We offer education and awareness around cryptocurrencies, in order to fully meet our goals of streamlining enterprise blockchain payments. With this in mind, we offer this brief introduction to cryptocurrencies for Salesforce administrators.

Understand the Basics of Public Key Encryption

Public key encryption relies on a series of mathematical equations that connects a private and public key for an account. Anyone with access to your public key can send a message to you and only you can decode it. You can “digitally sign” a message with your private key, and anyone with your public key can verify it. This key pairing is among the foundations of cryptocurrencies.

As a result, your organization can publish its public key to receive payments. However, only the possessor of the private key can authorize the “spending” of those coins, by sending a signed message to the network. In common usage, the private key is managed by the “wallet holder”.

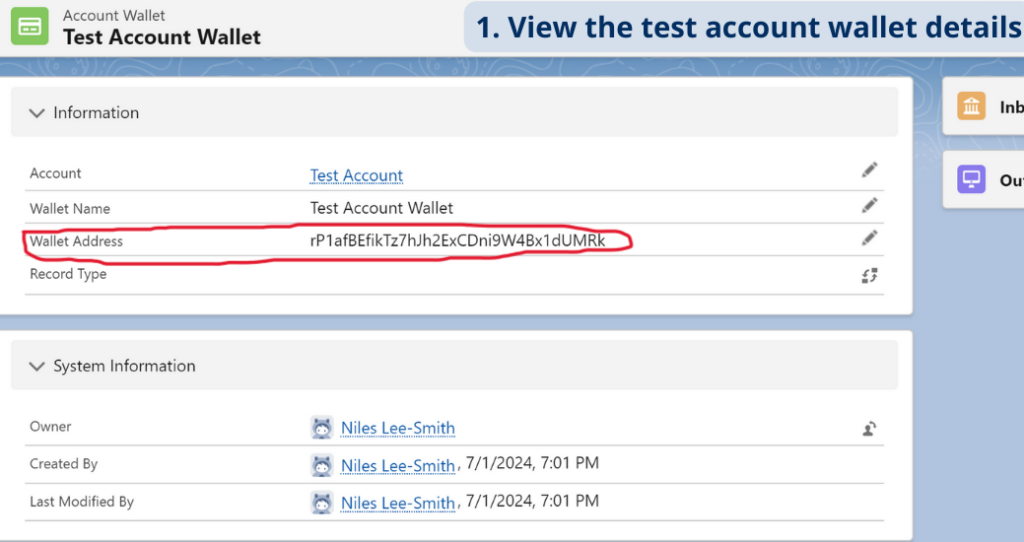

Web3 Enabler only stores public keys. For EVM networks, this is the public key to the “Account” you are using with Web3 Enabler.

For UTXO networks, this is the “extended public key” that creates transactional addresses. In all circumstances, Web3 Enabler relies upon publicly available information to report transactions. Only the “wallet holder” with the private keys can “spend those coins” – including transferring them to a fiat off-ramp.

Create Policies Around Wallet Access

Whoever controls the private keys controls the coins. You should generally have at least two people with access to the wallet to avoid losing your coins. You should decide how much crypto exposure you want to have, and convert to fiat when your coins on hand exceed it. One of Web3 Enabler’s wallet management best practices is that the uses your public key only, and does not have access to your coins.

Key Blockchain and Cryptocurrency Terms

Blockchain: A distributed ledger (series of transactions) stored in data elements called blocks. These blocks contain references to the prior blocks, creating a “chain” of data. The blockchain costs resources to maintain. The maintainers are compensated for validating or mining.

Coin: The native digital asset of a blockchain. It is used to pay for transactions (often called gas in Ethereum based systems). It is received as a reward for “mining” or “validating” data on the blockchain. Famous coins include Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE).

Fiat: Originally a term to separate currencies no longer backed by gold, it is used in the Web3 community to refer to currencies issued by central banks (i.e. US Dollars, Euros, Pounds, Yen).

Mining / Proof of Work: The process of maintaining and verifying blockchain operations generates small rewards for those doing the calculations. This is called “mining” and is done with a cryptographically complex operation. That “work” receives compensation, creating the correct incentives.

Stablecoin: A digital token that is “pegged” to an existing financial instrument, commonly US Dollars, Euros, or other major currencies. High quality stablecoins make conversion to fiat easy. Popular Stablecoins include (USDT, USDC, EURS).

Token: A non-native digital asset. The media talks about NFTs (non-fungible tokens) and cryptocurrencies (fungible tokens). Most financial digital assets are these tokens.

Transaction: An entry on the blockchain

Validating / Proof of Stake: The validators track the information. They prove their economic incentives by having proof of a “stake” of the coins from the blockchain.