International payments today move at a glacial pace. Banks take days to settle transactions across borders, and hidden fees eat into every transfer.

Cross-border stablecoin payments change this equation entirely. At Web3 Enabler, we’ve seen firsthand how blockchain-based settlements eliminate intermediaries and cut costs dramatically while completing in minutes instead of days.

Why Banks Can’t Match Stablecoin Settlement Speed

Traditional correspondent banking creates unnecessary delays

Traditional correspondent banking relies on a chain of intermediaries that each consume time to process, verify, and forward transactions. A wire transfer from the US to Southeast Asia passes through at least four to six banks, each applying their own processing windows and compliance checks. The result: settlement takes up to five days, and that timeline assumes no weekend delays or holiday interruptions. Wire transfers and ACH payments were designed for a slower financial world where real-time verification wasn’t possible, so they built in buffer time at every stage.

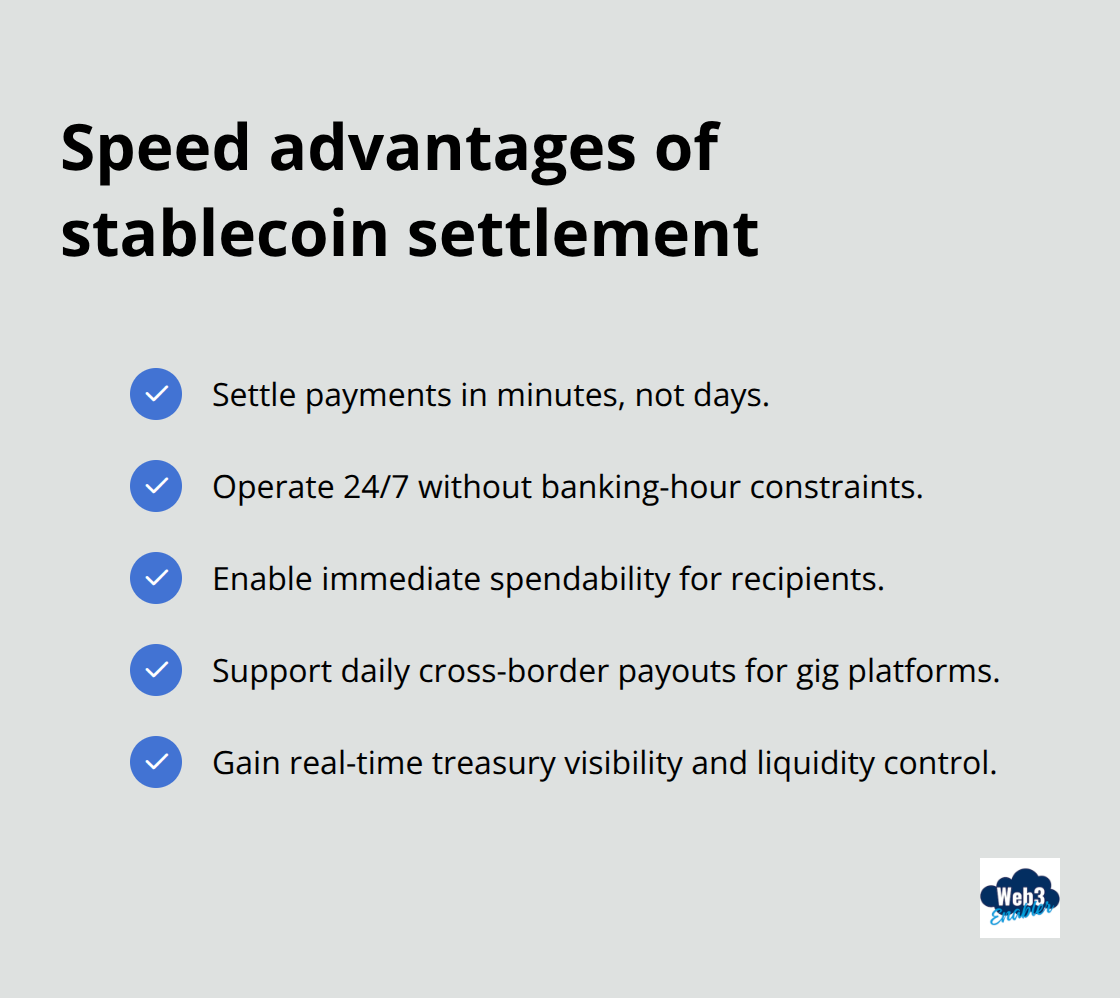

Stablecoins settle in minutes on blockchain rails

Stablecoins eliminate the correspondent bank chain entirely. A transaction on blockchain settles with finality in minutes, 24/7, without waiting for banking hours or intermediate institutions to process requests. An enterprise sending USD Coin or Tether to a vendor in Africa or Southeast Asia receives the payment immediately and can spend it right away, versus the multi-day wait with traditional rails.

This speed matters operationally: gig economy platforms paying drivers across borders can settle daily rather than weekly, reducing the need for capital reserves earmarked for payment timing delays. Enterprises managing global treasury operations gain visibility into liquidity positions in real time instead of waiting for batch settlement reports days after funds actually moved.

Fee structures collapse when intermediaries disappear

Traditional cross-border payments layer fees at each intermediary step. A correspondent bank takes a cut, the receiving bank takes a cut, and currency conversion spreads apply at multiple points. Stablecoin transfers eliminate most of these intermediaries, cutting costs significantly compared with traditional payment rails. For a business sending $100,000 across borders monthly, the savings compound substantially over time. Currency conversion becomes more efficient too: instead of converting at a bank’s quoted rate with embedded markup, businesses convert once to a stablecoin at tighter market spreads, then transfer at that fixed rate. The IMF notes that cross-border stablecoin use enables faster and cheaper payments, particularly for remittances, compared with traditional payment rails.

FX mechanics work in your favor

Institutions report that moving payment flows to stablecoins reduces their FX exposure and locks in conversion rates that beat traditional bank quotes by 50–100 basis points. Instead of accepting the bank’s all-in rate (which includes hidden spreads), businesses access market rates directly and execute transfers at that locked price. This matters especially for companies managing multiple currencies across regions: they convert once to a stablecoin, transfer across borders instantly, and convert back to local currency at the destination-all without the layered markups that traditional banking imposes at each step.

The speed and cost advantages of stablecoins only work if you can actually integrate them into your existing systems and manage the custody and compliance requirements that regulators now demand.

How Much Money Do Stablecoin Payments Actually Save

Intermediaries extract fees at every step in traditional banking

Traditional correspondent banking stacks fees at every stage of a cross-border transaction. The originating bank charges for the wire, each intermediary bank takes a processing fee, the receiving bank applies another charge, and currency conversion spreads embed hidden markups at multiple points. A $100,000 monthly cross-border payment typically loses 2–5% of its value to these layered costs according to industry analysis. Each intermediary extracts value before the funds reach their destination, and you have no visibility into where those costs originate. Stablecoins collapse this fee structure because transactions move directly on blockchain rails without intermediaries extracting value at each stage.

Stablecoin transfers cut FX costs dramatically

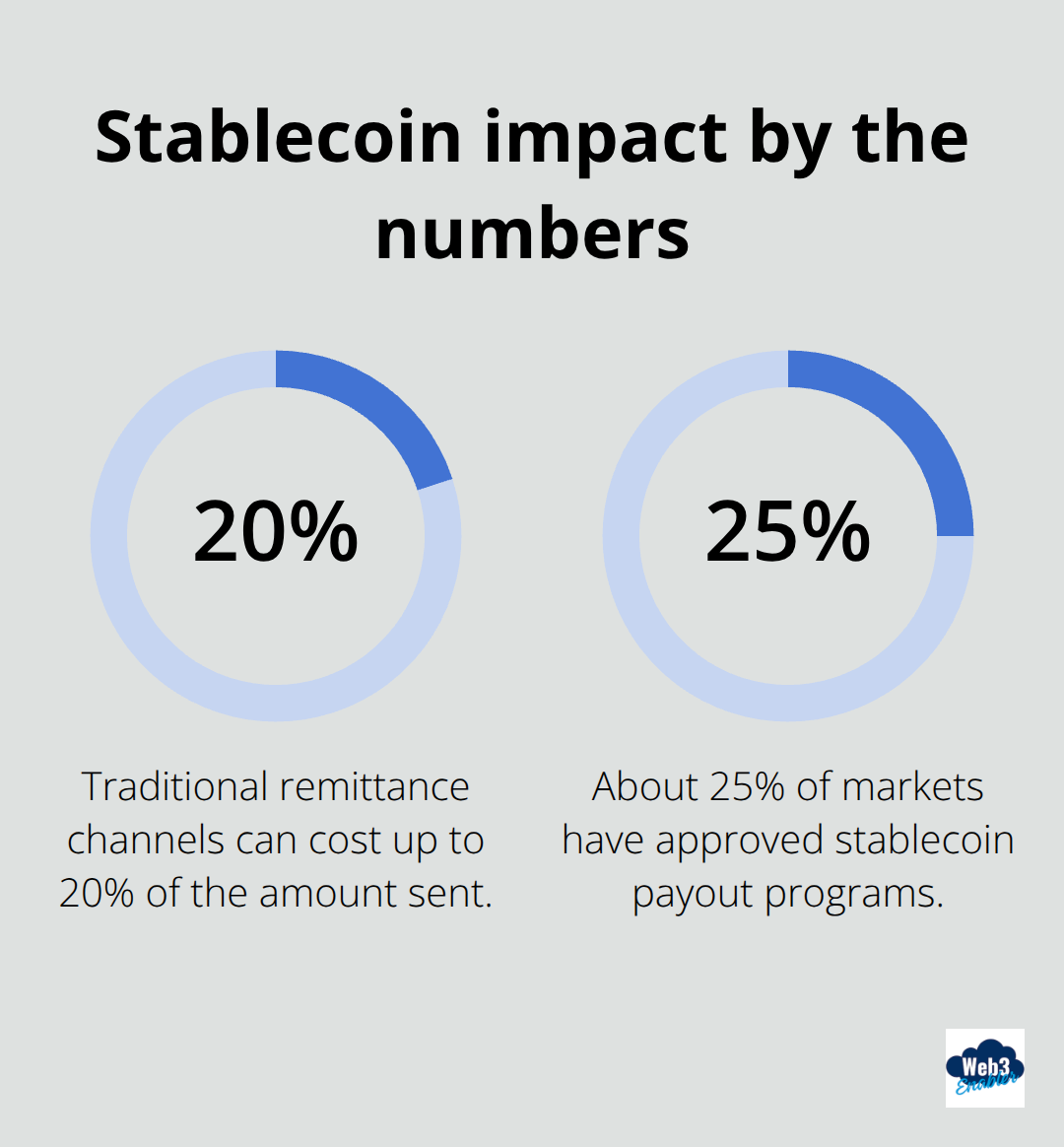

Institutions moving payment flows to stablecoins report FX savings when compared with traditional bank quotes. Instead of accepting the bank’s all-in rate (which includes hidden spreads), you access market rates directly and execute transfers at that locked price. This advantage compounds when you execute multiple transfers monthly or annually. The IMF research shows that remittance costs can reach up to 20% of the amount sent through traditional channels, making stablecoins particularly valuable for businesses and individuals sending money to high-cost corridors in Africa, Southeast Asia, and Latin America. A business sending $50,000 weekly to vendors across five countries recovers $100,000–$150,000 annually just from tighter FX rates and eliminated intermediary fees.

Capital reserves shrink when settlement happens instantly

Stablecoins settle in minutes, enabling you to move liquidity across entities in real time and redeploy capital the same day. Traditional wire transfers create a multi-day settlement window during which you cannot deploy capital elsewhere, forcing businesses to maintain buffer accounts. Treasury teams gain visibility into actual payment positions immediately rather than waiting days for batch settlement reports, which eliminates guesswork in cash forecasting and liquidity planning. You no longer need to hold reserves earmarked for payment timing uncertainty.

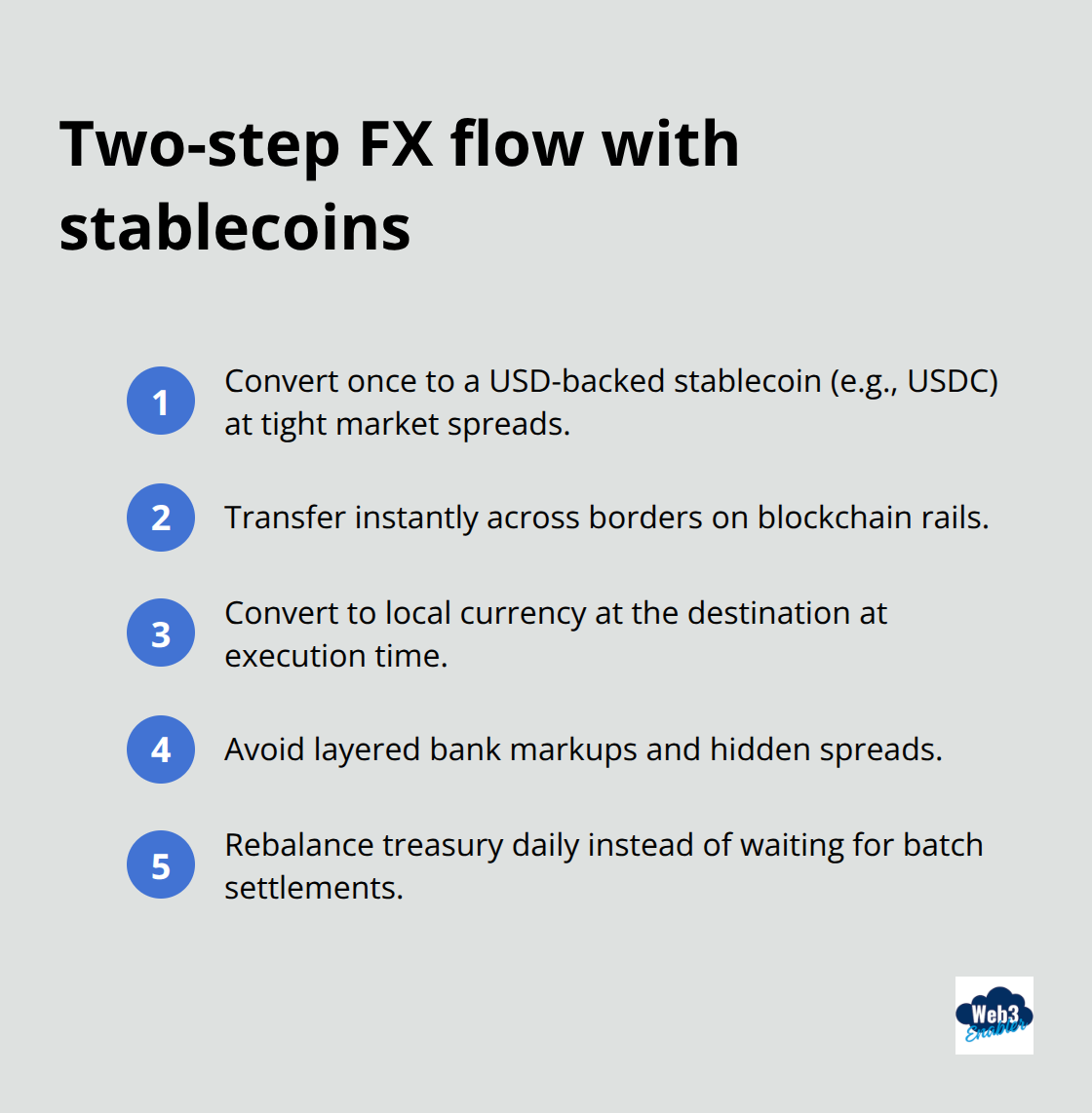

Two-step conversion replaces the five-step chain

Currency conversion becomes dramatically more efficient with stablecoins because you execute conversion once at market rates rather than accepting the bank’s embedded spreads at multiple points. You convert to a USD-backed stablecoin like USDC at a tight market spread, transfer instantly across borders, and convert to local currency at the receiving end.

This two-step process replaces the traditional correspondent banking chain and eliminates the markup layering that occurs when banks quote all-in rates to cover their own FX desk costs and intermediary fees. Enterprises managing treasury operations across multiple jurisdictions execute daily rebalancing instead of weekly batch settlements, giving you better control over currency exposure and the ability to respond to market movements immediately.

Real savings compound across your organization

Businesses moving $1–5 million monthly across borders report that switching to stablecoin rails reduces their total cost of international payments by 15–25%, with the largest savings coming from eliminated intermediary fees and FX efficiency gains rather than transaction fees alone. These savings accumulate across every payment your organization sends, and the operational benefits (faster liquidity access, better forecasting, real-time visibility) create additional value beyond the direct cost reduction. Once you understand the financial impact, the next challenge becomes integrating stablecoins into your existing systems without disrupting current workflows or creating compliance gaps.

Building Stablecoin Payments into Your Current Systems

Integrating stablecoins into existing business infrastructure requires three parallel workstreams: connecting payment flows to your operational systems, establishing secure custody arrangements, and implementing regulatory controls that satisfy both your internal risk teams and external regulators. Most enterprises underestimate the operational complexity here and assume stablecoins work like traditional APIs. They don’t. Stablecoins move on blockchain rails with irreversible transactions, so wallet accuracy, validation controls, and error-prevention systems become non-negotiable. Modern stablecoin infrastructure has matured enough that integration no longer means ripping out your existing tech stack. Salesforce-native solutions connect stablecoin rails directly into your CRM and ERP workflows without forcing your team to abandon systems they already know. This matters because your finance, sales, and operations teams don’t want to learn a new platform just to send or receive stablecoin payments.

Connecting payment rails without disrupting existing workflows

Your enterprise likely runs payments through Salesforce, SAP, NetSuite, or similar platforms where your customer records, vendor data, and transaction history live. Stablecoins integrate into these systems through APIs that feed payment instructions directly onto blockchain rails. When a customer order triggers a payment in Salesforce, the system automatically initiates a USDC or USDT transfer to the vendor’s wallet address without manual intervention. This automation eliminates data entry errors and reduces settlement times from days to minutes. The critical step involves mapping your existing payment logic (vendor approval workflows, amount thresholds, currency conversion rules) into stablecoin-compatible instructions before execution. Salesforce-native blockchain solutions handle this mapping without requiring custom code that your team can’t maintain. You connect your existing data to blockchain rails, not replace your infrastructure. The GENIUS Act framework establishes federal oversight for payment stablecoin issuers, which means the stablecoin providers you partner with now operate under clearer regulatory guidelines. This regulatory clarity reduces counterparty risk when you select a partner like Circle, whose USDC maintains transparent 1:1 reserves in cash and US Treasuries.

Custody architecture that prevents irreversible mistakes

Stablecoin custody differs fundamentally from traditional banking because blockchain transfers cannot be reversed once they execute. If your team sends funds to an incorrect wallet address, those funds are gone permanently. This reality demands custody solutions that go far beyond standard payment processing. Institutional-grade custody requires multi-signature wallets, hardware security modules that protect private keys offline, and transaction validation workflows that verify recipient addresses against whitelists before execution. Early adopters emphasize partner whitelisting, stringent compliance, and disciplined operations as trust foundations. Your custody provider should maintain offline key storage, perform regular security audits, and provide insurance coverage for digital assets in their care. Circle and similar regulated stablecoin issuers now offer custodial services specifically designed for institutional clients, combining reserve custody with private key management. When evaluating custody solutions, prioritize providers with transparent reserve management and on-chain risk controls. Your vendor should publish regular attestations proving that stablecoin reserves match issued tokens, which removes guesswork about whether your transfers settle against real assets. A custody partner handling $10 million in monthly stablecoin flows should maintain segregated accounts, employ role-based access controls that restrict who can initiate transfers, and run automated compliance checks before every transaction executes.

Regulatory compliance that scales across jurisdictions

Cross-border stablecoin payments trigger regulatory obligations in multiple jurisdictions simultaneously, which creates compliance complexity that traditional banking handled for you. The EU’s Markets in Crypto-Assets Regulation (MiCA) requires stablecoin issuers to maintain 1:1 reserves and prohibits payment stablecoins that don’t meet strict prudential standards. The US GENIUS Act establishes a federal framework allowing insured depository institutions to issue stablecoins through approved subsidiaries, with the FDIC as primary regulator for state-chartered institutions. Your compliance program must track these evolving rules across every jurisdiction where you send or receive payments. Practical implementation requires automated screening that blocks transactions to sanctioned jurisdictions, identifies beneficial owners of counterparties through blockchain analysis, and flags high-risk activity patterns before settlement. Tools like real-time blocklists and indirect risk reporting help protect your organization (surfacing exposures that manual review would miss). The IMF emphasizes that regulatory gaps may create arbitrage opportunities, meaning some jurisdictions currently lack clear stablecoin frameworks entirely. Your compliance team should map which corridors (US to Singapore, Europe to Southeast Asia, etc.) have established regulatory pathways versus those still evolving. For corridors with regulatory clarity, you can implement stablecoin rails immediately. For emerging markets where regulations remain undefined, maintain fallback payment channels until local frameworks solidify. Issuer due diligence becomes your first line of defense: assess reserve management practices, custody arrangements, and on-chain risk controls before sending material volumes through any stablecoin partner. This evaluation prevents counterparty failures from freezing your working capital.

Final Thoughts

Cross-border stablecoin payments eliminate the speed and cost barriers that have defined international finance for decades. Blockchain settlement in minutes, FX savings of 50–100 basis points, and the removal of intermediary fees create a financial case that traditional banking cannot match. The regulatory environment has shifted decisively in your favor: the GENIUS Act provides federal clarity for US stablecoin issuers, MiCA establishes prudential standards across Europe, and major institutions now operate under transparent reserve requirements.

Implementation requires discipline across three areas: your custody architecture must prevent irreversible mistakes through multi-signature wallets and transaction validation before execution, your compliance program must track evolving regulations across jurisdictions and screen transactions against sanctioned entities, and your systems integration must connect stablecoin rails directly into Salesforce or your existing ERP without forcing your team to abandon platforms they already know. The complexity here is real, but it is manageable when you partner with providers who understand both blockchain mechanics and enterprise operations.

Stablecoins have moved from crypto experiment to core infrastructure for international settlements, with about 25% of markets already approving stablecoin payout programs and adoption expanding rapidly beyond crypto-native firms to fintechs, marketplaces, and global businesses. Citibank forecasts the stablecoin market could reach $1.9 trillion by 2030, up from roughly $300 billion today.

We at Web3 Enabler specialize in connecting blockchain technology with your existing corporate infrastructure through 100% Salesforce Native solutions that handle cross-border stablecoin payments, compliance, and automation without forcing you to abandon the systems you already use.