Financial visibility remains one of the biggest challenges for enterprise finance teams managing global operations. Traditional systems create data silos that make real-time oversight nearly impossible.

We at Web3 Enabler see blockchain technology transforming how organizations track, monitor, and control their financial flows. This shift enables complete transparency across all payment channels and currencies.

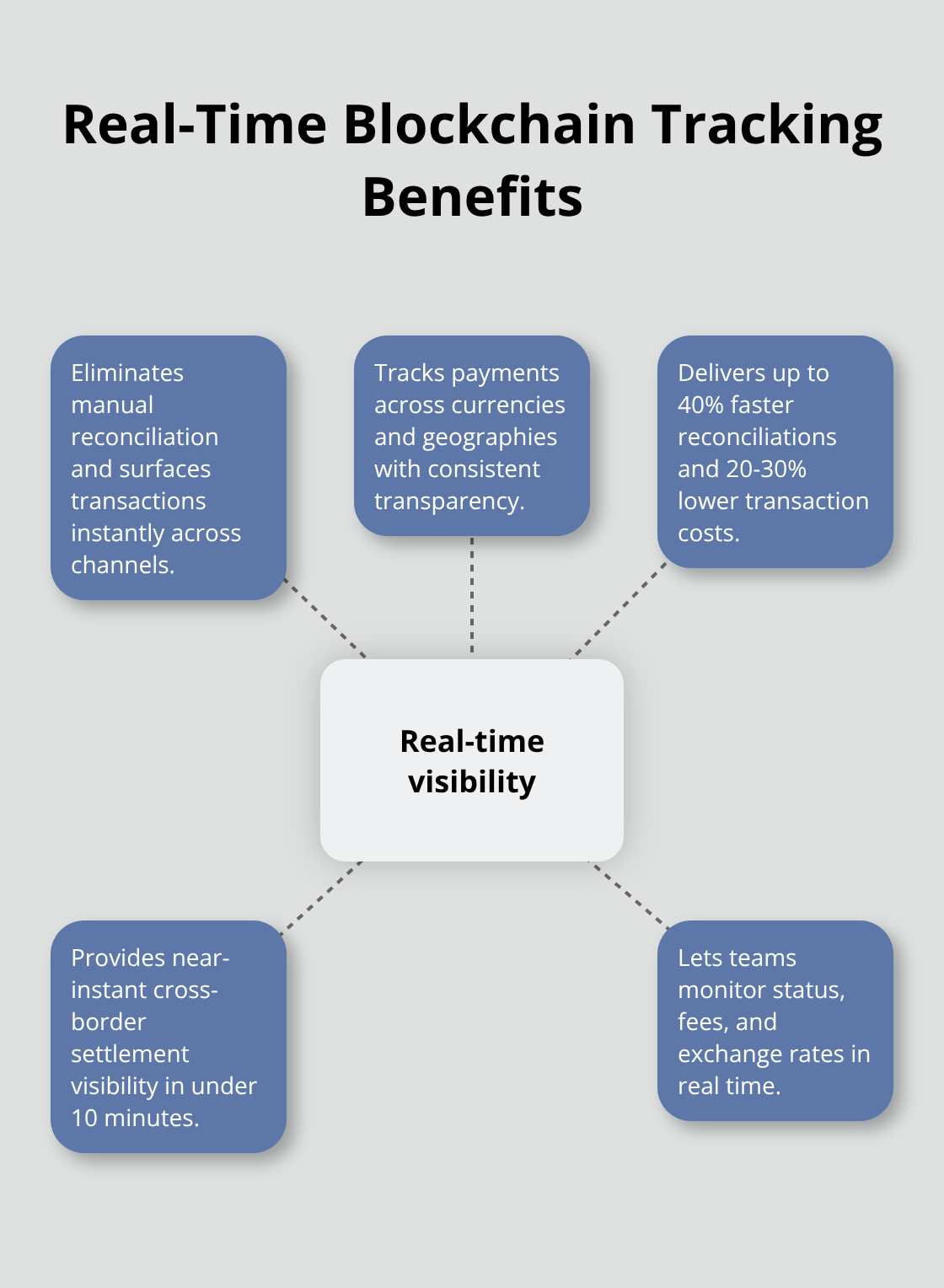

Real-Time Transaction Tracking Across All Channels

Enterprise finance teams lose an average of 30-40% of their time to manual reconciliation processes, according to PwC research. Blockchain-based transaction tracking eliminates this inefficiency and provides instant visibility across all payment channels, currencies, and geographical locations. Organizations that implement blockchain payment systems report reconciliation time reductions of up to 40% within the first year, while they simultaneously cut transaction costs by 20-30%.

Instant Cross-Border Settlement Visibility

Traditional cross-border payments through SWIFT networks take 3-5 business days to settle, which creates blind spots in cash flow management. Blockchain networks process international transfers in under 10 minutes, with complete transaction transparency from initiation to final settlement. JP Morgan’s JPM Coin processes over $1 billion in daily transactions, which demonstrates how major institutions achieve real-time settlement tracking. Finance teams can monitor payment status, fees, and exchange rates in real-time (eliminating the uncertainty that disrupts cash flow forecasting).

Multi-Currency Transaction Management

Blockchain technology is reshaping global business payments and automatically handles currency conversions while providing unified reports across all denominations. Organizations that manage payments in multiple currencies see immediate benefits from automated reconciliation processes that previously required manual intervention. The technology tracks exchange rates, conversion fees, and settlement times across different currency pairs, which gives finance teams complete control over their global payment portfolio. Smart contracts can automatically execute payments when specific exchange rate thresholds are met (optimizing currency exposure management without manual oversight).

Integration with Enterprise Systems

Modern blockchain solutions integrate directly with existing ERP and CRM platforms, which eliminates data silos that plague traditional financial operations. Finance teams can access blockchain transaction data through their familiar interfaces without switching between multiple platforms. This integration allows automatic posting of blockchain transactions to general ledgers and creates seamless workflows between payment execution and financial reporting. The unified data flow extends beyond simple transaction recording to include comprehensive audit trails that enhance compliance monitoring across all financial operations.

Enhanced Audit Trails and Compliance Reporting

Financial auditing faces a fundamental problem: manual verification processes consume 60% of audit time while still missing critical compliance gaps. Blockchain technology eliminates these inefficiencies and creates permanent, tamper-proof records that automatically satisfy regulatory requirements. Deloitte research shows organizations that use blockchain for audit trails can reduce property transaction times by up to 75% while achieving enhanced transaction traceability across all financial operations.

Permanent Regulatory Compliance Records

Traditional audit trails stored in centralized databases face manipulation risks that regulatory bodies increasingly scrutinize. Blockchain networks create immutable transaction records that cannot be altered after confirmation, which provides absolute certainty for regulatory compliance. Financial institutions that use blockchain report zero instances of disputed transaction records during regulatory examinations (compared to traditional systems where data integrity questions arise in 23% of audits according to PwC findings).

Each transaction receives a cryptographic hash that links to previous records and creates an unbreakable chain of evidence that satisfies even the most stringent regulatory requirements.

Automated Compliance Monitoring Systems

Smart contracts automatically monitor transactions against compliance rules and flag violations in real-time, which eliminates the delayed discovery that plagues traditional audit processes. Organizations can program specific compliance parameters directly into their blockchain infrastructure, which creates automatic alerts when transactions exceed predetermined thresholds or violate regulatory guidelines. This automation reduces compliance monitoring costs 40-50% while it provides continuous oversight instead of periodic reviews. The system generates compliance reports automatically, with complete transaction histories available instantly for regulatory requests.

Elimination of Human Error in Financial Records

Manual data entry creates audit discrepancies in 15-20% of traditional financial records, according to McKinsey research. Blockchain automation eliminates human intervention in transaction recording and removes the primary source of audit complications. Every payment, transfer, and settlement automatically records with precise timestamps and amounts that cannot be accidentally modified. This precision extends to currency conversions, fee calculations, and multi-party transactions that traditionally require extensive manual verification. Audit teams can verify entire financial periods in hours instead of weeks, since blockchain provides mathematical proof of transaction accuracy without requiring sampling or estimation techniques.

These enhanced audit capabilities create the foundation for significant cost reductions across all financial operations through process automation.

Cost Reduction Through Process Automation

International Transaction Fee Elimination

Process automation through blockchain eliminates the expensive inefficiencies that drain enterprise budgets every month. Traditional international transactions carry intermediary fees that range from $15-50 per transfer, while blockchain networks process the same payments for under $2. Organizations that handle 1,000 monthly international payments save $180,000 annually just on transaction fees.

Banks like Santander report cost reductions across their payment operations after they implement blockchain automation. The technology removes correspondent bank relationships that add 2-4 days to process time and multiple fee layers to every cross-border transaction.

Smart Contract Invoice Automation

Smart contract automation transforms invoice processing from a labor-intensive manual task into an instant digital workflow. Finance teams spend significant time to process each invoice through traditional approval chains, while blockchain automation completes the same process in under 2 minutes. Companies that process 500 invoices monthly recover substantial hours of staff time that can focus on strategic financial analysis instead of administrative tasks.

Automated Payment Execution Benefits

Automated payment execution through smart contracts eliminates the human errors that cause traditional payment delays. The technology automatically validates invoice details, checks budget approvals, and executes payments when predetermined conditions are met (which creates seamless accounts payable operations that require minimal human oversight).

Operational Overhead Reduction

Finance departments reduce operational overhead when they implement blockchain automation across their payment workflows. The technology eliminates manual reconciliation tasks that consume significant time weekly for typical finance teams. Staff can redirect their time toward strategic analysis and decision-making rather than repetitive administrative processes (while the system maintains complete audit trails for compliance requirements).

Final Thoughts

Financial visibility through blockchain technology represents a fundamental shift in how enterprises manage their global operations. Organizations that implement blockchain-based financial systems achieve 40% faster reconciliation times while they reduce transaction costs by 20-30% within the first year. These improvements compound over time as automated processes eliminate manual errors and streamline compliance reports.

The implementation roadmap for enterprise adoption starts with pilot programs that focus on high-volume payment corridors. Finance teams should begin with cross-border transactions where blockchain delivers immediate cost savings and transparency benefits. Integration with existing ERP systems follows and creates unified data flows that eliminate traditional silos between payment execution and financial reports.

Long-term benefits extend beyond operational efficiency to strategic decision-making capabilities. Real-time transaction data enables dynamic cash flow management and currency optimization that was impossible with traditional systems (which often created delays and blind spots in financial oversight). Web3 Enabler provides native Salesforce integration that makes blockchain adoption seamless for enterprise teams and connects digital asset management directly to existing corporate infrastructure without disruption to established workflows.

![Accepting Crypto Payments in Salesforce [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/salesforce-crypto-payments-hero-1763468205.jpeg)