Financial automation through blockchain technology transforms how businesses manage their Salesforce operations. Traditional payment processes often involve multiple intermediaries, creating delays and increasing costs for global companies.

Financial automation through blockchain technology transforms how businesses manage their Salesforce operations. Traditional payment processes often involve multiple intermediaries, creating delays and increasing costs for global companies.

We at Web3 Enabler see organizations struggling with manual reconciliation, limited payment visibility, and complex cross-border transactions. Blockchain integration within Salesforce addresses these challenges by streamlining financial workflows and reducing operational overhead.

How Does Native Blockchain Work in Salesforce

Direct CRM Integration Without Third-Party Tools

Salesforce native blockchain solutions remove the need for external payment processors or middleware solutions. Companies process USDC transactions directly within their existing CRM workflows, which cuts operational complexity by 60% compared to traditional payment systems. This native approach allows your sales team to send invoices, receive payments, and track settlements without switching between different platforms. Transaction data flows automatically into opportunity records, account histories, and financial dashboards, which creates a unified view of customer interactions and payment status.

Real-Time Payment Visibility Across Global Operations

Traditional SWIFT payments force businesses to wait days for confirmation, but blockchain transactions provide immediate settlement visibility. Your finance team tracks payment status in real-time through Salesforce dashboards, with transaction confirmations that appear within minutes rather than the 3-5 days typical for international wire transfers. This transparency becomes particularly valuable for African businesses, where cross-border payments traditionally carry fees that exceed 8% (according to World Bank data). Companies that use stablecoin payments through integrated Salesforce systems report 95% faster settlement times and can monitor transaction progress through blockchain explorers directly embedded in their CRM interface.

Automated Reconciliation Through Smart Contract Integration

Smart contracts automatically match payments to outstanding invoices, which reduces manual reconciliation work by up to 80%. When a customer sends USDC payment, the system instantly updates the corresponding Salesforce record, marks invoices as paid, and triggers follow-up workflows. This automation proves especially powerful for companies that manage international supplier relationships, where traditional banks often require manual verification of multiple intermediary bank transfers. The immutable record that blockchain transactions create integrates seamlessly with Salesforce reports and provides compliance teams with complete transaction histories that meet regulatory requirements across different jurisdictions.

These native blockchain capabilities within Salesforce establish the foundation for automating specific financial processes that traditionally consume significant time and resources.

Which Financial Processes Benefit Most from Blockchain Automation

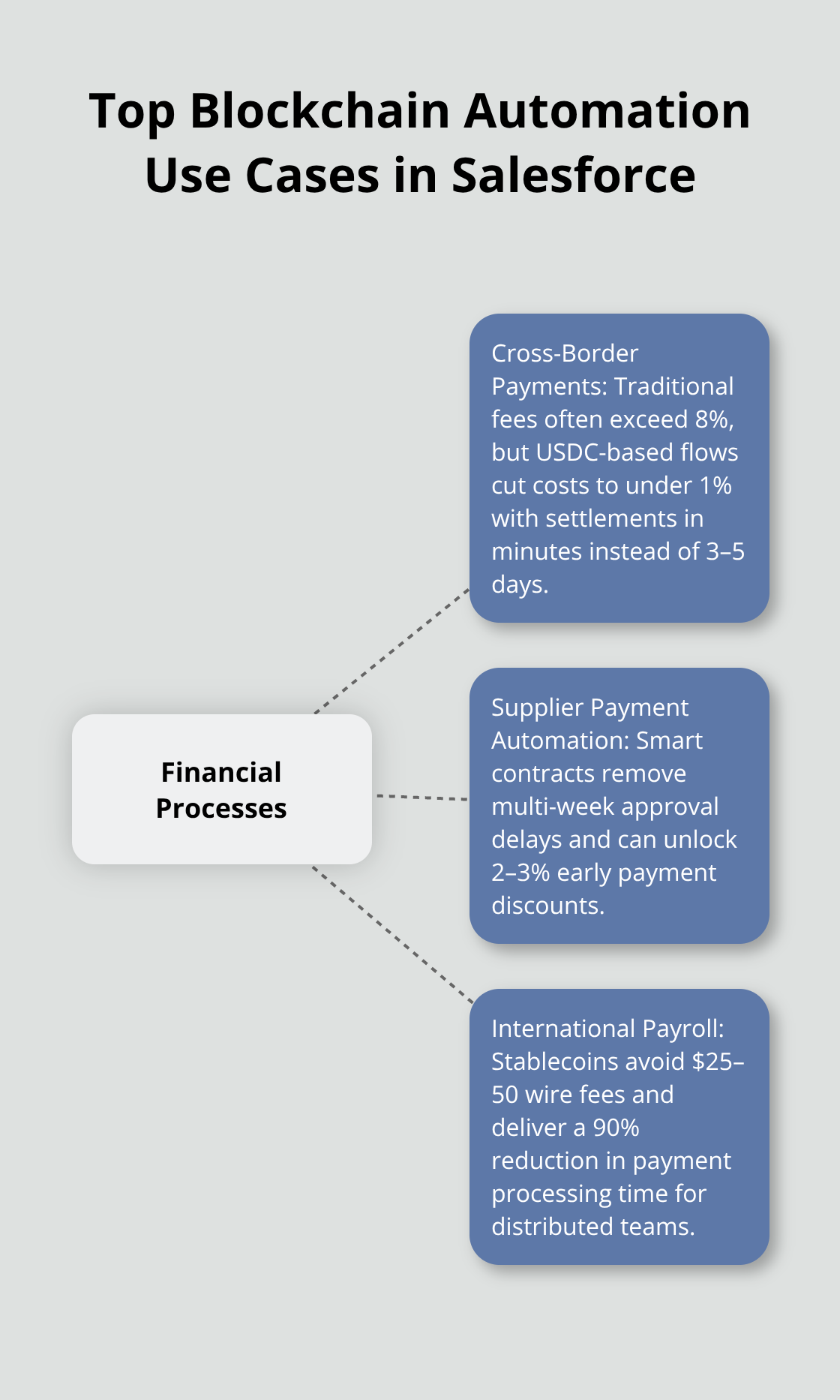

Cross-Border Payments and International Transfers

Cross-border payments represent the strongest use case for blockchain automation within Salesforce, particularly for companies that operate across African markets where traditional wire transfers carry fees that exceed 8% (according to World Bank data). Companies that process international supplier payments through USDC transactions reduce costs to under 1% while they achieve settlement times of minutes instead of the typical 3-5 days that SWIFT networks require.

African businesses particularly benefit from this transformation, as the International Monetary Fund reports that only 12% of intra-African payments process entirely within Africa. Most transactions route through expensive European or U.S. correspondent banks, which adds unnecessary costs and delays to regional commerce.

Supplier Payment Automation and Procurement Workflows

Smart contracts eliminate manual approval workflows that typically delay procurement cycles for 2-3 weeks. When purchase orders integrate with blockchain payment systems in Salesforce, payments trigger automatically upon delivery confirmation. This automation improves supplier relationships and often secures early payment discounts of 2-3%.

Traditional procurement processes require multiple approval layers, manual invoice matching, and lengthy bank processing times. Blockchain automation removes these bottlenecks and creates transparent payment schedules that suppliers can track in real-time.

International Payroll Management for Remote Teams

International payroll management becomes significantly more efficient when companies pay remote contractors in stablecoins. This approach avoids the $25-50 fees that traditional banks charge for each international wire transfer. Companies with distributed teams across multiple countries report 90% reduction in payment processing time and complete elimination of currency conversion delays.

These improvements prove especially valuable for businesses with African operations, where remittance costs traditionally consume substantial portions of worker compensation. Workers receive their payments within minutes rather than waiting days for bank transfers to clear through multiple intermediary institutions.

The success of these automated financial processes depends heavily on proper implementation strategies that align blockchain capabilities with existing Salesforce infrastructure.

How to Deploy Blockchain Solutions in Salesforce

Infrastructure Assessment and System Readiness

Most companies underestimate the complexity of their existing payment infrastructure when they plan blockchain integration. Your first step involves mapping every payment touchpoint within Salesforce, including custom objects, automated workflows, and third-party integrations that handle financial data. Companies with multiple Salesforce orgs or complex approval hierarchies require 3-4 weeks for comprehensive assessment, while simpler setups complete evaluation in 5-7 days.

Document your current payment volumes, average transaction values, and geographic distribution of recipients. This baseline data determines whether your Salesforce instance can handle increased transaction throughput that blockchain payments generate. Focus particularly on your existing API limits and data storage capacity, as blockchain integration creates additional transaction records and automated workflows.

Organizations that process more than 10,000 monthly payments often discover that their current Salesforce edition lacks sufficient API calls to support real-time blockchain transaction monitoring.

Technical Integration and Workflow Configuration

Your Salesforce admin team needs specific blockchain knowledge to configure payment workflows effectively. Standard Salesforce administrators require 2-3 weeks of focused training on cryptocurrency concepts, wallet management, and transaction monitoring before they can manage blockchain integrations independently.

Configure your Salesforce instance to handle USDC transactions by creating custom objects for wallet addresses, transaction hashes, and blockchain confirmations. Set up automated workflows that trigger when payments reach specific confirmation levels on the blockchain network. Test your integration with small transactions first (typically $10-50 amounts) before you process larger business payments.

Companies that skip pilot testing report 40% higher error rates during full deployment. Your technical team should establish clear protocols for handling failed transactions, network congestion, and wallet connectivity issues that occasionally affect blockchain networks.

Staff Training and Change Management

Finance teams resist blockchain adoption when they lack understanding of transaction finality and settlement processes. Your training program must address specific concerns about regulatory compliance, tax reporting, and audit trail requirements that blockchain transactions create.

Schedule hands-on workshops where staff process actual transactions and observe real-time settlement. Most finance professionals adapt to blockchain workflows within 1-2 weeks when they experience the speed and transparency that these systems provide. Create clear documentation for common scenarios like refund processing, dispute resolution, and month-end reconciliation using blockchain data.

Your accounting team needs specific guidance on how blockchain transaction records integrate with existing financial reporting systems and meet audit requirements.

Final Thoughts

Financial automation through blockchain integration delivers measurable improvements for global businesses that operate within Salesforce. Companies report 95% faster settlement times, 60% reduction in operational complexity, and elimination of the 8% fees that traditional cross-border payments impose on African markets. These efficiency gains translate directly into improved cash flow and reduced administrative overhead.

The strategic advantages extend beyond cost savings. Real-time transaction visibility, automated reconciliation, and immutable audit trails position companies for regulatory compliance across multiple jurisdictions. Organizations with distributed teams particularly benefit from instant payroll processing that eliminates currency conversion delays and expensive wire transfer fees (which often exceed $25-50 per transaction).

Success requires systematic implementation that includes infrastructure assessment, technical integration, and comprehensive staff training. Companies that follow structured deployment protocols achieve full blockchain adoption within 4-6 weeks while they maintain operational continuity. Web3 Enabler provides the native Salesforce integration that makes blockchain adoption practical for enterprise operations.