Accepting stablecoins shouldn’t mean managing wallets, watching markets, or running a separate crypto treasury. It should feel like getting paid any other way: funds arrive, they’re converted automatically, and they land in your company’s bank account.

With Org Liquidation Wallets, Blockchain Payments enables exactly that. Your business can accept stablecoins from customers and have those funds automatically converted to fiat and deposited into your company’s bank account — without manual conversions, external tools, or operational overhead.

Stablecoin payments without treasury complexity

Stablecoins are fast, global, and efficient — but for many companies, they introduce friction. Funds sit on-chain, conversions require manual action, and finance teams are left reconciling crypto balances against bank statements.

Org Liquidation Wallets remove that friction. Instead of treating stablecoins as a separate system, they become just another way your business gets paid. Customers pay in stablecoins. Your company receives fiat.

No crypto treasury.

No market timing.

No operational guesswork.

Org liquidation wallets as the settlement layer

An Org Liquidation Wallet is a company-managed wallet designed specifically for settlement. It acts as the destination for incoming stablecoin payments and defines how those funds should be handled once received.

Rather than holding assets indefinitely, the liquidation wallet is configured to automatically convert incoming stablecoins into fiat and route the proceeds to your connected bank account. This turns on-chain payments into predictable, bank-based cash flow.

How the flow works end to end

Here’s how a typical payment works when using an Org Liquidation Wallet:

A customer sends a stablecoin payment to your organization’s liquidation wallet.

The stablecoin payment is received and detected automatically.

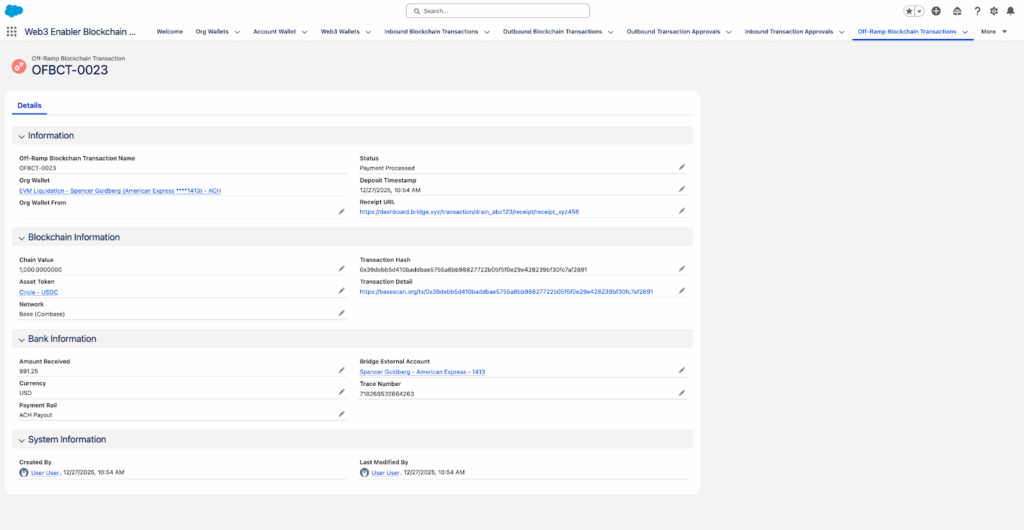

The funds are converted to fiat through an off-ramp.

The fiat proceeds are deposited directly into your company’s bank account.

The full transaction is recorded for reconciliation and reporting.

To the customer, it’s a stablecoin payment.

To your finance team, it’s a bank deposit.

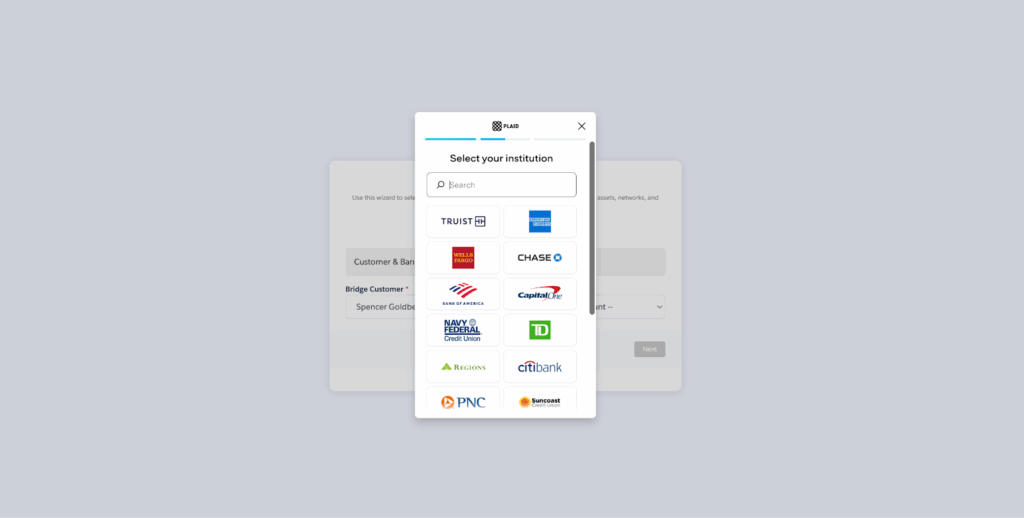

Simple bank account setup

Connecting your company bank account is intentionally straightforward. During setup, you can link your bank in minutes using Plaid or enter your account and routing details manually.

Once connected, that bank account becomes the destination for all liquidated stablecoin payouts. There’s no need to move funds between systems or manage separate payout workflows.

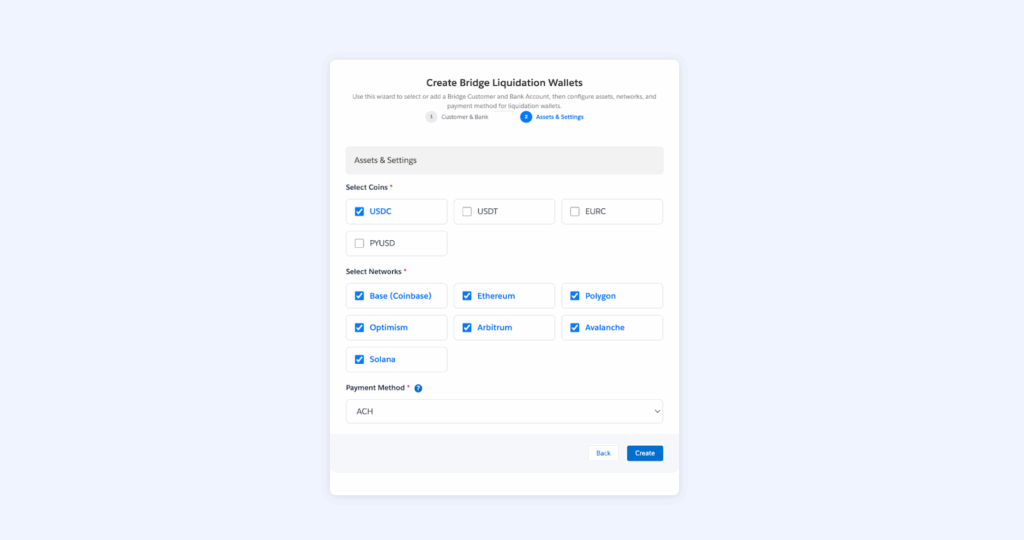

Choose what you accept and how you settle

Org Liquidation Wallets give your business full control over how payments are handled. You decide which stablecoins and which blockchain networks you want to support, and whether funds should be automatically converted to fiat.

This ensures alignment between customer payment options and your internal treasury policies, without adding complexity for either side.

Built for finance and operations teams

Org Liquidation Wallets are designed to fit cleanly into existing financial workflows. Payments are converted automatically, settlements are traceable, and payouts align with how companies already manage cash.

There’s no need to hold crypto on your balance sheet, no need to manually reconcile conversions, and no need to explain blockchain mechanics to auditors.

What you gain is:

- Predictable cash flow

- Faster settlement

- Clear audit trails

- Reduced operational risk

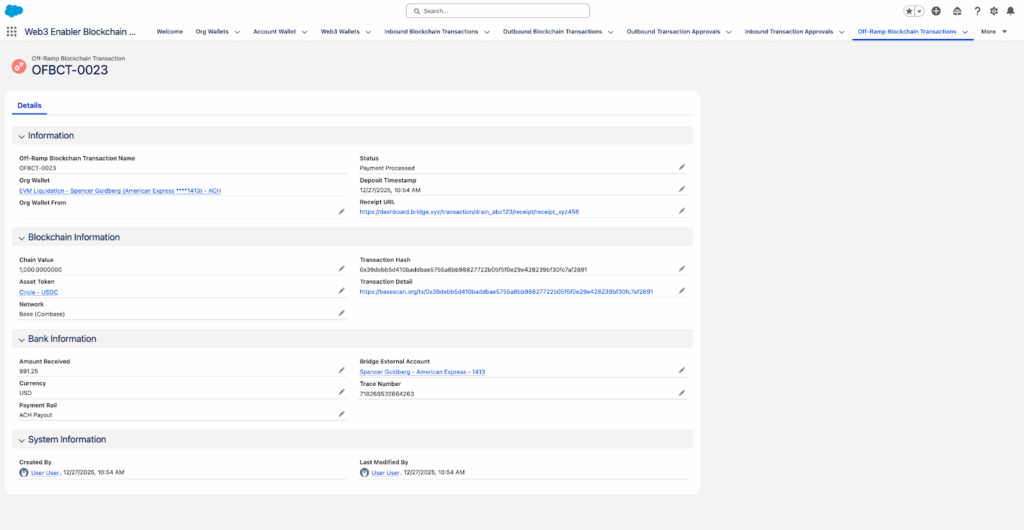

One payment, complete visibility

Each payment is tracked end to end. Incoming stablecoin transactions, conversions, and bank payouts are captured as a single, coherent lifecycle.

Finance teams get clarity without spreadsheets. Operations teams get repeatable, reliable flows they can trust.

Payments that work the way businesses expect

Org Liquidation Wallets turn stablecoins into a practical payment method for real businesses. Customers get the speed and efficiency of blockchain payments. Companies get the familiarity and reliability of bank deposits.

The complexity stays hidden, and the payments just work.