Financial services firms are transforming their operations through blockchain technology integrated with cloud infrastructure. This powerful combination cuts transaction costs by up to 30% while reducing settlement times from days to minutes.

We at Web3 Enabler see how Financial Services Cloud blockchain solutions eliminate traditional bottlenecks in treasury management and cross-border payments. The technology delivers real-time transparency that executives demand for modern financial operations.

Why Blockchain Changes Everything for Financial Operations

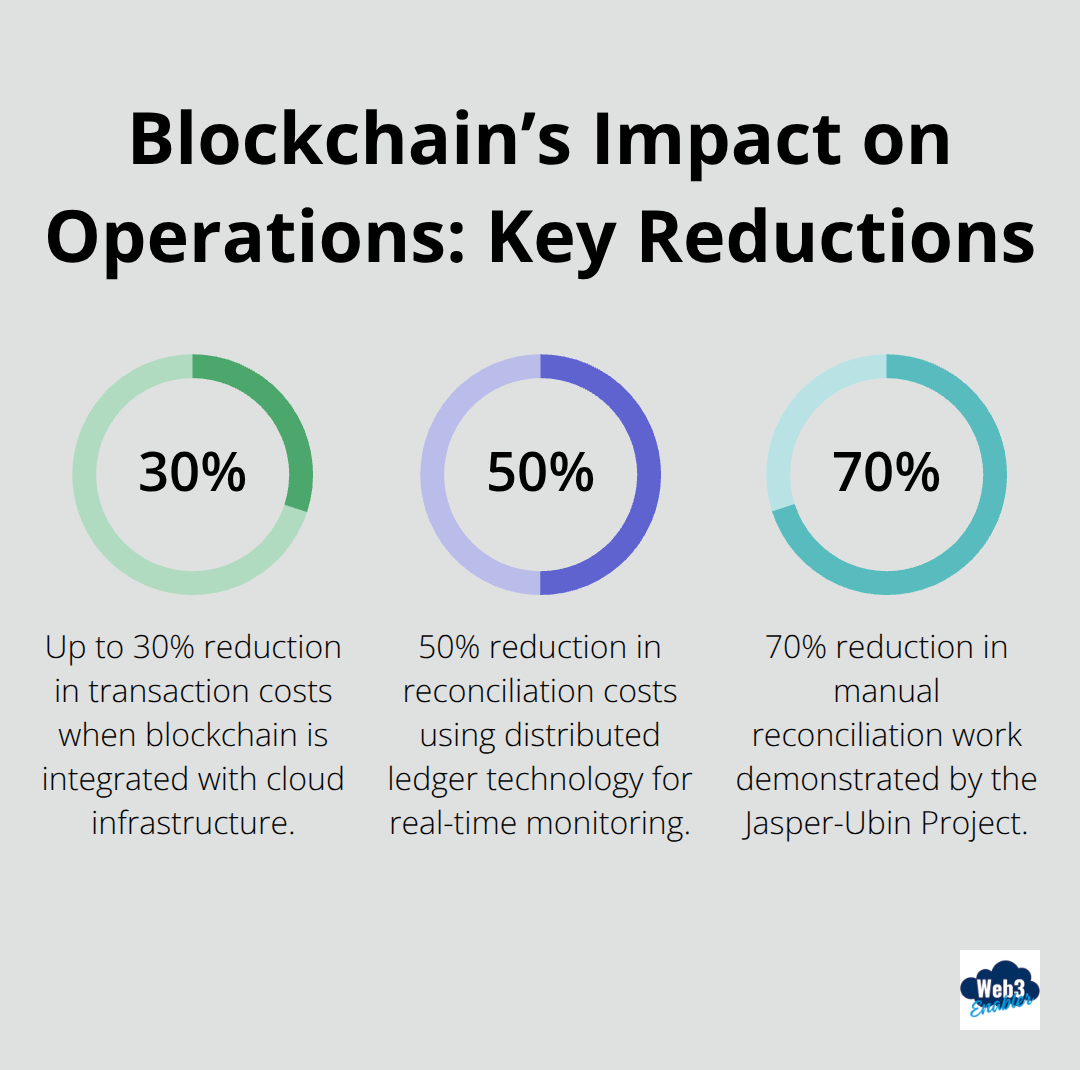

Traditional financial operations rely on outdated systems that create delays, increase costs, and limit visibility. Blockchain transforms these operations by providing immediate transaction tracking across all payment channels. JPMorgan’s blockchain research shows that financial institutions can reduce reconciliation costs by 50% when they implement distributed ledger technology for real-time transaction monitoring.

Transaction Transparency Drives Operational Efficiency

Financial teams waste countless hours as they reconcile payments across multiple systems and currencies. Blockchain eliminates this inefficiency by creating a single source of truth for all transactions. The Jasper-Ubin Project between Canada and Singapore demonstrated how blockchain enables instant gross settlement verification, which reduces manual reconciliation work by 70%. Financial institutions that use blockchain can track payment status, fees, and settlement times in real-time rather than wait days for confirmation through traditional networks.

Speed and Cost Reduction Transform Treasury Management

Cross-border payments that typically take 1-5 days through SWIFT networks settle in seconds on blockchain networks. This speed improvement directly impacts cash flow management and liquidity planning. Traditional bank-to-bank SWIFT transactions cost approximately $25 per side, while blockchain-based stablecoin payments cost only 0.5% of the transaction value. The B2B cross-border payments market is expected to grow from $195 trillion in 2024 to $320 trillion by 2032.

Security Features Prevent Financial Fraud

Blockchain’s cryptographic protection creates immutable transaction records that cannot be altered once confirmed. This immutability eliminates common fraud vectors in traditional payment systems where transaction data can be manipulated during processing. The distributed nature of blockchain networks removes single points of failure that hackers typically target in centralized financial systems.

These operational improvements set the foundation for specific blockchain applications that financial institutions can implement today across their core business functions.

Which Blockchain Applications Actually Work in Financial Services

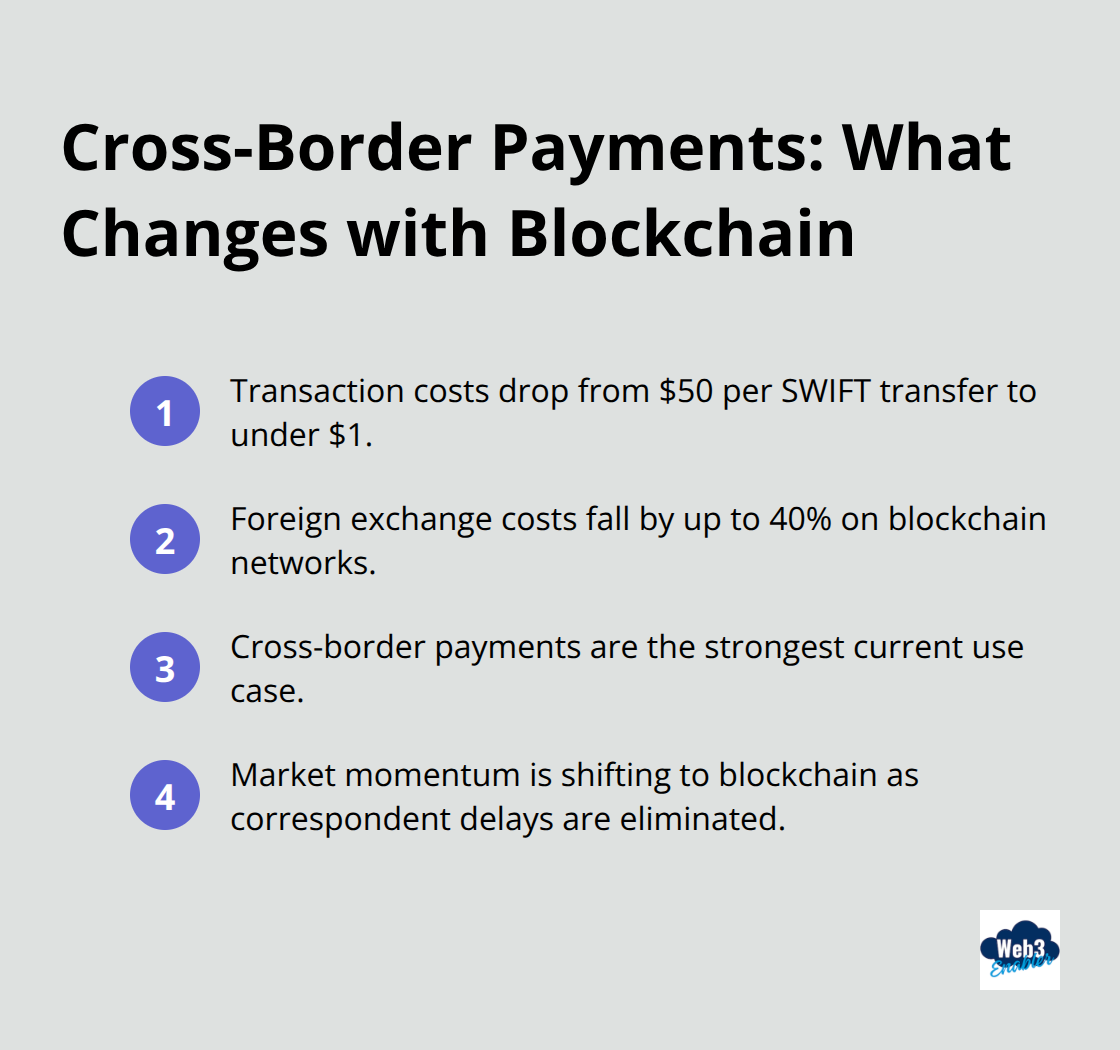

Financial institutions that implement blockchain solutions see immediate improvements in three core operational areas where traditional systems consistently fail. Cross-border payments represent the strongest use case, with institutions like JPMorgan reporting transaction cost reductions from $50 per SWIFT transfer to under $1 for blockchain-based settlements. The $4.4 trillion B2B cross-border payments market shifts toward blockchain networks because they eliminate correspondent banking delays and reduce foreign exchange costs by up to 40%.

Cross-Border Payments Transform International Operations

Traditional SWIFT networks create bottlenecks that cost financial institutions millions in delayed settlements and manual reconciliation work. Blockchain networks process international transfers in seconds rather than the typical 1-5 days required by correspondent banks. Major financial institutions now save $25 per transaction side when they replace SWIFT transfers with blockchain-based stablecoin payments (costing only 0.5% of transaction value). This cost reduction becomes significant for institutions processing thousands of international transfers monthly.

Treasury Operations Get Real-Time Control

Treasury teams gain unprecedented liquidity visibility when they move cash management operations to blockchain networks. Traditional treasury systems require 24-48 hours to confirm international transfers and reconcile positions across multiple bank accounts. Blockchain treasury management provides instant settlement confirmation and real-time balance updates across all currencies and jurisdictions. Financial institutions can now optimize cash positions hourly rather than daily, which improves capital efficiency by 15-25% according to recent industry studies.

Digital Asset Integration Creates Competitive Advantage

Financial advisors can track client cryptocurrency holdings alongside traditional portfolios in real-time when they use blockchain-integrated platforms. The crypto asset management market is expected to increase from $1.1 billion in 2024 to $2.28 billion by 2031, with 73% of institutional investors now holding some form of cryptocurrency exposure. Blockchain integration allows wealth management teams to provide comprehensive portfolio analysis that includes both traditional securities and digital assets without switching between multiple systems. This unified view enables more accurate risk assessment and better client advisory services, particularly for high-net-worth clients who increasingly demand cryptocurrency investment options.

These practical applications demonstrate blockchain’s immediate value, but successful implementation requires careful planning to address integration challenges and regulatory requirements that many financial institutions face.

How Do You Actually Implement Blockchain in Financial Services

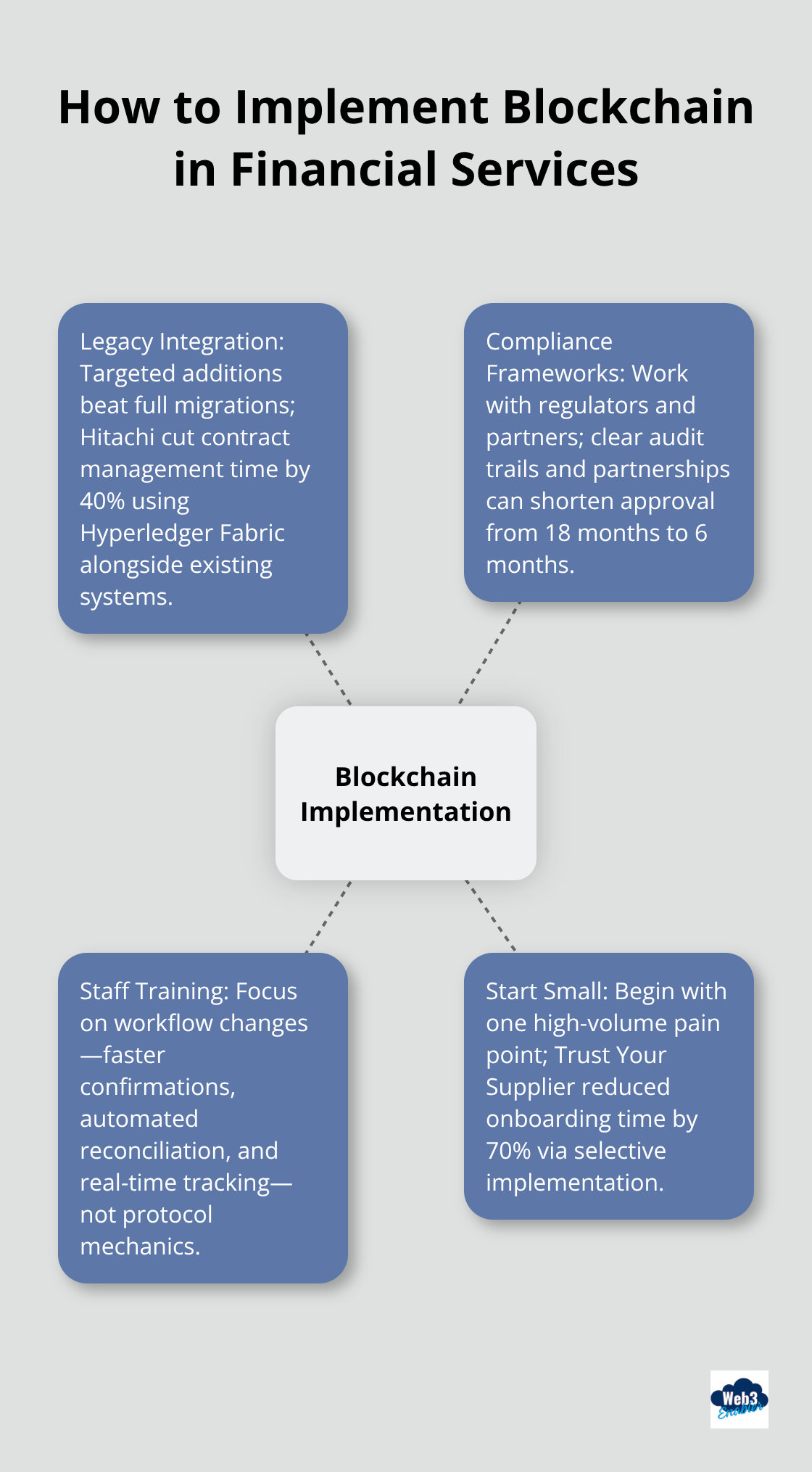

Financial institutions face three major hurdles when they implement blockchain solutions, but successful deployment follows predictable patterns that reduce both timeline and costs. The biggest mistake executives make is to treat blockchain as a complete system replacement rather than a strategic addition that works alongside existing infrastructure.

Legacy System Integration Demands Strategic Planning

Most financial institutions waste 6-12 months when they attempt full-scale blockchain migrations while targeted additions deliver faster results. Hitachi reduced contract management time by 40% when they implemented Hyperledger Fabric alongside their existing procurement systems rather than replaced everything. The key is to identify specific pain points where blockchain adds immediate value – typically cross-border payments, treasury reconciliation, or trade finance documentation.

Trust Your Supplier cut supplier onboarding time by 70% through blockchain addition with existing vendor management systems, which proves that selective implementation beats wholesale replacement. Financial institutions should start with one high-volume process that already causes operational headaches, then expand blockchain usage once teams understand the technology’s practical benefits.

Regulatory Compliance Requires Proactive Partnership

Financial regulators increasingly support blockchain adoption when institutions demonstrate clear compliance frameworks and audit trails. The SEC and FinCEN now provide specific guidance for blockchain-based financial services, but institutions must document every blockchain transaction for regulatory reports (which creates additional operational overhead). Circle and Ripple have established compliance partnerships that help financial institutions meet anti-money laundering and know-your-customer requirements through blockchain networks.

Smart compliance teams work directly with blockchain vendors who already maintain regulatory relationships rather than build compliance frameworks from scratch. This partnership approach reduces regulatory approval time from 18 months to 6 months for most financial blockchain implementations.

Staff Training Focuses on Business Process Changes

Technical training fails when institutions focus on blockchain mechanics instead of workflow improvements. Successful blockchain deployments require operations teams to understand new reconciliation processes, not cryptocurrency theory. Companies benefit when they train staff on blockchain training rather than distributed ledger technology concepts.

The most effective programs show employees exactly how blockchain changes their daily tasks – faster payment confirmations, automated reconciliation, and real-time transaction tracking. Finance teams adapt quickly when they see blockchain as a tool that eliminates manual work rather than complex technology that requires specialized knowledge (which reduces resistance to adoption).

Final Thoughts

Financial Services Cloud blockchain solutions transform how institutions handle payments and treasury operations with concrete results. Major banks cut transaction costs by 30% and reduce settlement times from days to minutes when they adopt blockchain technology. The $943 billion blockchain market by 2032 shows that financial institutions lead this transformation through practical applications that solve real operational problems.

Banks save $25 per transaction when they replace SWIFT transfers with blockchain settlements, while treasury teams optimize liquidity hourly instead of daily. The regulatory environment supports this shift with clear compliance frameworks from the SEC and FinCEN. Financial institutions that implement blockchain now gain competitive advantages through faster payments and lower operational costs (while their competitors struggle with outdated systems).

Web3 Enabler offers blockchain payment solutions that integrate directly with existing financial workflows. Our platform enables finance teams to process stablecoin payments without complex system changes. Financial institutions can leverage blockchain benefits while maintaining their current operational processes.