Global payments are transforming at breakneck speed. Traditional banking systems that once took days to process international transfers now compete with blockchain solutions promising instant settlements.

Ripple and SWIFT represent two powerful forces reshaping how money moves across borders. We at Web3 Enabler see businesses increasingly choosing faster, cheaper payment rails over legacy systems that drain time and resources.

How Ripple Outpaces Traditional Payment Systems

Real-Time Settlement Transforms Business Operations

Ripple settles cross-border transactions in 3 to 5 seconds through its XRP Ledger, while traditional SWIFT transfers still require 1 to 5 business days. SBI Remit in Japan demonstrates this speed advantage when it uses Ripple’s On-Demand Liquidity system to send money instantly from Japan to the Philippines, Vietnam, and Indonesia. This dramatic time reduction eliminates the need for businesses to maintain pre-funded nostro accounts in multiple currencies, which frees up millions in capital that was previously locked in correspondent accounts.

Direct Settlement Slashes Transaction Costs

Ripple’s blockchain technology cuts payment costs when it eliminates multiple intermediary banks that traditional systems require. Each intermediary typically charges 0.5% to 2% in fees, which means a $100,000 transfer through traditional channels can cost $1,500 in fees alone. Ripple’s direct settlement model reduces these costs to under 0.1%, and businesses save thousands on large international payments. Financial institutions like SBI Holdings have integrated XRP into their treasury management operations because the cost savings compound significantly across thousands of monthly transactions.

Major Financial Institutions Drive Network Expansion

Ripple’s partnership network spans over 300 financial institutions globally, and includes major players like Santander, American Express, and Standard Chartered. These institutions chose Ripple because it integrates with their current infrastructure without complete system overhauls. The network effect accelerates adoption as more banks join and creates liquidity corridors that make XRP settlements even faster and cheaper. Regional banks and fintechs particularly benefit from this network growth (gaining access to global payment rails that were previously available only to the largest institutions).

SWIFT recognizes this competitive pressure and has launched its own modernization efforts to maintain its dominant position in global payments.

How SWIFT Fights Back Against Blockchain Competition

SWIFT launched its Global Payments Initiative in 2017 to counter Ripple’s speed advantage, and the results show measurable improvements in cross-border payment processing. SWIFT gpi now processes payments on the SWIFT network, with 40% of payments credited to beneficiaries within five minutes and 95% within 24 hours. This represents a massive improvement from the traditional 3-5 day settlement times that plagued international transfers for decades.

Speed Improvements Close the Gap

Banks that use SWIFT gpi report 60% fewer payment inquiries because the system provides real-time status updates throughout the payment journey. This eliminates the black hole effect where payments disappeared into correspondent networks without visibility. Finance teams at major corporations now spend significantly less time on payment investigations and can focus on strategic financial operations instead.

Real-Time Tracking Changes Payment Management

SWIFT gpi transforms payment visibility through its service that provides end-to-end transaction monitoring across 4,000 banks in 200 countries. Payment originators can now track their transfers in real-time and receive confirmation when funds reach the beneficiary account (similar to package services). This transparency reduces operational costs for businesses because finance teams spend 75% less time on payment status inquiries and resolving customer questions about missing transfers.

Blockchain Integration Modernizes Legacy Infrastructure

SWIFT tests blockchain technology through partnerships with Consensys to develop interoperable payment solutions that support both traditional currencies and tokenized assets. The new SWIFT blockchain initiative aims to connect with major public and private networks while it maintains compatibility with existing infrastructure that serves 11,000 financial institutions worldwide. This approach allows banks to gradually adopt blockchain solutions without complete infrastructure overhauls (which gives SWIFT a strategic advantage over competitors that require system replacements).

The battle between these two payment giants creates opportunities for businesses to choose the solution that best fits their specific needs and transaction patterns.

Which Payment System Wins for Business Operations

Speed Differences Transform Cash Flow Management

Ripple delivers 3-5 second settlements that transform cash flow management, while traditional cross-border payments through SWIFT require longer processing times. This speed difference matters when businesses need immediate access to capital or must meet tight supplier payment deadlines. Companies that use Ripple can convert receivables to available funds almost instantly, which eliminates the cash flow gaps that force businesses to maintain expensive credit lines. SWIFT still requires businesses to plan payment schedules around bank hours and weekend delays, though its improvements represent massive progress from traditional 3-5 day settlement windows.

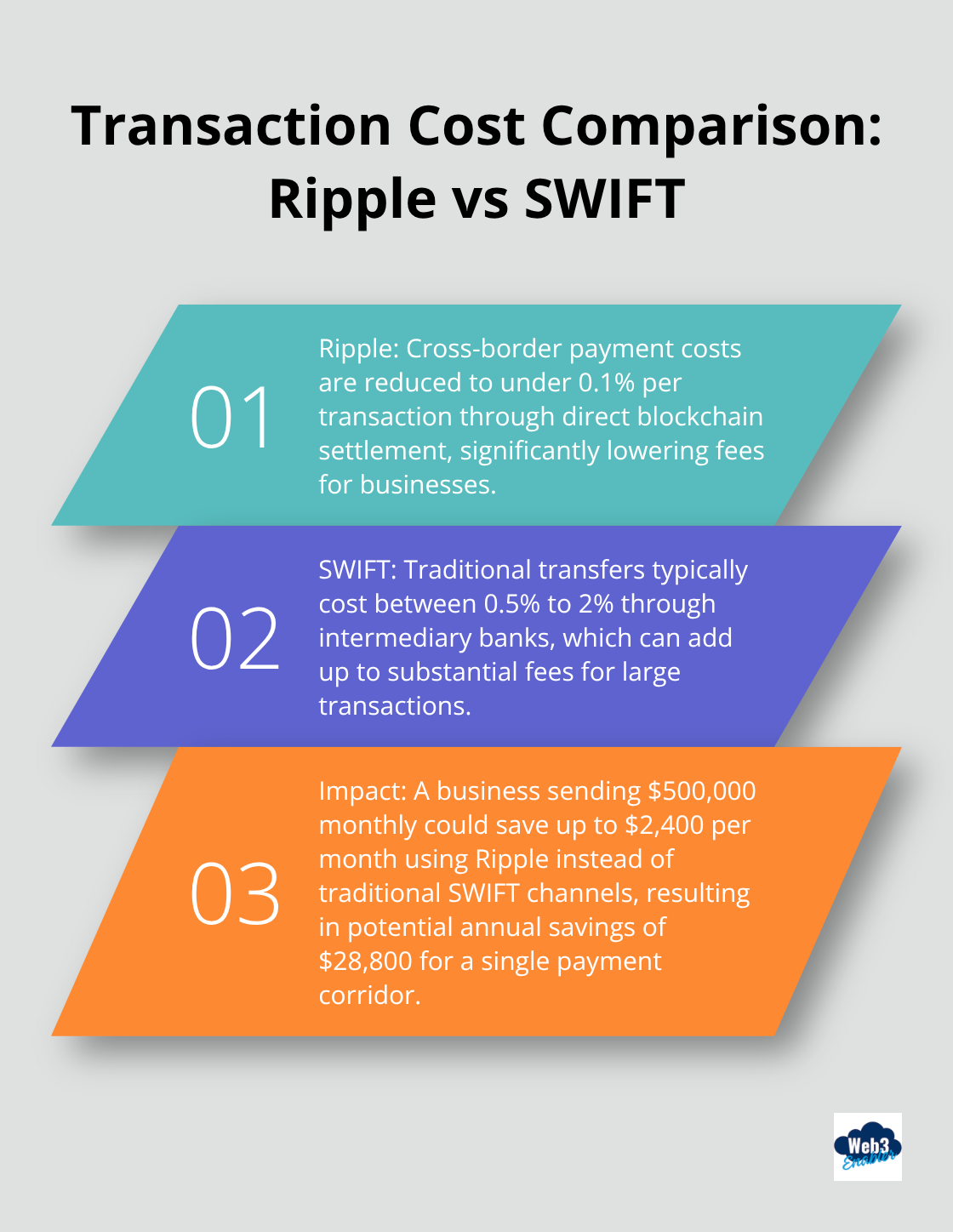

Transaction Costs Create Significant Bottom-Line Impact

Ripple reduces cross-border payment costs to under 0.1% per transaction through direct blockchain settlement, while traditional SWIFT transfers cost 0.5% to 2% through intermediary banks. A manufacturer that sends $500,000 monthly to Asian suppliers saves $2,400 per month when it uses Ripple versus traditional SWIFT channels. These savings compound quickly for high-volume businesses (with annual cost reductions that reach $28,800 for this single payment corridor). SWIFT gpi reduces some fees through faster processing and fewer payment investigations, but intermediary bank charges remain unchanged in most corridors.

Network Adoption Patterns Reveal Strategic Advantages

SWIFT maintains its dominance with 11,000 connected financial institutions across 200 countries, while Ripple operates through 300+ financial partners that include major banks like Santander and Standard Chartered. SWIFT’s massive network means universal acceptance for international payments, but Ripple’s targeted partnerships create highly efficient payment corridors in specific regions. Asian markets show particularly strong Ripple adoption, with SBI Remit that processes thousands of transactions monthly to Philippines and Vietnam markets. Businesses that operate in Ripple-supported corridors access significantly better rates and speed, while companies that require global payment reach still depend on SWIFT’s comprehensive network coverage. Organizations looking to streamline operations with blockchain efficiency can leverage these payment innovations to reduce costs and enhance vendor payment processes.

Final Thoughts

The competition between Ripple and SWIFT fundamentally reshapes global payment infrastructure. Traditional banks that processed trillions in annual cross-border transfers now face pressure to modernize or lose market share to blockchain alternatives. Financial institutions increasingly adopt hybrid approaches, with Ripple for specific high-volume corridors while they maintain SWIFT connectivity for universal reach.

Ripple delivers 3-5 second settlements and sub-0.1% transaction costs that prove instant global payments work at scale. SWIFT responds through gpi improvements that show established networks can evolve, but intermediary bank fees remain a significant cost burden for businesses. Companies that embrace modern payment rails gain competitive advantages through improved cash flow management and reduced operational costs.

We at Web3 Enabler help businesses integrate these payment innovations through our blockchain solutions for the Salesforce ecosystem. Our platform enables companies to accept stablecoin payments and send global transfers faster while they maintain compliance within existing workflows. The future belongs to businesses that leverage both traditional and blockchain payment systems strategically (rather than choose sides in the Ripple versus SWIFT debate).