Your business sends millions through payment processors every month, watching fees pile up like parking tickets. Those third-party gatekeepers control your cash flow timing, settlement speeds, and transaction costs.

Payment sovereignty changes this game completely. We at Web3 Enabler see enterprises taking direct control of their financial operations, cutting out middlemen and building their own payment infrastructure.

The result? Faster settlements, lower costs, and predictable cash flow management that actually serves your business goals.

What Does Payment Sovereignty Actually Mean

Payment sovereignty means your enterprise controls every aspect of its financial operations without external processors who approve, delay, or charge fees for transactions. Traditional payment systems force businesses into dependency relationships where Visa, Mastercard, and payment processors like Stripe control transaction approval rates, settlement times, and fee structures. These gatekeepers freeze accounts, reject legitimate transactions, or change terms without notice, which leaves enterprises vulnerable to operational disruptions.

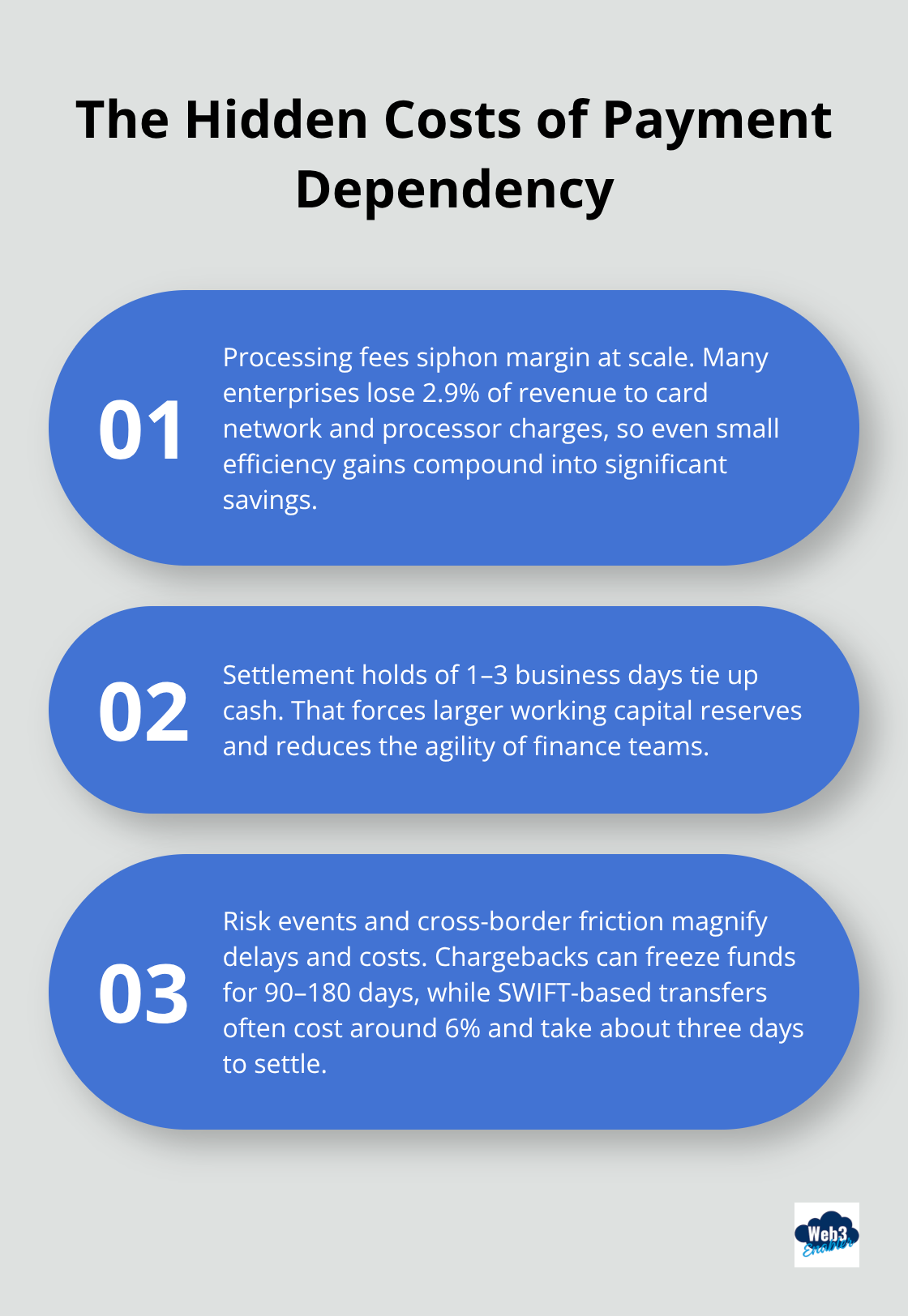

The Hidden Costs of Payment Dependency

Most enterprises lose 2.9% of revenue to payment processing fees, but the real cost goes deeper. Payment processors typically hold funds for 1-3 business days, which creates cash flow gaps that force companies to maintain larger working capital reserves. Chargebacks freeze funds for 90-180 days, and high-risk industries face even longer holds or outright account terminations. International transactions through SWIFT networks cost around 6% and take three days to settle (making global expansion expensive and slow).

Direct Infrastructure Control Changes Everything

Payment sovereignty replaces these dependencies with direct infrastructure control. Companies process stablecoin payments with 0% processing fees and instant settlement, which eliminates the cash flow delays that traditional systems create. Domestic payment networks like India’s UPI and Brazil’s PIX demonstrate how sovereign infrastructure outperforms international alternatives in speed, reliability, and cost.

Real-World Performance Gains

Enterprises that implement direct payment rails report 40-60% reductions in transaction costs and same-day settlement capabilities that transform cash flow management from reactive to predictable. The stablecoin market reached $27.6 trillion in transfer value during 2024, which shows businesses actively seek alternatives to traditional payment processors.

This shift toward payment independence opens up specific business benefits that traditional systems simply cannot match.

What Financial Gains Can Payment Sovereignty Deliver

Payment sovereignty transforms enterprise finances through three measurable improvements that traditional processors cannot match. Companies that switch to direct payment infrastructure typically reduce transaction costs by 40-60% within the first quarter of implementation. PayRam demonstrates this advantage with 0% processing fees compared to the standard 2.9% that traditional card networks charge, which means a company that processes $1 million monthly saves $29,000 in fees alone. This proves businesses actively embrace these cost savings.

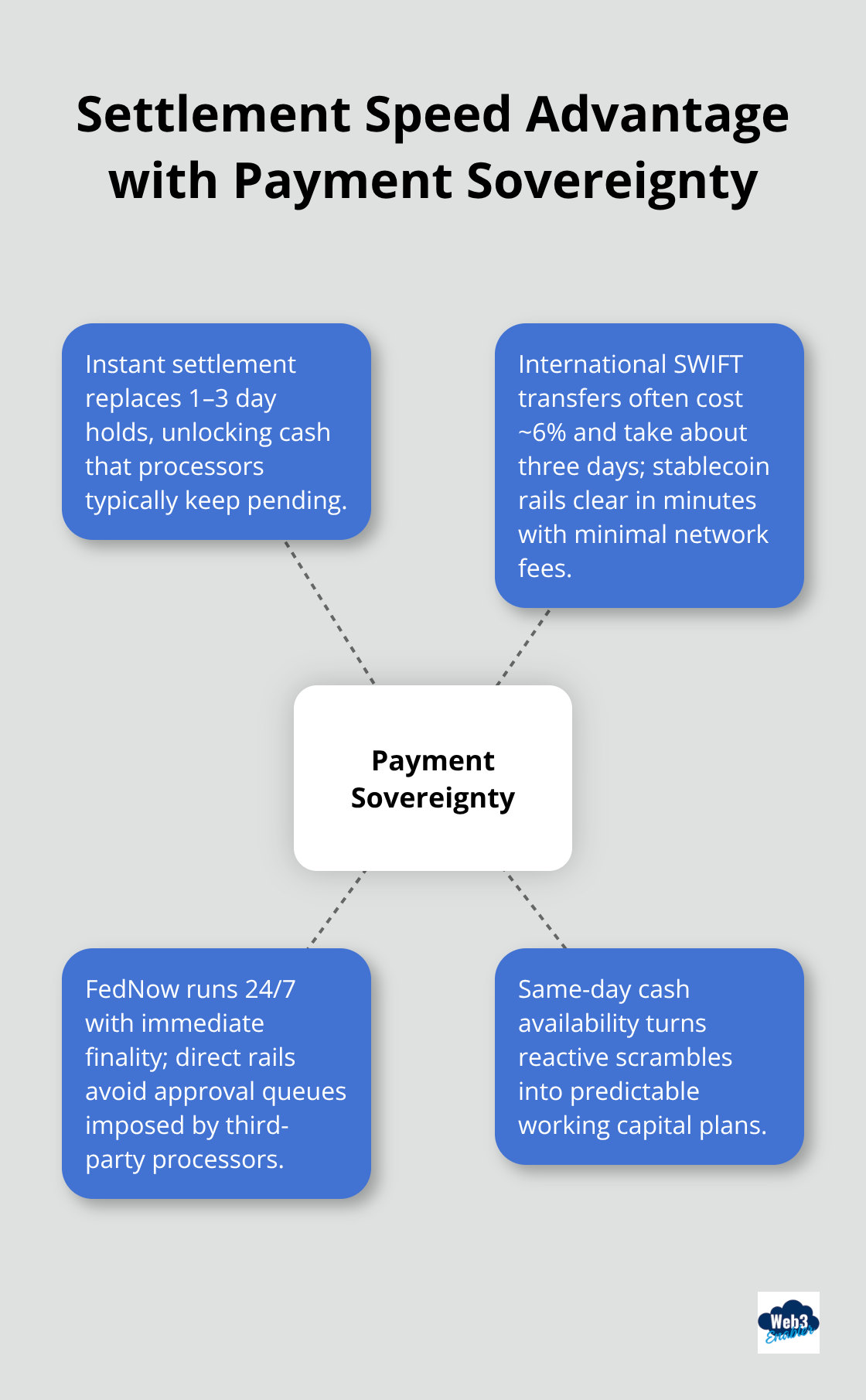

Settlement Speed Becomes Your Competitive Edge

Traditional payment processors hold funds for 1-3 business days while they charge fees for the privilege, but sovereign payment systems settle transactions instantly. SWIFT international transfers cost approximately 6% and require three days to complete, while stablecoin transfers process in minutes with minimal network fees. The Federal Reserve’s FedNow system runs 24/7 with immediate finality, yet most businesses still wait for processor approval and clearance times that sovereign systems eliminate entirely. Companies that use direct blockchain rails report same-day cash availability that transforms working capital management from reactive scrambles to predictable plans.

Cash Flow Predictability Replaces Financial Guesswork

Payment sovereignty eliminates the cash flow gaps that force companies to maintain excessive working capital reserves. Traditional processors freeze funds for 90-180 days during chargeback disputes, while high-risk industries face account terminations without warning. Sovereign payment systems provide complete transaction transparency and immediate settlement, which allows finance teams to predict cash positions with accuracy that traditional systems never deliver. Domestic payment sovereignty outperforms international alternatives in reliability and speed.

Risk Reduction Through Direct Control

Payment processors can freeze accounts or reject legitimate transactions without notice, which creates operational disruptions that sovereign systems prevent. Traditional payment dependencies expose businesses to arbitrary policy changes and sudden fee increases that affect profit margins. Direct payment infrastructure eliminates these third-party risks and provides businesses with complete control over their transaction approval processes. Companies that implement sovereign payment rails report fewer transaction failures and zero unexpected account restrictions.

These financial advantages create the foundation for implementation strategies that maximize payment independence while businesses maintain operational efficiency.

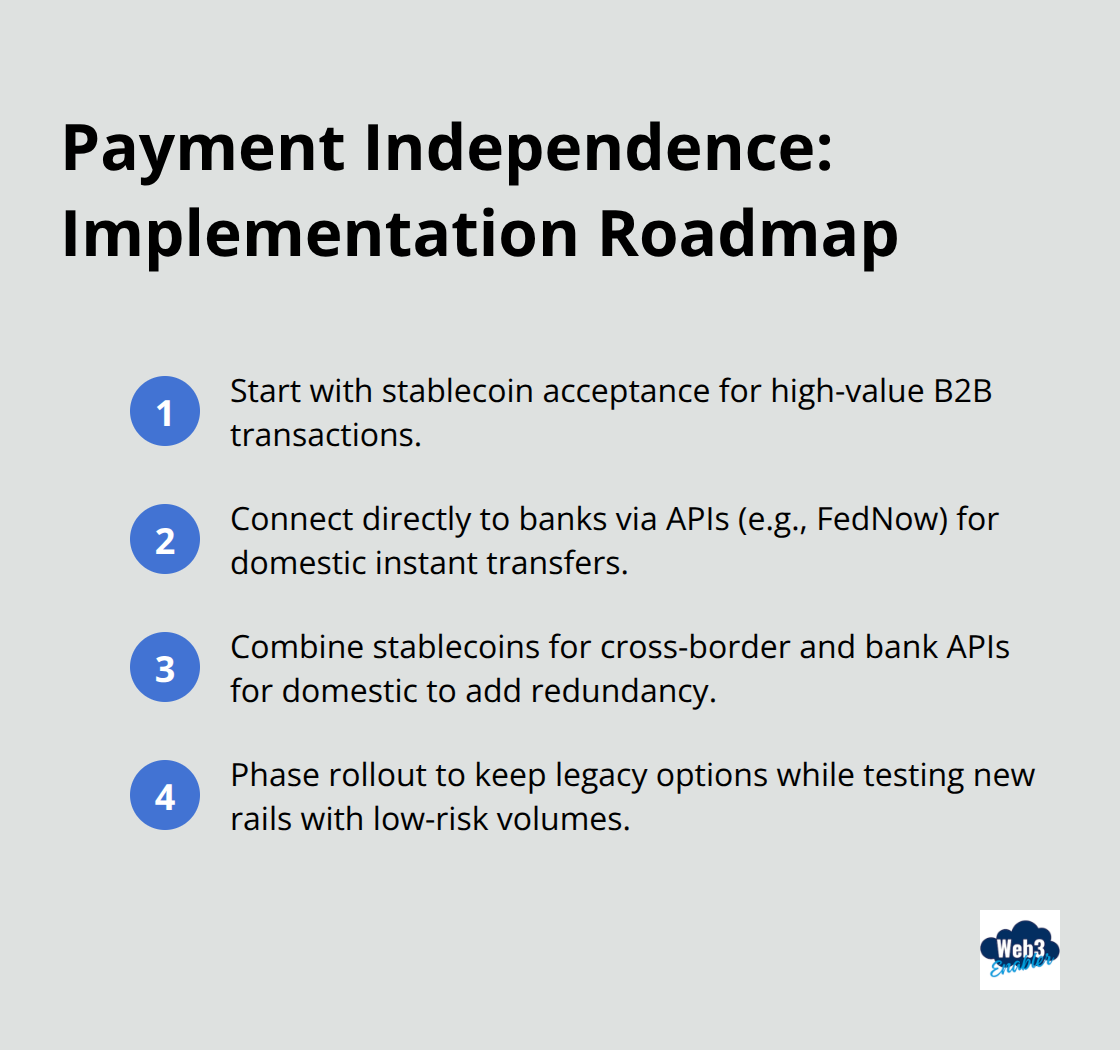

How Do You Actually Build Payment Independence

Start with Stablecoin Integration

Stablecoin integration provides the fastest path to sovereignty with platforms like PayRam that offer 0% processing fees and instant settlement compared to traditional 2.9% charges and 1-3 day holds. Companies implement USDC or USDT payment acceptance through blockchain rails that process transactions in minutes rather than days. This eliminates the cash flow gaps that traditional processors create and gives businesses immediate access to their funds.

Connect Directly with Banks Through APIs

Direct API connections with banks through services like FedNow enable 24/7 instant transfers with immediate finality. These connections bypass traditional payment processors entirely and give companies direct access to banking infrastructure. Domestic payment networks such as India’s UPI demonstrate 25% transaction count growth year-over-year, which proves that direct bank connections outperform traditional processors in speed and reliability.

Combine Both Approaches for Maximum Impact

Smart enterprises use stablecoins for international payments and direct bank APIs for domestic transfers, which creates redundancy that prevents single points of failure. Companies start with stablecoin integration for high-value B2B transactions where the cost savings justify the implementation effort, then expand to consumer payments as adoption increases. Direct bank partnerships through APIs handle routine domestic transactions with instant settlement, while blockchain rails manage cross-border payments that would otherwise cost 6% through SWIFT networks.

Phase Implementation to Maintain Operations

The hybrid strategy proves most effective because it maintains traditional payment acceptance while companies build sovereign capabilities step by step. Businesses reduce payment processing costs by 40-60% within the first quarter while they maintain customer payment preferences during the transition period. This approach allows companies to test new payment rails with low-risk transactions before they commit to full sovereignty implementation (which reduces operational disruption and maintains customer satisfaction).

Final Thoughts

Payment sovereignty delivers measurable advantages that traditional processors cannot match. Companies reduce transaction costs by 40-60% while they gain instant settlement capabilities that transform cash flow from unpredictable to manageable. The elimination of third-party dependencies prevents account freezes and arbitrary policy changes that disrupt operations.

Your independence journey starts with stablecoin integration for high-value transactions, followed by direct bank API connections for domestic payments. This hybrid approach maintains customer payment preferences while you build sovereign capabilities step by step. Companies that implement these systems report fewer transaction failures and complete control over their approval processes (which eliminates the operational disruptions that traditional processors create).

The future belongs to enterprises that control their financial infrastructure directly. Stablecoin transaction volumes reached $27.6 trillion in 2024, which surpassed traditional card networks and proved that businesses actively seek alternatives to processor dependency. Web3 Enabler connects blockchain technology with existing corporate infrastructure through Salesforce Native solutions that help businesses accept stablecoin payments while they maintain compliance within familiar systems.