The cross border payments market size reached $190 trillion in 2023, with projections showing 6.2% annual growth through 2030. Traditional banking methods still dominate, but digital solutions are rapidly gaining ground.

We at Web3 Enabler see businesses struggling with slow, expensive international transfers that drain resources and delay operations. Modern payment technologies offer faster, more cost-effective alternatives that smart companies are already adopting.

What Drives the $190 Trillion Cross-Border Payments Market

Market Size Reaches Record Highs

The cross-border payments market hit $190 trillion in 2023 and shows no signs of slowing down. EY estimates total global cross-border payment flows will reach $290 trillion by 2030, which represents a compound annual growth rate of 6.2%. This growth translates to an additional $100 trillion in cross-border transaction volume over just seven years. Companies that process international payments today handle volumes that dwarf entire national economies, which makes payment efficiency a competitive advantage rather than a back-office function.

Asia Pacific Leads Global Payment Innovation

Asia Pacific dominates cross-border payment volumes and accounts for 42% of global transactions in 2023 according to Swift data. China processes over $4.8 trillion annually, while India’s Unified Payments Interface handled 131 billion transactions in 2023. Brazil’s Pix system became the country’s most popular payment method within two years of launch and processed 42 billion transactions worth $1.2 trillion in 2023. These government-backed real-time payment systems prove that speed and cost reduction drive adoption faster than traditional bank partnerships.

Digital Transformation Accelerates Business Adoption

B2B payments represent 85% of cross-border transaction value, with corporate treasuries that demand faster settlement times and lower fees. Traditional correspondent banks add 3-5% in fees and take 3-5 business days for completion. Digital payment platforms now offer same-day settlement at 0.1-1% fees (a reduction of up to 98% in costs), which forces businesses to reconsider their payment infrastructure. Companies that use blockchain-based solutions report 24/7 transaction capability and settlement times under 30 seconds, which eliminates weekend delays and currency risk exposure.

Technology Adoption Reshapes Payment Infrastructure

Financial institutions face pressure to modernize their payment rails as clients demand real-time visibility and instant settlement. Traditional wire transfers require multiple intermediaries and manual processes that create delays and increase costs. Modern payment platforms integrate APIs that automate compliance checks and provide real-time transaction status updates. This shift toward digital infrastructure sets the stage for how different payment methods compete for market share in today’s rapidly evolving landscape.

How Payment Methods Compare in Market Share

Traditional correspondent banks still process 75% of cross-border payment volume despite digital alternatives that offer superior speed and cost efficiency. Bank wire transfers handle approximately $142 trillion annually through SWIFT’s network of 11,000 financial institutions, but these transactions average 3-5 business days for completion and cost 3-5% in total fees. Major banks like JPMorgan Chase and Bank of America maintain correspondent relationships that add multiple intermediaries to each transaction, which creates delays and increases operational risk for businesses that need predictable cash flow.

Digital payment platforms capture 20% of cross-border market share and grow at 15% annually according to McKinsey research. Stripe processes over $640 billion in payment volume across 195 countries, while PayPal handles $1.4 trillion in total payment volume with same-day settlement capabilities. Blockchain-based solutions represent just 5% of current market share but demonstrate 40% annual growth rates as enterprises adopt stablecoin payments for treasury operations.

SWIFT Network Maintains Legacy Dominance

SWIFT processes 42 million messages daily across its correspondent network, but message-based settlement creates friction that modern businesses reject. Traditional wire transfers require manual intervention for compliance checks and foreign exchange conversion, which extends processing times and increases error rates. Banks charge fees that range from $15-50 per transaction plus currency conversion spreads that add 2-4% to total costs.

Digital platforms automate these processes through API integration and provide real-time transaction tracking that eliminates uncertainty about payment status. Companies that switch from SWIFT to digital alternatives report 60% faster settlement times and 50% lower operational costs within the first quarter of adoption.

Stablecoin Payments Transform Enterprise Treasury

Enterprise treasuries increasingly use stablecoins for cross-border payments because they eliminate currency conversion delays and reduce settlement risk. Tether processes over $50 billion in daily transaction volume, while USDC handles institutional payments for companies that require 24/7 liquidity access. Circle’s USDC processes $190 billion monthly in transaction volume with settlement times under 30 seconds and fees below 0.1% (compared to 3-5% for traditional wire transfers).

Businesses that adopt stablecoin payments report 90% reduction in settlement times and 80% lower transaction costs compared to traditional methods. These efficiency gains become more significant as companies scale their international operations and need instant access to working capital across multiple time zones.

Digital Wallets Capture Consumer Market Share

Regional digital wallet adoption varies significantly across markets, with Asia Pacific leading global penetration rates. WeChat Pay processes over $17 trillion annually in China, while India’s UPI system handled 131 billion transactions worth $1.8 trillion in 2023. These platforms offer instant settlement and fees below 0.5%, which traditional banks cannot match through correspondent relationships.

The shift toward digital payment methods accelerates as businesses examine how different industry segments adopt these technologies for specific use cases and operational requirements.

Which Industries Drive Cross-Border Payment Growth

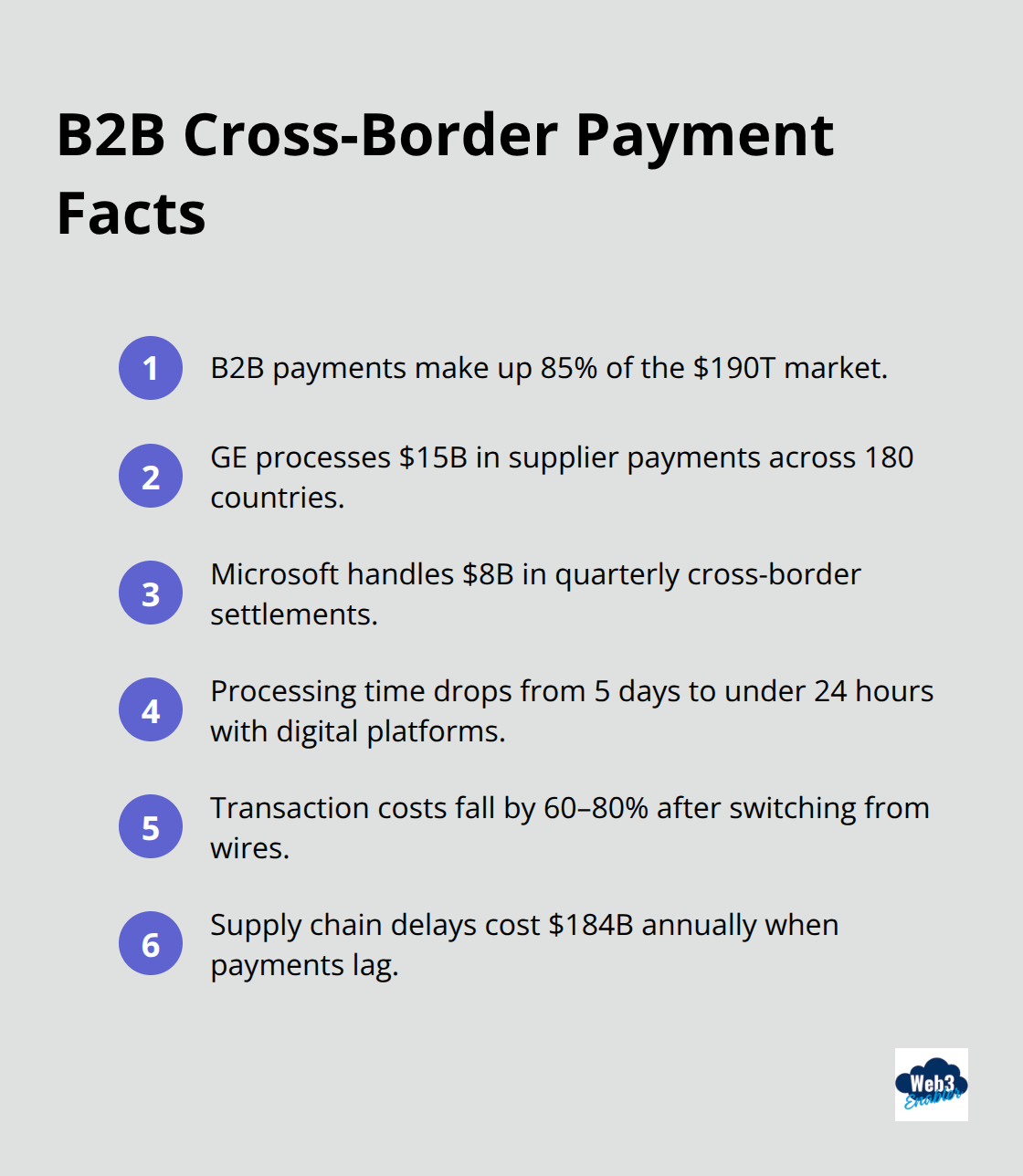

B2B corporate payments dominate cross-border transaction volumes and account for 85% of the $190 trillion market according to BIS data. Manufacturing companies like General Electric process over $15 billion in supplier payments annually across 180 countries, while technology firms such as Microsoft handle $8 billion in quarterly cross-border settlements. Corporate treasuries that switch from traditional wire transfers to digital payment platforms reduce processing time from 5 days to under 24 hours and cut transaction costs by 60-80%. Companies in pharmaceuticals, automotive, and energy sectors report the highest adoption rates of real-time payment systems because supply chain disruptions cost $184 billion annually when payments delay shipments.

Corporate Treasury Operations Transform Payment Speed

Enterprise treasuries face mounting pressure to accelerate international payments as suppliers demand faster settlement terms. Traditional correspondent banks require multiple intermediaries that add 2-3 days to each transaction, while digital platforms complete transfers within hours. Fortune 500 companies that adopt blockchain-based payment systems report 90% faster settlement times and eliminate weekend delays that previously froze working capital. Manufacturing giants like Boeing and Caterpillar now process vendor payments 24/7 through stablecoin networks that operate independently of traditional banking hours.

Remittances Generate Significant Consumer Flows

Global remittances to low-and middle-income countries are projected to have grown by 7.3% to reach $589 billion in 2021 according to World Bank data. Traditional money transfer operators like Western Union charge 6-8% fees plus currency conversion spreads, while digital platforms reduce costs to 1-3% and complete transfers within hours instead of days. Nigeria processes $20 billion in annual remittances with 70% now flowing through digital channels that offer mobile wallet integration and instant settlement. Blockchain-based remittance services report 90% cost reduction compared to traditional operators and process transactions 24/7 without banking hour restrictions.

E-commerce Merchants Process $6.2 Trillion Globally

Cross-border e-commerce transactions totaled $6.2 trillion in 2023 with Amazon processing $574 billion and Alibaba handling $248 billion in international sales according to Statista research. Merchants that accept stablecoin payments reduce checkout abandonment by 15% and eliminate chargeback risk that costs retailers $117 billion annually. Payment processing fees drop from 2.9% for credit cards to 0.5% for stablecoin transactions which increases profit margins significantly for high-volume sellers. Fashion retailers like ASOS and electronics companies report 25% faster settlement times when customers pay with digital currencies instead of traditional payment methods.

Final Thoughts

The cross-border payments market size will reach $290 trillion by 2030, driven by businesses that demand faster settlement and lower costs than traditional banks provide. Digital payment platforms already capture 20% market share with 15% annual growth, while blockchain solutions show 40% growth despite representing just 5% of current volume. Financial institutions face a clear choice: modernize payment infrastructure or lose clients to competitors that offer same-day settlement at 80% lower costs.

Enterprises that adopt stablecoin payments report 90% faster processing times and eliminate weekend delays that freeze working capital across time zones. The shift toward real-time payments accelerates as B2B transactions demand 24/7 liquidity access and instant settlement capabilities. Companies that process international vendor payments through blockchain networks complete transfers in under 30 seconds (compared to 3-5 days for traditional wire transfers).

We at Web3 Enabler help organizations modernize their payment operations directly within Salesforce, enabling stablecoin payments and real-time transaction visibility without leaving existing CRM workflows. The future belongs to businesses that embrace digital payment technologies today rather than wait for traditional banks to catch up. Smart companies act now to gain competitive advantages through faster, cheaper international payments.

![Flexible Payment Terms Using Stablecoin Technology [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-terms-hero-1764936594.jpeg)