We at Web3 Enabler know that payment velocity can make or break your business operations. Blockchain technology transforms how Salesforce handles payments, cutting settlement times from days to minutes.

Why Traditional Payment Systems Slow Down Business

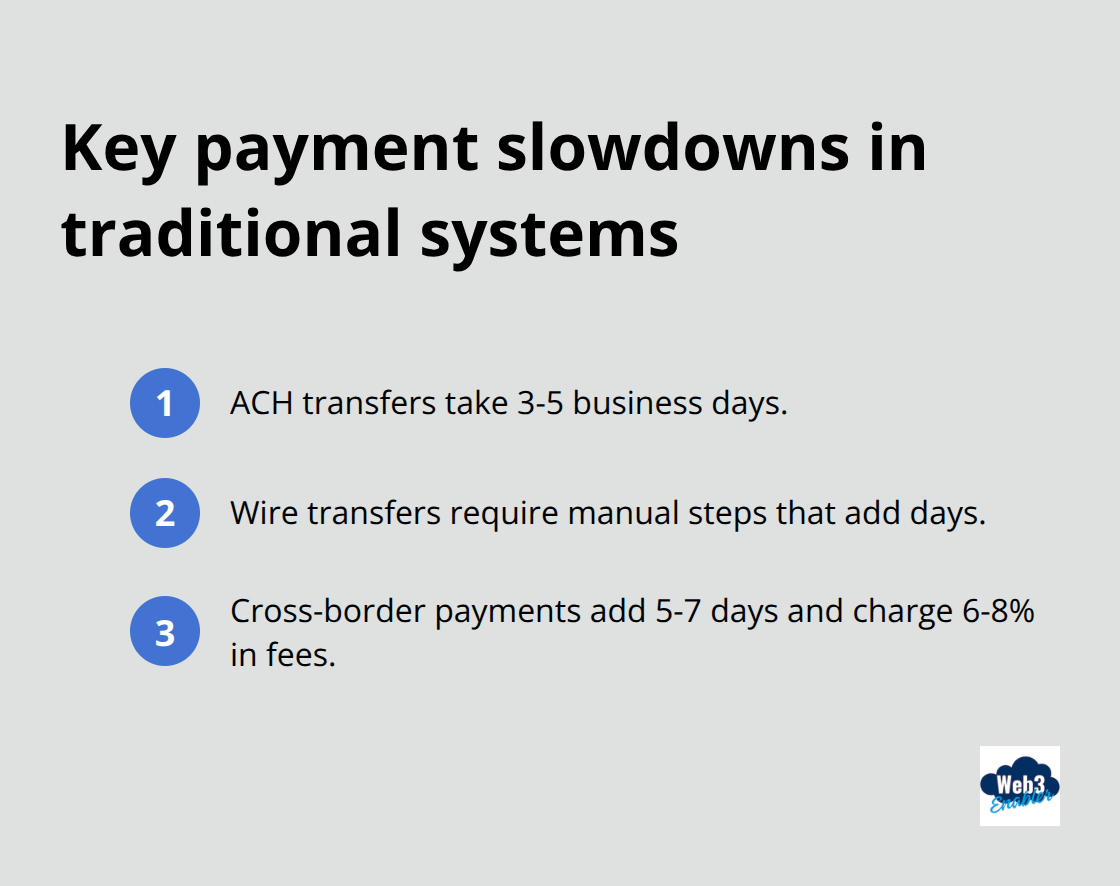

Your traditional payment system operates like a bureaucratic nightmare from the 1980s. ACH transfers crawl along for 3-5 business days while your customers wait and your cash sits in limbo. Wire transfers demand manual intervention at multiple banks, which creates delays that stretch simple transactions into multi-day ordeals.

Cross-border payments face even worse torture, with correspondent banks that add 5-7 days to international transfers while they charge fees that reach 6-8% of transaction value (according to World Bank data).

Settlement Speed Problems Kill Cash Flow

Standard payment rails force businesses into artificial wait periods that strangle capital. Credit card settlements take 2-3 business days minimum, while international B2B payments through SWIFT networks average 5-7 days for completion. Your finance team watches money disappear into processing purgatory while vendors demand faster payments and customers expect instant results. These delays compound during high-volume periods and create cash flow gaps that force expensive bridge financing or delayed supplier payments.

Manual Reconciliation Wastes Resources

Payment reconciliation consumes significant accounting team bandwidth with daily entry of operations, data reconciliation, and accuracy control of accounting records. Finance teams manually match payments across multiple systems, chase missing transaction details, and resolve discrepancies that emerge from fragmented payment data. International payments multiply this complexity with currency conversion tracking, correspondent bank fees, and regulatory requirements. Each manual touchpoint introduces errors that require additional investigation time and delayed month-end closes.

Cross-Border Payment Complications

International payments navigate a maze of correspondent banks that each add their own fees and delays. SWIFT networks route transactions through multiple intermediaries, which transforms a simple payment into a week-long journey across continents. Currency conversion happens at unfavorable rates, and regulatory compliance checks create additional bottlenecks that slow transactions to a crawl.

Blockchain technology offers a direct path around these antiquated systems, and smart businesses are already making the switch to faster alternatives.

How Blockchain Accelerates Payment Processing in Salesforce

Blockchain transforms Salesforce payment processing through stablecoin transactions that settle in under 60 seconds rather than the 1-3 business days that ACH transfers require. Stablecoins like USDC bypass correspondent banks entirely, which eliminates the intermediary fees that typically consume 6-8% of cross-border transaction value (according to World Bank research). Your Salesforce environment processes payments 24/7 without banking hour restrictions, and international transfers complete in minutes instead of the 5-7 days standard with SWIFT networks.

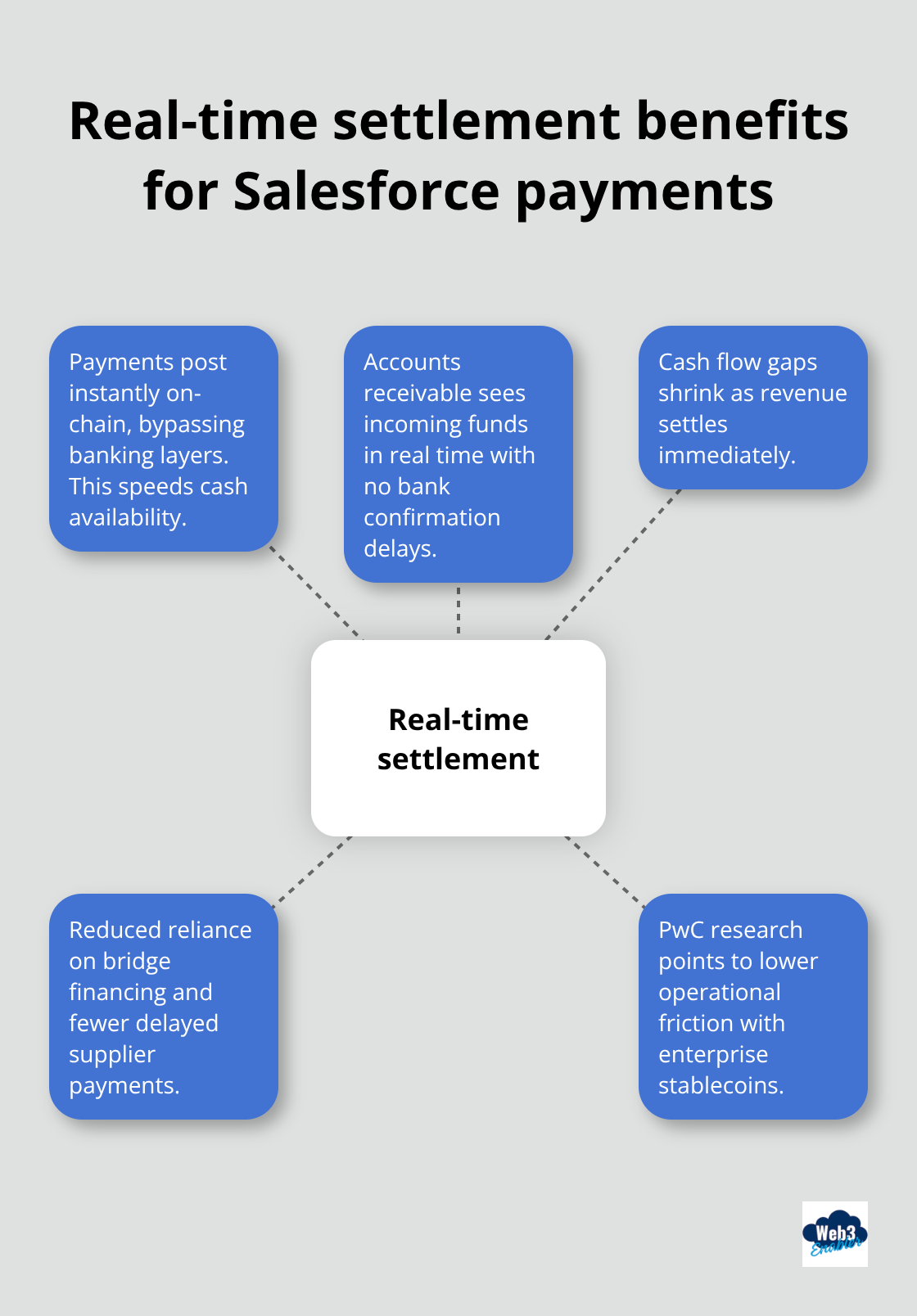

Real-Time Settlement Transforms Cash Flow

Stablecoin payments settle instantly on blockchain networks while traditional payments crawl through multiple banking layers. Your accounts receivable team watches payments arrive in real-time rather than waiting days for bank confirmations. This immediate settlement eliminates the cash flow gaps that force expensive bridge financing or delayed supplier payments.

PwC research confirms that stablecoin adoption reduces operational friction while maintaining regulatory compliance for enterprise payments.

Automated Workflows Eliminate Manual Tasks

Blockchain payment systems automate reconciliation tasks that currently consume significant accounting bandwidth. Payment triggers activate automatically when Salesforce opportunities close or invoices generate, which eliminates manual payment initiation steps that delay cash collection. Transaction data flows directly into Salesforce records with complete audit trails, removing the manual matching processes that finance teams perform across multiple systems. Your team gains real-time visibility into payment status rather than waiting for bank confirmations that arrive days later.

Direct Settlement Cuts Intermediary Costs

Blockchain payments connect sender and receiver directly through distributed networks that operate without traditional banking infrastructure. Your payments avoid the correspondent bank maze that adds multiple fees and processing delays to international transactions. Settlement happens on-chain with cryptographic verification that provides stronger security than traditional payment rails. Transaction costs drop to under $0.50 for transfers that previously required $50-200 in banking fees.

Enterprise-grade stablecoin providers offer the regulatory compliance and institutional support that businesses need while delivering the speed advantages that blockchain technology provides. Now let’s explore how to actually implement these blockchain payment capabilities within your existing Salesforce environment.

How Do You Actually Install Blockchain Payments in Salesforce?

Three strategic moves transform your payment infrastructure without disrupting daily operations. Start with a native Salesforce solution from the AppExchange that connects directly to your existing opportunity and invoice workflows without custom code. The installation takes 15 minutes and integrates with Circle’s USDC infrastructure, which provides institutional-grade liquidity for digital dollar processing that meets banking compliance standards. Configure payment triggers within Salesforce workflow rules so payments automatically initiate when opportunities close or invoices generate (this eliminates the manual steps that currently delay your cash collection by 2-3 days).

Setting Up Stablecoin Infrastructure

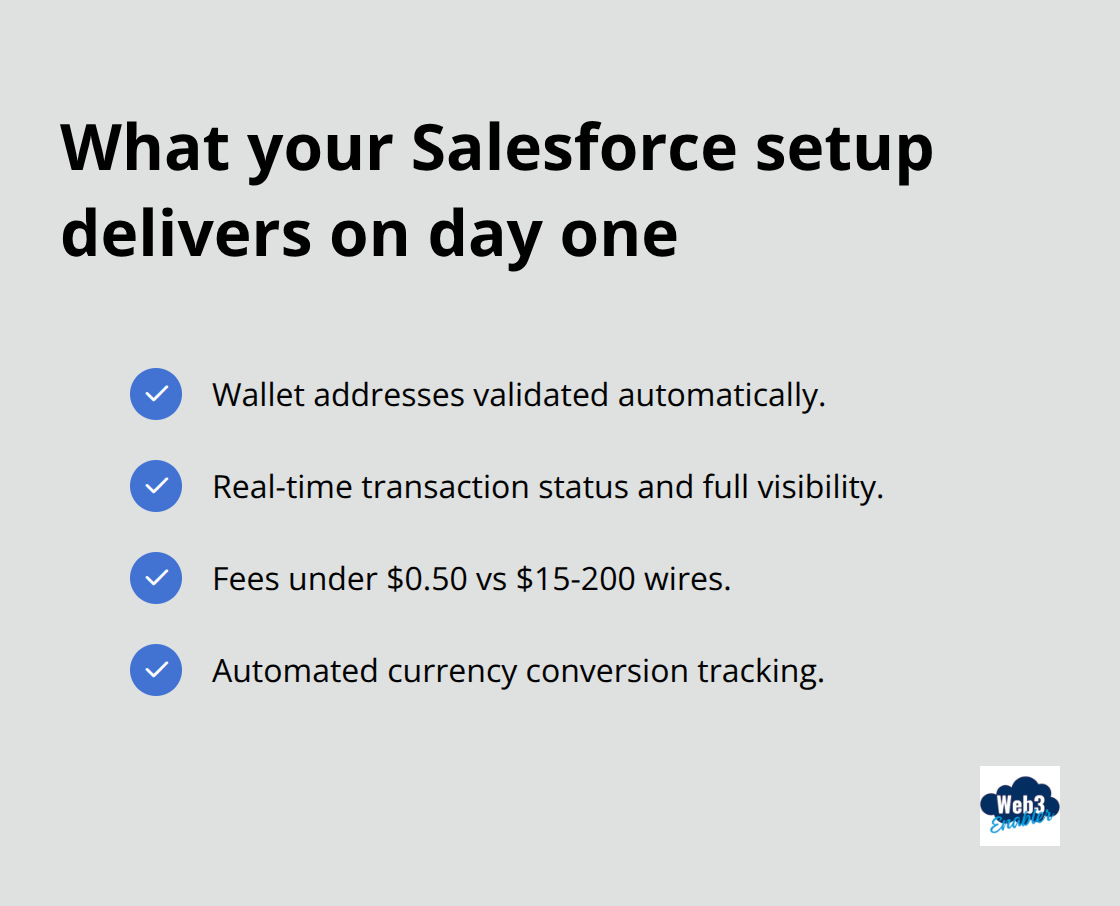

Your stablecoin integration connects through regulated providers like Circle that offer institutional-grade USDC processing with full audit trails and compliance reports. Configure your Salesforce environment to accept wallet addresses as payment methods, just like you add credit card fields to customer records. The system validates wallet addresses automatically and tracks transaction status in real-time, which gives your finance team complete visibility into payment progression. Transaction fees stay under $0.50 per transfer regardless of amount, compared to traditional wire fees that range from $15-50 domestically and $50-200 internationally. Set up automated currency conversion tracking within Salesforce custom fields to maintain accurate accounting records for international transactions.

Training Teams on Blockchain Payment Operations

Your sales and finance teams need specific training on wallet address collection, transaction monitoring, and dispute resolution procedures that differ from traditional payment methods. Train your customer service representatives to explain stablecoin payments to clients while emphasizing the speed and cost advantages over traditional banking transfers. Finance teams learn to monitor blockchain explorers for transaction confirmation rather than wait for bank notifications that arrive hours or days later. Set up Salesforce dashboard views that display payment status, transaction hashes, and settlement confirmations so teams access real-time payment data without switching between multiple systems (most teams become proficient with blockchain payment processes within one week of hands-on training).

Final Thoughts

Blockchain technology transforms business operations through payment velocity improvements that deliver instant settlement and slash processing costs. Your Salesforce environment processes stablecoin payments in under 60 seconds while traditional systems crawl through 3-5 business days for completion. Cross-border transactions settle in minutes rather than the week-long delays that SWIFT networks create, and transaction fees drop to under $0.50 compared to traditional wire costs of $50-200.

These speed improvements directly impact cash flow management when they eliminate the artificial wait periods that force expensive bridge financing. Your finance team gains real-time visibility into payment status while automated workflows reduce manual reconciliation tasks that currently consume significant accounting bandwidth. International payments bypass correspondent bank fees that typically consume 6-8% of transaction value (according to World Bank data).

Implementation starts with a 15-minute AppExchange installation that connects directly to existing Salesforce workflows. Web3 Enabler provides Salesforce Native blockchain solutions that support payments, compliance, and automation for businesses ready to modernize their payment infrastructure. Your team becomes proficient with blockchain payment processes within one week of hands-on training, and the technology delivers immediate operational benefits without disruption to daily business operations.