Cross-border payments drain business resources through high fees and slow processing times. Traditional banking systems often take days to complete international transfers while charging substantial fees.

We at Web3 Enabler see cryptocurrency transforming how businesses handle global payments. The best crypto for cross border payments offers instant settlement, minimal fees, and 24/7 availability that traditional systems can’t match.

What Makes Crypto Ideal for Business Payments

The most effective cryptocurrencies for international business payments share three non-negotiable characteristics that traditional systems simply cannot deliver. Transaction costs must stay below 1% while settlement completes within minutes, not days. The stablecoin market has grown significantly, proving businesses demand this speed and cost efficiency.

Speed Beats Everything in Global Commerce

Settlement speed determines cash flow health for international businesses. While SWIFT transfers take 3-5 business days, top payment cryptocurrencies process transactions in under 10 minutes around the clock. Ripple’s XRP network processes cross-border payments in 3-4 seconds with fees under $0.01 per transaction. Stellar handles similar volumes at comparable speeds, which makes both networks viable for high-frequency business operations. Companies that use these networks report 40-60% cost savings compared to traditional banks (according to payment processor data).

Regulatory Partnerships Drive Enterprise Adoption

Smart businesses choose cryptocurrencies with established bank relationships and regulatory compliance frameworks. PayPal launched its stablecoin in 2023, while Mastercard now facilitates stablecoin transactions for 3.5 million cards globally. Fiserv plans to launch FIUSD stablecoin integration across its bank infrastructure by end of 2025. The GENIUS Act (signed in July 2025) provides regulatory oversight for stablecoin use, which gives enterprises the compliance certainty they need.

Network Stability Prevents Payment Failures

Enterprise payment systems require consistent uptime and predictable performance. Networks that experience frequent congestion or technical issues can disrupt critical business operations. Established cryptocurrencies maintain 99.9% uptime while handling thousands of transactions per second without performance degradation. This reliability becomes essential when businesses process payroll, vendor payments, or customer settlements across multiple time zones.

The next consideration focuses on which specific cryptocurrencies deliver these essential features for different business use cases.

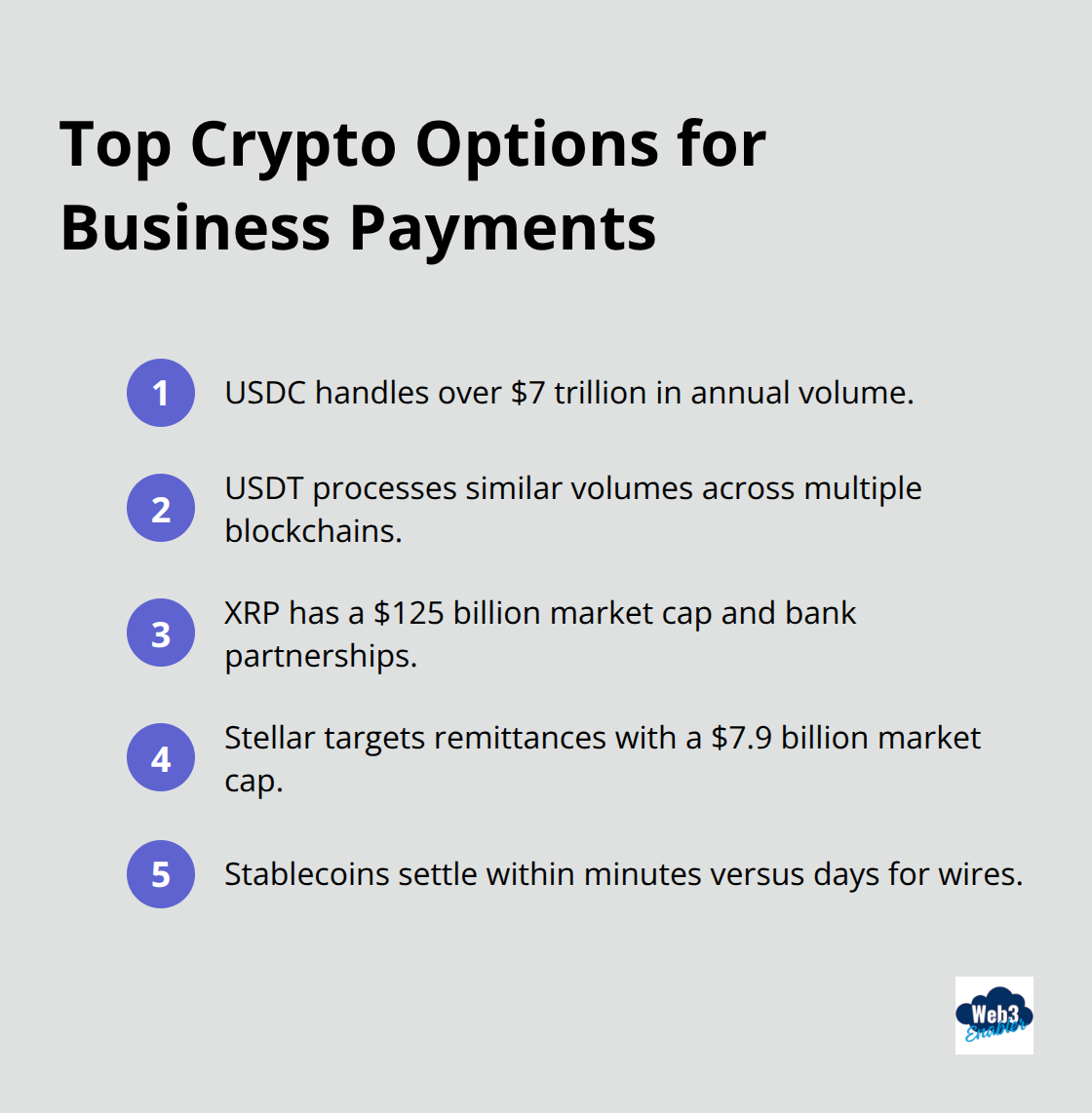

Which Cryptocurrencies Work Best for Business Payments

Stablecoins dominate enterprise payment flows because volatility destroys business predictability. USDC and USDT maintain dollar parity while they process transactions faster than traditional banks. Circle’s USDC handles over $7 trillion in annual transaction volume, which makes it the preferred choice for companies that require stable value transfers. Tether’s USDT processes similar volumes across multiple blockchains and gives businesses flexibility in network selection. Both stablecoins settle within minutes while traditional wire transfers take days. This speed advantage explains why stablecoins processed $9 trillion in payments in 2025, an 87% jump from the year before.

Enterprise Networks Deliver Institutional-Grade Performance

XRP leads institutional adoption with its $125 billion market cap and bank partnerships through RippleNet. Major financial institutions use Ripple’s infrastructure for international transfers, with Ripple pursuing a U.S. national bank charter to enable direct Federal Reserve reserves. Stellar targets humanitarian and remittance markets with its $7.9 billion market cap and processes low-cost transfers for organizations like the United Nations. However, XRP’s institutional focus and larger scale make it more compelling for enterprise adoption than Stellar’s humanitarian mission.

Payment Processors Build Native Stablecoin Support

Payment processors now build stablecoin functionality directly into existing systems. Stripe announced stablecoin support for subscription payments in October 2025, while Klarna develops KlarnaUSD for international payment cost reduction in 2026. Visa Direct pilots stablecoin wallet payments in Latin America through its Bridge partnership and enables direct transfers to recipient wallets. Mastercard facilitates stablecoin transactions across 3.5 million cards globally and partners with Circle for merchant settlements in Eastern Europe, Middle East, and East Africa.

Technical Integration Eliminates Adoption Barriers

Modern payment infrastructure removes the technical complexity that previously prevented widespread business adoption. Enterprise-grade platforms now offer direct blockchain integration within existing financial systems. These integrations eliminate the need for separate crypto wallets or complex technical implementations. Businesses can process stablecoin payments through familiar interfaces while they maintain full compliance and audit trails. The seamless integration approach allows finance teams to adopt crypto payments without extensive technical training or system overhauls.

Smart implementation requires careful consideration of how these payment solutions integrate with existing business operations and compliance frameworks.

How Businesses Deploy Crypto Payments Successfully

Direct System Integration Eliminates Implementation Delays

Finance teams achieve faster crypto payment adoption when they integrate blockchain capabilities directly within existing ERP and CRM systems. Web3 Enabler provides the only native blockchain platform on Salesforce AppExchange, which allows enterprises to process stablecoin payments without complex system overhauls. This approach cuts implementation timelines from 6-12 months to weeks compared to standalone crypto solutions.

Companies that use Financial Services Cloud gain on-chain visibility into client wallet balances and digital assets through native Salesforce objects. Commerce Cloud merchants accept stablecoins for e-commerce transactions while they maintain existing checkout flows. Revenue Cloud users automate on-chain revenue recognition and settlement through familiar Salesforce automation tools.

Enterprise-Grade Partners Reduce Operational Risk

Smart businesses select regulated, established partners rather than experimental platforms for crypto payment operations. Circle’s USDC maintains full reserve backing with monthly attestations from Grant Thornton LLP (providing transparency that businesses require). Regulatory frameworks like the GENIUS Act now provide legal clarity for stablecoin operations across enterprise environments.

Companies should prioritize partners with active banking relationships, compliance certifications, and transparent audit processes. Traditional financial institutions continue building stablecoin capabilities directly into banking infrastructure, with UAE Zand Bank recently launching its Central Bank regulated, multi-chain AED stablecoin. Partner stability matters more than transaction fees alone when businesses evaluate long-term crypto payment strategies.

Cost Analysis Reveals True Implementation Value

Enterprise blockchain implementations require partners with 99.9% uptime guarantees, regulatory compliance documentation, and established financial institution relationships. Cost analysis must include compliance overhead, system integration expenses, and staff training requirements alongside transaction fees to calculate accurate ROI.

Companies that process high-volume international payments typically see 40-60% cost reductions compared to traditional SWIFT transfers. However, businesses must factor in initial setup costs, ongoing compliance requirements, and technical support needs when they evaluate total cost of ownership for crypto payment systems.

Final Thoughts

The best crypto for cross border payments combines speed, stability, and enterprise-grade compliance. USDC and USDT lead stablecoin adoption with $7 trillion in annual volume, while XRP’s institutional partnerships and $125 billion market cap make it ideal for large-scale business operations. These solutions deliver 40-60% cost savings compared to traditional banks while they process transactions in minutes rather than days.

Successful implementation requires native system integration rather than standalone crypto platforms. Web3 Enabler provides native blockchain capabilities on Salesforce AppExchange, which enables enterprises to process stablecoin payments directly within their existing systems. This approach eliminates complex system overhauls and reduces implementation time significantly.

The regulatory landscape continues to strengthen with the GENIUS Act providing stablecoin oversight and major payment processors like Stripe, Visa, and Mastercard building native crypto capabilities (traditional banks now integrate stablecoin infrastructure as CBDCs emerge). Companies that adopt these solutions now gain competitive advantages in speed, cost efficiency, and global reach. Crypto payments will become standard practice for international business operations as infrastructure matures.