot manage what you cannot see, and scattered stablecoin holdings across wallets and exchanges invite settlement delays, regulatory exposure, and lost reconciliation data. Companies processing cross-border payroll or supplier payments in stablecoins need a single source of truth for asset location, custody status, and movement history.

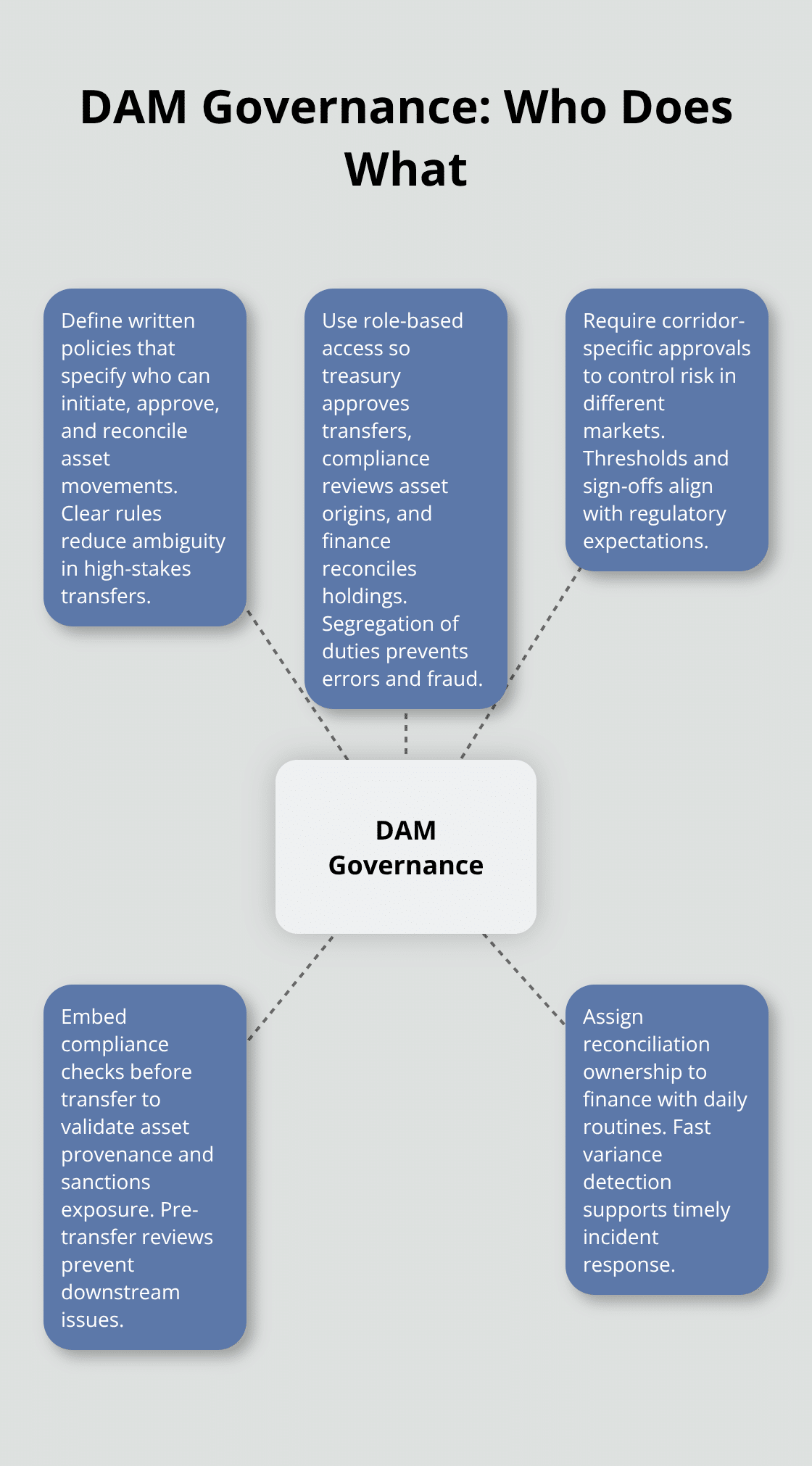

Governance Forms the Foundation

Effective DAM starts with governance, not technology. You need written policies defining who moves assets, which corridors require approval, and what compliance checks happen before transfer. Set up role-based access immediately: treasury managers approve transfers, compliance reviews asset origins, and finance reconciles holdings. Without clear roles, you lose accountability the moment a payment fails or a regulator asks where your USDC came from.

Integrate Data Across All Channels

Your DAM system must capture both on-chain and off-chain movements. A stablecoin sitting in a wallet has no value if your finance team cannot see it in your ledger. Build an integrated data layer that pulls blockchain transaction data into your business systems, tagging each movement with metadata: sender, receiver, asset type, settlement time, and FX rate applied. This integration matters for companies managing multi-market payouts. Without real-time visibility, you cannot optimize liquidity, predict settlement delays, or respond to compliance queries.

Eliminate Manual Reconciliation Work

The cost of manual reconciliation alone-hours spent matching blockchain records to bank statements-justifies automation. Your team spends time on spreadsheets when they should focus on strategy and risk management. A connected DAM system eliminates the spreadsheet trap and gives your team instant visibility into holdings and transaction status across all markets and corridors. This visibility also prepares you for the compliance and operational demands that come with scaling digital asset flows across multiple regions and payment corridors.

Building a Workflow That Works

Establish Naming Conventions That Stick

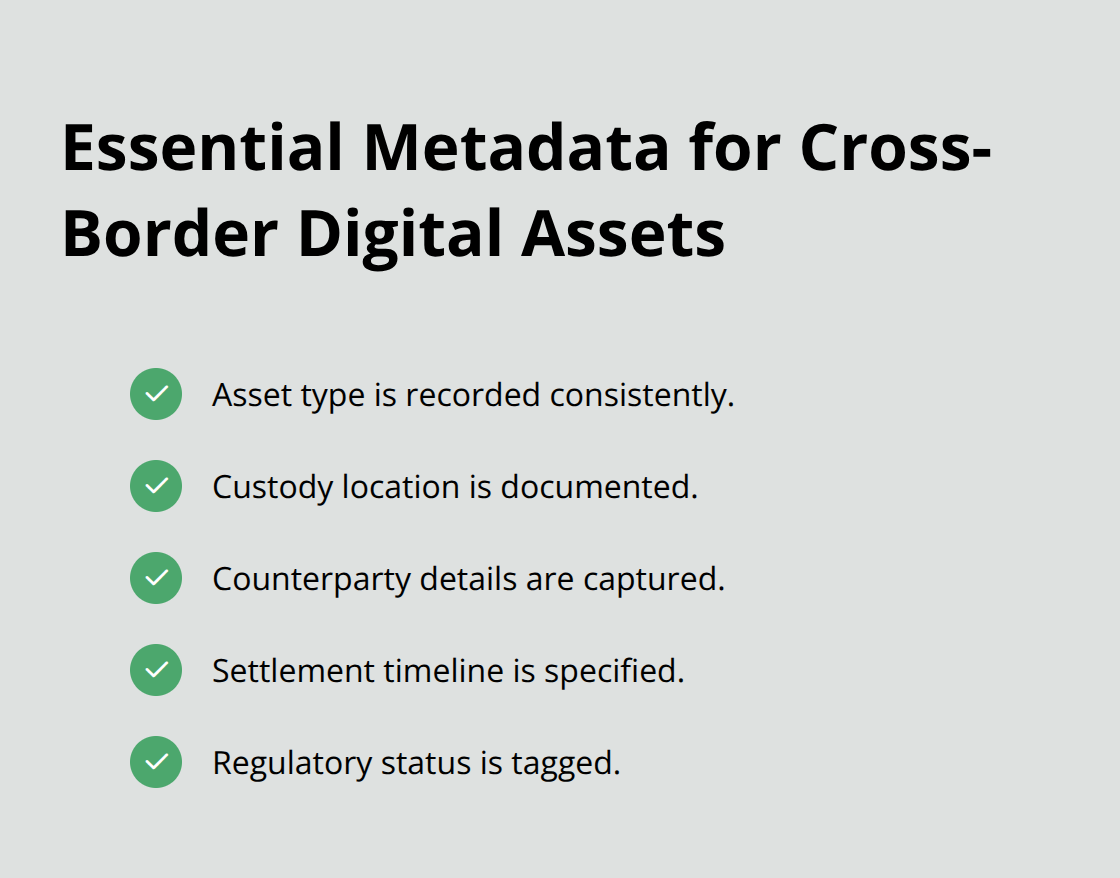

Naming conventions and metadata standards form the backbone of asset tracking-they are not bureaucratic overhead but the difference between finding a transaction in seconds and losing hours to search. When you store stablecoins across multiple wallets and exchanges, every asset needs a consistent identifier that your team understands immediately. Use a format like ASSET-CORRIDOR-DATE-PURPOSE, such as USDC-NG-PAYROLL-20250115 for USDC held for Nigerian payroll on January 15. This approach lets you scan a dashboard and know exactly what each holding represents. Without this discipline, your treasury team rebuilds the same context repeatedly, and compliance cannot prove asset provenance during audits.

Companies managing cross-border payments in Africa benefit most from this rigor because liquidity moves quickly across markets like Nigeria, Kenya, and South Africa. A clear naming system also prevents the dangerous error of moving funds intended for supplier payments into the wrong corridor. Your metadata must include asset type, custody location, counterparty, settlement timeline, and regulatory status. Store this information in a single system where every team member sees the same data.

Automate Categorization and Access Control

Automated categorization systems reduce the manual work that kills productivity. Set up rules that tag incoming transactions by asset class, market, and risk level as they arrive on-chain. For example, a USDC inflow to your Kenya corridor gets tagged automatically as settlement-ready, while a transfer to a new wallet triggers a compliance review flag. Role-based access controls must separate concerns: treasury managers approve transfers above a threshold, compliance reviews asset origins before settlement, and finance reconciles holdings daily.

Without clear roles, accountability vanishes the moment a payment fails or a regulator asks questions. A single person should never move large amounts unreviewed. Your system enforces this through workflow rules, not hope. Test your automation with small volumes first-a 2% test batch of your typical monthly payments-before rolling out to full scale. This pilot approach catches integration bugs and process gaps before they cost you time or compliance credibility.

Connect Blockchain Data to Your Business Systems

Your DAM system must capture both on-chain and off-chain movements. A stablecoin sitting in a wallet has no value if your finance team cannot see it in your ledger. Build an integrated data layer that pulls blockchain transaction data into your business systems, tagging each movement with metadata: sender, receiver, asset type, settlement time, and FX rate applied. This integration matters for companies managing multi-market payouts. Without real-time visibility, you cannot optimize liquidity, predict settlement delays, or respond to compliance queries.

The cost of manual reconciliation alone-hours spent matching blockchain records to bank statements-justifies automation. Your team spends time on spreadsheets when they should focus on strategy and risk management. A connected DAM system eliminates the spreadsheet trap and gives your team instant visibility into holdings and transaction status across all markets and corridors.

Prepare for Compliance and Scale

This visibility also prepares you for the compliance and operational demands that come with scaling digital asset flows across multiple regions and payment corridors. As your operations grow, the friction of manual processes compounds. Your next step involves defining the specific approval workflows and compliance checks that protect your organization while keeping payments moving.

Optimizing and Maintaining Your DAM System

Schedule Regular Audits Across All Corridors

Your DAM system only works if you actively maintain it and connect it to the tools your team already uses daily. A well-built system decays quickly without oversight-wallets drift offline, reconciliation gaps widen, and team members default to workarounds that bypass your controls entirely. Schedule monthly audits of your asset holdings across all corridors and wallets. During these audits, verify that every stablecoin balance matches your metadata records and that transaction timestamps align with your blockchain data.

If you manage operations across Nigeria, Kenya, South Africa, and Ghana, regulatory scrutiny is rising. Check your naming conventions too-if your team starts inventing new tags instead of following your standard format, your system is already breaking down. Set a hard rule: any asset that cannot be matched to metadata within 15 minutes gets flagged for investigation. This sounds strict, but it catches custody errors, unauthorized transfers, and reconciliation drift before they compound into compliance headaches. Companies processing monthly payroll in stablecoins across multiple African markets report that monthly audits catch 3-5 discrepancies on average that manual spreadsheet tracking would miss entirely.

Connect Blockchain Data to Your Business Systems

Integration with your existing business systems determines whether your DAM becomes operational or stays theoretical. If your treasury team manages approvals in one system, your finance team reconciles in spreadsheets, and your compliance team tracks asset origins in email chains, your DAM fails immediately. Connect your blockchain data directly into your Salesforce environment or accounting software so that every team member sees the same real-time information.

Web3 Enabler offers native Salesforce integration that pulls blockchain transactions directly into your CRM, eliminating the manual data entry and reconciliation delays that plague most organizations. This connection ensures your team works from a single source of truth rather than fragmented tools and spreadsheets.

Train Your Team on Real Workflows

Train your team on the system itself-not just the concept of DAM, but the specific workflows, approval thresholds, and compliance checks embedded in your tools. Conduct quarterly training sessions focused on real scenarios: a payment that fails settlement, an asset that arrives in an unexpected wallet, a regulator inquiry about transaction history. Walk through how your system responds to each scenario and what each team member should do.

Without this hands-on training, your governance framework exists only on paper. Your team needs to understand not just the rules but why those rules protect the organization. When people understand the purpose behind a process, they follow it instead of creating workarounds.

Assign Clear Ownership and Accountability

Assign one person as the DAM owner who monitors system health, flags integration failures, and updates team procedures as regulatory requirements shift. This role prevents the common failure where responsibility diffuses across the organization and nobody owns the outcome. Your DAM owner should have direct access to audit logs, integration dashboards, and compliance reports so they spot problems before they escalate.

This person also serves as the bridge between your technical team and your business operations, translating regulatory changes into system updates and catching gaps before audits expose them. Without clear ownership, your DAM system drifts into neglect the moment competing priorities demand attention.

Final Thoughts

A digital asset management process flow succeeds when governance, data integration, and team accountability work together. Organizations that recover hours each week and reduce compliance risk treat DAM as operational infrastructure, not an afterthought. Your naming conventions, automated categorization, and real-time visibility into blockchain transactions form the foundation that prevents settlement delays, reconciliation gaps, and regulatory exposure.

The most common failure occurs when companies build a system but fail to maintain it-audits slip, team training becomes optional, and people revert to spreadsheets because the system feels disconnected from their daily work. Assign clear ownership, schedule monthly audits, and connect your blockchain data directly to the tools your team already uses so the system becomes indispensable rather than burdensome. As you scale stablecoin payouts across Nigeria, Kenya, South Africa, and Ghana, regulators expect you to prove asset provenance, track custody changes, and respond to inquiries within days, which a fragmented DAM system cannot accomplish.

Start with a pilot program covering one payment corridor or one month of transactions to test your naming conventions, automation rules, and approval workflows at small scale before rolling out across your entire operation. Web3 Enabler provides native Salesforce integration that pulls blockchain transactions directly into your CRM, eliminating manual data entry and giving your team real-time visibility into digital asset movements. This connection transforms your digital asset management process flow from theory into daily operational reality, where every team member works from a single source of truth.