Cryptocurrency payments are reshaping the business landscape. At Web3 Enabler, we’ve witnessed a surge in companies adopting this innovative payment method.

From tech giants to small startups, businesses are recognizing the potential of crypto to streamline transactions and expand their customer base. This shift isn’t just a trend-it’s a strategic move that’s revolutionizing how companies handle finances and engage with their markets.

Why Are Companies Embracing Crypto Payments?

Cost Savings and Efficiency

The adoption of cryptocurrency payments in the business world continues to accelerate. This surge represents a strategic move driven by tangible benefits and evolving market dynamics.

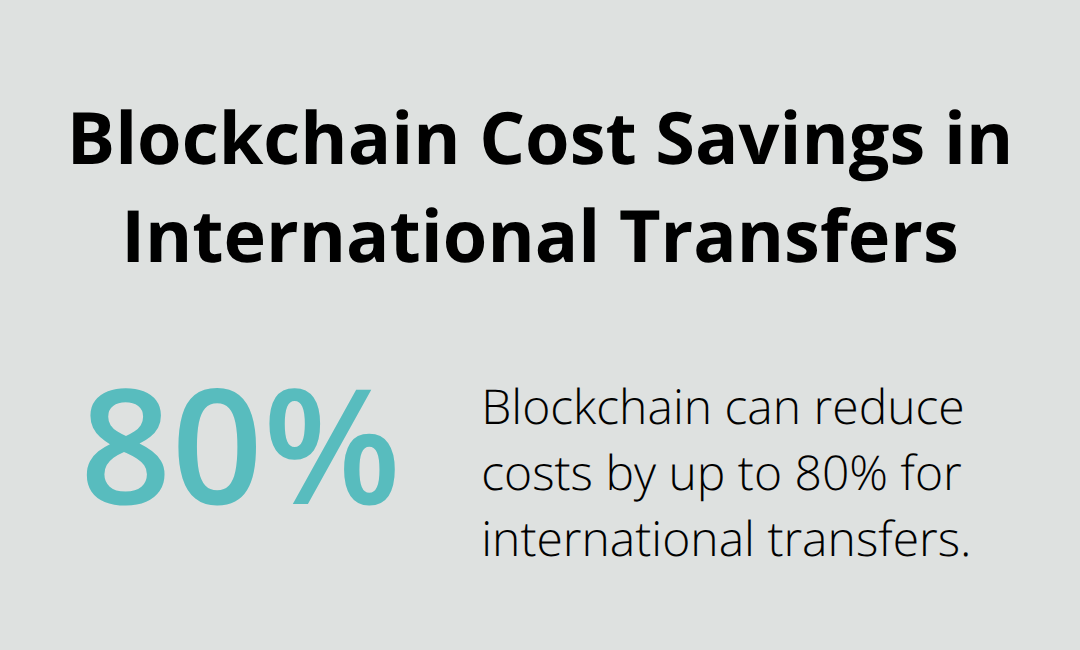

One of the primary factors driving cryptocurrency acceptance is the potential for significant cost savings. Traditional payment methods often involve substantial transaction fees, especially for international transfers. Blockchain can cut these costs by up to 80%. For example, a $10,000 international transfer through traditional banking systems might cost $330 and take 2-5 business days to settle, while the same transaction using blockchain technology could be significantly cheaper and faster.

Speed and Global Reach

The speed of cryptocurrency transactions outpaces traditional banking systems. While bank transfers can take days to process (especially across borders), crypto payments typically settle within minutes. This rapid settlement time appeals particularly to businesses operating in the global marketplace, allowing for near-instantaneous international transactions.

Customer Demand and Market Expansion

Tech-savvy consumers increasingly expect cryptocurrency payment options. Businesses that offer this payment method can tap into a growing market of crypto users worldwide. This expansion not only broadens their customer base but also positions them as forward-thinking and adaptable in a rapidly evolving digital economy.

Companies like Tesla, Microsoft, and Overstock have already implemented crypto payment options, setting a precedent for others to follow. Even traditional financial institutions take notice, with PayPal and Visa now offering cryptocurrency services to their customers.

Enhanced Security and Reduced Fraud

Cryptocurrency transactions offer enhanced security features that traditional payment methods struggle to match. The decentralized nature of blockchain technology (the backbone of cryptocurrencies) makes it extremely difficult for hackers to manipulate or falsify transaction records. This increased security translates to reduced fraud risks for businesses, potentially saving millions in losses due to fraudulent activities.

Competitive Advantage and Innovation

Businesses that adopt cryptocurrency payments often gain a competitive edge in their respective markets. This adoption signals to customers and competitors alike that the company embraces innovation and stays ahead of technological trends. In some cases, businesses integrating crypto payments have seen sales increases, demonstrating the tangible impact of this payment innovation on revenue growth.

As we move forward, the next chapter will explore the specific benefits that businesses can reap by accepting cryptocurrency payments, including lower transaction fees, faster settlement times, and the potential to attract new customer segments.

How Crypto Payments Can Boost Your Business

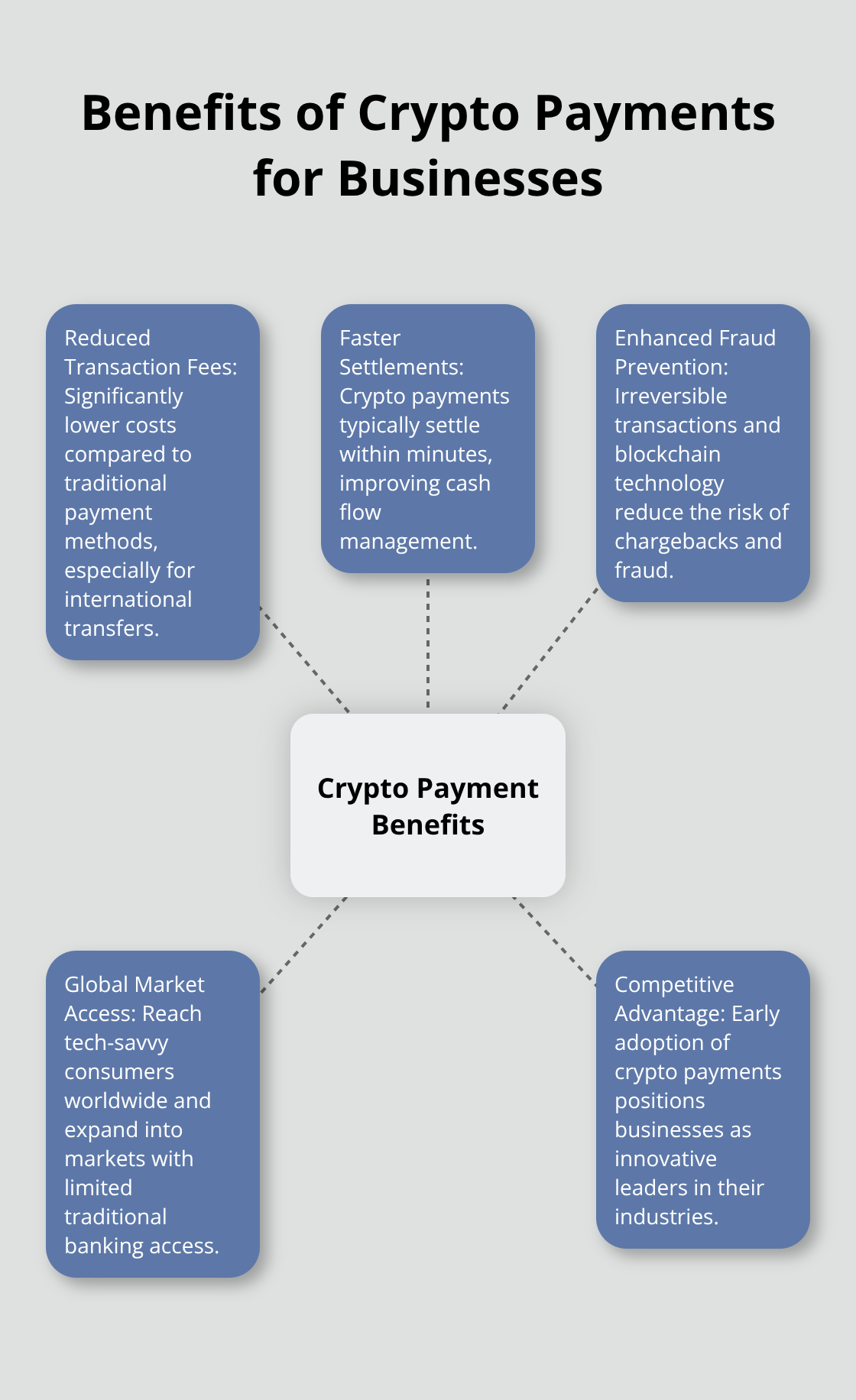

Accepting cryptocurrency payments can significantly enhance your business operations and financial performance. Let’s explore the key advantages that crypto payments offer to forward-thinking companies.

Dramatic Reduction in Transaction Fees

One of the most immediate benefits of adopting cryptocurrency payments is the substantial cut in transaction fees. Traditional payment methods often come with hefty charges, especially for international transfers. A typical cross-border wire transfer can cost anywhere from $25 to $65, which eats into your profits. In contrast, cryptocurrency transactions can cost mere cents, regardless of the amount transferred or the destination.

A recent study found that effective organizations achieved over 20% savings from their Global Business Services. While this doesn’t directly relate to blockchain-based payments, it demonstrates the potential for significant cost reductions in business operations.

Rapid Settlement Times

Speed is another crucial advantage of cryptocurrency payments. While traditional bank transfers can take days to clear (especially for international transactions), crypto payments typically settle within minutes or even seconds. This rapid settlement time can transform your cash flow management.

Consider a UK-based company selling products to customers in Asia. With traditional methods, they might wait up to five business days for a bank transfer to clear. Cryptocurrency could complete that same transaction in under an hour, allowing for quicker reinvestment of funds or faster payment to suppliers.

Enhanced Fraud Prevention

Cryptocurrency transactions are irreversible, which effectively eliminates the risk of chargebacks. This feature proves particularly valuable for businesses in high-risk industries or those dealing with digital goods. The immutable nature of blockchain technology also makes it extremely difficult for fraudsters to manipulate transaction records.

Access to New Markets

Accepting cryptocurrency opens your business to a global market of tech-savvy consumers. With nearly 440 million cryptocurrency users worldwide as of August 2025, this represents a significant potential customer base. These users often actively seek out businesses that accept their preferred payment method.

Moreover, cryptocurrency allows you to serve customers in regions with limited access to traditional banking services. This can be a game-changer for businesses looking to expand into emerging markets. For instance, a U.S.-based e-commerce company might struggle to accept payments from customers in certain African countries due to banking restrictions. Cryptocurrency bypasses these limitations, allowing you to serve these previously untapped markets.

The adoption of crypto payments positions your business at the forefront of a financial revolution. As more companies recognize these benefits, early adopters will gain a significant competitive advantage. The next section will address the challenges and considerations businesses should keep in mind when implementing cryptocurrency payment systems.

Navigating the Crypto Payment Landscape

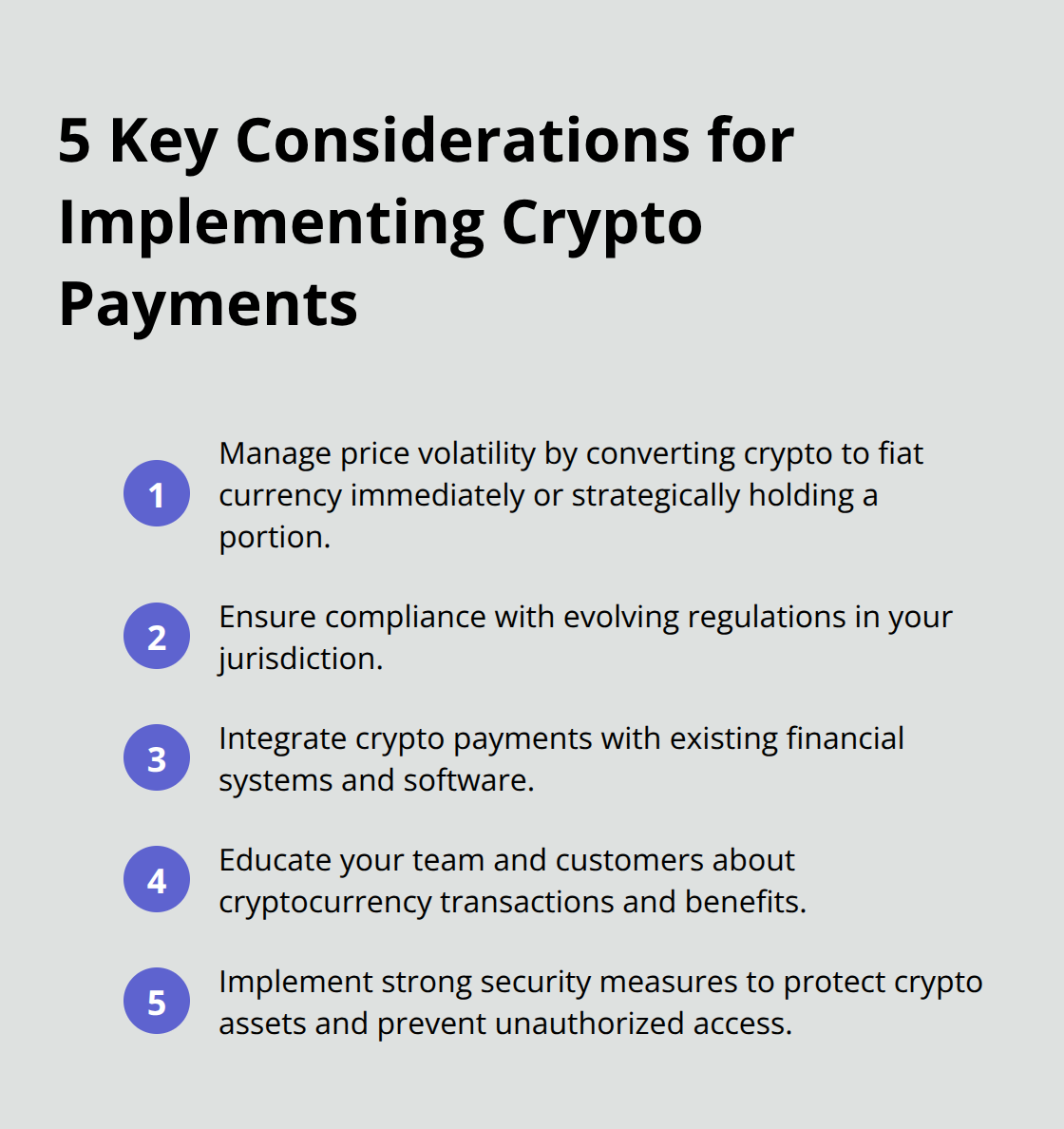

While the benefits of cryptocurrency payments are substantial, businesses must navigate several challenges to implement them effectively. Here are the key considerations for companies looking to adopt crypto payment systems:

Managing Price Volatility

Cryptocurrency price fluctuations can impact your bottom line. To mitigate this risk, convert cryptocurrency to fiat currency immediately upon receipt. Many payment processors offer this service, which ensures you receive stable value without exposure to crypto volatility. As an alternative strategy, hold a portion of payments in cryptocurrency as a potential investment, but prepare for market swings.

Compliance in a Shifting Regulatory Environment

Cryptocurrency regulations vary widely by jurisdiction and change constantly. The U.S. Securities and Exchange Commission (SEC) should clarify or amend rules to permit side-by-side and pairs trading of securities and non-securities (e.g., stablecoins, bitcoin) on a single platform. Stay informed about your local requirements and consult with a crypto-savvy accountant or legal advisor. Implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to ensure compliance and build trust with regulators and customers alike.

Integration with Existing Systems

Integrating cryptocurrency payments with your current financial infrastructure is essential. Look for solutions that offer API connectivity to your existing accounting software. Some providers offer native Salesforce support for cryptocurrencies, which allows businesses to manage digital assets and track investment returns within their familiar Salesforce environment. This integration minimizes disruption and streamlines your financial operations.

Education for Your Team and Customers

Successful implementation of crypto payments requires buy-in from both your staff and customer base. Develop a comprehensive training program for your employees. Cover the basics of blockchain technology, transaction processing, and customer support for crypto-related inquiries. For customers, create clear, jargon-free guides that explain the benefits and process of paying with cryptocurrency. Try to offer incentives (such as small discounts) to encourage adoption.

Security Measures

Implement strong security protocols to protect your crypto assets. Use multi-signature wallets, cold storage solutions, and regular security audits to safeguard your funds. Train your team on best practices for handling private keys and recognizing potential security threats. These measures will help prevent unauthorized access and potential loss of funds.

Final Thoughts

Crypto payments offer businesses significant advantages, including reduced fees and faster settlements. The enhanced security of blockchain technology protects against fraud, while global reach opens new markets. These benefits position early adopters at a competitive advantage in the evolving digital economy.

Challenges exist, but solutions are available. Volatility can be managed through immediate conversion to fiat currency. Regulatory compliance requires vigilance, but proper guidance makes it achievable. The right tools and strategies can overcome integration hurdles and employee training needs.

For businesses ready to embrace this financial revolution, Web3 Enabler provides solutions to bridge traditional infrastructure with blockchain technology. Our platform allows companies to manage digital assets, track returns, and handle international payments within their Salesforce environment. The future of business transactions is digital, decentralized, and more efficient than ever before.