We at Web3 Enabler see companies struggling with outdated financial infrastructure daily. Stablecoin cashflow solutions are changing the game by offering instant settlements, lower fees, and round-the-clock availability that makes traditional banking look prehistoric.

Why Stablecoins Beat Traditional Banking

Traditional cross-border payments take 3-5 business days to settle through correspondent banks, while stablecoin transactions complete in minutes. USDC transfers settle within 15 minutes on average, compared to SWIFT payments that crawl through multiple intermediary banks. This speed difference transforms working capital management – instead of parking millions in pre-funded accounts across dozens of countries, businesses deploy capital instantly when needed.

Settlement Speed Transforms Working Capital

Payment processors like Thunes report that stablecoins are entering the mainstream as demand surges for global payment solutions. When your supplier in Vietnam needs payment today, you don’t wait until Thursday because of bank holidays. Visa and Mastercard test stablecoin rails specifically because current settlement infrastructure costs them billions in trapped liquidity. Smart CFOs already move high-frequency payments to stablecoin rails, which frees up capital that was previously stuck in nostro accounts while banks processed transfers.

Transaction Costs Drop Dramatically

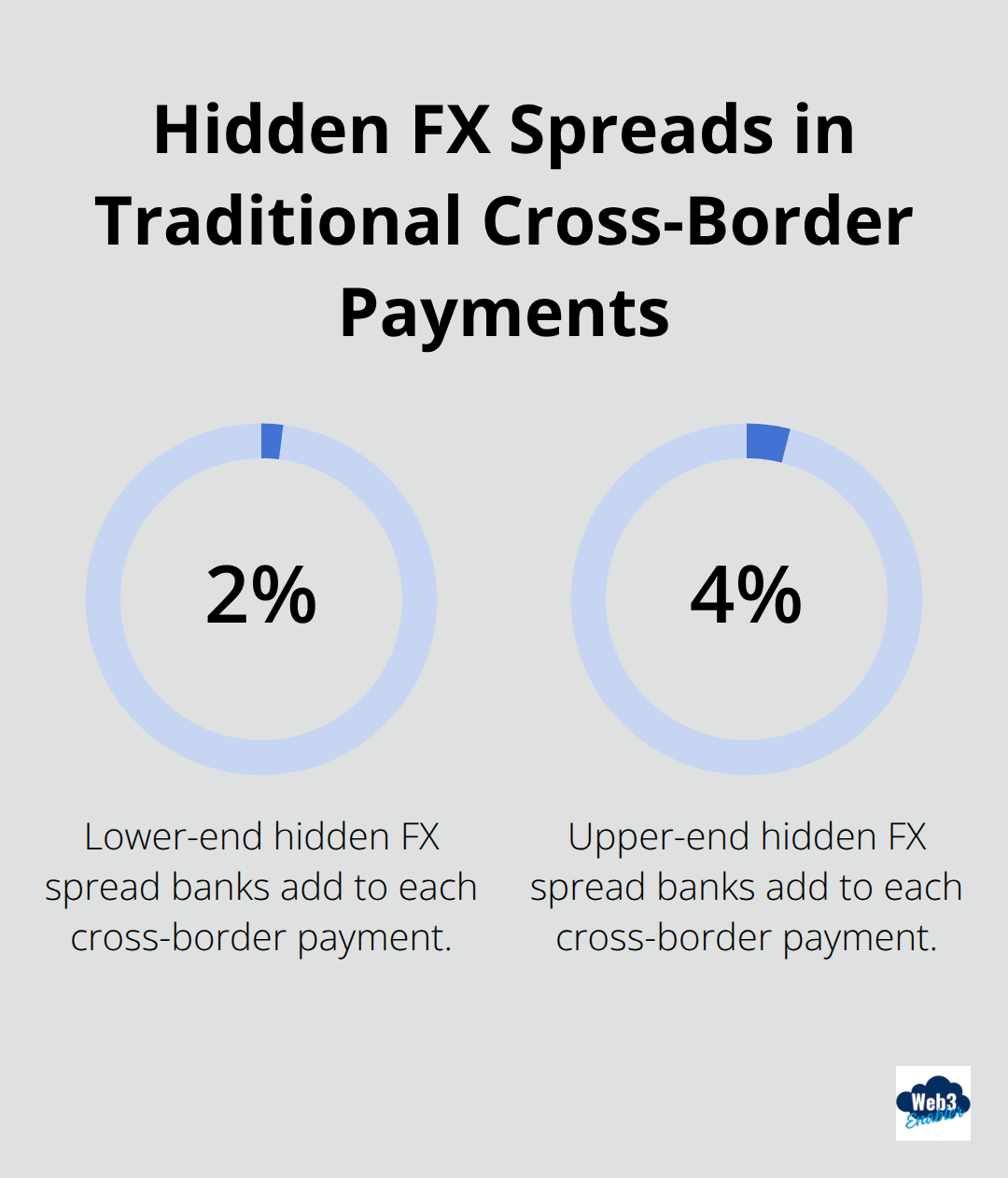

Cross-border wire transfers cost between $15-50 per transaction through traditional banks, plus hidden FX spreads that add 2-4% to every payment. Stablecoin transactions cost under $1 on most networks, with transparent exchange rates. Companies that pay hundreds of international contractors monthly save thousands in fees alone.

The math hits hard for traditional banks – when you process $100,000 in monthly international payments, stablecoins save you $3,000-5,000 compared to wire transfers.

Round-the-Clock Liquidity Access

Banks close, blockchain doesn’t. Weekend emergencies and holiday supplier payments become manageable when your treasury operates 24/7. Companies in underbanked regions particularly benefit – when local bank infrastructure fails, stablecoin payments continue to flow. This isn’t theoretical convenience; it’s operational resilience that prevents supply chain disruptions (and keeps your business partners happy).

These speed and cost advantages create new possibilities for how businesses manage their daily operations and supplier relationships.

How Companies Use Stablecoins Daily

Smart companies deploy stablecoins for specific pain points where traditional banks fail spectacularly. Remote-first businesses that pay contractors across 50+ countries switched to stablecoin payroll after they burned $15,000 monthly on wire transfer fees. Digital marketplaces like freelancer platforms process thousands of micro-payments to sellers globally – traditional banks make this impossible due to minimum fees that exceed payment amounts.

E-commerce companies that handle supplier payments in volatile currency corridors reduce FX exposure through USDC settlements. They avoid the 2-4% spreads banks charge for exotic currency pairs while maintaining predictable costs.

Supplier Payments That Actually Work

Manufacturing companies with Asian suppliers face settlement delays that disrupt production schedules. Stablecoin payments complete within hours and enable just-in-time inventory management without cash flow gaps. Traditional cross-border payments can take three to five days to settle while passing through multiple correspondent banks. Companies that operate in Latin America report that 40% of their B2B transactions now use stablecoins to avoid local currency devaluation risks.

Payment processors like Thunes connect stablecoin liquidity to over 130 countries and handle FX conversion automatically while they maintain enterprise compliance standards. This eliminates the need for pre-funded accounts in dozens of local currencies.

Subscription Revenue Without Banking Friction

SaaS companies that serve global customers lose 15-20% of international subscribers due to failed credit card payments and banking restrictions. Stablecoin subscription systems eliminate these friction points while they reduce chargeback risks to near zero (goodbye dispute headaches).

Recurring payment automation through smart contracts processes monthly subscriptions without manual intervention and cuts operational overhead for finance teams. Companies in high-risk sectors that traditional banks refuse to serve maintain payment continuity through stablecoin infrastructure when banking relationships terminate unexpectedly.

Emergency Liquidity When Banks Sleep

Weekend emergencies don’t wait for Monday morning bank hours. Companies access stablecoin liquidity 24/7 to handle urgent supplier payments, emergency contractor fees, or time-sensitive opportunities. This proves especially valuable during banking holidays when traditional wire transfers sit in queue for days.

Businesses in regions with unreliable banking infrastructure rely on stablecoins as their backup payment system (because local bank outages shouldn’t kill your operations). The infrastructure that powers these solutions requires careful selection and proper implementation to maximize benefits.

How Do You Actually Implement Stablecoin Payments

Smart implementation starts with USDC over experimental tokens and partners with compliance-first infrastructure providers. Circle-backed USDC dominates with $40 billion in circulation and full reserve backing that Grant Thornton audits monthly. Tether USDT has larger volume but faces regulatory scrutiny that makes it risky for corporate treasury use. Skip algorithmic stablecoins entirely – they collapse when markets stress test them (Terra Luna taught us that lesson the hard way).

Platform Selection Makes or Breaks Implementation

Payment processors like Thunes and Circle’s enterprise solutions handle regulatory compliance automatically while they connect to traditional banking rails. These platforms cost 0.1-0.3% per transaction versus the six-figure budgets companies burn on custom compliance infrastructure. Companies that attempt custom blockchain integration waste months on KYC systems and regulatory reporting before they process their first payment.

Enterprise-grade providers include sanctions screening, AML monitoring, and automated regulatory reporting that internal teams cannot replicate cost-effectively. The math favors established platforms over DIY approaches every time.

Integration Without Breaking Existing Systems

Modern stablecoin processors integrate through standard APIs that connect to existing ERP systems like SAP and Oracle without custom development. Accounting teams track stablecoin transactions through familiar interfaces while treasury systems receive real-time balance updates. The key insight: treat stablecoins as another payment method rather than revolutionary technology.

Companies that succeed start with single use cases like contractor payments before they expand to supplier settlements. Finance teams require detailed transaction histories for audit purposes – choose providers that export data in formats your accounting software accepts natively. For businesses using Salesforce, native blockchain solutions can automate payment records and trigger workflows seamlessly.

Compliance Cannot Be an Afterthought

BSA/AML regulations apply to stablecoin transactions with stricter reporting requirements than traditional banking. Transaction monitoring must happen in real-time rather than daily batch processing that banks use. Elliptic and Chainalysis provide blockchain analytics that flag suspicious transactions before they settle.

Companies operating internationally need providers that understand local regulations in each jurisdiction – what works in Singapore fails compliance tests in the EU. The Clarity for Payment Stablecoins Act creates distinct regulatory paths for issuers that businesses must understand. Tax implications vary dramatically by country, so involve your tax advisors early rather than discover obligations during year-end reporting (nobody wants that surprise).

Final Thoughts

Stablecoin cashflow management transforms how businesses handle international payments and working capital. Companies save $3,000-5,000 monthly on cross-border transactions while they access 24/7 liquidity that traditional banks cannot match. Settlement times drop from days to minutes, which frees up millions in trapped capital across global accounts.

Start with USDC payments for specific pain points like contractor payroll or supplier settlements. Choose compliance-first providers that connect with existing ERP systems rather than build custom infrastructure. Focus on single use cases before you expand to full treasury operations (because gradual adoption reduces implementation risks).

The regulatory landscape continues to evolve with clearer frameworks that emerge globally. Major payment processors integrate stablecoin rails while corporations pilot B2B settlements at scale. Web3 Enabler provides Salesforce-native blockchain solutions that connect stablecoin payments directly to existing corporate workflows.